Credit Builders Alliance and VantageScore Expand Pilot Program to Empower Underserved Borrowers

Hey FinTech Fanatic!

Credit Builders Alliance (CBA) and VantageScore have expanded their innovative pilot program, adding ten nonprofit lenders to test the VantageScore 4plus credit scoring model. This model integrates traditional credit data with consumer-permissioned bank account information, aiming to provide a more accurate assessment of creditworthiness for individuals with limited credit histories.

The initiative, supported by JPMorgan Chase, offers each participating nonprofit a $10,000 grant, access to CBA's CREDIT AS ASSET™ training, and entry to the 2025 CBA Annual Symposium. These resources are designed to assist lenders in effectively implementing the new scoring model and enhancing financial inclusion efforts.

Dara Duguay, CEO of CBA, emphasized the program's potential impact: "The VantageScore 4plus model and the bank account data it takes into account deliver a more accurate credit score, facilitating access to credit for people who have previously been declined."

Jeff Richardson, SVP of Marketing at VantageScore, added, "By testing the credit score impact with nonprofit lenders, this initiative will showcase the positive impact that the VantageScore 4plus credit score model can have on lending outcomes for underserved borrowers."

This expansion underscores a commitment to leveraging alternative data to bridge credit gaps and promote equitable access to financial services.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

#FINTECHREPORT

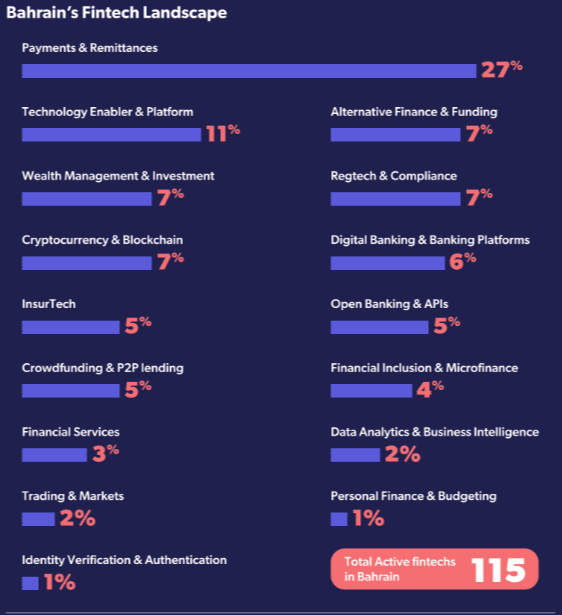

🇧🇭 Bahrain FinTech Ecosystem Report 2025.

FINTECH NEWS

🇺🇸 Trump team eyes politically connected startup to overhaul $700 billion government payments program. A little-known firm with investors linked to JD Vance, Elon Musk, and Trump could get a piece of the federal expense card system and its hundreds of millions in fees.

🇺🇸 FinTech IPO index gains 3.3% as pay later continues its upward March. This time around, partnerships dominated the headlines, and earnings season has yet to make its presence felt in the space. Read more

🇮🇳 Razorpay converts into a public limited company ahead of IPO, marking a critical step in its preparation for an eventual stock market debut in India. The development comes amid the efforts to redomicile its parent entity from the United States back to India.

🇮🇳 Walmart-Backed FinTech PhonePe becomes 'Public Company' ahead of IPO. The FinTech firm decided to change its name from “PhonePe Private Limited” to “PhonePe Limited”. This is a crucial legal step for companies seeking to list on the Indian stock markets.

PAYMENTS NEWS

🇧🇷 Digital scams are likely to increase in the coming years. Digital fraud is set to rise in 2025, with mobile devices as the main target, says Kaspersky. In Brazil, Pix scams remain the most common and could cost the country R$12 billion by 2028, warns ACI Worldwide. The Central Bank offers guidance as 76.4% of the population uses the service.

🇻🇳 FOMO Pay extends its payment solutions with the launch of VND accounts. The new feature enables simplified cross-border collections and payouts in the Vietnamese market and expands FOMO Pay digital payment solutions. Clients can now send and receive VND through locally established payment channels using their names.

🇿🇦 Virtual cards surge in South Africa: safety, convenience drive adoption. According to the Visa and Discovery Bank SpendTrend25 South African Consumer Survey, 45% of respondents now use virtual cards, citing benefits such as reduced fraud risk and seamless digital transactions.

🇧🇦 Card payments are getting more popular in Bosnia and Herzegovina. According to a recent report, cash on delivery was still the most commonly used payment method in the country, with a share of 46.4 percent last year. However, card payments are on the rise, growing from 32.8% in 2023 to 43.1% in 2024.

OPEN BANKING NEWS

🇺🇸 Credit Builders Alliance and VantageScore expand nonprofit lenders pilot program. The platform developed in collaboration with data firm Pentadata provides lenders with a comprehensive view of consumers' financial behavior by combining traditional credit data with real-time, consumer-permissioned cash flow insights from bank accounts.

DIGITAL BANKING NEWS

🇹🇻 Tuvalu, with just 11,000 citizens, makes banking history; gets its first-ever ATMs in 2025, marking a significant milestone in its financial modernization. The ATMs, located in Funafuti and other key areas, currently support prepaid cards, with plans to expand to debit and credit card services in the future.

🇺🇸 U.S. Bank closes five local branches. The Blackfoot closure is one of several branch shutdowns scheduled in southern and eastern Idaho over the next month. U.S. Bank notified customers of the affected branches in January and assured them their accounts and services would remain uninterrupted.

🇮🇹 Bancomat lands on Google Pay: Intesa Sanpaolo opens up to digital payments via smartphone. For the first time in Italy, the banking group’s customers can now add their card to Google Wallet and make payments directly with an Android smartphone.

🇵🇰 SBP launches 'Go Cashless' campaign to promote digital economy. This move is part of the central bank’s broader push to enhance financial inclusion and increase documentation of the economy through digital transactions. Keep reading

🇺🇬 MTN’s SASE solution powers PostBank’s digital revolution. For Post Bank, this means optimized connectivity across its branches, improved reliability, and cost-effective scalability—critical factors in Uganda’s competitive banking sector.

BLOCKCHAIN/CRYPTO NEWS

🇨🇭 International grocery chain Spar pilots Bitcoin payments in Switzerland. DFX Swiss, a company that offers crypto-to-cash solutions, announced that the Spar location in the Swedish city of Zug has officially gone live on BTC Map, a platform tracking businesses worldwide that accept Bitcoin.

🇺🇸 Kraken sheds ‘hundreds’ of jobs to streamline business ahead of IPO. A Kraken spokesperson said the firm is “making the difficult decision to eliminate certain roles and consolidate teams where redundancies exist, while continuing to hire in key areas of the business.”

PARTNERSHIPS

🇧🇷 Trace Finance joins Borderless.xyz Network, enhancing FX liquidity and stablecoin payments in Brazil. This integration is set to significantly reduce the cost of stablecoin-based FX transactions while offering institutions and enterprises a faster, more transparent, and secure experience across borders.

🇶🇦 QNB joins hands with Harrods and Visa to provide ‘unrivalled’ payment experience. This collaboration will see the launch of the QNB Harrods co-branded Visa credit cards exclusively in Qatar, offering customers an unprecedented blend of superior, convenient, and secure payment methods.

DONEDEAL FUNDING NEWS

🇺🇸 Deck raises $12M to ‘Plaid-ify’ any website using AI. Deck claims that it is building the infrastructure for user-permissioned data access across the entire internet. Its browser-based data agents “unlock” the data from any website through automation.

🌍 Opera reports an investment in OPay to boost FinTech innovation in Africa. OPay, a privately held FinTech company, focuses on driving financial inclusion in emerging markets like Nigeria and Egypt through digital wallet services and payment solutions powered by AI and big data.

🌏 Astra FinTech launches $100M Solana ecosystem fund to accelerate innovation, building on its successful track record of supporting projects through initiatives like the Seoulana event. Astra FinTech’s expansion plans are strategically centered on Asia, with Korea serving as the regional hub.

M&A

🇨🇴 Banorte acquires RappiCard in $50M deal. “This transaction aligns with GFNorte’s digital strategy, which aims to boost profitability through cross-selling and hyper-personalization by leveraging technology and scale,” the bank stated. Read more

🇨🇳 Payoneer enters China with Easylink payment acquisition. According to CEO John Caplan, the acquisition strengthens Payoneer’s global regulatory infrastructure and enhances its ability to serve customers with more localized and advanced products and services.

🇺🇸 Shift4 extends previously announced tender offer to acquire Global Blue. The offer is subject to certain conditions, including satisfaction of a minimum tender condition, for which the 90% threshold has been met, the receipt of regulatory approvals in certain jurisdictions, and other customary closing conditions.

🇪🇬 DPI acquires Egypt’s FinTech fund Nclude. Following the transaction, DPI took over the investment advisory responsibilities of the fund. The launch of DPI Venture Capital and the completion of the Nclude transaction anchors DPI’s position as the premier Africa-focused private investment adviser.

🇺🇸 Capital One’s $35 billion deal for Discover gets the Green Light. Approval could help encourage deals in the financial services industry. The deal is expected to close in May, subject to closing conditions. Continue reading

MOVERS AND SHAKERS

🇯🇵 Square has appointed Stephen Adams as the Head of Japan. Adams previously served as Vice President at Visa Japan and was responsible for merchant sales and acquiring business. In his new role as Head of Japan, Adams will be responsible for accelerating business growth.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()