Coinbase Expands Its Payments Game with Big Plans and Acquisitions

Hey FinTech Fanatic!

Coinbase is doubling down on payments with plans to grow through acquisitions and new revenue streams. The US's top crypto exchange recently snapped up Utopia Labs, a payments startup, and might pursue more deals to supercharge its offerings, says Shan Aggarwal, VP of Corporate Development at Coinbase.

One focus? Charging for premium features in Coinbase Wallet, like subscription-based tools, to enhance its payments ecosystem.

Coinbase’s edge lies in stablecoins, which enable nearly instant, ultra-cheap global transfers—costing less than a cent and taking under a second. Compare that to traditional transfers, which can cost up to 15% of the amount and take days. “Legacy payment systems aren’t cutting it,” Aggarwal says.

The company’s Base blockchain, launched in August 2023, is central to this vision. They’re also teaming up with major players like PayPal to test crypto-powered payments for businesses.

For everyday users, Coinbase is crafting an "everything app," combining crypto trading, holding, and payments. CEO Brian Armstrong dreams big, aiming for 20% of global GDP to run on crypto rails: faster, cheaper, and more inclusive.

With stablecoins gaining traction worldwide—especially in Europe with clearer regulations—Coinbase is watching the market closely. Though not launching its own stablecoin yet, Aggarwal teases that “it’s always a possibility.”

What’s your take on Coinbase’s payments push? Let me know your thoughts in the comments!

Cheers,

#FINTECHREPORT

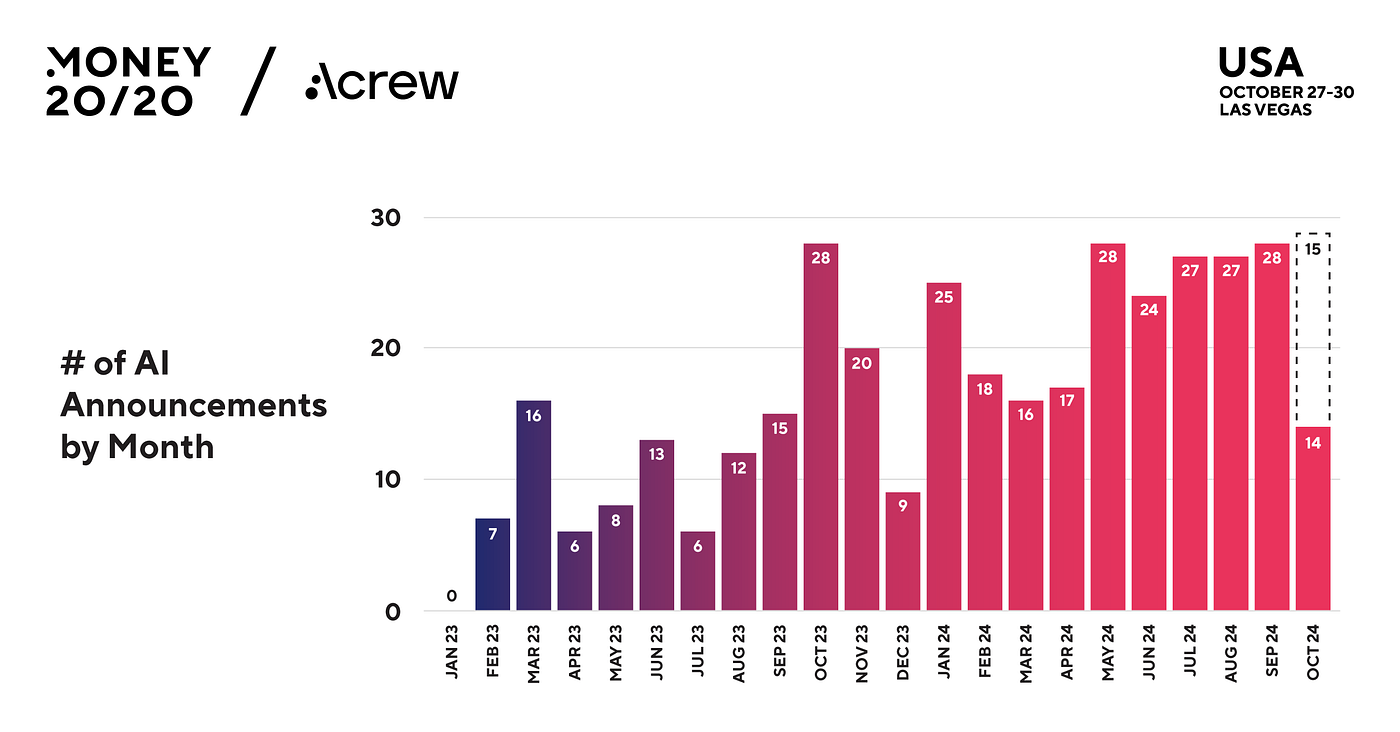

📊 The 'AI in Financial Services Adoption Index' compiles data to address two pivotal questions for the industry's future: how Gen AI will transform financial services and where value will concentrate as AI reshapes the competitive landscape. Access the full report

FINTECH NEWS

🇺🇸 European climate tech poster child Northvolt is filing for Chapter 11 bankruptcy in the US after months of trying to secure fresh capital from investors. Northvolt will undergo a reconstruction process, set to conclude in Q1 2025. Read more

🇬🇧 FinTech Finastra confirms data theft; investigation underway. The firm warned customers that an attacker stole an unknown quantity of data after a hacker on a criminal forum offered for sale data purportedly filched from the company. Finastra confirmed the incident was confined to a single platform with no lateral spread.

🇺🇸 Finix unveiled Advanced Fraud Monitoring in partnership with Sift. The new service uses AI and machine learning to analyze transactions, offering backtesting, rule simulations, and customizable rulesets. It is designed to combat the creation of fake accounts and unauthorized financial movements.

🇬🇧 Tide launches new carbon calculator to help SMEs reach Net Zero. The new tool has been developed in partnership with carbon measurement pioneer Connect Earth and will allow Tide’s 650,000 UK customers to view an estimated and categorised understanding of their carbon emissions.

🇺🇸 Intuit adds Generative AI-Powered financial assistant to QuickBooks. The new Intuit Assist for QuickBooks is designed to help small and medium-sized businesses (SMBs) by generating estimates, invoices, bills and payment reminders and delivering personalized recommendations, the company said.

PAYMENTS NEWS

💵 How does Payout work?

Payout simplifies your payment operations by providing a centralized platform for managing all your payment activities.

🇧🇷 The race of banks and FinTechs to get ahead of Automatic Pix. The launch of Pix Automático is scheduled for June 16, 2025, by Brazil’s Central Bank (BC), but some players are already gearing up to introduce the feature at least seven months early.

🇬🇧 Wirex Pay announces public access to its payment API. This will enable wallets, dApps, and FinTech platforms to integrate with its infrastructure. It allows non-custodial card issuance and real-time stablecoin payments, leveraging blockchain technology and Visa's global network.

🇺🇸 PayPal resolves 2-hour global outage affecting multiple products. The incident lasted from 10:53 UTC to 12:59 UTC Thursday and affected account withdrawals, express checkout, cryptocurrency, the receive money function of Xoom and several functions of Venmo, according to a status page.

🇺🇸 One Inc and U.S. Bank partner to modernize payment solutions for insurance carriers and policyholders. In the future, the partnership will help accelerate the use of instant payments within the insurance industry. U.S. Bank was part of the first payment on the RTP Network® and a launch partner of the FedNow® Service.

🇸🇻 Nayax self-service payments will launch its payment solution across to El Salvador. Nayax is partnering locally to bring Salvadoran operators into its global network of 90,000+ customers, enhancing customer experiences with cashless payments and loyalty programs.

🇬🇧 Spendesk partners with Adyen to accelerate SMB innovation with embedded payments and financial services. Adyen's UK banking license enables Spendesk to control the payment experience, offer UK customers card customization, and expand embedded financial products beyond payments.

🇲🇪 Montenegro and Albania join the Single Euro Payments Area (SEPA). The inclusion of these nations in SEPA aligns with the EU’s Growth Plan, which seeks to enhance socio-economic integration of the Western Balkans through phased access to elements of the EU single market.

🇦🇪 Mastercard partners with Fundbot to accelerate payments between buyers and suppliers across multiple markets. The two companies will introduce a payments platform linking buyers and suppliers, initially focusing on early claim settlements in healthcare to resolve significant payment delays.

🇬🇧 K3 MStore partners with DNA Payments to deliver unified payment solutions for visitor attractions. This collaboration will offer a seamless and unified payment solution for visitor attractions, enabling organisations to integrate their onsite and online payment systems effortlessly.

🇦🇪 Royal Group launches Comera Pay in the UAE. At the forefront of the UAE’s cashless economic vision, Comera Pay provides users with services like digital wallets, P2P transfers, QR payments, remittances, bill payments, mobile top-ups, and virtual accounts.

🇮🇳 Paytm goes global, facilitates UPI payments for Indians abroad. Indian travellers can now use their Paytm UPI app to make seamless, cashless payments at destinations where UPI is accepted, including popular spots in the UAE, Singapore, France, Mauritius, Bhutan, and Nepal.

OPEN BANKING NEWS

🇩🇪 AAZZUR partners with Fourthline to optimise its Open Banking offering. AAZZUR will integrate Fourthline's KYC and AML compliance solutions into its Embedded Finance ecosystem, enhancing fraud prevention, compliance, and Open Banking services.

DIGITAL BANKING NEWS

🇬🇧 Revolut reveals 2025 vision, with AI Assistant, mortgages, and ATMs on the horizon. At the Revolutionaries event in London, Revolut celebrated 𝟱𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 customers and revealed BIG plans for 2025. Read on to learn about what’s next for Revolut.

🇨🇴 Amsterdam’s Qash exits stealth mode to democratise access to the US banking system in volatile economies. The company’s first product, launching in Colombia, is built on blockchain technology and features a Qash-branded Visa credit card in partnership with Rain, a global issuer with the Visa network.

🇷🇺 HSBC stops processing Russia payments for retail customers. HSBC has ceased processing all payments from Russia and Belarus for personal banking customers, according to a notice on its UK website. The bank advised customers to arrange alternatives for such transactions.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase eyes more acquisitions as it expands payments business. After acquiring Utopia Labs’ team, Coinbase may pursue more payments-focused businesses, said Shan Aggarwal, VP of corporate and business development. The company is also exploring fees for payment services in Coinbase Wallet, including subscription-based features.

🇬🇧 CoinW partners with CoinCover to strengthen digital asset security. This partnership underscores CoinW’s commitment to protecting funds against risks such as hacking, lost access, and operational disruptions. More on that here

🇬🇧 UK to unveil long-awaited crypto, stablecoin rules early in 2025. Rules on stablecoins and on so-called staking services will be part of a single overarching regime for cryptoassets, Economic Secretary to the Treasury Tulip Siddiq said at a conference in London on Thursday.

Pythagoras Crypto Fund returns 230% to outpace Bitcoin’s rally. It’s been nearly a year since the launch and the fund has beaten Bitcoin every single month except two, with year-to-date gains of around 230%, or 206% after fees. Read on

DONEDEAL FUNDING NEWS

🇺🇸 Stripe is once again buying back shares, valuing the company at approximately $𝟳𝟬 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 🤯 According to documents seen by Bloomberg, the share price is set at $27.51, reflecting the same valuation Stripe reached in a previous share sale earlier this year.

🇮🇳 Indian FinTech startup CredFlow raises $3.7m pre-series B. Founded in 2019, CredFlow plans to use the funds to enhance its financial and lending services. The company operates as a cash flow management platform for small and medium-sized enterprises.

MOVERS & SHAKERS

🇩🇰 Lunar appoints new CFO. With over two decades of experience in the financial services sector, Robert Stambro has held senior roles in both banking and FinTech. His extensive experience with publicly listed companies, as well as his expertise in IPO readiness, will be invaluable as Lunar enters the next phase of its strategic growth.

🇺🇸 SEC Chair Gary Gensler to step down as Trump signals pro-crypto agenda. Gary Gensler plans to leave on January 20, 2025, according to a statement released by the agency on Thursday. Continue reading

🇮🇳 Flipkart co-founder Binny Bansal leaves PhonePe’s board. Bansal played a key role in Flipkart’s acquisition of PhonePe in 2016 and has served on the FinTech’s board ever since. He still owns about 1% of PhonePe and is the largest individual minority investor in the firm.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()