Coinbase Adds Real-Time Funding with Visa Direct

Hey FinTech Fanatic!

Today, Visa announced a partnership with Coinbase, one of the most trusted names in the crypto world. This new alliance is set to unlock a level of convenience and flexibility that could reshape the way Coinbase users in the US and EU manage their funds and trade crypto.

By integrating with Visa Direct, Coinbase customers with eligible Visa debit cards can now deposit funds into their accounts in real-time, giving them the agility they need to take advantage of trading opportunities. Whether you're adding funds, purchasing crypto, or cashing out to a bank account, this partnership makes it all faster, more reliable, and more secure.

As Yanilsa Gonzalez Ore, Head of Visa Direct, North America, put it: "We are thrilled to be partnering with Coinbase to help service their customers’ money movement needs. Providing real-time account funding using Visa Direct and an eligible Visa debit card means that those Coinbase users know they can take advantage of trading opportunities day and night."

Here’s a quick rundown of what this partnership means for Coinbase users:

- Real-time deposits into Coinbase accounts using an eligible Visa debit card.

- Purchases made directly with an eligible Visa debit card.

- Cash outs to bank accounts via Visa debit, with funds available in real-time.

Keep scrolling to read more updates in FinTech and I'll see you tomorrow with more!

Cheers,

POST OF THE DAY

🏛️ FinTech Robinhood is Introducing the Presidential Election Market 🤯

What's your vote? Kamala Harris 🔵 or Donald Trump 🔴?

#FINTECHREPORT

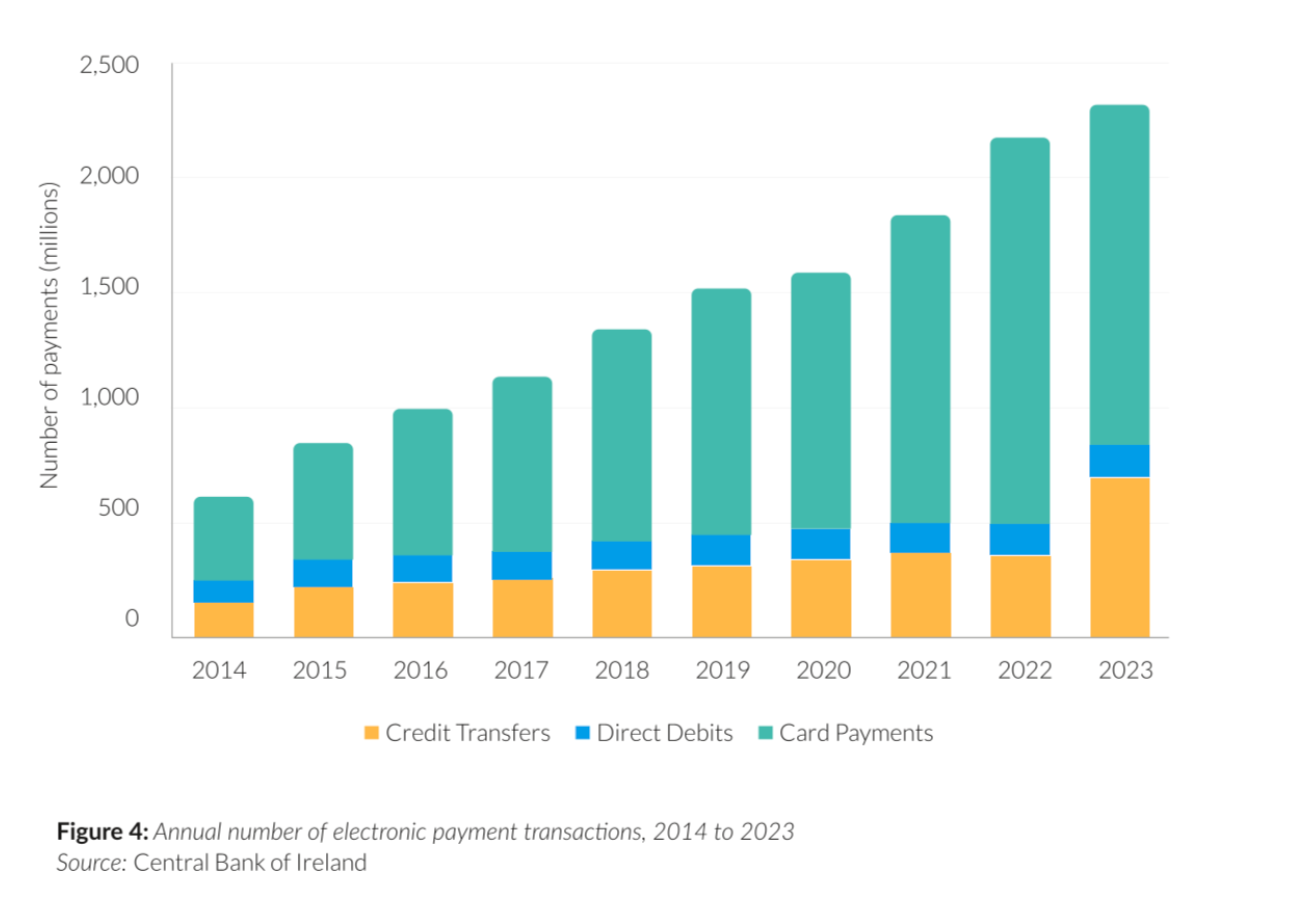

📊 The Irish 🇮🇪 Goverment's National Payments Strategy 👇

FEATURED NEWS

🌐 Visa plans to lay off around 1,400 employees and contractors 🤯 Visa is restructuring its global operations and will cut roughly 1,400 roles by year-end, according to sources familiar with the decision, as part of its effort to streamline international business.

INSIGHTS

🔁 Success With Subscriptions: How businesses can meet customer expectations. Solidgate’s latest survey, featuring insights from 1,000 subscription customers, provides a deeper understanding of what customers truly value—and what frustrates them. Explore now

FINTECH NEWS

💰 Airwallex seeks funding at $6 billion value. Airwallex is in talks to raise about $200 million to support growth, targeting a $6 billion valuation. The firm hit $500 million in annual revenue in August and aims to close the funding round by year-end, according to sources.

🇮🇹 BNPL provider Scalapay strikes a deal with BNL BNP Paribas to finance up to $3 billion of current and new credits. Scalapay’s CEO Simone Mancini said: “We aim to become the most user-friendly financial platform in Southern Europe.”

🇬🇧 Finastra extends strategic partnership with DXC Luxoft and RightClick Solutions to offer best-in-class managed services for Summit customers. This collaboration accelerates strategic outcomes and reduces risk for Finastra's treasury and capital markets clients with top-tier managed services and specialized regional resources.

🇱🇹 ConnectPay recently introduced the European FinTech Index (EFI), a comprehensive data tool providing key insights into Europe's FinTech market. Originally developed as an internal market research project, it was later expanded into a country ranking of key FinTech attractiveness indicators. Explore more

🇲🇽 More than three years after FEMSA entered the FinTech sector, Spin by Oxxo is preparing to offer credit options to its users, adding a new vertical for the company led by José Antonio Fernández Carbajal. Martín Arias Yaniz, the company’s Chief Financial Officer, explained that current revenue from its financial business comes from services like remittances, though there are many other developments underway.

🇺🇸 Pipe CEO says business card product shifts small business capital from banks to software platforms. Luke Voiles, CEO of embedded solutions FinTech Pipe, told Karen Webster that access to capital and credit is shifting from banks to the software platforms SMBs use to manage operations. Read on

PAYMENTS NEWS

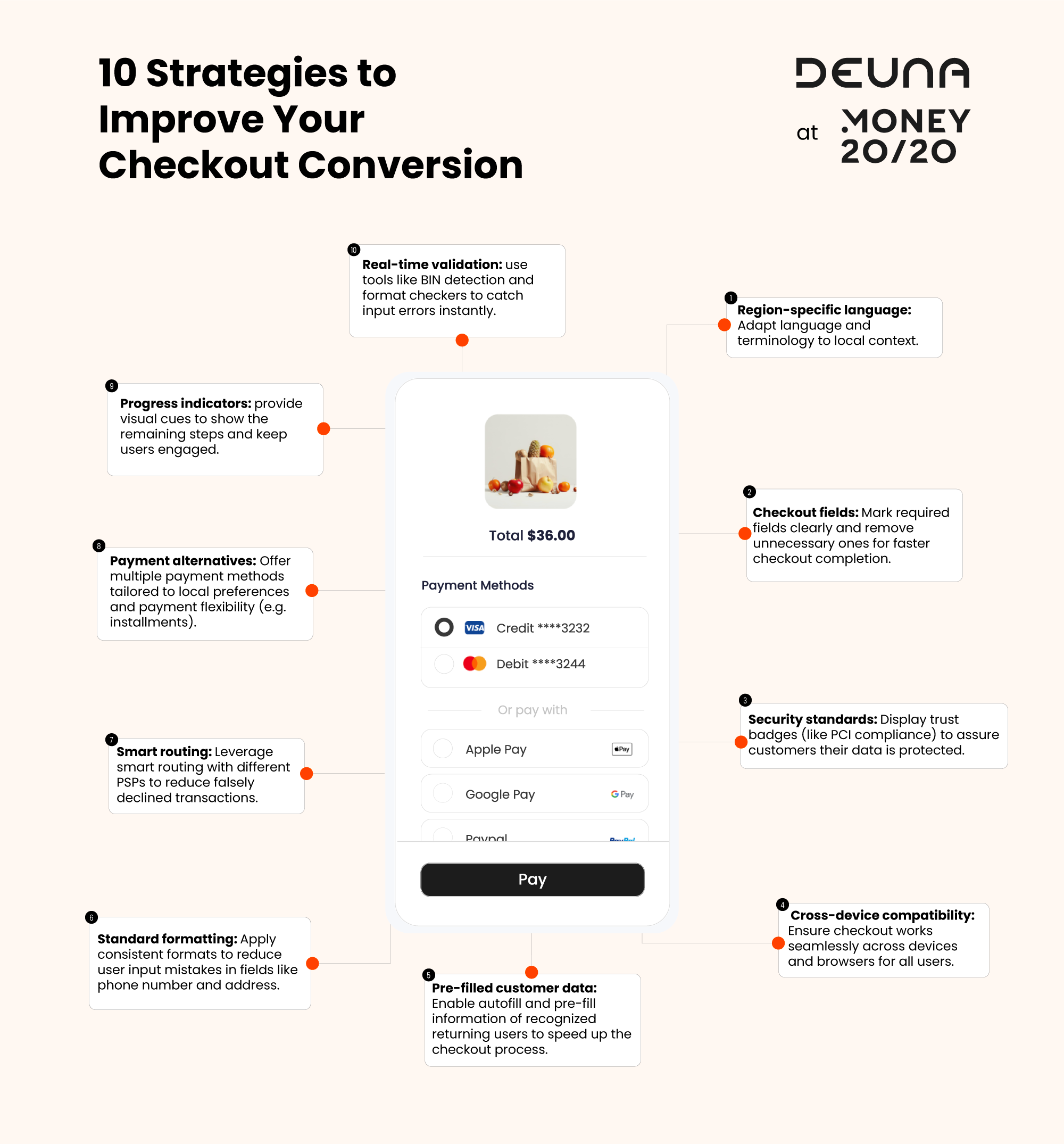

📝 10 Strategies to Improve Your Checkout Conversion, by Deuna👇

🇪🇺 Solidgate partners with Nova Post to power its international expansion. Through its partnership with Solidgate, Nova Post now offers EU clients a seamless payment experience, allowing secure one-click payments with high acceptance rates.

🇬🇧 Klarna and Worldpay expand partnership to unlock global merchant network. Under the expanded partnership, Klarna will be a preferred payment method for Worldpay’s merchants worldwide, alongside traditional card payments. Read on

🇺🇸 PayPal sees a 20% increase in BNPL revenue and more than one million debit card accounts added. The company reported a 9% year-over-year increase in total transaction volume for Q3, reaching $422.6 billion, largely due to growth in Venmo and PayPal digital payments.

🇺🇸 Mastercard launches new gen AI digital assistant capabilities to enhance customer value. The product onboarding assistant automates routine tasks and answers customer’s critical questions during onboarding by utilizing a large language model with Retrieval Augmented Generation (RAG) and fine-tuning.

🇺🇸 Visa Unveils new Push-to-Wallet capabilities to cover virtual card use. This allows users push virtual cards to mobile wallets such as Apple Pay and Google Pay with the ability to set spending limits and monitor transactions for fraud and unauthorized expenditures.

🇺🇸 Visa profit beats expectation on resilient consumer spending. Visa exceeded Wall Street's fourth-quarter profit expectations on Tuesday, as consumers eased concerns about a slowing economy and increased spending on travel and dining, boosting its shares by 2% in after-hours trading.

🇬🇧 Aevi and Paydock team up for Omnichannel Payment Orchestration. This partnership unites Paydock’s expertise and agnostic infrastructure in digital payments with Aevi’s advanced in-store payment solutions. Keep reading

🇺🇸 Affirm updates BNPL app ahead of holiday shopping season. The app update prioritizes what consumers want the most: to quickly discover their favorite credit offers from Affirm, seamlessly manage their payments, and see their real-time purchasing potential, according to Senior Vice President of Product Vishal Kapoor.

OPEN BANKING NEWS

🇧🇷 Thomson Reuters, a global media and technology company, is making a significant move to increase its reach among accountants. The company is expanding its presence in the accounting sector by adding a digital account and a benefits section to its Domínio platform through partnerships with Belvo, Pismo, Celcoin, and VR.

DIGITAL BANKING NEWS

🇦🇺 Up, the neobank for millennials and Gen Z, aims to engage more customers as it reaches the one million customer milestone. The neo bank reached 920,000 customers in June, reflecting a 29% growth for the year ending June 2024. Its growth is attributed to its entrepreneurial roots and lack of traditional financial services background, which CPO Anson Parker calls "our unfair advantage."

🇭🇰 Standard Chartered, Ant complete HKD intra-group transactions. Ant International makes use of treasury management principles to move funds between entities using its Whale platform. Read the full piece

🇺🇿 TBC Uzbekistan announces strategic partnership with Mastercard. The partnership enables TBC Bank Uzbekistan to introduce Mastercard cards and expand payment options, enhancing customers' online shopping, international purchases, and money transfers.

🇳🇿 Westpac hit by another round of online glitches. The bank says it’s working urgently to fix the problems. “Over the past week, a small number of customers have experienced issues logging into Westpac One online banking,” a Westpac spokesman said.

➡️ Banco Santander, Lloyds Banking Group, and UBS successfully settle pilot uncleared margin transfers in the Sterling Fnality Payment System. This proof-of-concept demonstrates Fnality’s use of £FnPS for bilateral margin payments, marking the first regulated DLT system for settling inter-bank derivatives margin.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase to integrate Visa Direct to deliver real-time account funding for customers. This partnership adds convenience and new services for Coinbase customers across the US and EU, including real-time, reliable, and secure money movement.

🇸🇬 MAS grants Gemini In-Principle approval for crypto payment license. This approval enables Gemini to offer cross-border money transfers and digital payment token services in Singapore, while expanding its local team to support growth and compliance with regulations.

DONEDEAL FUNDING NEWS

🇺🇸 Revolut: US investor tried to scoop up cheap shares with Budget tax warning. Jamba Europe, controlled by New York-based HOF Capital, advertised a secondary offer to nearly 3,500 investors in the British banking app this month through the Republic trading platform. The FCA halted the offer due to concerns it could be seen as a "financial promotion," requiring regulatory approval.

M&A

🇺🇸 nCino to buy FullCircl for $135M in cash. The acquisition will enhance nCino's onboarding and client lifecycle management capabilities. Acquiring FullCircl strategically boosts nCino's data and automation strengths while expanding its reach in the UK and Europe.

🇺🇸 Carta acquires Tactyc. With this acquisition, Tactyc by Carta will provide data for Carta Fund Administration customers who need to deploy capital effectively and maximize LP returns, offering multiple benefits. Continue reading

MOVERS & SHAKERS

🇮🇹 Gemini appoints Claudio Bedino as Head of Consumer Growth, Europe. Claudio brings a wealth of knowledge and a proven track record of success. Based in Italy, Claudio will be instrumental in advancing the presence of Gemini in Italy and wider Europe.

🇬🇧 Triodos Bank’s UK CEO Bevis Watts to step down in 2025. He will continue to lead Triodos Bank UK until June 2025, with the bank confirming a “recruitment process for his successor is underway”. Continue reading

🇺🇸 Kraken lays off staff, announces new co-CEO. Kraken announced layoffs Wednesday as it restructures, though the number of affected roles remains unclear. The company appointed Arjun Sethi as co-CEO of the firm.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()