Coinbase Acquires BUX Cyprus, Rebrands as Coinbase Financial Services Europe

Happy New Year, FinTech Fanatic!

Coinbase has expanded its European footprint by acquiring BUX's Cyprus unit and rebranding it as Coinbase Financial Services Europe. The strategic move gives the cryptocurrency exchange a Cyprus Investment Firm (CIF) license, enabling them to offer CFDs and passport their services across the European Economic Area (EEA).

The Cyprus regulator's registry shows approval for a "coinbase.com/international-exchange/europe" domain, though it's not yet live. Yorick Naeff, CEO of BUX, commented on the deal: "We are pleased with the sale of our MiFID licensed entity, BUX Europe Limited (BEU) to Coinbase, a globally recognised leader in the crypto industry."

This development follows a broader trend of crypto exchanges entering the traditional finance space, with Crypto.com recently acquiring Australian-licensed CFDs broker Fintek Securities, and Bybit holding a Mauritius license for forex and CFDs instruments.

I am back with all you need to know about what's been happening in FinTech, keep scrolling for more!

Cheers!

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

FINTECH REPORT

📊 A look back: Top 10 Cross Border Payment trends that defined 2024. This report by Almond FinTech underscores how efficiency, inclusivity, and innovation are reshaping the industry, offering a glimpse into the future of global finance. Click here to learn more.

FINTECH NEWS

🇺🇸 FinTech startup Level abruptly shuts down. Benefits startup Level announced it is shutting down after an acquisition deal fell through. Founded in 2018 and having raised $27 million in a 2021 Series A round, Level informed its clients to notify their employees and refer them to other benefits providers. Read More

🇺🇸 Robinhood's ambitious plans for 2025. Robinhood CEO celebrates the company’s turnaround, with Robinhood named Yahoo Finance’s “comeback stock” of the year after its turbulent post-IPO years. He’s excited about upcoming opportunities, particularly under potential deregulation and crypto-friendly policies. Robinhood aims to capitalize on the rapidly evolving FinTech landscape.

🇺🇸 Dave faces lawsuit over hidden fees. The Department of Justice (DOJ) and the Federal Trade Commission (FTC) filed a civil enforcement action against financial technology company Dave Inc. The lawsuit claims the company engaged in deceptive practices, including hidden fees, misleading advertising, and unclear cancellation mechanisms for recurring charges.

🇫🇷 Fast-growing French FinTech Aria eyes European expansion. Aria offers onboarding, credit and fraud risk management, and insurance. The startup has seen over 300% year-on-year revenue growth and raised €15 million in a Series A round. Continue reading

🇪🇺 What’s next for European FinTech? Sifted asked industry experts for their top predictions for 2025, highlighting key trends and innovations set to shape the sector in the year ahead. Explore the full article

Regulation, Deals and Crypto: FinTech Themes to Watch in 2025. The FinTech industry is seeing renewed optimism in 2025 as interest-rate cuts, FinTech stock recoveries, and a looser regulatory environment signal brighter prospects. Industry insiders anticipate momentum from technologies like stablecoins and expect an uptick in capital raising, acquisitions, and public listings.

PAYMENTS NEWS

🇮🇳 India lifts WhatsApp payment curbs, allowing Meta to roll out the service to its entire user base of over 500 million in the country. This removes the previous cap of 100 million users and marks a shift in the regulator's cautious stance. The move strengthens WhatsApp's position in India’s growing digital payments market. Continue reading

🇮🇳 India again delays UPI duopoly rules. This provides temporary relief to Google Pay and PhonePe, which together process over 85% of UPI transactions. UPI, handling 13 billion monthly transactions, is crucial to India's digital economy. The regulator faces challenges in enforcing the cap without disrupting services for millions of users. The delay prolongs regulatory uncertainty in the sector.

🇺🇸 iWallet adds voice AI payments. This new technology aims to revolutionise how payments are processed, combining advanced security features with seamless usability. “Adding the ability for businesses to use AI for payments saves them a lot of time and money,” stated the company’s Founder and CEO.

🇨🇳 Alipay introduces AI tool for analyzing images in app. The “Tanyixia” feature allows users to analyze images of plants, animals, food, or cartoons to access relevant details like menu translations or medication instructions also allows to gather information from uploaded images.

DIGITAL BANKING NEWS

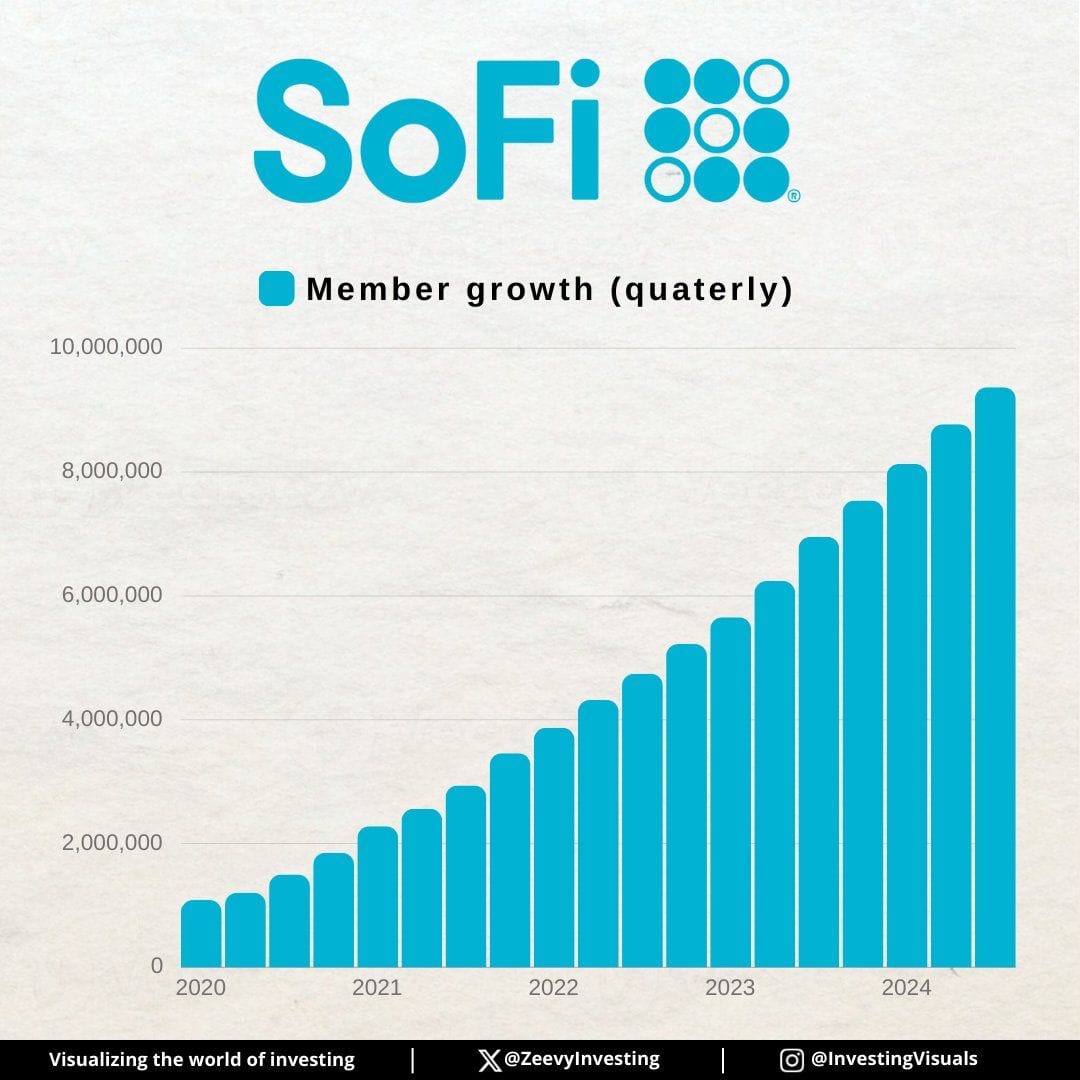

In 2024, SoFi hit 10 million members.

Here's their impressive growth over the past years 👇

🇷🇺 Putin ordered Russian government and top bank to develop AI cooperation with China. This move follows his announcement of AI partnerships with BRICS nations and others to counter Western dominance. Sanctions have limited Russia's access to key technologies like GPUs. Russia aims to advance its AI ambitions despite these constraints.

🇺🇸 Debanking’ debate resurfaces amid Trump’s return to office. Debanking can present major obstacles for affected parties, especially if they depend on financial services to operate. For businesses, it could mean trouble accessing payment systems, getting credit or even simply making deposits. Find out more

🇺🇸 OCC to intensify oversight of larger banks. The OCC is increasing scrutiny on anti-money laundering (AML) practices. Recently, it issued a cease-and-desist order to Bank of America for deficiencies in Bank Secrecy Act (BSA) and sanctions compliance, citing delays in filing suspicious activity reports. Read more

🇵🇰 Mashreq pioneers digital retail banking pilot. The bank plans to offer best-in-class Islamic banking solutions, aiming to onboard millions of retail customers over the next five years. This initiative highlights Mashreq’s role in driving financial accessibility and supporting Pakistan’s economic growth.

🇺🇸 Morgan Stanley’s E-Trade explores offering crypto trading. This move comes as the Trump administration takes a more crypto-friendly approach, with other large brokers like Schwab also exploring crypto services. E-TRADE's potential entry highlights the expanding role of cryptocurrencies in retail investing.

🇧🇬 Revolut is beta testing its product in Ukraine. Revolut’s beta test is a significant milestone in its journey to enter the Ukrainian market. With over 6 million Ukrainians living abroad, the app has the potential to earn revenue through cross-border transactions.

🇺🇸 Bank of America, Citigroup, Morgan Stanley latest to exit Net-Zero Banking Alliance. The exits follow similar moves by Goldman Sachs and Wells Fargo in December, amid increasing GOP-led scrutiny of NZBA. Critics argue the departures highlight the limitations of voluntary commitments and call for stronger state-level climate regulations.

🇩🇪 Deutsche Bank targets US fixed income for investment banking growth. The bank has rebuilt its trading operations since 2019, boosting revenues in Europe and Asia by 45% to €8 billion. It is also expanding its advisory arm to balance the capital-intensive fixed income business.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Frax launches frxUSD, backed by BlackRock's BUIDL fund. This partnership bridges traditional finance and blockchain, offering fiat redemption and enhanced compliance with U.S. financial systems. The collaboration highlights the transformative potential of tokenizing real-world assets for modern finance.

🇺🇸 Do Kwon pleads not guilty to US fraud charges. Federal prosecutors accused him of securities, wire, commodities fraud, and conspiracy following the $40 billion collapse of his cryptocurrencies in 2022. An updated indictment added a money laundering conspiracy charge. Read more

🇺🇸 Blockchain groups sue IRS DeFi rules. New IRS regulations set for 2027 require crypto brokers, including decentralized exchanges and platforms, to report digital asset transactions, sparking industry backlash. Blockchain groups argue the rules are unconstitutional, impose unlawful compliance burdens on developers, and stifle innovation.

🇧🇷 Binance gets Brazil's approval for Sim;paul. This move enhances Binance's compliance with Brazil's regulatory framework and positions it to adapt to ongoing regulatory developments. It becomes the first crypto exchange in Brazil to hold a broker-dealer license. The acquisition strengthens its presence in the country as a global exchange.

🇪🇺 MoonPay secures MiCA approval. MiCA aims to create a standardized regulatory environment for digital assets. It sets new rules for consumer protection, market transparency, and financial integrity across Europe. For MoonPay, this approval is a major step forward, allowing the company to continue expanding its services while ensuring compliance with the latest regulations.

🇺🇸 The $205B market ready to revolutionize payments. Stablecoins have become lucrative as issuers invest reserves in high-yield US Treasuries. Unlike volatile cryptocurrencies, stablecoins are increasingly used as currencies for global transactions. Their stability and utility make them a growing focus for mainstream financial players.

🇪🇺 Tether hits 2-year low after MiCA rules. Tether's USDT market cap dropped over 1% to $137.24 billion this week, its sharpest decline since the FTX crash, amid EU cryptocurrency rules under the MiCA regulation. Traders can still hold USDT in non-custodial wallets, but the delistings have fueled speculation of a broader crypto market downturn. Analysts suggest the impact may remain localized to the EU.

🇿🇦 KuCoin launches crypto payment solution. This system allows businesses to accept crypto payments easily, offering contactless, borderless transactions with reduced fees and instant settlements. The platform provides businesses access to KuCoin’s global user base, boosting reach and enhancing customer experience.

🇺🇸 US crypto industry eyes possible day-one Trump executive orders. Industry officials hope for a bitcoin stockpile, improved banking access, and the creation of a crypto council. The move aims to mainstream crypto and fulfill Trump's campaign pledge to be a "crypto president."

PARTNERSHIPS

🇮🇶 Iraq’s Qi Card partners with Ant International. Combining a digital super app with a functional digital bank, SuperQi aims to boost financial inclusion in Iraq and offers services like scan-to-pay, transfers, loans, and shopping, targeting millions of unbanked Iraqis. With over 20,000 merchants and 10,000 cash-out agents, SuperQi supports Iraq’s growing financial infrastructure.

DONEDEAL FUNDING NEWS

🇬🇧 Strictly Money launches crowdcube campaign. The primary objective with this campaign is to accelerate its growth, fuel product development, and expand its shareholder base. The company plans to introduce hedge fund returns products, broadening investment options for consumers by the end of 2025.

Binance Labs invests in THENA to boost DeFi. The strategic investment from Binance Labs marks a transformative moment for THENA. The new resources will catalyze several crucial developments within the platform's ecosystem. This funding will support extensive user acquisition initiatives and facilitate strategic partnerships within the BNB Chain ecosystem.

🇺🇸 Infinant raises $15M in series A funding. The company intends to use the funds to enhance its product suite, align with regulatory requirements, and support banks in scaling innovative financial solutions. It gives banks operational and regulatory control of their programs on a bank-owned platform, allowing them to maintain complete control of the ledger, operations and compliance.

M&A

🇨🇦 Thomson Reuters acquires SafeSend for $600m. This move enhances Thomson Reuters' tax software portfolio, following its $500M acquisition of SurePrep in 2021. Thomson Reuters plans to continue offering SafeSend as a market solution, ensuring compatibility with various tax software vendors.

🇺🇸 Employer. com acquires Canadian FinTech Bench Accounting. Employer. com plans to integrate Bench’s capabilities into its payroll and workforce management solutions. The acquisition follows Bench’s recent announcement of a planned shutdown, which has now been reversed. Bench’s platform is fully operational under the new ownership.

🇨🇾 Coinbase acquires BUX's Cyprus unit. The crypto exchange renamed the entity Coinbase Financial Services Europe, according to Finance Magnates. Through this acquisition, Coinbase has obtained a Cyprus Investment Firm (CIF) license, allowing it to offer contracts for differences (CFDs) products.

MOVERS AND SHAKERS

🇬🇧 Freetrade co-founder Davide Fioranelli returns as a Non-Exec Director. Fioranelli has returned following a four year absence. The firm experienced a tough period, posting a £13.9 million loss in 2023, but has shown signs of improvement in 2024.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()