Circle and Binance Partner to Boost Global USDC and Crypto Adoption

Hey FinTech Fanatic!

A major partnership has just been announced at Abu Dhabi Finance Week between Circle Internet Group Inc., the USDC stablecoin issuer, and Binance. The collaboration aims to expand USDC adoption across Binance's platform, which serves over 240 million global users.

Jeremy Allaire, Chairman and CEO of Circle emphasizes: "With Binance rapidly becoming the world's leading financial super app, and stablecoin adoption and utility at the core of this future financial system, this is a tremendous opportunity for USDC as it becomes ubiquitous on the Binance platform."

Additionally, Richard Teng, CEO of Binance adds: "Through our strategic partnership, our users will have even more opportunities to use USDC on our platform, including more USDC trading pairs, special promotions on USDC across trading, and other products on Binance."

BTW - Speaking of exciting FinTech news, don't miss out on your chance to meet me in Las Vegas in March and join the best community in FinTech!

The best FinTech event of the year is back from March 10th until March 13th, and of course, I'll be attending 😉

Less than one week remains to secure the best price on your ticket to FinTech Meetup 2025.

Do I see you in Vegas? Let me know in the comments.

Enjoy the read, and I'll catch up with you tomorrow with more tales and updates. 👇

Cheers,

#FINTECHREPORT

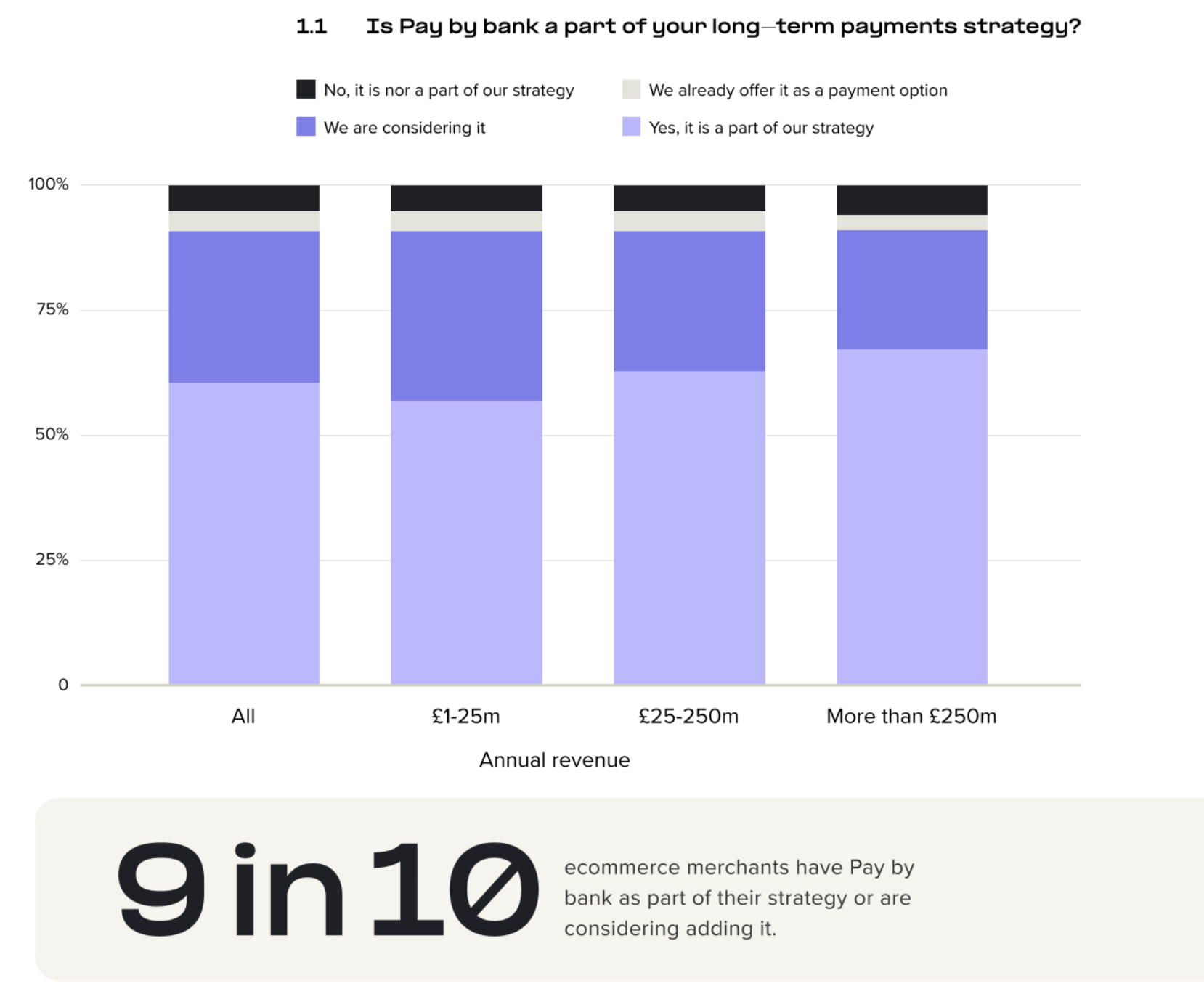

📊 Here is what online shoppers and Ecommerce Merchants think about Payments

In this report👇 you can find some insights from recent research by TrueLayer done in the U.K. 🇬🇧

FINTECH NEWS

🇬🇧 Curve optimizes fees to save £2.5 million a year with Checkout.com. Since 2020, Checkout.com has helped Curve overcome challenges, enhance payment performance, and cut costs. Looking ahead, Curve focuses on global expansion, new markets, and alternative payments, with Checkout. com as a key partner.

🇺🇸 Digital Matrix Systems establishes strategic alliance with Stratyfy to enable automated credit decisions for small to midsize lenders. This alliance supports the two companies’ common goal of helping leading institutions improve processes and mitigate risk.

🇸🇪 Klarna fined $50mn and reprimanded by Swedish regulator. The regulator said on Wednesday that between 2021 and 2022 Klarna had “significant deficiencies”, such as not having any assessments of how its services could be used for money laundering or terrorist financing.

🇺🇸 Klarna adds a dozen banks to US IPO roster as listing nears. Bank of America Corp., Barclays Plc, Citigroup Inc. and Deutsche Bank AG have been selected as so-called joint bookrunners on the Stockholm-based digital payments company’s listing, according to sources. Other banks have been tapped for junior roles on the IPO, sources said.

🇦🇪 MNT-Halan has entered the UAE market, marking a key milestone in its rapid expansion across the region. MNT-Halan will offer innovative financial solutions, starting with Halan Advance, a secure salary financing option in the UAE, with more services to come.

🇱🇹 Lithuania’s Finbee expands into Poland. The alternative lender will provide loans of up to PLN200,000 (£38,673) to small- and medium-sized businesses in the country for up to three years without collateral. A company called Finbee Poland has been created to manage the new Polish business.

PAYMENTS NEWS

🇬🇧 Ecommpay Compliance expert names the themes shaping payments. The regulatory landscape for payments across Europe in 2025 is set to prioritise building trust, enhancing security and ensuring the reliability of payment ecosystems. With evolving technologies and increasing reliance on seamless payment systems, Willem Wellinghoff, Chief Compliance Officer at Ecommpay, says regulators are sharpening their focus on critical areas to safeguard the integrity of the payments infrastructure. Click here to access the full piece

🇨🇦 Klarna is now available to users in Canada checking out on Apple Pay online and in apps. From now on, eligible Apple Pay users in Canada will have access to Karna's flexible payment offerings, including pay later in four installments with no interest, or over longer periods with competitive APRs.

🇨🇦 Loop launches Canada’s first multi-currency credit card for SMEs. This will be one of the first corporate credit card solutions for Canadian businesses, allowing them to spend and settle credit balances in multiple currencies.

🇪🇸 CloudPay & Banco Santander bring on-demand pay to SMEs in Spain. CloudPay's partnership with Banco Santander has brought Pay On-Demand to businesses of all sizes across Spain, enabling Santander’s SME customers to offer a service typically reserved for larger enterprises.

🇩🇪 Computop ready to support payment processing for Wero acquirers. With over 25 years of experience in payment processing, Computop has now positioned itself to play a key role supporting the first banks in providing services for Wero payment acceptance.

REGTECH NEWS

🇦🇪 VersiFi announced it has received In-Principle Approval from the Financial Services Regulatory Authority (FSRA) of ADGM, the international financial center of Abu Dhabi. Subject to final regulatory approval, VersiFi will launch a fully regulated digital asset trading solution for institutional clients from its new global headquarters in ADGM.

DIGITAL BANKING NEWS

🇸🇬 Revolut launches joint accounts in Singapore to simplify financial management for various types of duos including partners, family members, housemates, and even domestic helpers to simplify spending on groceries and household essentials.

🇺🇦 Revolut is now available in Ukrainian language. This change will make it even easier for over half a million Ukrainian customers in Europe to use our services, and communicate with us in their native language.

🇲🇽 FinTech Plata Card wins approval for banking license in Mexico. Mexico’s Banking and Securities Commission is expected to announce the decision in coming days, people familiar with the matter said, asking not to be identified before the information is public.

🇺🇸 Santander goes National in the United States with Openbank. The initial offering brings high-yield savings opportunities to more Americans. By launching Openbank, Santander extends its nationwide reach, grows deposits as a cost-effective funding source, and bolsters its Auto lending business.

🇬🇧 Habib Bank Zurich (HBZ UK) partners with nCino to power an enhanced digital experience for its Buy-to-Let lending business. The partnership aims to streamline processes, enhance risk management, and improve loan origination and management through digital web, mobile, and intermediary channels.

🇩🇰 Lunar unveils personalized app update. The platform has released its latest app update, version 5.0, introducing a range of new features designed to make financial management more user-friendly and personalized. The update focuses on customization and streamlined functionality.

🇪🇪 audax and Tuum partner to accelerate digital transformation for financial institutions. Initially focused on the Middle East, the partnership will deliver rapid digital banking capabilities, incremental core modernization, and scalable BaaS solutions, with plans to extend these benefits to other regions.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Circle and Binance form a strategic partnership to accelerate Global USDC and crypto adoption. Binance will integrate USDC across its platform for trading, saving, payments, and corporate treasury, while Circle will provide technology and liquidity to boost trust and drive stablecoin innovation globally.

🇺🇸 Coinbase's Project Diamond strategically integrates the Chainlink Standard to scale institutional adoption of digital assets. With Chainlink integrated into Project Diamond, asset issuers and fund managers can securely and compliantly scale tokenized assets across blockchains with verifiable data connectivity.

🇦🇪 Chainlink Labs strengthens MENA reach with Abu Dhabi Office. This development positions the blockchain interoperability leader to cater to the growing demand for decentralized finance solutions in the area. Read full article

HongShan, Peak XV back stablecoin-powered neobank KAST, a dollar-denominated, neobank-like platform that lets customers hold and spend stablecoins via traditional payment methods, and issues credit cards allowing users to spend stablecoins at merchants who don’t support crypto transactions.

🇦🇪 Ex-SoftBank rainmaker Akshay Naheta eyes stake sale in his stablecoin startup. Naheta is in early talks to sell a minority stake in the stablecoin payments startup he co-founded, according to sources. Distributed Technologies Research Ltd. will use the funds to expand into newer markets, including the US.

PARTNERSHIPS

🇺🇸 Google Cloud and Swift have partnered to build an AI-powered fraud detection capability. The new tool aims to support the financial industry in tackling sophisticated financial crime and help prevent cross-border payments fraud. Rhino Health and Capgemini will support the partnership with secure AI tools and seamless integration.

DONEDEAL FUNDING NEWS

🇳🇬 Nigerian FinTech Billboxx raises $1.6 million in pre-seed from Norrsken, 54 Collective. The company plans to leverage the capital to scale its operations, hire new talent and expand product features. Continue reading

🇦🇪 UAE FinTech gets $500 million asset-backed facility from Citi. Quantix Technology Projects, which operates the CashNow consumer lending platform, received the asset-backed securitization financing from Citi, the bank said in a statement.

🇸🇪 Mynt raises a cool $23M at $210M valuation to build a smarter expense card for SMEs. Mynt offers company cards through its primary partner, Visa, along with spend management tools and automated integrations for major accounting apps. Read on

🇬🇧 Ayan Capital raises $3.6mln equity to expand Islamic FinTech solutions in the UK. The funding will help the company launch new tech-driven products in the UK, addressing gaps in customer experiences like long waits and hidden commissions, despite the competitive FinTech ecosystem.

🇮🇩 CarDekho SEA raises first-ever outside funding, co-founder says he’s interested in acquisitions. The company will use the funding to support its further expansion into Southeast Asia, focusing on the used car and bike financing industry in Indonesia and the used auto financing sector in the Philippines.

M&A

🇳🇿 Fat Zebra acquires Pin Payments. This acquisition represents a significant milestone in Fat Zebra's commitment to providing exceptional payment solutions for businesses of all sizes across Australia and New Zealand. Continue reading

🇬🇧 Equals Group agrees to acquisition by investor consortium incl TowerBrook, J.C. Flowers, and Railsr shareholders, at approximately £𝟮𝟴𝟯 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 🤯 The deal, valued at approximately £283 million, will see Equals shareholders receive 140 pence per share, which includes a 135 pence cash consideration and a 5 pence special dividend.

🇫🇷 French regulator approves Ageras' takeover of Shine from SocGen. The approval allows Shine to offer bank accounts and payment services under its own license, presenting a unique opportunity for expansion into Ageras' home markets and beyond as part of Shine's pan-European growth plans starting in 2025.

MOVERS & SHAKERS

🇪🇸 Santander hires Nitin Prabhu as global head of Digital Consumer Bank. Nitin, formerly PayPal's head of Product for SMBs and Financial Services, will join Santander in early 2025 (pending regulatory approval). Based in Madrid, he will report to the group executive chair.

🇬🇧 FinTech software and payments veteran Simon Black joins ClearCourse Board. This appointment comes at an exciting time for ClearCourse, as the company expands its UK market presence while continuing to provide mission-critical products and services to help customers manage and grow their businesses.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()