Chrysalis Boosts Klarna Valuation as IPO Prep Intensifies

Hey FinTech Fanatic!

Today, I'm diving into some big news on Klarna. Shareholder Chrysalis Investments Ltd recently marked up its stake in Klarna to an impressive £120.6 million, up from £100.3 million in the previous quarter. This increase gives Klarna an implied valuation of around $14.6 billion, according to Deutsche Bank analysts.

This move was fueled by share price gains among Klarna’s listed competitors like Affirm and PayPal, which have surged 145% and 59% in the past year. Klarna’s valuation, while rebounding from a $6.7 billion low in 2022, is still well below the $45.6 billion peak it reached in 2021. Yet, Chrysalis is optimistic, saying, “We are also expectant of a Klarna IPO in due course, the next potential window for this appears to be the first half of 2025.”

Meanwhile, Klarna’s boardroom saw a recent shake-up as Mikael Walther was ousted following clashes with leadership. Despite the internal turbulence, the company is actively preparing for a public debut, eyeing a potential $20 billion valuation at IPO.

What’s your take on Klarna’s trajectory? Let’s discuss it in the comments and if you’re interested in reading a bit about what’s been happening in FinTech, keep scrolling!

Cheers,

#FINTECHREPORT

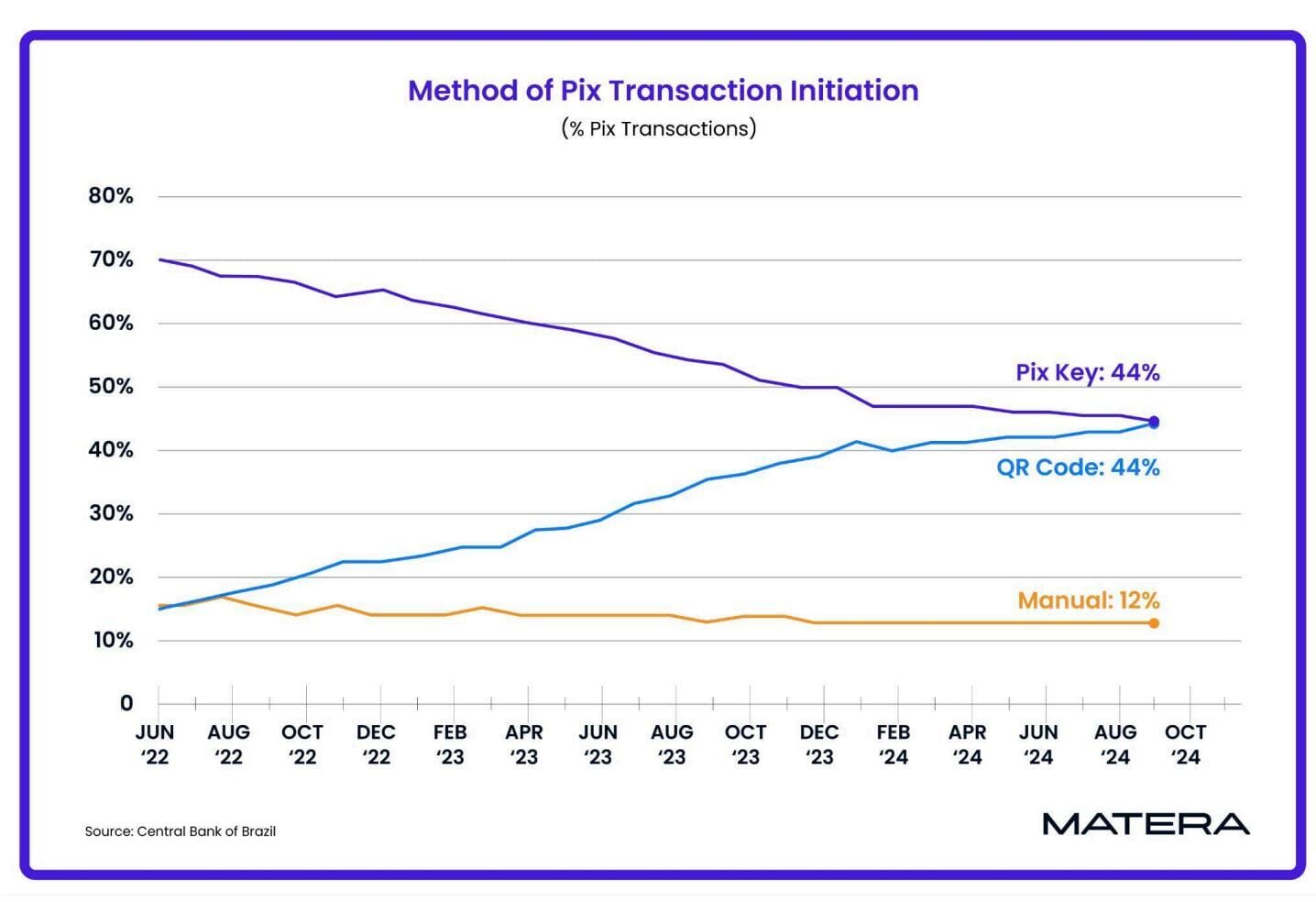

📊 There were an estimated 𝟱.𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 Pix transactions in Sept 2024 - 41% more than Sept 2023 🤯

Let's dive into more mind blowing info & Stats by reading the full report by Matera

FINTECH NEWS

🇲🇽 Kuady expands digital wallet services into Mexico, boosting financial access across Latin America. Kuady's launch in Mexico marks its continued growth in Latin America, expanding market access and enabling seamless cross-border transactions, with more countries added monthly.

🇪🇺 Mastercard announces ten winners for the Mastercard Strive EU Innovation Fund. These winners offer a variety of digital solutions, carefully selected to support small businesses in their digitalization and growth journey. Among the winners are Bizcuit from the Netherlands, Cresco Cybersecurity from Belgium, and Direct Market from France. See the full list in the complete article.

🇨🇳 Ant CEO Eric Jing touts tokenisation benefits for cross-border transactions at FinTech Week. “If we can really solve … cross-bank, cross-currency [issues], then we are really moving to real-time settlement on a global scale.” said Jing in a panel discussion with Howard Lee, Deputy Chief Executive of the Hong Kong Monetary Authority.

🇭🇰 Hong Kong to strengthen FinTech cooperation with Middle East region. Hong Kong's Financial Secretary Paul Chan announced a new milestone in FinTech cooperation with the Middle East. He will be leading a delegation to Riyadh for the Future Investment Initiative, promoting collaboration.

🇬🇧 FinTech billionaire Kristo Kaarmann fined £350K for failing to disclose tax issues. The FCA stated that Kaarmann failed to inform the regulator about a "significant fine" he paid to HM Revenue and Customs in February 2021 and his inclusion on the public tax defaulters list in September.

🇺🇸 Extend launches Bill Pay for invoice payments. The new feature enables businesses to streamline invoice payments with virtual cards by simplifying accounts payable workflows, optimizing cash flow and enhancing security for organizations of all sizes.

🇺🇸 Episode Six and dash.fi partner to launch a daily net 60 term charge card for brands and startups. Through this partnership, brands using dash.fi’s daily net 60 term charge card can better manage their working capital, keeping more money in the bank.

PAYMENTS NEWS

🇺🇸 Yuno unveils Payout at Money 20/20, revolutionizing payment orchestration with first of its kind end-to-end solution for merchants. Payout allows businesses to quickly transfer funds globally to suppliers and clients via a single API that connects to multiple payout providers. Yuno Co-founder and CEO Juan Pablo Ortega unveiled Payout at Money 20/20 USA alongside James Stack, Yuno's Head of Product.

🇸🇬 Thunes expands global reach with launch of Pay-to-Card Solution. Thunes now connects Members of its proprietary Network to 15 billion cards globally, including Mastercard, Visa, and UnionPay, making cross-border payments faster, more efficient, and more accessible than ever before.

🇺🇸 X Payments delayed after Musk’s X weirdly withdrew application for NY license. Approvals in New York stalled after Walden Macht Haran & Williams (WMHW) sent a letter in September 2023 urging that X be deemed "unfit" for a money transmitter license. In April 2024, X withdrew its application and did not resubmit it, according to the NY Department of Financial Services. Discover more

🇬🇧 Klarna valuation raised by Chrysalis as FinTech preps for IPO. Chrysalis Investments Ltd increased the value of its stake to £120.6 million, up from the £100.3 million it assigned the holding in the second quarter, according to company filings.

🇺🇸 PublicSquare formally launches payments platform. The company also announced a capital raise to fund further growth and stated that it is taking significant steps to modify its marketplace strategy and launch a fee-based affiliate offering in 2025.

🇺🇸 Account verification becomes critical factor in cross-border payments. Money movement can accelerate the flow of funds between consumers and corporations, but it faces complexities and fraud risks. According to Nium CPO Alex Johnson, the accuracy of payee information is a significant vulnerability in cross-border payments. More on that here

🇺🇸 Nium launches Nium Verify for real-time account verification to eliminate misdirected global payments. Nium Verify aims to reduce errors, operational inefficiencies, and compliance risks, increasing the confidence of the finality of real-time payments.

🇺🇸 Mastercard unveils Bill Qkr to streamline and enhance the way bills are paid. The solution will enable merchants, acquirers, payment facilitators and service providers globally by providing them with leading, faster card-based bill payment solutions and tailored expertise to improve the consumer experience.

🇺🇸 Worldpay and Capital One join forces in a new collaboration to optimize payment fraud decisioning and enhance payment security and efficiency with a data sharing agreement. Merchants using Worldpay’s FraudSight™ solution will automatically benefit when accepting payments made with Capital One-issued cards.

🇺🇸 Marqeta announces Marqeta Flex, an industry-leading, BNPL solution that can be embedded into payment apps. This new solution, developed with leading payment providers Klarna and Affirm, along with the payments platform Branch, plans to be integrated into its app for W-2 and 1099 workers.

🇬🇧 Online Payment Platform (OPP) expands its offering and obtains EMI license in the UK. This license enables OPP to continue its growth journey to become a PSP for marketplaces and platforms with their new product offering in the UK.

🇪🇺 Kia launches CarPay, an in-car payment service that allows drivers to pay for items and services directly from their vehicle, starting with the EV3 electric compact SUV. The first application is with Parkopedia, which helps European drivers find and pay for parking through the vehicle's navigation screen.

🇸🇬 Network International partners with Ant International. The companies have signed a Memorandum of Understanding to extend innovative digital payment solutions to businesses in the Middle East and Africa, driving digital transformation and financial inclusion in the region.

🇧🇷 Scheduled Pix becomes mandatory. Starting Monday (10/28), institutions participating in Pix are required to offer their customers the Scheduled Pix feature for recurring transactions. Until now, offering this feature was optional.

📈 Adyen and BCG research finds embedded payments and finance now a $185 billion opportunity -- a 25% Increase in Two Years. BCG's analysis reveals this market growth is driven by a favorable interest rate environment — due to higher bank revenues from accounts — and an overall expansion of banking revenue pools.

REGTECH NEWS

🇬🇧 FCA’s new guidelines on PEPs: A shift towards risk-sensitive compliance. Key changes include classifying UK PEPs as lower risk than international ones, clarifying that non-executive civil service board members are not automatically PEPs. Napier AI has expressed strong support for these changes.

DIGITAL BANKING NEWS

🇬🇧 Metro Bank has launched a switcher incentive for small businesses, offering free business banking for two years to those who complete a full switch via the Current Account Switching Scheme. Read more

BLOCKCHAIN/CRYPTO NEWS

₿ Bitcoin may shift to a super cycle, breaking the crypto market norm. The cryptocurrency world is witnessing a seismic shift as bitcoin, the pioneer in digital assets, appears to be breaking free from its long-established four-year cycle in favor of a so-called “super cycle.”

🇺🇸 Robinhood jumps into election trading, giving users chance to buy Harris or Trump contracts. The broker is jumping into the prediction betting game, announcing on Monday that users can begin trading the 2024 presidential election that is a few days away.

🇺🇸 Shift4 unveils global crypto payment capabilities. The company announced Pay with Crypto, allowing businesses to accept cryptocurrency with the click of a button for both ecommerce and POS merchants. Read the full piece

PARTNERSHIPS

🇬🇧 Dojo partners with YouLend to streamline SME financing. The partnership allows Dojo to integrate YouLend’s financing solutions into its payments platform, providing customers with access to business funding directly through the existing interface.

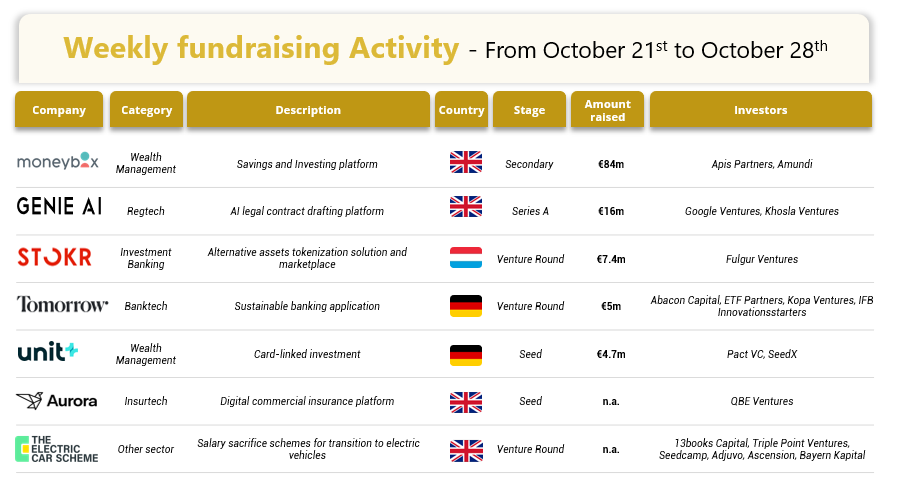

DONEDEAL FUNDING NEWS

💰 Last week, we saw 7 official FinTech deals in Europe, raising a total of €117.1 million, with 4 deals in the UK, 2 deals in Germany and 1 deal in Luxembourg. Read the complete BlackFin Tech article

🇺🇸 FinTech investment sector remains muted. According to a report from Silicon Valley Bank, venture capital investment in US FinTech remains muted, nearing a six-year low for the sector, with deal flow increasingly concentrated in early-stage investments.

🇺🇸 Osigu’s $25m Series B to help revolutionise healthcare payments in Latin America. This funding aims to transform healthcare payment transactions in the region by improving interactions among providers, payers, and patients through innovative technology and real-time payment solutions.

🇬🇧 Zilch secures £150m Deutsche Bank-led securitisation deal. The expanded facility, which represents a £50m increase from its initial securitisation, will support £10bn in annual commerce through Zilch's payment network. Read on

M&A

🇮🇳 Indian FinTech Slice seals bank merger. Slice has completed its merger with North East Small Finance Bank, entering India's regulated banking sector. The firm will continue its digital payments and lending services while expanding into banking products like savings accounts and investments.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()