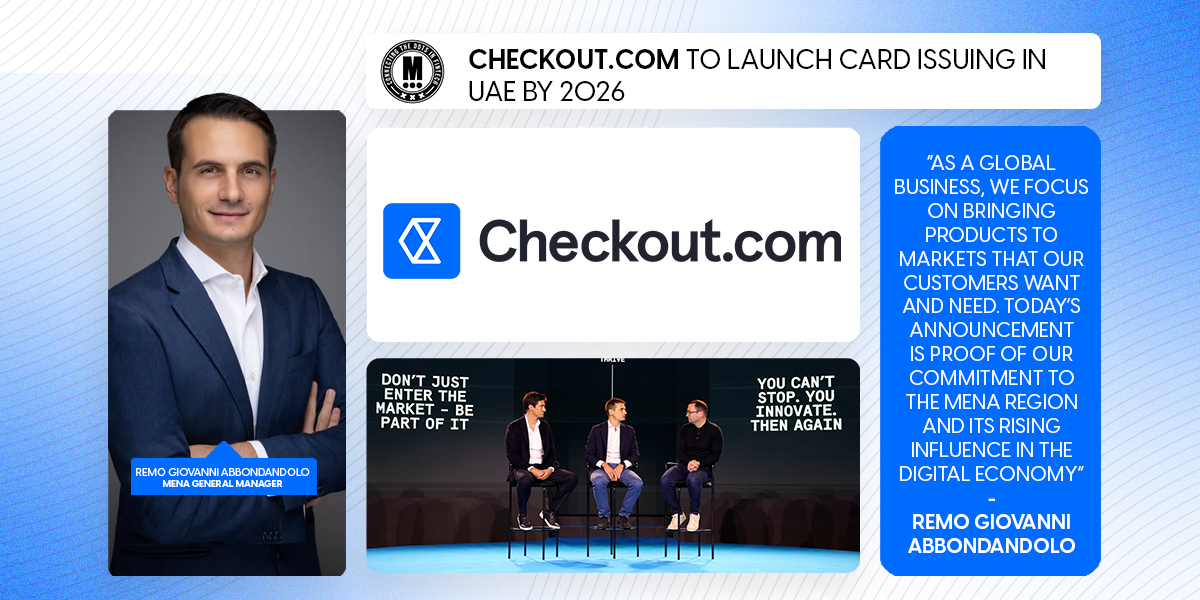

Checkout.com to Launch Card Issuing in UAE by 2026

Hey FinTech Fanatic!

Abu Dhabi was the stage this week for an important announcement from Checkout.com. The company hosted its first conference in the UAE — Thrive Abu Dhabi — gathering over 150 merchants and partners on Saadiyat Island to share its next big step for the region.

CEO & Founder Guillaume Pousaz, together with MENA General Manager Remo Giovanni Abbondandolo, announced Checkout.com’s plans to become the first global digital PSP to launch domestic card issuing in the UAE by 2026, subject to regulatory approval. This will allow businesses to issue branded cards — physical or virtual — and offer new ways to reward customers, manage expenses, and simplify payouts.

“As a global business, we focus on bringing products to markets that our customers want and need. Today’s announcement is proof of our commitment to the MENA region and its rising influence in the digital economy,” said Remo Giovanni Abbondandolo.

Checkout.com has been steadily building its presence in the UAE. The FinTech partnered with Tamara in 2021, secured a Retail Payment Services license from the UAE Central Bank in 2023 — becoming the first global payments platform to do so — and grew its Dubai team to nearly 100 local experts.

By 2024, its total processing value in MENA had increased 658% since 2020. In 2025, partnerships with noqodi and Tabby expanded its reach, integrating advanced payment technology and driving adoption of Buy Now, Pay Later services across the region.

Read more FinTech news below 👇 and I'll be back on Monday!

Cheers,

POST OF THE DAY

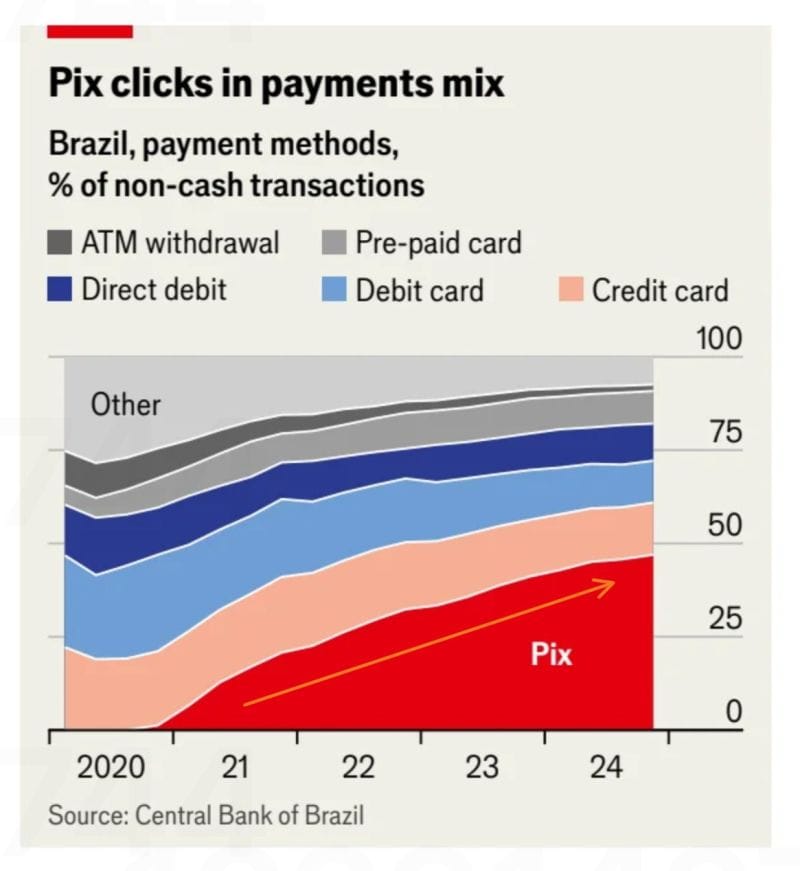

📈 In less than 5 years, Pix has grown to almost 50% of Brazil’s non-cash payments.

ARTICLE OF THE DAY

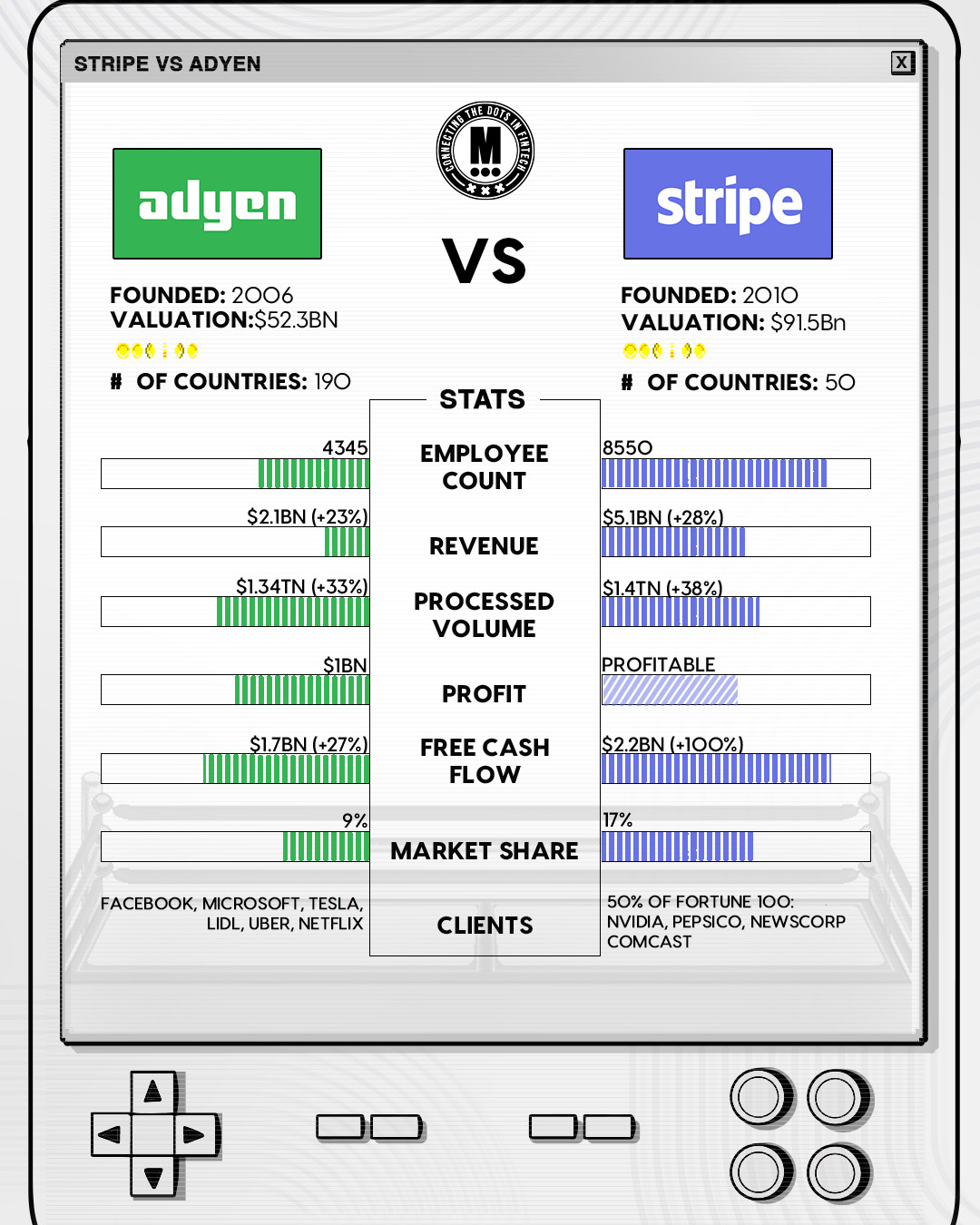

📈 Adyen vs Stripe (2024)

Let’s take a closer look at how 2024 unfolded for these two payment giants 👇

FINTECH NEWS

🇦🇪 Checkout.com gears up to become the first global digital PSP to launch card issuing in the UAE. The company aims to roll out domestic card issuance in the region in 2026, pending regulatory approval. This will enable businesses to launch branded cards, whether physical or virtual, power customer rewards, streamline expenses, and simplify business-to-business payouts.

🇺🇸 Inside ACI Worldwide’s 2025 growth strategy. The company is eyeing international opportunities coupled with increasing adoption of real-time and commercial payments to grow operations in 2025. The $5.2 billion global payments firm this year developed a hub called ACI Connetic that routes payments in the most efficient way to complete the transaction, Tom Warsop, Chief Executive, said in an interview.

🇨🇦 Yoo Financial partners with Episode Six to launch its range of credit card offerings in Canada. With E6’s flexible TRITIUM® platform, Yoo Financial will offer credit card products precisely tailored to each customer’s needs, instead of being constrained within the limitations of existing legacy technology.

🇩🇪 auxmoney successfully issues 6th ABS bond, "Fortuna Consumer Loan ABS 2025-1", totaling €425 million. Despite tough market conditions, the deal saw strong investor demand. At least 50% of the loan portfolio meets social bond criteria, and the issuance is STS-certified and listed on the Luxembourg Stock Exchange.

🇬🇧 Wise expands India presence to hire hundreds across functions. The company is setting up a technology and operations hub in Hyderabad, which will serve as a full-stack centre for product, engineering and servicing teams. It is also introducing a new feature that allows SMBs and freelancers to receive overseas payments in foreign currencies.

🇸🇬 Australian lender Bizcap launches in Singapore to bring flexible lending to SMEs. The company aims to fill a financing gap, providing fast access to capital with quick approval and minimal paperwork. Its expansion is led by Joseph Lim, appointed as Managing Partner for Asia, to support underserved small businesses in Southeast Asia.

🇮🇹 Italy seeks $1.3 bln from FinTech group ION in tax evasion probe. The investigation adds to a series of tax evasion cases in Italy targeting U.S. tech companies, which are also at the centre of a wider EU response to the trade war sparked by U.S. President Donald Trump's tariffs.

🇺🇸 Cash App owner Block pays $𝟰𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 fine to New York over compliance failures. Block will pay a $40 million civil fine and hire an independent monitor to settle charges by New York's financial services regulator that it failed to adequately police and stop money laundering on its Cash App mobile payment service.

PAYMENTS NEWS

🇮🇹 Ecommpay streamlines Italian market entry for e-commerce merchants. The company is providing access to the most popular local and global payment methods in the region. In addition to acquiring and credit card payments, seamless integration is available with popular payment methods, Satispay, MyBank, and BANCOMAT Pay.

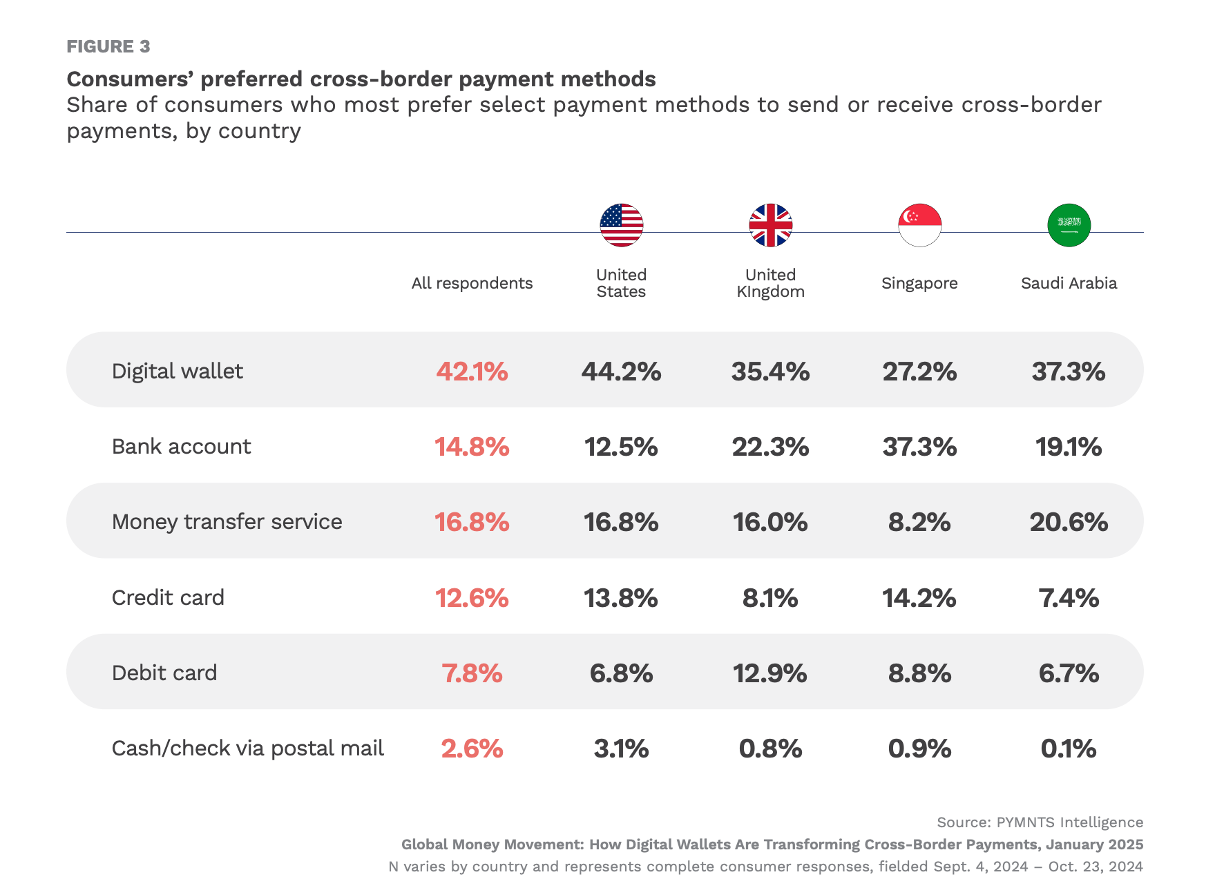

📊 42% of consumers prefer digital wallets for cross-border payments.

🇬🇧 Curve Pay takes on tech giants with alternative to Apple Pay. The company is also advocating for regulatory intervention to address Apple's fees for third-party access to NFC payment technology in the UK, aligning with the European Commission's push for increased competition in mobile payments.

🌍 Instapay partners Mastercard to revolutionise remittances for migrant workers. This partnership allows the over three million migrant workers residing in Malaysia, hailing predominantly from Indonesia, Nepal, Bangladesh, India, and the Philippines, to remit funds to their home countries in local currencies in near real-time.

🇱🇻 Nets and BluOr Bank enter issuing and processing agreement to allow the latter to utilise its payment card issuing services and improve the customer banking experience. Through this move, Nets is set to process the bank’s customers' card transactions, with plans to deliver increased security when conducting transactions and withdrawing funds.

🇺🇸 Klarna Plus marks first year in the US, signaling growing momentum in subscription services. Klarna Plus represents a key pillar in delivering enhanced value and deepening consumer adoption beyond the brand’s day-to-day services. In the last year, customers have saved a total of $5 million in discounts and fees.

DIGITAL BANKING NEWS

🇷🇴 Salt Bank has reached half a million customers one year after its launch on the Engine by Starling Platform. The cloud-native bank was designed and built for Romanians, helping them navigate financial admin with a seamless mobile experience packed with self-serve features like card controls, spending insights, and saving spaces.

🇪🇸 CaixaBank taps Salesforce to enhance AI capabilities. CaixaBank will leverage Salesforce's AI tools, including its Agentforce AI agents, to provide specialised support to customers across the bank's apps, chatbots, call centres, and branches.

BLOCKCHAIN/CRYPTO NEWS

🇨🇳 7 in 10 Hong Kongers pick digital banks for crypto trading on convenience, regulatory concerns. In a survey of 300 retail customers, Hong Kong’s ZA Bank found that 69% of respondents cited the convenience of trading directly with bank deposits without the need for additional fiat transfers as a key attraction.

🇰🇪 Kenya will regulate digital assets with a new crypto bill. The bill will be spearheaded by the National Treasury and aims to introduce a structured framework requiring all virtual asset providers to be licensed by designated regulators, such as the Capital Markets Authority and the Central Bank of Kenya.

PARTNERSHIPS

🇬🇧 eToro expands relationship with BNY to launch stock lending program. Eligible eToro users will be given the option to opt into the program, at which point their entire portfolio of stock positions will be considered for lending. Once opted in, they will begin receiving monthly statements if their stock is successfully lent to keep track of the income they earned.

🇺🇸 Signature Bank signs with Q2. The partnership with Q2 enables the bank to offer a cohesive experience across all digital channels and provide robust services to both commercial and retail customers. Read more

🇺🇸 EDX Markets and BitGo partnership set to strengthen institutional adoption of digital assets enabling secure, instant settlement of digital assets and fiat with counterparties directly from BitGo Trust qualified custody, minimizing exchange exposure without compromising on price.

🇨🇳 X Pay and STOREBERRY form a strategic alliance to revolutionize local e-commerce payments and drive sustainable growth. Through seamless integration with STOREBERRY's ecosystem, X Pay tailored a smooth payment experience to meet the rapidly evolving demands of the market.

🌍 Weavr integrates B4B Payments, boosting European payment flexibility. B4B Payments allows Weavr to strengthen its position within its current markets, allows the company to expand into key European markets outside the Eurozone, and validates a model for expansion that can follow the customer beyond Europe.

DONEDEAL FUNDING NEWS

🇸🇪 Visa invests in spend management platform Mynt. The fresh investment will help fuel Mynt’s next phase of growth, with plans to expand into the UK and other European markets, broaden its product offering, and capitalise on growing demand for spend management among SMEs.

🌍 Fixed income trading FinTech TransFicc raises $25m. The company, which claims 20 market participants and three exchanges among its client base, plans to use the funding for a push into the EU and US. Continue reading

🇦🇺 Hejaz Group secures €100m in Sharia-compliant financing for underserved Islamic SMEs. The funding milestone will enable Hejaz to expand its Sharia-compliant financing solutions, catering to the growing demand across property, auto, SME, commercial, and development finance in the Australian market.

🇰🇪 Kenya’s digital bank Umba secures $5m debt financing. This latest funding round is expected to accelerate growth while strengthening its financial position. According to the co-founder and CEO, the funding will allow Umba to expand its market reach.

🇬🇧 Damisa secures £2.25 million pre-seed to build the fastest and most secure stable-coin payment experience to date. The funds will enable Damisa to accelerate its go-to-market strategy, scale its operational infrastructure, obtain the necessary licenses, and advance technological capabilities ahead of its public launch.

M&A

🇨🇳 Payoneer completes acquisition of licensed PSP based in China, Easylink Payment Co., Ltd. “We serve a diverse range of companies in China, allowing them to grow their business globally,” says John Caplan, CEO of Payoneer. Keep reading

🇨🇦 Wealthsimple acquires wealth management platform Plenty. Its expertise complements Wealthsimple’s expansion of products for couples and families, including householding for Premium and Generation status, joint accounts, spousal RRSPs, and RESPs.

MOVERS AND SHAKERS

🇮🇳 PayPal India VP-HR Jayanthi Vaidyanathan steps down after a 17-year tenure. She joined PayPal in 2008 as the HR Head for India, tasked with establishing and scaling the India operations from the ground up. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()