Checkout.com and MRC Launch Course to Combat Fraud and Cybersecurity Risks

Hey FinTech Fanatic,

If you're in the payments industry, you know the importance of understanding how to combat fraud and cybersecurity threats.

Checkout.com announced the launch of an online course in partnership with the Merchant Risk Council (MRC) to help payment professionals on this matter.

‘Fraud Essentials’ is the second in “a series of online courses available to all MRC members for free, and will provide participants with a comprehensive introduction to digital fraud tactics and the fundamental skills needed to protect their businesses and communities from harm.”

Checkout.com’s latest launch builds on its partnership with the MRC, which kicked off earlier this year with the introduction of the 'Payment Essentials' course. The collaboration seeks to make top-tier training more accessible to payment professionals across the globe, empowering the next generation of leaders in the industry.

Rory O’Neill, Chief Marketing Officer at Checkout.com, comments: “There has never been a better time to invest in a payments education. As the world continues adapting to a ‘digital-first’ economy, in order to thrive, businesses will need experts with deep payment knowledge who can manage risk alongside innovation."

Would you consider taking this course? Tell me more in the comments.

Cheers,

FINTECH NEWS

🇺🇸 Checkout.com and Merchant Risk Council introduce initiative to combat fraud and cybersecurity threats. The partnership aims to make high-quality training “more accessible for all payment professionals worldwide and support the next generation of payment leaders.”

🇮🇪 Chargebee opens office in Dublin. This milestone in Chargebee's international expansion highlights its commitment to its European customers and aligns with its strategy to accelerate growth and enhance its European market presence. Read on

🇺🇸 DailyPay launches ‘Credit Health,’ a new, free financial Wellness tool. Credit Health is a tool integrated within the DailyPay app that allows DailyPay users to stay informed about their credit status, identify potential issues promptly, and make more informed decisions about their overall financial situation.

PAYMENTS NEWS

🇯🇵 Payment Services for E-Commerce Japan

Is anyone missing from this overview?

🇱🇺 Mangopay, a leading provider of modular payment infrastructure for platforms, has appointed FinTech leader Sergi Herrero as CEO, succeeding Romain Mazeries, who is stepping down but will remain on the board. Herrero, previously Meta’s Global Director for Payments and Commerce Partnerships, has also held senior roles at Square, BNP Paribas, and VEON.

🇬🇧 Club L London partners with Checkout.com to Accelerate International Expansion on Shopify Platform. Club L London has chosen Checkout.com as its primary payment provider, taking advantage of Checkout. com’s robust pre-built Shopify checkout solution and leading payments performance capabilities.

🇪🇺 Viva.com and Alipay+ expand strategic partnership. This allows global tourists, mostly from Asia, to pay in businesses across Europe with their preferred home e-wallets securely and conveniently via over 15 e-wallets and banking partners.

🇲🇾 Hong Leong Bank adds Weixin Pay to DuitNow QR for easier payments. The bank now allows HLB DuitNow QR merchants to accept Weixin Pay (WeChat Pay), offering an additional payment option for Weixin Pay users and Chinese tourists in Malaysia.

🇮🇱 Nayax partners with Adyen to globally expand electric vehicle charging and automated self-service payments infrastructure. With this partnership, Adyen integrates Nayax’s end-to-end payment and loyalty platform into its global system. This will enable Nayax to expand into new regions, including LatAm and APAC.

🇬🇧 CEO of Lanistar exits amid report of winding-up petition. Jeremy Baber, CEO of UK-based payment provider Lanistar, has left the FinTech amidst a report of the company facing a winding-up petition from its London landlord over unpaid rent. Read on

🇺🇸 Mastercard CFO Sachin Mehra, diagnosed with cancer, will continue working. Mehra will undergo treatment for non-Hodgkin lymphoma while remaining actively involved in the company's daily operations. Mastercard announced Monday that Mehra’s blood cancer was detected early and is highly localized and curable, with an “excellent” long-term prognosis. Find out more

🇦🇪 Xpence, Paymob join forces at 24 FinTech to reshape digital payment landscape. The partnership will enhance digital payments for SMEs across the GCC. Xpence will integrate Paymob’s advanced payment technology into its platform, enabling seamless online and in-person card payments for SMEs throughout the region.

🇺🇸 Why ORNG’s founder pivoted from college food ordering to real-time money transfer. After six years running Phood, a payments app to use dining dollars globally, Alex Parmley pivoted the company to ORNG. This newly named startup partners with banks, FinTechs, and large businesses for quick and easy payments.

🇺🇸 CloudPay partners with Workday. The new offering is expected to deliver an optimised, end-to-end global payroll experience, which will ensure that customers will have the possibility to benefit from secure, integrated, and efficient solutions.

🇬🇧 OKTO Unleashes Next-Gen Pay-Ins and Payouts on its way to SBC Summit. In this interview, OKTO’s CCO Simon Dorsen shares insights on the company’s priorities, the latest advancements in their product suite, and what attendees can expect at the upcoming SBC Summit in Lisbon. Read full interview

OPEN BANKING NEWS

🇲🇩 Victoriabank joins forces with Salt Edge to lead open banking compliance in Moldova. This collaboration with Salt Edge not only elevates the user experience and transforms Victoriabank operations but also reaffirms its leadership in financial innovation in the Republic of Moldova.

🇬🇧 Ecospend retains Open Banking contract with HMRC. As part of the re-awarded contract, Ecospend will continue to provide its account-to-account payment services which allow HMRC to process payments across more than 40 tax regimes, including Self-Assessment, PAYE, Corporation Tax and VAT.

DIGITAL BANKING NEWS

🇬🇧 Zopa Bank amasses £5 billion in customer deposits. This milestone comes after Zopa announced its first full year of profitability earlier this year. The bank now has 1.3 million users and continues to grow its customer base at 30% year-on-year.

🇺🇸 Citi COO’s data responsibility cut after $136mn fine; European governments sell €16bn of bailed-out bank shares. Citigroup is transferring responsibility for its data compliance overhaul from COO Anand Selva to Tim Ryan, the bank’s CTO, according to a Financial Times report on Monday. Continue reading

🇩🇪 Commerzbank snubs overtures for UniCredit takeover. Germany's Commerzbank CEO snubbed takeover offers from Italy's UniCredit, stating he had his own plans for the bank and hoped it could stay independent.

🇺🇸 Finastra integrates with Prelim to streamline retail and commercial deposit account opening. The new partnership makes account opening faster and more efficient, unlocking cost savings and an enhanced customer experience. Read on

🇦🇺 Westpac reports steep rise in app uptake in H1. The number of customers using personal finance tools in Westpac’s mobile banking app has increased by 36% since the start of the year, with around 620,000 logging in each month to access features to help monitor cash flow, categorise spending and manage bills.

🇺🇸 Bankwell Financial Group chooses Lendio Intelligent Lending. The cooperation with Lendio is aimed at helping small businesses access necessary funds without any unnecessary delays. The objective is to upgrade the banking experience and meet the needs of the customers.

🇨🇦 Broadridge Financial Solutions announced that a Tier-1 Canadian bank has successfully implemented its Distributed Ledger Repo (DLR) platform for managing HQLA treasury securities. The implementation, as per the company, marks a significant step forward in the adoption of Distributed Ledger Technology (DLT) in the financial industry.

🇪🇸 Sabadell and BBVA executives joust over prospects for takeover bid. Banco Sabadell CEO stated at a Madrid banking event that BBVA's multi-billion euro hostile bid for Sabadell is highly unlikely to succeed, calling the chances of success "very slim." Conversely, BBVA's Country Manager for Spain expressed confidence that the acquisition would proceed.

BLOCKCHAIN/CRYPTO NEWS

🇮🇳 India leads crypto adoption despite regulatory pressure. Efforts to regulate the cryptocurrency sector have not hurt India’s adoption of the digital currency. In fact, the country now leads the world on the Chainalysis 2024 “Global Adoption Index.”

DONEDEAL FUNDING NEWS

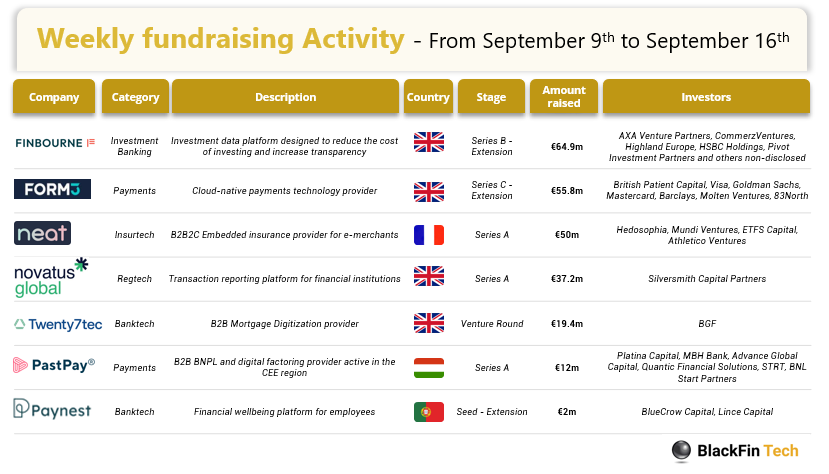

💰 Last week, we saw 7 official FinTech deals in Europe, raising a total of €241.4 million, with 5 deals in the UK, 1 deal in Portugal and 1 deal in Hungary. Read the complete BlackFin Tech overview article

🇺🇸 Polly raises additional $25M in growth equity funding. The company intends to use the funds to further accelerate its growth and invest in R&D, product innovation, and expansion. Discover more

🇧🇩 Bangladesh’s Pathao secures $12m in a pre-Series B funding round as the company shifts its focus towards FinTech. The firm will use the new funding to scale Pathao’s FinTech offerings, enhance its technology, and expand its market presence.

🇨🇴 Colombian real-time payments startup, Cobre, raises $35M Series B. The company is making a little over $40 million in ARR, and has raised $66 million to date. Cobre sees Colombia's real-time payments push as an opportunity for the company.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()