CFPB to Supervise Big Tech Payment Services

Hey FinTech Fanatic!

A significant regulatory shift is reshaping the digital payments landscape as the Consumer Financial Protection Bureau (CFPB) extends its supervisory reach to major tech companies and FinTechs.

The finalized rule will bring companies processing over 50 million transactions annually under the same regulatory scrutiny as traditional banks - a notable increase from the initially proposed 5 million transaction threshold, which would have affected 17 companies instead of the current seven.

The scope is substantial, covering seven nonbank giants including Apple Pay, Google, Amazon, PayPal, Block, and Venmo. These platforms collectively process more than 13 billion consumer payments annually and have gained "particularly strong adoption" among low- and middle-income users.

"Digital payments have gone from novelty to necessity and our oversight must reflect this reality," states Rohit Chopra, CFPB Director, adding that "the rule will help to protect consumer privacy, guard against fraud, and prevent illegal account closures."

While the CFPB already had some authority over digital payment companies through its oversight of electronic fund transfers, this new rule enables them to conduct proactive examinations, demand records, and interview employees - essentially treating these tech companies more like traditional banks.

Payment apps that only work at a particular retailer, like Starbucks, are excluded from the rule. Interestingly, this is one of those rare instances where the U.S. banking industry has publicly supported the CFPB's actions.

It's a jam-packed newsletter full of interesting FinTech News updates today, so you better get to it👇

Cheers,

POST OF THE DAY

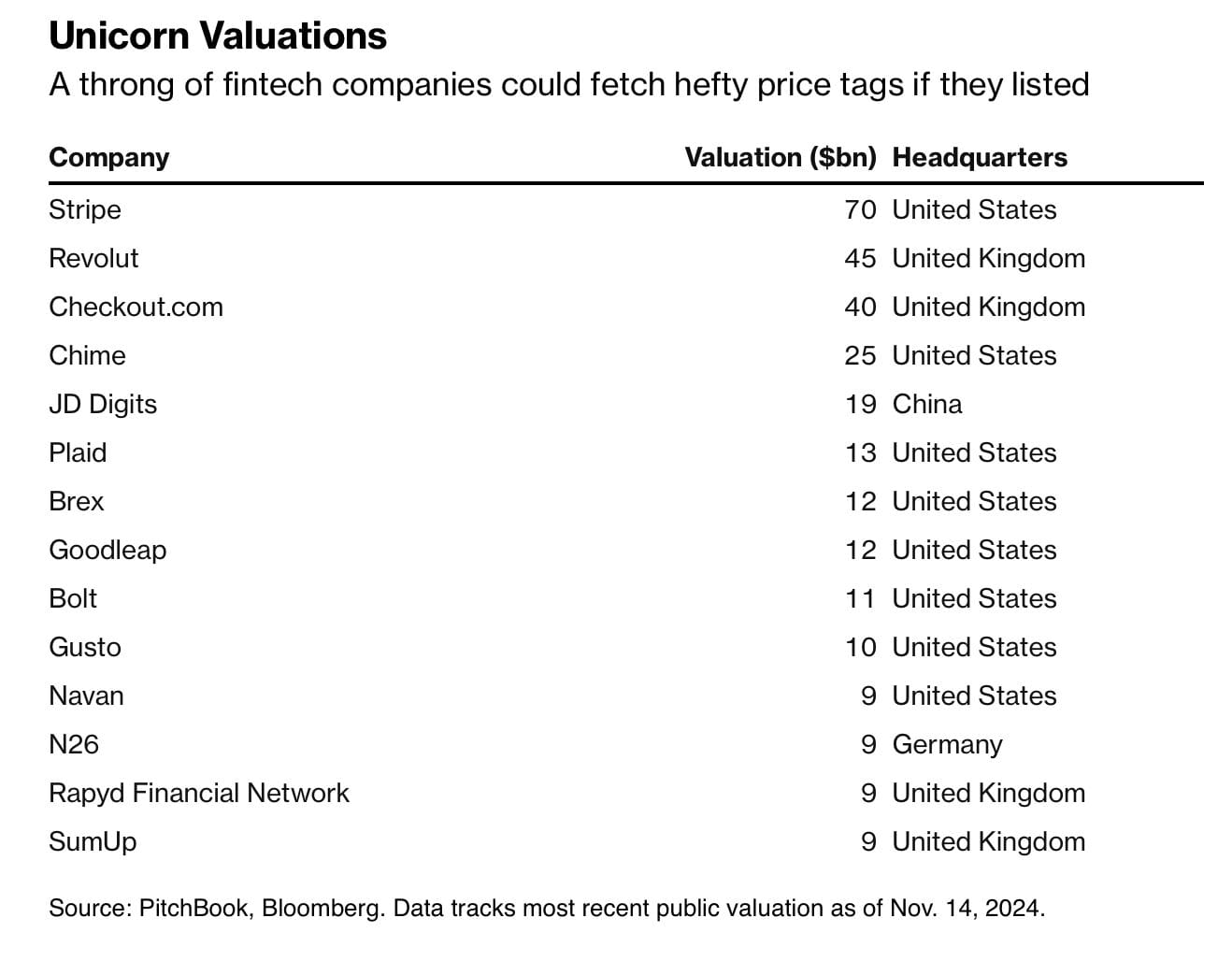

🇺🇸 Klarna’s Planned IPO Sets the Stage for More FinTech Listings. Klarna confidentially filed for an IPO with the US Securities and Exchange Commission. While the company provided no financial details, analysts last month put Klarna’s implied valuation at about $𝟭𝟰.𝟲 𝗯𝗶𝗹𝗹𝗶𝗼𝗻.

BREAKING NEWS

📣 Revolut announces the launch of a new product you probably won’t expect… 🤯

Check this out👇

🇺🇸 Apple will now be treated like a Bank, says US Consumer Financial Protection Bureau, finalizing a proposal from last year with several changes. The popularity of Apple Pay will now see the Cupertino company regulated by the US CFPB, a watchdog whose role is normally limited to banks and financial services companies. Discover more

INSIGHTS

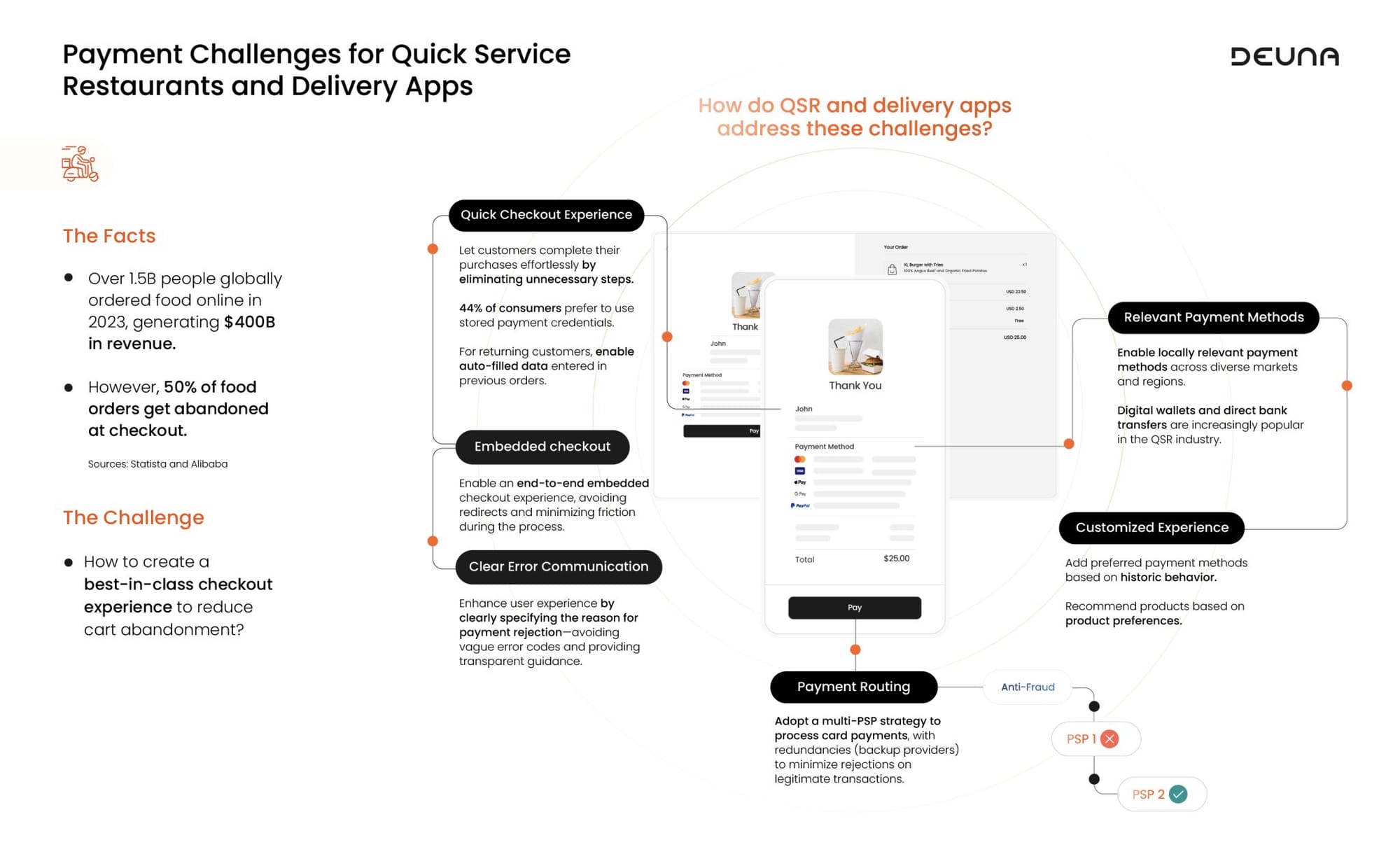

Payment Challenges for Quick-Service Restaurants and Delivery Apps: 3 Key Strategies to Drive Seamless, Scalable Growth, by DEUNA

FINTECH NEWS

🇺🇸 Betterment expands charitable giving with donor-advised funds from Daffy. Betterment’s 900,000+ customers can now donate shares to Daffy directly from taxable accounts. Funds grow tax-free, enabling donations to nearly any U.S. charity via Daffy’s app or web.

🇫🇷 Worldline to raise new debt after tumultuous year hurts earnings. Worldline SA, the French payments firm formerly part of Atos SE, completed a refinancing effort to secure cash for upcoming debt maturities, despite raising its interest costs. The company issued a five-year bond at a 5.375% yield, according to a source.

PAYMENTS NEWS

🇺🇸 Collections vs Payouts: Risks of using a single provider for both, by PayQuicker. In the complex world of business finance, understanding the nuances between collections, or pay-in, and payouts is crucial for maintaining healthy cash flow. Dive deeper into the topic by reading the full article

🇧🇷 The race of banks and FinTechs to get ahead of Automatic Pix. The Central Bank plans to launch Automatic Pix on June 16, 2025, but players like Santander and FinTech Ebanx are already moving to implement it seven months ahead. Keep reading

🇳🇿 Adyen goes live with Tap to Pay on iPhone with launch partner NewStore in New Zealand. By partnering with NewStore for the launch, businesses can now accept contactless payments using only an iPhone and the NewStore Associate iOS app. Read more

🇺🇸 Apple Card has expanded its Daily Cash scheme to include two new partners. Apple Card customers can now get 3% Daily Cash back when they book prepaid car rentals or holidays stays with Booking.com, or charge their vehicle at qualifying ChargePoint stations.

🇺🇸 Mastercard’s Multi-Token Network (MTN) connects to J.P. Morgan’s Kinexys Digital Payments for settlement. This collaboration enables mutual MTN and Kinexys customers to streamline B2B transactions via a single API integration. Continue reading

🇪🇺 Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution. Worldline has partnered with GarantiBBVA International N.V. to implement its cloud-based instant payments solution. This multi-year agreement will help the bank meet regulatory requirements and advance its digital transformation.

🇺🇸 CFPB expands oversight of digital payments services including Apple Pay, Cash App, PayPal and Zelle. The CFPB announced it will soon supervise nonbank firms, including tech giants and payments companies with 50 million+ transactions annually. The new rule ensures these firms follow the same regulations as banks and credit unions.

🇺🇸 Shift4 has been named the payments partner for Barclays Center, handling ticketing, food, beverage, and retail transactions. The partnership aims to enhance the customer experience at one of Brooklyn's top sports and entertainment venues. Read on

OPEN BANKING NEWS

🇪🇺 tell.money selected as Open Banking Gateway Provider for Monese, expanding EU coverage and streamlining TPP integration. This strategic partnership arrives at a crucial time when embedded finance solutions are experiencing unprecedented growth in the UK and EU markets.

DIGITAL BANKING NEWS

🇬🇧 UK challenger bank Kroo considers offering investment products. The challenger bank has suggested that it could begin offering investment products, amid a further fall in interest rates and customers becoming less risk-averse. Read on

🇬🇧 Banking-as-a-Service will provide plumbing for half of future banking activity, says NatWest Boxed boss. George Toumbev, chief commercial officer, NatWest Boxed, talks through its proposition and some of the challenges in the market. Listen here

🇦🇺 Australian banks pilot fraud intelligence sharing network. Australia's leading banks are testing a fraud and scam intelligence-sharing network, leveraging behavioral and device-based technology from security provider BioCatch.

🇪🇸 CaixaBank sets business growth and transformation as the pillars of its new strategic plan. To achieve this goal, the Group is focusing on three strategic priorities: accelerating business growth, driving transformation and investment, and solidifying its position as a leader in sustainability.

🇺🇸 GTreasury, PNC Bank introduce embedded banking integration through PINACLE® Connect. Through this expanded partnership, GTreasury and PNC Bank now offer shared clients access to PNC's treasury services directly within the GTreasury platform.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Chainlink, Banco Inter, and Microsoft Sync Up to Power Brazil’s CBDC Pilot. Brazil’s central bank, Banco Central do Brasil (BCB), has entered Phase 2 of its Drex CBDC pilot, aiming to enhance cross-border agricultural trade and streamline supply chain operations using blockchain and finance solutions.

🇿🇦 Universal Digital Payments Network and Forus Digital co-operate on CBDC testing environment. This partnership is set to empower African communities, governments, and businesses, and represents a significant step toward realising the shared goal of financial inclusion and economic advancement across Africa.

🇳🇬 The US stablecoin startup fueling a $3 billion boom in Africa. Cryptocurrencies pegged to the dollar are becoming a vital solution for businesses grappling with currency shortages in Africa. Read the full article to discover how stablecoins are enabling companies to bypass local currency challenges and thrive in a volatile market.

🇺🇸 Coinbase wallet introduces rewards program for USDC holders. Rewards will be paid out monthly, directly into user wallets. This feature is available in most regions worldwide, and is being offered to American users this week. Read on

PARTNERSHIPS

🇺🇸 Stripe becomes Nacha’s preferred partner. Nacha, which operates the US ACH network, has named Stripe as its new Preferred Partner for ACH Experience. The ACH network facilitates electronic funds transfers (EFT), and this partnership aligns with Nacha's goal to expand the network's reach.

🇸🇳 Senegal-based FinTech company New Africa Technology (NAT), joins forces with Mastercard to introduce a virtual and physical prepaid card for individuals through NAT’s existing digital wallet solution, ‘’Flash’’. This collaboration aims to transform the payment landscape in Senegal, Côte d’Ivoire, and Benin.

🇸🇬 Crypto.com and Triple-A simplify crypto payments for online shopping. This service, starting in Singapore, will enable users pay with crypto from their Crypto. com wallet without the need to convert it to local currency, and also earn crypto rewards on their purchases.

🇺🇸 FinTech New Silver inks deal with Fortress for real estate loans. The investment firm will support New Silver's expansion into short-term real estate transition loans, such as fix-and-flip and construction loans, through a forward-flow agreement where loans are purchased before origination.

🇺🇸 MANTL names Pinwheel Preferred Partner for direct deposit switching. MANTL will use Pinwheel's PreMatch technology to streamline direct deposit switching, helping partners capture more deposits, reduce churn, and foster lasting customer relationships.

DONEDEAL FUNDING NEWS

🇬🇧 CellPoint raises $30 Million for travel sector payment orchestration. The company states the new funding will allow it to intensify its focus on optimizing payment and money movement service for clients while expanding its alternative payment method hub.

🇲🇽 Mexican FinTech Minu bags $30m Series B funding. The cash injection has been earmarked to expand Minu’s “regional footprint in Mexico and to continue strengthening its wellness offering across financial, physical and mental health”, according to a company statement.

MOVERS & SHAKERS

🇷🇺 Russia's central banker in charge of digital payments system resigns. Olga Skorobogatova, Russia's First Deputy Governor and key figure behind the digital rouble and domestic payments system, has resigned. She joined the central bank in 2014 and played a pivotal role in the rapid digitalization of the Russian banking sector.

🇬🇧 Emily Turner appointed CEO of HSBC Innovation Banking UK. Turner replaces former Silicon Valley Bank UK head Erin Platts, HSBC said, who will support the bank as a special adviser. More on that here

🇫🇷 Qonto appoints Heidrun Luyt as Chief Growth Officer to accelerate European expansion and drive customer-centric growth, reaching 45% women in leadership team. As CGO, Luyt will oversee Qonto's 300-member growth team, covering sales, acquisition, client development, brand, communications, and growth operations.

🇬🇧 Curve appoints Edoardo Volta as SVP, partner marketing and business development. Edoardo’s expertise in building multinational payment partnerships will be key to expanding Curve’s digital payment solution across Europe and driving its growth.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()