Bunq Targets UK Market with EMI Licence Amidst IPO Plans

Hey FinTech Fanatic!

We start the week with interesting news from Amsterdam. Neobank Bunq, Europe's second-largest with 11 million customers, is seeking a UK payments license, aiming to rival Revolut and Monzo as it prepares for an IPO.

The Amsterdam-based bank, profitable for the first time in 2023 with a net profit of €53.1m, caters to digital nomads.

In the last quarter of 2023, bunq’s gross fee income grew by 20%, compared to the last quarter of 2022, and user deposits grew almost fourfold, from €1.8 billion to almost €7 billion at the end of 2023. Gross interest income in the last quarter of 2023 grew by 488%, compared to the same period in 2022.

A testament to bunq’s sustainable business model proven to yield record profits throughout 2023, the challenger will direct its net profit to propel its global expansion strategy.

Despite halting new UK accounts post-Brexit, Bunq still serves existing UK clients, unlike Germany's N26, which exited the UK entirely.

Bunq has applied for an E-Money Institution (EMI) licence with the UK's Financial Conduct Authority. With a European banking licence and a pending application in the US, Bunq's UK EMI licence would enable access to the large market of British digital nomads, where the UK ranks second globally.

While not pursuing a full UK banking licence currently, Niknam sees the EMI licence as a strategic start, serving EU and UK citizens working across regions.

Ali Niknam also said the firm has always had a “dream” of IPO-ing eventually.

“The one thing I have not yet done in my entrepreneurial life is an IPO,” he said. “But we will let our timing and our actions be decided by the wants and needs of our users. And at this point in time, I think we’re doing perfectly well.”

Nikham added: “London could be a consideration. There are some regulatory advantages to being in London, but then there’s also obviously the disadvantage of not being part of a bigger block like the US or the EU. The jury’s out on that one.”

Bunq’s gross fee income grew by 20 per cent year-on-year in the fourth quarter, while user deposits rose nearly fourfold to just under €7bn.

2024 is going to be an interesting year with a lot of potential IPO's in FinTech. I'll keep you informed in this daily mailing.

Enjoy more FinTech industry news I listed for you below👇 and I'll be back in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

FEATURED NEWS

Amazon is partnering with Mexico FinTech Kueski, which focuses on “buy now pay later options” and personal loans, to offer payments in bi-weekly installments in LATAM’s second-largest economy. The partnership marks the first time Amazon Mexico will allow users without a credit card to make purchases of up to 12 bi-weekly installments.

#FINTECHREPORT

Finance "Super Apps" Use Multiple Useful Features to Maintain Market Share: In a competitive mobile market, top finance apps have continued to add new features to incentivize customers turning to their app for all finance needs, from mobile banking to sending money to trading in crypto. Read the full report here

FINTECH NEWS

Visa opens applications for second cohort of Africa Fintech accelerator programme, launched in June 2023. The program aligns with Visa’s pledge to invest $1 billion in Africa by 2027, aiming to revolutionize Africa’s payment ecosystem and uplift the digital economy.

🇭🇰 Neo opens Hong Kong office to expand its APAC presence. As part of the new office opening, Neo is joining the Cyberport Incubation Programme, gaining financial and networking support. This move strengthens Neo's position in Asia's thriving Web3 ecosystem, fostering community growth and innovation.

🇲🇽 Fintech Bonanza, in collaboration with Pomelo, has announced the launch of three virtual credit cards. With this partnership, Bonanza makes the credits granted to its users available for making purchases in stores worldwide. Learn all the details of the financial inclusion tool created by Bonanza.

🇺🇸 SoFi Technologies shares rally as quarterly results beat view. The company reported a profit of $24.62 million or $0.02 per share for the fourth quarter, compared with a loss of $50.2 million or $0.05 per share a year ago. Analysts on average, polled by Thomson-Reuters expected the company to report breakeven per share.

🇸🇬 Grasshopper caps strong year with 83% revenue growth through expansion of small business, venture and BaaS partner ecosystem. The digital bank hits stride with new partnerships and products designed to meet the needs of the business and innovation economy.

PAYMENTS NEWS

🇬🇧 GuavaPay adds Apple Pay, a safer, more secure and private way to pay that helps customers avoid handing their payment card to someone else, touching physical buttons or exchanging cash — and uses the power of iPhone to protect every transaction.

Unzer rolls out mPOS in Austria and Luxembourg. With its iPad checkouts, card terminals and the POS Go mini checkout, Unzer supports all merchants who want to digitize their processes and meet the growing demand for contactless payments.

🇺🇸 Visa debit payments growth slows. Visa blamed a slowdown in U.S. payment flow growth late last year and into January partly on the impact of an updated Fed regulation calling for more competition in online debit processing. The biggest U.S. card network also flagged other causes, including bad weather in the U.S.

OPEN BANKING NEWS

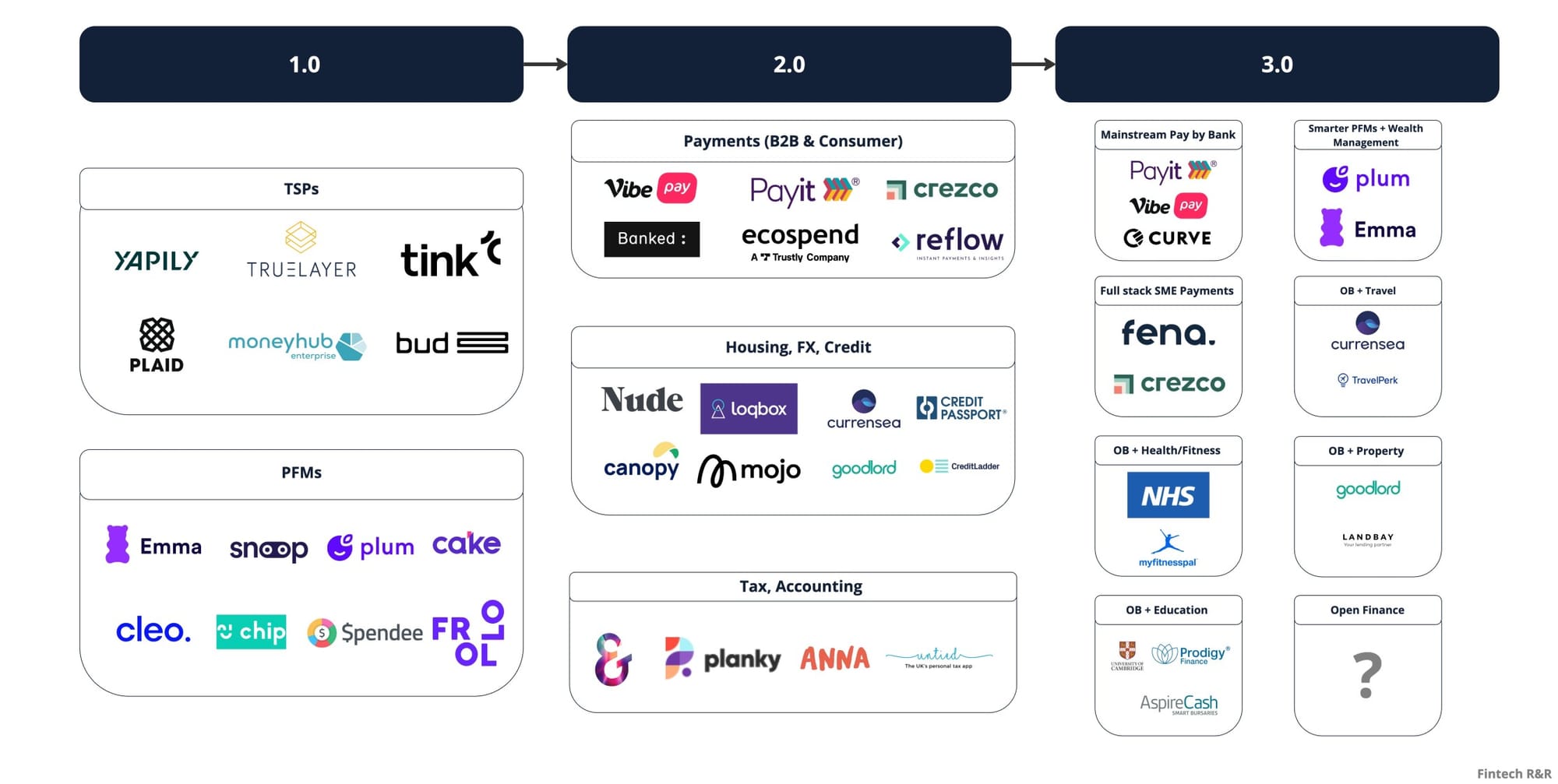

According to Jas Shah the evolution of UK Open Banking can be divided into 3️ distinct phases:

DIGITAL BANKING NEWS

🇬🇧 Kroo Bank launches ‘Kroo Pots’ feature, which will make it easier for customers to feel financially empowered to budget their money in 2024 as they save for specific things or to ensure they can set aside money to pay bills and rent each month.

🇨🇴 Fintechs Nequi and Daviplata lead preferences in financial behavior in Colombia. According to the latest study by Inmark, digital banking is significantly reshaping the financial habits of Colombians. The study revealed that 13.9% of banked Colombians exclusively use digital entities, while 32.2% enjoy products from both traditional and digital banks.

🇵🇰 Raqami Islamic Digital Bank receives approval to launch in Pakistan. The bank obtained a no objection certificate (“NOC”) and in-Principal Approval (IPA) from the State Bank of Pakistan (SBP) to establish an Islamic digital retail bank in Pakistan under the Licensing and Regulatory Framework for Digital Banks (the Framework).

🇨🇱 Tanner Banco Digital, under Tanner Servicios Financieros S.A., has made a significant stride in the Chilean banking sector. The Financial Market Commission (CMF) of Chile granted it provisional authorization for its establishment as a banking entity. This move marks a crucial step in the expansion of digital banking services in the country.

🇮🇳 YES Bank shares fall sharply from day's high after Q3 results; Kotak downgrades the lender. Shares of YES Bank have surged more than 80% in the last 3 months from its 52-week low at Rs 14.10 hit in October. The quarter’s performance is broadly on expected lines. Performance on NIM has been marginally ahead, as the increase in cost of funds has been slower, Kotak said.

🇨🇴 Ualá, the first technology-based company in Colombia to receive a financing company license from the country's Financial Superintendence, celebrates two successful years in Colombia. The digital bank has impressively reached over 400,000 users, with 90,000 of them holding a PPT document.

DONEDEAL FUNDING NEWS

🤑Last week we saw 12 official FinTech funding deals in Europe for a total amount of 95,6m€ raised: With two deals in the UK, two in Italy, two in Denmark one in Germany, one in France, one in Switzerland, one in Luxemburg, one in Netherlands, and one in Spain. Link here

🇬🇧 YouLend secures deal with J.P. Morgan to extend £4 billion in additional financing to SMEs. This will be accessible via partnered global e-commerce sites, tech companies, and payment service providers. The partnership with J.P. Morgan demonstrates a commitment to powering the backbone of the economy, by closing the funding gap for SMEs.

🇺🇸 Mesh announces investment from PayPal Ventures. This investment helps to reinforce Mesh's position as a leading player in embedded finance and highlights PayPal's commitment to fostering innovation in the digital payments landscape. Read more

🇨🇭 Swiss crypto neobank Sygnum lands $40m growth investment. Sygnum says it will use its new capital to expand into new markets and further develop its product suite. The CEO has stated that the capital injection will “allow us to further build out our suite of fully regulated solutions to support investors as they increase their exposure to the asset class.”

🇺🇸 Rainbow raises $12 million. Founded in 2021 and based in California, Rainbow’s flagship program, an admitted business owner’s policy product tailored to the restaurant industry, is currently live in 8 states and expected to be available in over 25 states in 2024.

🇮🇱 Sequence secures $5.5 million to ‘reshape the personal finance industry’. The company helps users visualize their money, automate payments to boost savings and optimize finances, take more direct action, and make financial management more accessible.

🇧🇷 BRLA Digital, operating in the cross-border payments and crypto infrastructure market, received an additional investment from 99 Capital for its pre-seed round. The investment, endorsed by Dave Wang, founder of 99 Capital and former Head of crypto at Softbank LatAm, raises the total round to over R$ 4 million.

MOVERS & SHAKERS

🇬🇧 Lloyds Bank to cut 1,600 jobs across branches in shift to online banking. The role reductions follow a tranche of branch closures announced last year as the group said the way customers are choosing to do their banking has changed “rapidly” in recent years.

🇺🇸 Goldman’s global banking and markets co-chief, Jim Esposito, to leave bank. Esposito, who co-led a unit that brought in two-thirds of Goldman’s revenue last year, “has decided to retire” after nearly 29 years, according to a memo published in full Monday by Business Insider.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()