bunq first bank in Europe to leverage AI in Open Banking with Mastercard

Hey FinTech Fanatic!

bunq has partnered with Mastercard to offer its 12.5 million users across Europe a complete overview of their finances. bunq is the first bank in Europe to leverage AI in Open Banking with Mastercard.

This is achieved by leveraging Mastercard’s Open Banking platform, which allows users to add accounts from any bank to their bunq app.

With this integration, bunq users can now get spending insights from all their bank accounts directly within the bunq app, enabling them to budget more effectively and plan ahead.

Further enhancing the user experience, bunq’s AI money assistant, Finn, will enrich these insights with transaction data from multiple banks.

For instance, users can ask Finn for a complete overview of their travel expenses in the last year, and it will retrieve travel-related transactions from both bunq and any external banks.

In that way, bunq becomes the first bank in Europe to leverage AI in open banking.

Cheers,

#FINTECHREPORT

📈 Digital Payments - A Wave of Innovation in the Nordics. Check out the complete report by Visa Consulting & Analytics. Read the complete report here

FINTECH NEWS

🇺🇸 PayQuicker, a leader in global payouts orchestration, yesterday announced the launch of Insta-Pay, a powerful new solution enabling businesses to offer on-demand earned income access. Built on PayQuicker's Payouts OS platform, Insta-Pay is designed to change the way employees access their earned incomes, providing financial flexibility and peace of mind.

🇹🇷 Turkish FinTech Papara announces at Money 20/20 Europe, its partnership with DriveWealth, a financial technology platform providing Brokerage-as-a-Service. The partnership will provide Papara’s 20 million users with the ability to invest real-time in U.S. stocks on the Nasdaq and NYSE starting in October.

🇺🇸 LoanPro integrates with Visa DPS to enhance their next-generation end-to-end credit card platform. Integrating LoanPro’s credit platform with Visa DPS’ digital issuer processing enables scalable, first-to-market credit card programs featuring transaction level credit™.

🇺🇸 After raising $100M, AI FinTech LoanSnap is being sued, fined, evicted. The firm is facing an avalanche of lawsuits from creditors and has been evicted from its headquarters in Southern California, leaving employees worried about the company’s future, TechCrunch has learned.

🇦🇪 Egyptian FinTech startup Thndr expands into UAE after acquiring a Category 3A license with retail endorsement from the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA). Thndr will initially provide direct access to US-listed securities, including stocks, exchange traded funds (ETFs), and fractional shares.

🇺🇸 Ramp announced the launch of Ramp Travel – a solution designed to make booking travel and automating expenses easy, low cost, and intuitive. This news marks Ramp's entry into business travel booking, a significant step in helping companies automate non-strategic work and make smarter spending decisions.

PAYMENTS NEWS

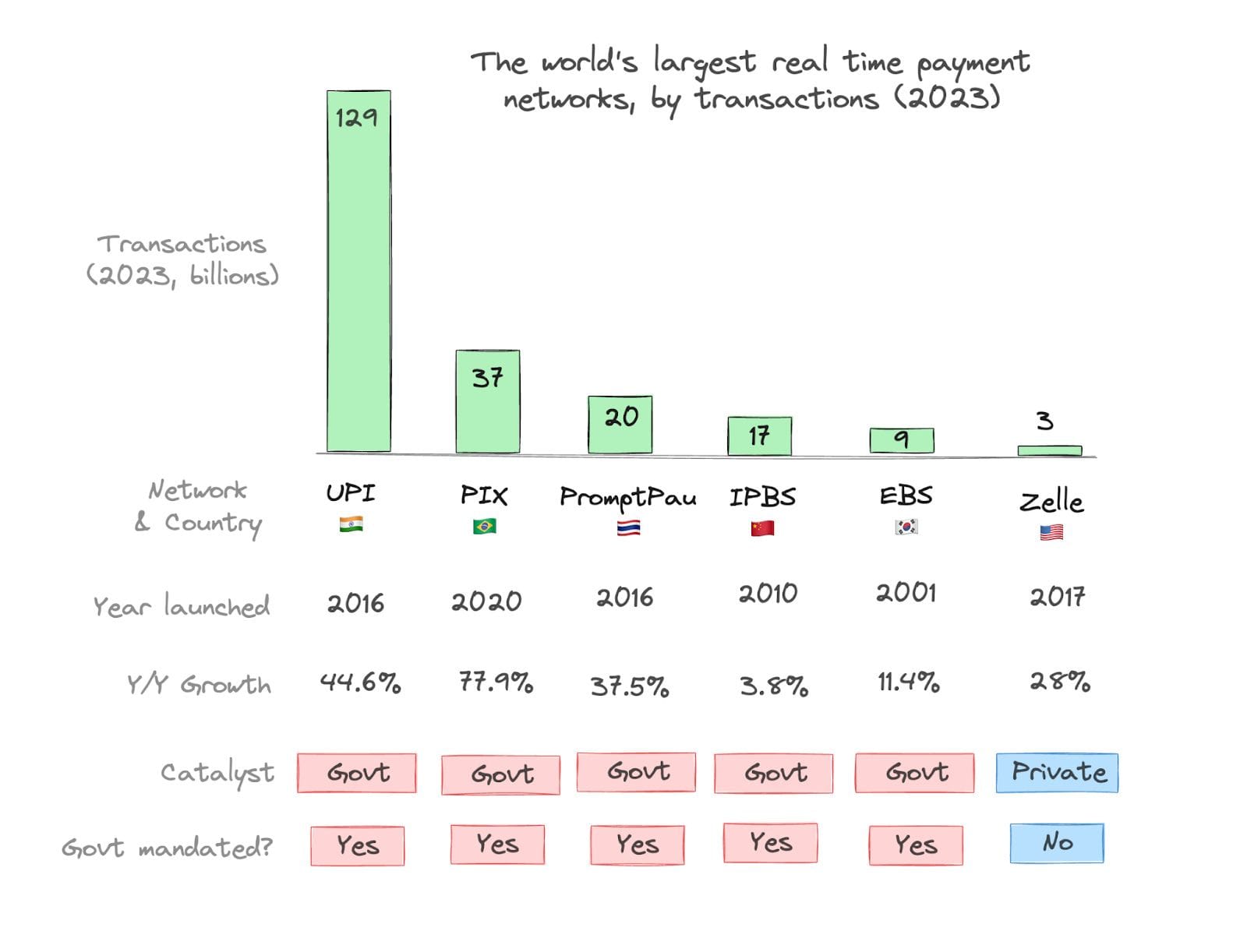

📱 The global growth of Real-Time Payments (RTP) is impressive – 266 billion transactions and 42% y/y growth in 2023. However, 80% of real-time transactions occur in a handful of countries:

💳 Visa generated $40 million in USD in incremental e-commerce revenue globally, after issuing over $10 billion tokens, announced at Money 20/20 Europe. Recently unveiled Visa data tokens will give consumers more control over their data and deliver seamless AI-powered shopping experiences.

🇿🇦 Onafriq partners with payment tokenisation firm VGS to improve security for FinTechs in Africa and the Middle East. This cooperation is part of a long-standing relationship between the two companies, with VGS serving as Onafriq's trusted partner for Payment Card Industry (PCI) compliance and payment features.

🇪🇺 Elavon, an international payments provider, has played a significant role in advancing the adoption of cashless transactions in the Czech Republic, Slovakia, and Hungary. Elavon’s seamless integration across various merchants ensures a smooth payment process, boosting customer satisfaction and loyalty.

🇬🇧 DNA Payments launches online card acceptance of Discover® Global Network to UK merchants. This will particularly benefit businesses in the tourism, hotel, and hospitality sectors looking to grow through bookings or accepting payments for goods and services.

🇺🇾 Mastercard launches Biometric Checkout Program in Uruguay. The Program allows for faster payment and shorter lines at checkout, and integrates with loyalty programs, leading to an enhanced and personalized customer experience. Read more

🇦🇪 Network International leads launch of UAE Domestic Card Scheme ‘Jaywan’ among merchants. Jaywan aims to advance the UAE national agenda, enhance efficiency, and promote digital payments by increasing card-based transactions across all customer segments.

OPEN BANKING NEWS

🇳🇱 bunq has partnered with Mastercard to offer its 12.5 million users across Europe a comprehensive overview of their finances. Bunq is the first bank in Europe to leverage AI in Open Banking with Mastercard. Find out more

DIGITAL BANKING NEWS

🇬🇧 A criminal investigation into Monzo over potential breaches of anti-money laundering rules has been dropped after a two-year investigation. The online bank said the FCA was no longer assessing criminal liability in its long running investigation into the bank.

🇫🇷 Marqeta expands partnership with Lydia to power the new European digital bank Sumeria, which aims to simplify banking with its easily accessible app designed to mimic the ease of use and intuitiveness of beloved consumer brands.

🇦🇹 Deutsche Bank will work with Bitpanda to process customer deposits and withdrawals for the Austrian crypto broker. This means that deposits or withdrawals of fiat currencies from Bitpanda will go through Deutsche Bank.

🇬🇧 New lifeline for bank customers as ‘super-ATMs’ go on trial in England. Described as a UK industry first, major high street banks have worked together to install “multi-bank deposit ATMs” that could offer a lifeline for residents and small businesses in areas that have in some cases lost all their bank branches.

🇨🇭 Temenos and Mastercard join forces to expand cross-border payment capabilities through Mastercard Move. Temenos integration with Mastercard Move’s full range of money transfer solutions offers banks and their customers more choice in how they send and receive money abroad. Read on

🇸🇪 PPRO partners with Lunar and Swish to unlock Swedish consumer market for global businesses. This collaboration will boost PPRO’s instant payment capabilities in Sweden by seamlessly integrating with Lunar’s payment infrastructure, enabling Swedish consumers to use Swish for payments at more global merchant brands.

🇫🇷 European digital banking solution for SMEs and entrepreneurs FINOM has announced the launch of local IBAN accounts in France. This move aims to offer customised financial services to more French small and medium-sized businesses.

DONEDEAL FUNDING NEWS

🇺🇸 BankTech Ventures, a strategic investment fund redefining the landscape of community banking through innovative investments, announced its recent investments in three bank-enabling technology companies: Equabli, Filejet, and Monit.

🇦🇺 Breezepay secures US funding grant to expand stablecoin payments platform, scale up its technological infrastructure, and foster partnerships that will bring its payment solution to a wider audience. Read on

🇬🇧 WealthOS has topped up a £2 million seed round led by Barclays Bank with a further injection of capital from the UK lender and FinTech investors. The firm will use the investment to further develop its platform, increase distribution and scale the organisation to support a "strong client pipeline."

🇪🇸 FinTech platform Bcas raises €17m for flexible financing solutions. The latest €17 million funding brings Bcas’s total raised to €25m, for the FinTech platform dedicated to helping students access higher education without financial barriers.

MOVERS & SHAKERS

🇪🇺 Marqeta appoints Marcin Glogowski as SVP, Managing Director Europe and UK CEO. Glogowski joins Marqeta from PayPal, where most recently he led the Central Eastern Europe region, overseeing growth strategy and sales across 30 European markets. More on that here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()