BREAKING: SEC says it did NOT yet approve Bitcoin ETF

Hey FinTech Fanatic!

Brace yourselves for a rollercoaster update in the crypto world. Just when we thought the financial landscape was taking a historic turn, the unexpected has happened.

SEC Clarifies: Bitcoin ETF Announcement a Hoax

- Social Media Misfire: In a dramatic twist, the SEC announced Tuesday afternoon that recent social media buzz about the approval of Bitcoin ETFs was, in fact, incorrect. Turns out, their Twitter account @SECGov got compromised, leading to the unauthorized and misleading tweet.

- Awaiting the Real Deal: While the crypto community reels from this confusion, the SEC remains on the cusp of a crucial decision. After years of resistance, they are expected to rule on Bitcoin ETFs this week. With over a dozen asset managers, including some who filed updated registrations on Tuesday morning, the anticipation is palpable.

- Bitcoin's Wild Ride: The crypto market responded with its usual fervor. Bitcoin's price briefly soared, riding on the false announcement, only to plummet below $46,000 once the truth surfaced. The recent months have seen Bitcoin's value climb, fueled by the optimism surrounding the potential approval of spot Bitcoin ETFs.

- What's at Stake: The approval of Bitcoin ETFs is more than just another financial product. It's a gateway for a new wave of investors. Financial advisors and investors, previously wary of the complexities around Bitcoin custody, could find ETFs a more palatable entry into the crypto realm.

Stay tuned for the latest updates. In the ever-evolving world of FinTech, being informed is your best asset 😉

See you again tomorrow!

Cheers,

Marcel

SPONSORED CONTENT

Fintech Meetup (March 3-6) is less than 60 days away! Don't miss Fintech's new BIG show with "the highest ROI" for attendees & sponsors. Ticket prices go up Friday 1/12 at midnight. Don't miss out!

Get tickets Now!

POST OF THE DAY

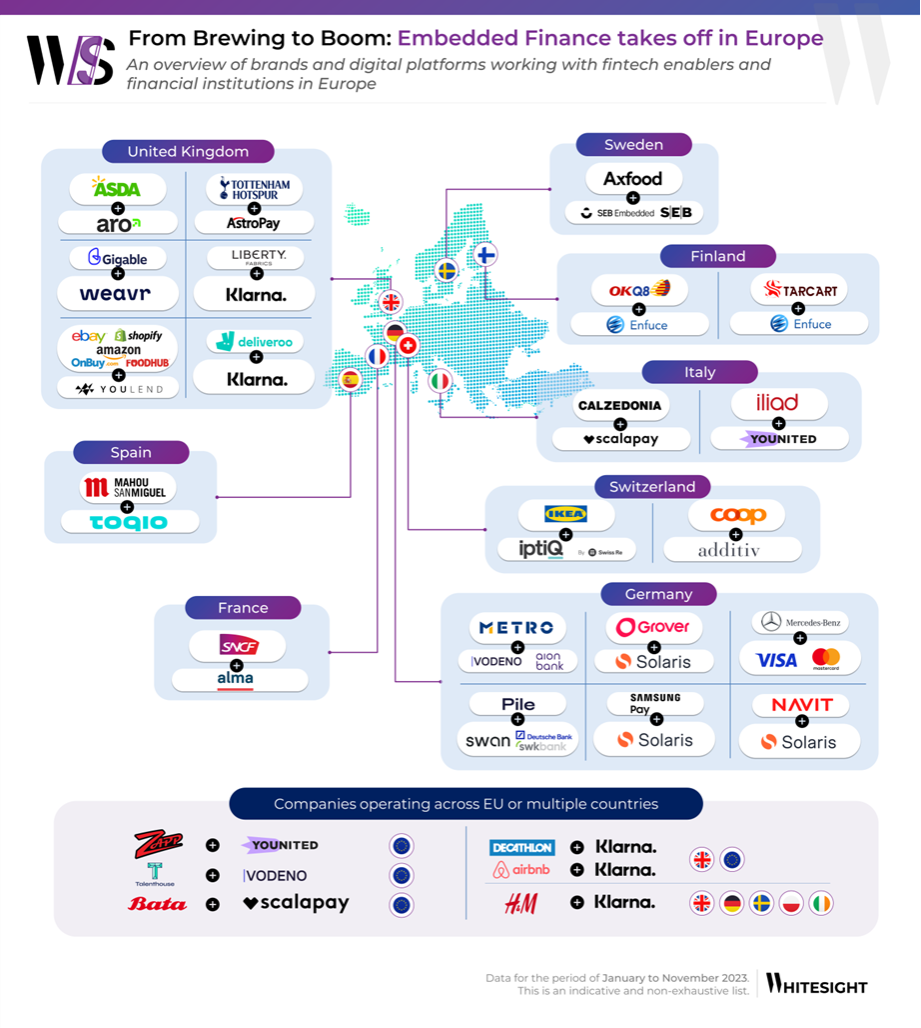

Embedded Finance takes off in Europe: Germany and the UK lead embedded finance innovation.

FEATURED NEWS

🇸🇬 Thunes expands its leadership to accelerate growth. Thunes appoints Floris de Kort as its new CEO. Peter De Caluwe has been promoted to Deputy Chairman focusing on strategy, M&A and further expansion into key markets, including China and the Gulf countries. Read more

PODCAST

Demystify Podcast: Griffin, a brand new UK bank, with David Jarvis, co-founder and CEO. In this compelling episode, David Jarvis, with his rich background in development infrastructure for renowned companies like Airbnb, delves into the story behind his leap into founding a full-stack bank in the UK. Listen to the full podcast episode here

FINTECH NEWS

🇺🇸 Big Tech firms begin fight back over regulatory oversight of digital wallets. A US lobby group representing the interests of Big Tech firms has hit out at proposals by the CFPB to regulate tech giants such as Apple and Google that offer digital payment apps and wallets.

Visa adds more digital wallets to CIBC and Simplii global money transfers. Visa and CIBC announced a new collaboration that will enable the bank’s clients to send funds to family and friends across borders more conveniently. The new capability will be made available early this year.

🇨🇱 Shinkansen, a leading fintech company, has recently been authorized to establish the first Fintech Payment Chamber in Chile. This approval marks a significant stride in providing a modern infrastructure to connect banks and other financial institutions for efficient money transfers. Read more

🇯🇵 Payroll fintech Zebec debuts in Japan. The startup announced the launch of its advanced web3 payment and real-time payroll services in the country. This strategic move underscores Zebec’s commitment to fostering collaborative financial innovation worldwide.

🇲🇹 Andaria partners with Mastercard. The partnership marks a key move in Andaria's strategy to enhance its card and payment solutions under the Principal membership agreement. It will also optimize existing dedicated IBANs, business accounts, and tools within the broader Embedded Finance offering.

PAYMENTS NEWS

OVO Network selects Mangopay to streamline holiday rental payments. Through the partnership, Mangopay streamlines guest payments to property owners, automating fund requests from guests and handling third-party online travel agent integration for chalet bookings.

X promises peer-to-peer payments, AI advances in 2024. In an X blog post recently published, the company claims it will launch P2P payments this year, to unlock “more user utility and new opportunities for commerce,” suggesting a tie-in with other X products, like creator revenue sharing and online shopping.

🇦🇺 Tyro adopts the Pismo platform to enhance its operations in Australia. The Aussie payments and cash flow solutions company selected the cloud-based platform to speed up innovation and expand its market presence. More here

🇲🇾 GHL offers Mastercard Click to Pay for seamless online checkouts. GHL provides acquiring services and card payment acceptance solutions to retailers in-store, online, and via mobile. This provides a seamless enhancement to merchants' payment solutions without additional integration.

Visa cracks down on surcharge programs. The card network company is boosting efforts to enforce surcharge rules, with non-compliance potentially resulting in fines up to $1 million, according to one card processor. Read more

🇧🇷 Trio has recently obtained approval from Brazil's Central Bank (BC) to become a Payment Institution (PI). This accreditation allows Trio to function as both an issuer of electronic money (managing prepaid accounts) and a Payment Transaction Initiator (PTI). Besides, in the coming months, the company will begin the accreditation process to operate as a direct participant in Pix, revealed CEO.

REGTECH NEWS

Visa zones in on Government digital ID with Tech5 partnership. The two organizations will design a roadmap that encompasses a series of initiatives and projects aimed at establishing a robust foundation for advancing digital payments, digital identity management, and other ecosystem-driven services.

🇺🇸 CFTC takes aim at ID discovery in DeFi. A regulatory report issued by the CFTC recommends specific actions applied to anti-money laundering and digital identity in the opaque world of DeFi. It proposes exploring regulations and enforcing requirements for discoverability and verification of identity information across DeFi ecosystem layers.

GenAI could make KYC effectively useless. Viral posts on X (formerly Twitter) and Reddit show how, leveraging open source and off-the-shelf software, an attacker could download a selfie of a person, edit it with generative AI tools and use the manipulated ID image to pass a KYC test. Read on

DIGITAL BANKING NEWS

🇨🇦 Mastercard collaborates with BaaS platform 4t Wave. The collaboration will leverage 4thWave’s advanced supply chain finance platform for managing B2B payments to benefit Mastercard’s commercial customers, enabling cashflow for corporate buyers and suppliers.

🇵🇭 Fintech startup Salmon becomes licenced bank in the Philippines after acquiring a controlling interest in Rural Bank of Sta. Rose. Salmon will own 59.7% of the bank upon the completion of this transaction, to conclude in the coming weeks. The bank’s license and its geographic footprint will enable Salmon to offer consumer credit and debit products nationwide.

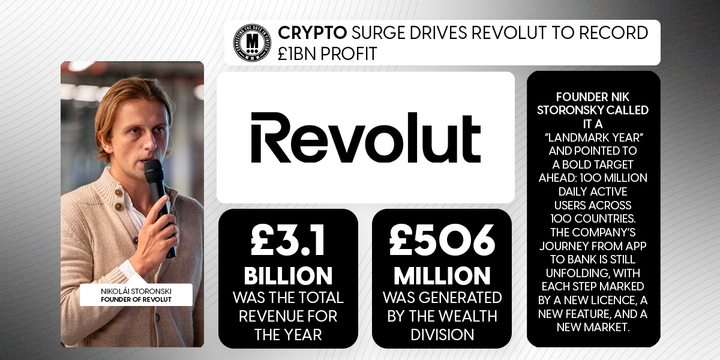

Revolut rolls out HR platform to more than 300 firms. Dubbed Revolut People, the platform has seen 325 corporate signups since it was officially made available to other companies. The software is currently available in the UK and Ireland ahead of a European Economic Area rollout in the second half of January.

🇺🇸 Three failed US banks had one thing in common: KPMG. Big Four auditor’s work for SVB, Signature and First Republic comes under scrutiny in aftermath of their collapses. The trio of bank failures since March has cast a pall over KPMG’s lucrative business as the largest auditor of the US banking sector. Read more

🇳🇬 Kuda hits ₦55.8 trillion in transaction value within four years. Known as "the bank of the free", Kuda has secured at least $91.6 million in funding since its inception. In 2021, the bank raised $55 million in a Series B funding round, reaching a valuation of $500 million.

BLOCKCHAIN/CRYPTO NEWS

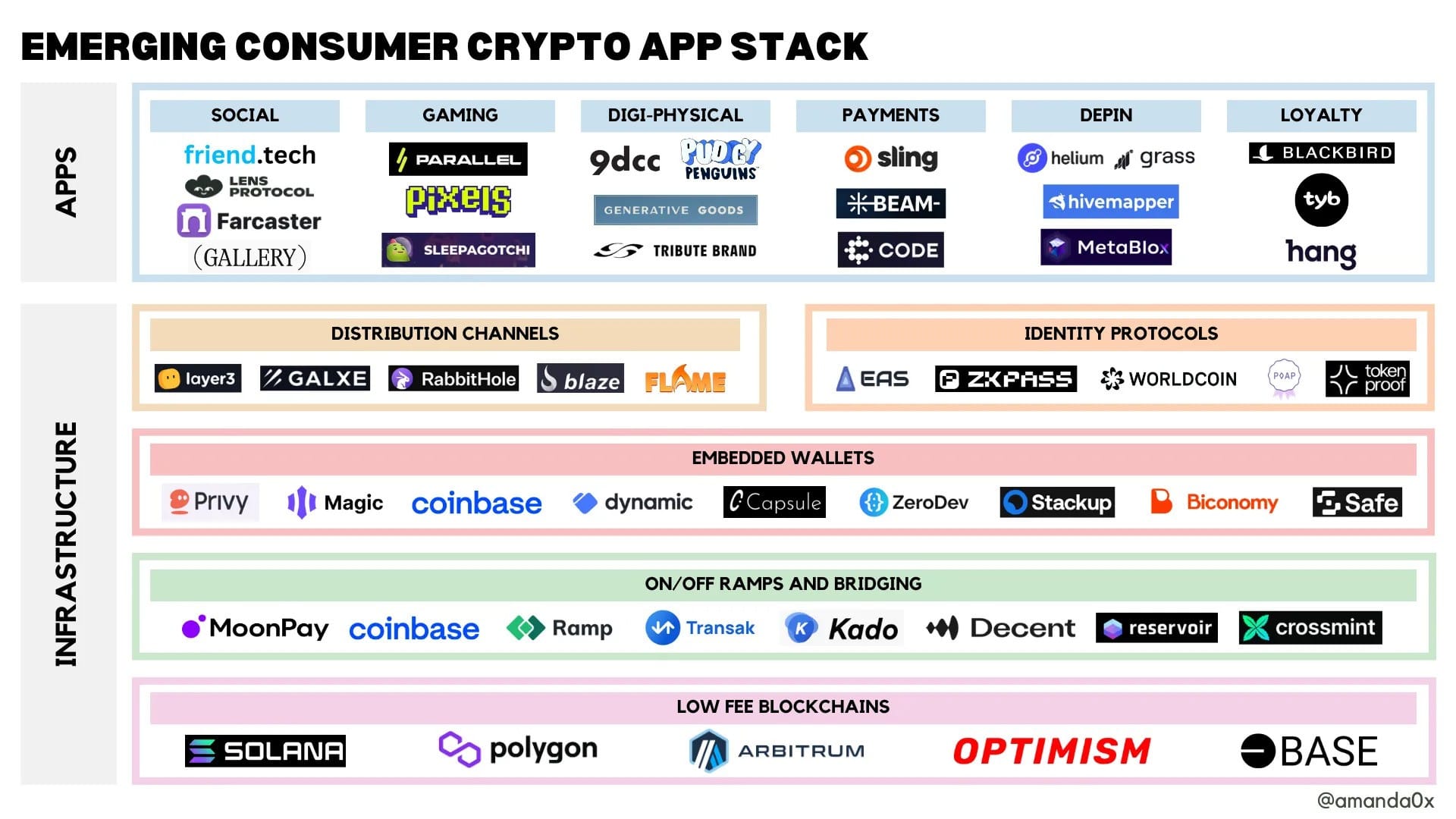

Historically, it’s been difficult for users to “fund” their crypto accounts. In the past couple of years, numerous solutions have arisen to tackle this problem:

🇬🇧 CoinTracking releases crypto tax tool for UK investors. With a crypto tax software like CoinTracking, UK-based investors can track their crypto portfolios by importing trades from hundreds of exchanges, crypto wallets and blockchain networks.

🇺🇸 PayPal stablecoin deployment on Aave sought by Paxos. While PYUSD adoption experiences moderate growth, Paxos is playing a pivotal role in establishing DeFi markets for this stablecoin. Lending protocol, Aave, is currently gauging community interest in integrating PYUSD into its Ethereum pool.

Crypto and fintech groups fined $5.8bn in global crackdown on illicit money. Data analysed by FT showed crypto and digital payments companies paid $5.8bn in fines last year for shortcomings in customer checks and anti-money laundering controls, as well as for failing to uphold sanctions and other financial crime issues.

DONEDEAL FUNDING NEWS

🇬🇧 Citi joins £25m Series A for UK fintech Zilo. The funding will be used for product development, drive user acquisition, reach into new markets and pursue strategic partnerships that will broaden Zilo's service offerings. Read more

🇧🇪 HSBC AM leads €12 million investment in Unbox. The platform embraces a wide range of use cases, including traditional and community currencies through Unbox Community Issuance, high-value assets, and low-value items using the State of Product software suite.

🇬🇧 AbbeyCross raises US$6.5 million in seed round led by Peter Thiel’s Valar to disrupt EM FX infrastructure. The new capital will support the continued development and deployment of the ABX Sync platform, aimed at improving cost-efficiency, regulatory compliance for banks, payment companies, and NGOs.

🇬🇧 Ryft wins portion of Innovate UK £5 million funding pot. Ryft has grown exponentially throughout 2023, seeing figures rise by 300% across the business. To sustain this growth and boost innovation, the grant will be utilized for various business expansion initiatives, including entering the travel and events industries.

Stripe, AWS alums’ brainchild Cleva raises $1.5M: How this African fintech is revolutionising finance? Cleva has assisted thousands of Nigerians in opening US-based accounts, processing over $1 million in monthly payments while experiencing month-on-month revenue growth of 100%.

🇧🇷 Conta Simples receives US$41.5M investment to expand its portfolio with credit operations. The firm intends to continue at a strong pace of increasing its customer base, evolving the company's distribution channels and expense management software.

MOVERS & SHAKERS

🇬🇧 IFX Payments names Sara Cass as chief compliance officer. Sara will lead the team in upholding the high compliance standards set at IFX payments as it continues to cement its place as an industry leader in compliance. Learn more

🇺🇸 Nymbus welcomes Jeff Fonda as CFO. Jeff arrives with a rich background in financial leadership. His deep expertise in fintech, SaaS, and executive leadership, honed during his tenure at Mortgage Cadence, an Accenture company, among others, prepares him well for this pivotal role.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()