🚨BREAKING: PayPal 'shocks' the world with 6 new updates on innovation day

Hey FinTech Fanatic!

PayPal CEO Alex Chriss announced a week ago that it would 'shock' the word on innovation day. And today was the day.

PayPal is introducing six major AI-driven updates to enhance commerce for both merchants and consumers:

- New PayPal Checkout Experience: This update significantly speeds up the checkout process, aiding merchants in converting more transactions and offering consumers a quicker checkout experience.

- Fastlane by PayPal: A new feature designed for faster and more efficient guest checkouts, allowing consumers to complete purchases with a single click, without the need to remember usernames or passwords.

- Smart Receipts: Offering AI-personalized shopping recommendations and cashback rewards on receipts, encouraging repeat business from customers.

- PayPal Advanced Offers Platform: This platform uses AI to create personalized, real-time offers for consumers, based on their shopping habits, enhancing the relevance of merchant promotions.

- Reinvented PayPal Consumer App: The updated app will provide new ways for shoppers to earn cashback, incentivizing more frequent use of PayPal for transactions.

- Enhanced Venmo Business Profiles: These profiles aim to help small businesses attract and engage customers more effectively, with features like subscribe buttons and profile rankings.

These initiatives, announced by PayPal's President and CEO Alex Chriss, are part of the company's mission to revolutionize global commerce and address customer pain points in the evolving world of digital payments and e-commerce.

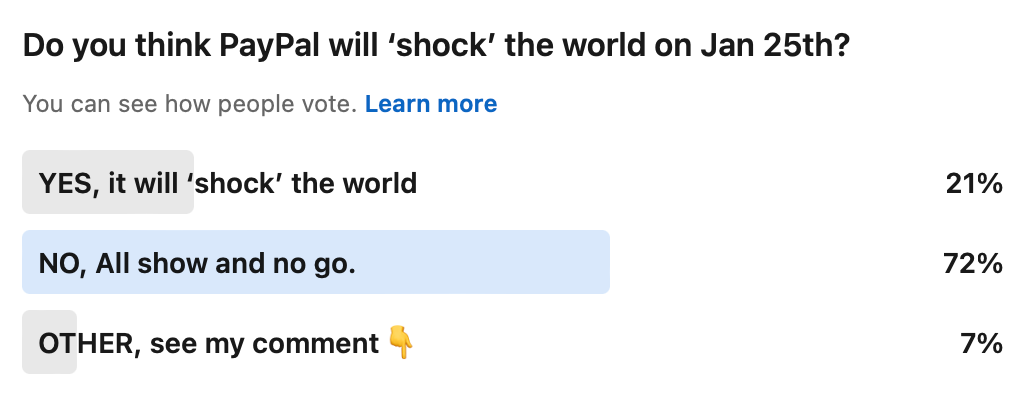

Not sure of these innovations are really shocking the world, and beforehand when I asked you in a Poll, you didn't seem to have a lot of confidence:

Now that these innovations has been revealed by PayPal, what do you think now? Let me know in this POLL and/or in the comments below👇

Cheers,

Marcel

SPONSORED CONTENT

#FINTECHREPORT

Fraud Prevention in Ecommerce Report 2023-2024. This edition provides a thorough review of the global state of the fraud ecosystem and how can deploying the best fraud prevention techniques can deter cyber criminals and scammers. Download report here

INSIGHTS

Embedded Finance Usecase: Completing the all-in-one finance app for French independent workers: The Indy Story. How partnering with a BaaS was a great way to deliver a satisfying banking experience for Indy users. Click here to read Swan's full article.

FINTECH NEWS

ServiceNow builds disputes management system with Visa. ServiceNow Disputes Management is a streamlined solution that blends the best of ServiceNow’s AI-first platform and the company’s Financial Services Operations solution with Visa’s deep technology investments.

🇺🇸 How Walmart’s Financial Services became a fraud magnet: Scammers have duped consumers out of more than $1 billion by exploiting Walmart’s lax security. The company has resisted taking responsibility while breaking promises to regulators and skimping on training. Read the complete article here

🇵🇰 Y Combinator-Backed ‘Elevate’ debuts in Pakistan Offering Alternative to Wise And Payoneer. Elevate transforms the landscape by empowering freelancers and remote workers to easily open US bank accounts through a strategic partnership with Bangor Savings Bank, a reputable institution with over $7 billion in assets.

PAYMENTS NEWS

🇮🇳 Food-delivery platform Zomato and international financial infrastructure provider Stripe are the latest entities to have received final approval from the RBI in India to operate as online payment aggregators. With these additions, 11 entities have now received such approval in the country.

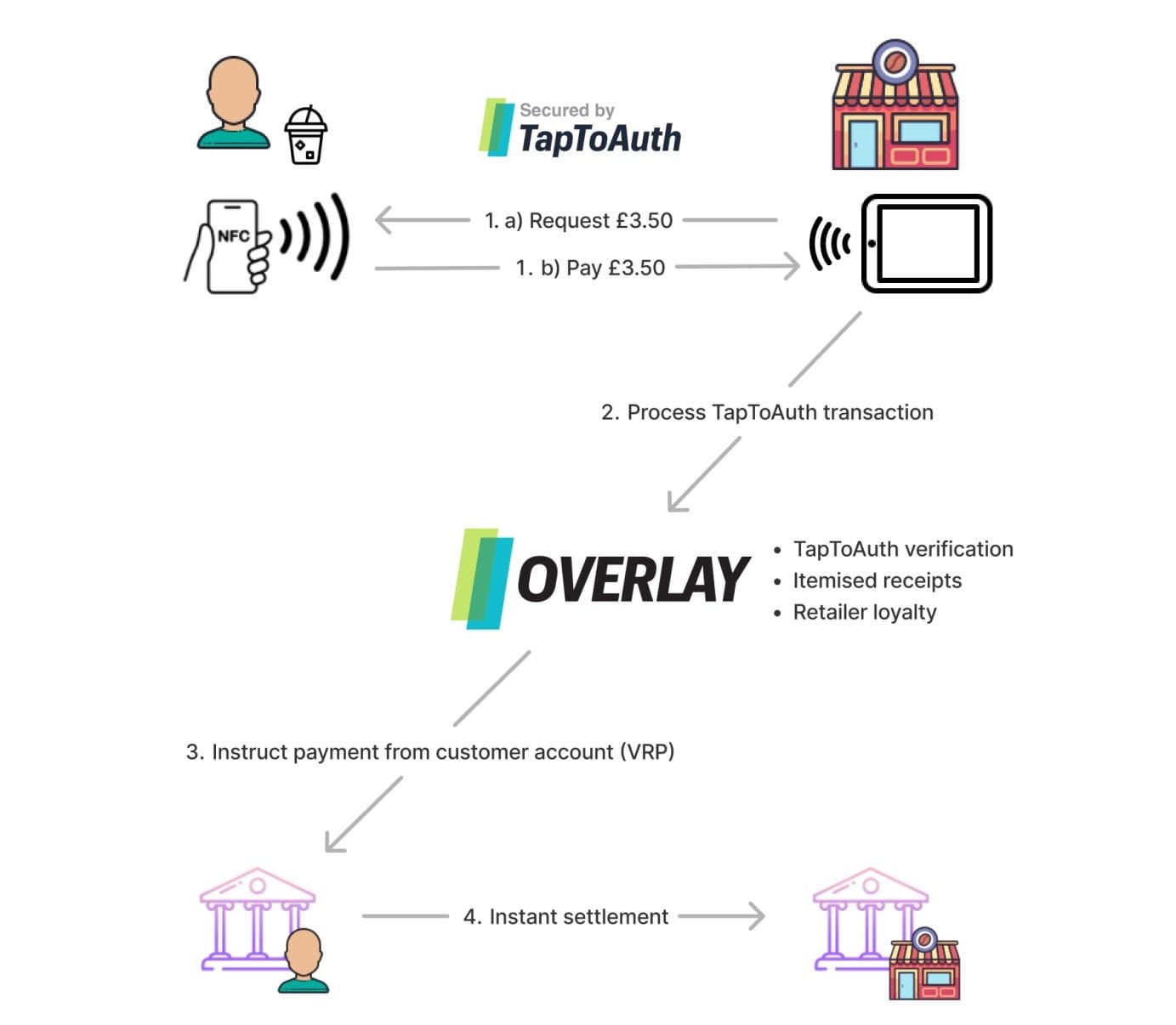

🇬🇧 Token.io joins SPAA scheme: a commercial API initiative that will enable greater innovation and unlock wider adoption of A2A payments in Europe. As a SPAA participant, Token.io will contribute to the development of the richer payment functionality outlined in the scheme’s rulebook and Minimum Viable Product for banks and TPPs.

🇬🇧 PayPoint on track after 'positive' quarter. Updating on third-quarter trading, the tech firm - which provides a range of in-store and online payment services - said group net revenues jumped 60% in the three months to 31 December, to £52m.

🇨🇴 Wompi, a payment gateway by Grupo Bancolombia, has announced the launch of a new app that enables customers to send payment links or transform their smartphones into a POS terminal. Alejandro Toro, CEO, highlighted the innovative feature enabling users to turn their mobile devices into card readers for instant sales.

OPEN BANKING NEWS

Tink launches ‘Risk Signals’ feature. The European Open Banking platform has unveiled a new feature, initially in Germany, which conducts real-time risk checks during the payments process. The product ‘Risk Signals’ is set to roll out across Europe, with payment services provider Adyen already using the service.

🇨🇦 Central 1 partners with Flinks to introduce open banking functionality to its credit union members and financial institution clients. Through this partnership, Central 1 is taking an important step in enabling open banking opportunities and optionality in the credit union system.

DIGITAL BANKING NEWS

Here are the most downloaded UK banking apps heading into 2024👇

“Maybe we can acquire Monzo” - An interview with Lunar’s CEO Ken Villum Klausen. A push for profitability in 2023 has brought about a surge in revenue generation for one of Europe’s leading neobanks. Read the complete interview here

🇬🇧 Current Account Switch Service hits 10 million total switches following busiest quarter since launch. Between October and December 2023, the Current Account Switch Service facilitated 433,701 switches, the highest quarterly total recorded since the Service was launched over ten years ago. Read more

🇧🇷 Nubank launches feature to add money to the account using credit card limit. The idea is to offer more convenience, speed, and flexibility to customers and help them consolidate their expenses in a single place. The new feature will be gradually rolled out to the user base.

🇬🇧 Revolut account closure lawsuit from late Russian oligarch’s son-in-law struck out by High Court. A High Court judge has struck out the case brought by the son-in-law of a late Russian oligarch against Revolut for “unlawfully” closing his account.

BLOCKCHAIN/CRYPTO NEWS

Wirex announces strategic integration with Liquity. Users can now seamlessly engage in buying, selling, and utilising Liquity tokens for everyday transactions with 50 million merchants in 200+ countries through the Wirex app. Read more

DONEDEAL FUNDING NEWS

🇩🇪 Mondu secures €30m to double down on European expansion. The fresh round of debt financing adds to €20m the fintech raised from the German bank back in 2022, and brings its total funding to more than €115m since it launched in October 2021.

M&A

🇬🇧 ieDigital has announced the acquisition of ABAKA, the AI - recommendation engine platform which uses machine learning and behavioural segmentation software to predict which products are the most likely to be bought by financial services consumers.

MOVERS & SHAKERS

🇮🇱 Team8, a global company-building and venture group, announced the addition of two new leaders to its executive team, bolstering the firm's presence in Israel and globally. Asaf Azulay has been promoted to Partner and Chief Marketing Officer, and Dror Grof is Team8’s new Partner and Ideation Lead in the Digital Health Foundry.

🇧🇷 Livia Chanes becomes CEO of Nubank’s Brazilian operation. Nubank announces that Brazil Country Manager Livia Chanes will join Nu Holdings’s management team, taking the position of CEO Brazil. Read on

🇬🇧 Adam Seale is joining as non-executive chair of Chip. He brings considerable experience to Chip at a time of significant growth, with the business growing assets under management by ten times in the last year.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()