Brazilian FinTech PicPay Prepares for US IPO

Hey FinTech Fanatic!

PicPay, a prominent Brazilian neobank owned by the billionaire Batista family’s holding company, is partnering with Citigroup Inc. to pursue an initial public offering (IPO) in the United States, according to sources familiar with the situation.

The timing of the IPO will depend on favorable market conditions. Both PicPay and Citigroup representatives have declined to comment on the matter.

Previously, PicPay filed for a US IPO in April 2021, seeking a valuation of $8 billion, as reported by Bloomberg News. However, the company withdrew its registration in June of the same year.

Founded in 2012 as a digital wallet, PicPay was acquired in 2015 by J&F Investimentos SA, the parent company of meatpacking giant JBS SA.

In 2023, the FinTech reported a net income of 37 million reais ($6.8 million), a significant turnaround from a loss of 693 million reais in 2022. PicPay also announced it achieved break-even status for the first time in March 2023.

As of December, PicPay boasted over 35 million active customers.

Have a great day and I'll be back with more FinTech news in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

INSIGHTS

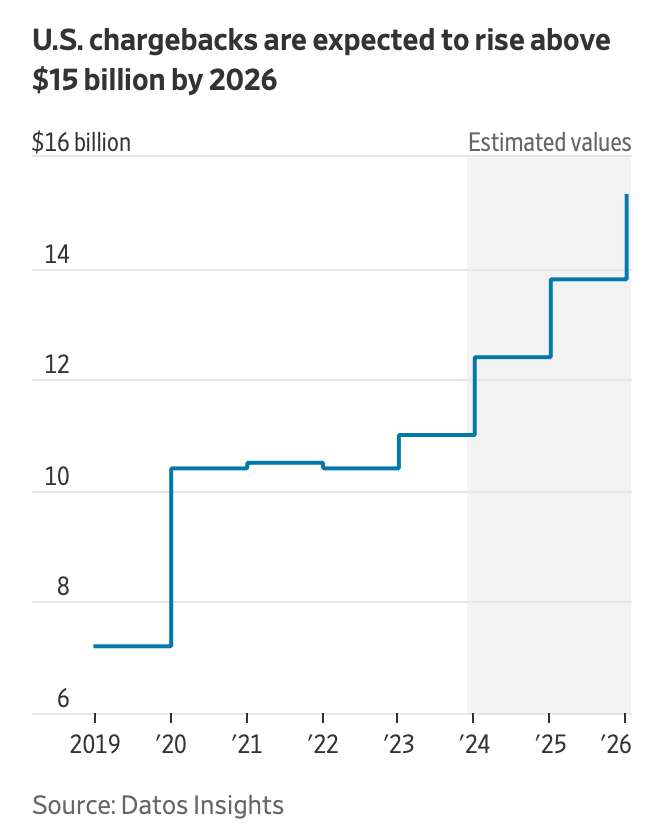

🇺🇸 Disputes over Chargebacks in the US are expected to rise abover $𝟭𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 by 2026 🤯

Disputes over credit-card charges, once a measure of last resort, have surged as shoppers learn how easy it is to deploy them.

Last year, consumers disputed about 105 million charges with credit-card issuers in the U.S., worth an estimated $𝟭𝟭 𝗯𝗶𝗹𝗹𝗶𝗼𝗻.

That is up from $7.2 billion in 2019, according to Datos Insights, a finance-industry research firm. The company predicts that figure will rise nearly 40% by 2026.

PODCAST

🎙️ In this podcast episode, Jason Mikula interviews Nicolas Benady, CEO at Swan, Live At Money2020 Europe. They discuss topics such as embedded finance and banking-as-a-service in Europe vs. the US, the benefits of Swan's e-money institution license compared to banking, Swan's oversight of third-party partners, and more. Listen to the full podcast episode here

FINTECH NEWS

🇧🇷 PicPay, the Brazilian mobile banking app owned by the billionaire Batista family’s holding company, is working with Citigroup Inc in order to try to do an initial public equity offering in the US, aiming to execute the transaction as soon as market conditions allow, according to people familiar with the matter.

🇺🇸 Brex announced that companies incorporated with Stripe Atlas can apply for Brex business accounts immediately after incorporation, making it faster for a company to manage their finances and get their businesses off the ground. Read more

🇲🇽 Ecuadorian FinTech company PayMon launches operations in Mexico with specialized software for the digitalization of cafeterias. The FinTech is introducing software that is transforming cafes, increasing sales by an average of 25% and saving hours of daily administrative work.

🇬🇧 Terrapay selects Thredd for virtual card payments. This strategic partnership aims to develop payment solutions within the travel industry, offering seamless, secure, and compliant virtual card services to intermediaries as part of TerraPay’s cross-border money movement network.

🇩🇪 ACE Alternatives, a FinTech company based in Germany, has formed a strategic partnership with Monite, an embedded finance platform that enables SMB platforms to integrate invoicing and bill pay functionalities into their interface.

PAYMENTS NEWS

🇺🇸 Affirm’s Chief Financial Officer Michael Linford doesn’t expect profits from its Apple tie soon. The company’s Finance Chief compared the rollout of its partnership with Apple to the launch of its own payment card, saying the company preferred a “very thoughtful and controlled” approach.

🇳🇿 Corpay Cross-Border continues global expansion with launch of new office in New Zealand to provide clients with access to Corpay’s Cross-Border business’s full suite of products, including global payments and in the case of wholesale customers, currency risk management solutions as well.

🇺🇸 Loop and JPMorgan Payments tie up to turbocharge freight payments. Together, both companies will boost working capital with freight payments — and facilitate stronger relationships between carriers and shippers built on speed, transparency, and trust.

🇿🇦 Spenda releases Scan to Pay QR payment tech in South Africa. Spenda Scan to Pay aims to address issues of affordability and accessibility, leveraging the largest QR ecosystem in South Africa, in its unique offering. More on that here

🇺🇸 Documents show how Musk’s X plans to become the next Venmo. State license applications give new insight into the company’s plans: A major plank of Elon Musk’s plan for expanding X into an “everything app” has been grafting a payments network onto its main social networking service.

🇰🇪 Paystack has announced that Virtual Terminal, which allows businesses to accept in-person payments with real-time confirmations and zero hardware costs, is now available in Côte d’Ivoire, Ghana, Kenya, and South Africa. It was first launched in Nigeria in 2021.

OPEN BANKING NEWS

🇬🇧 DNA Payments adds Open Banking for POS terminals in a bid to offer consumers more ways to pay. Following the launch of this solution, customers can now pay by using their mobile devices and banking apps via a QR code that is shown on the terminal.

🇲🇽 Citibanamex partners with Belvo to promote greater financial inclusion, enabling individuals who are currently outside the banking system to access credit. Through Open Finance, both companies aim to provide more people with access to financial products and services in Mexico.

🇬🇧 Open Banking could become a mainstream payment method in 5 years time surpassing BNPL, emerchantpay research finds. The survey of UK consumers found that 1 in 2 people are unknowingly using this payment method during checkout, with more than half (51%) of the UK population being unfamiliar with the term. Despite this, Open Banking payments are actively used by consumers.

DIGITAL BANKING NEWS

🇬🇧 Starling Bank is pursuing several debtors that have never shown signs of active trading, as the FinTech that relied on government-backed Covid-19 loans battles rising defaults and a probe into its financial-crime controls.

About 90 per cent of Starling’s outstanding £830mn in loans to small and medium-sized enterprises, or SMEs, was guaranteed by the UK government as of the end of March, it reported last week. Continue reading

💳 Spanish Virtual IBANs are now live at Mangopay. Explore here the benefits of virtual IBANs, an essential tool for simplifying payment operations, improving local payment experiences, and fighting IBAN discrimination.

🇨🇦 Canada's TD Bank launches tech-focused banking unit. Shez Samji, a tech banker hired from the Canadian arm of failed U.S. lender Silicon Valley Bank last year, will head the new unit. The team brings experience from working with technology companies from the earliest stages to companies that are seeing growth.

🇨🇦 Royal Bank of Canada has enlisted Nova Credit to help migrants leverage their international credit history when they arrive in the country. Eligible customers will complete an online application through Nova Credit which uses their home country's credit bureau information to create equivalent scores for Canada.

🇮🇹 Finom enters Italy. Finom, a European digital banking solution for SMEs and entrepreneurs, today announced its entry into the Italian market with the local IBANs and integrated e-invoicing services with automated reconciliation. Read on

🇺🇸 Brex launches new digital banking products for startups in partnership with Column. This launch makes Brex the only spend management platform to marry corporate cards, expense management, bill pay, travel booking, treasury, and banking into one vertically integrated offering.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Transak, one of the leaders in Web3 payments infrastructure, has listed PayPal’s stablecoin, PayPal USD (PYUSD). The increased accessibility of PYUSD through Transak's platform seeks to accelerate mainstream adoption of cryptocurrencies and create exciting new use cases.

🇺🇸 SEC drops investigation into Ethereum studio Consensys, which shared the news on X overnight. “Today we’re happy to announce a major win for Ethereum developers, technology providers, and industry participants: the Enforcement Division of the SEC has notified us that it is closing its investigation into Ethereum 2.0,” the company posted.

PARTNERSHIPS

🇬🇧 UK online trading house CMC Markets Plc has announced a new FinTech partnership with global neobank, Revolut. The partnership will see the two companies connecting via multiple APIs, with the user interface delivered directly via the Revolut app whilst trading, pricing, account systems, execution and clearing are provided by CMC Markets Connect, CMC’s institutional services arm.

DONEDEAL FUNDING NEWS

🇬🇧 Zilch says it has raised $𝟭𝟮𝟱 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 in debt financing from Deutsche Bank in a deal that will help the company triple sales in the next couple of years and move closer toward an IPO. The company said the debt was structured as a securitization, where multiple loans can be packaged together.

🇨🇦 Canadian FinTech startup Chexy raises $4.1m to expand renter rewards platform. The company plans to use the new funding to make its rent reporting feature free for all active users, further aligning with national policies aimed at benefiting renters.

🇦🇺 National Australia Bank’s venture arm invests in crypto-focused Zodia Custody. The investment underpins Zodia’s push into Australia, where the custody firm established operations in late 2023, according to a press release. The size of the investment was not disclosed.

M&A

🇨🇦 Nuvei shareholders approve previously announced go-private deal. The Canadian FinTech has obtained shareholder approval for its previously announced plan for a going private transaction with Advent International. Find out more

🇩🇰 Danish accounting software FinTech Ageras has entered into an exclusive agreement with Societe Generale to acquire Shine, a provider of banking and accounting software for SMEs. The takeover of Shine represents the Danish FinTech's largest acquisition to date and its eighth overall.

🇧🇷 Celcoin to speed up M&A. Marcelo França tells Latin Finance FinTech will pursue consolidation in Brazil and beyond after the latest investment round. Click here to learn more

🇮🇱 Dejavoo expands global reach with acquisition of Israeli FinTech, Z-Credit. The acquisition reflects Dejavoo's continued commitment to growth, expansion, and the delivery of innovative payment solutions to its clients.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()