Block Earnings Reveal Dorsey’s Bitcoin and Banking Vision

Hey FinTech Fanatic!

Block, formerly Square, is shifting focus toward Bitcoin accessibility and small-business lending. On their Q3 earnings call, Jack Dorsey shared that Block is winding down TBD’s DeFi and scaling back on Tidal, redirecting resources to Bitkey (their self-custody Bitcoin wallet) and Bitcoin mining.

“We’re focused on making Bitcoin more accessible and secure for people,” Jack Dorsey, Block head, Square head, chairman and co-founder of Block told investors. “We want to make it usable every day, by having an open protocol for payments on the internet.”

“Bitcoin has all the elements necessary to trust it as a currency,” he added, noting that “Bitcoin mining is going to be very large for us.”

The real game-changer? Lending. Block’s goal is to bank its user base by expanding Square Loans, Afterpay BNPL, and Cash App Borrow.

“I think this is one of those things that will ultimately set Square and Cash App apart … getting a personally sized loan right to their email inbox, and then pay it off just by selling products. We want to lead with technology,” Dorsey said. “And we want to make it very transparent, no hidden fees and everything is visible and simple — particularly the payback experience. With a simple payback experience it doesn’t feel like a loan.”

What do you think about this? Let's discuss in the comments.

Catch more FinTech updates below👇, and I’ll see you tomorrow!

Cheers,

#FINTECHREPORT

📊 Check out Global Payment Trends report by HSBC. This edition focuses on how the payments landscape continues to transform, driven by technological advancements, the adoption of new digital business models and the emergence of new payments infrastructure. Link here

FINTECH NEWS

🇺🇸 Block earnings show Jack Dorsey’s Bitcoin and banking ambitions. On Nov. 7 third quarter 2024 earnings call, Jack Dorsey highlighted Block’s goal to make Bitcoin more accessible for everyday payments, with the larger ambition of banking its entire user base to enhance ecosystem benefits.

🇪🇸 Ebury expands its presence in international football by becoming the 'Official FX Partner' of Spanish club C.D. Leganés, offering a range of international trade services, across payments and collections, FX risk management, and business lending in over 130 currencies. Learn more

🇺🇸 Caruso and Fidel API renew partnership to enhance consumer experience with innovative card-linked offers. This collaboration aims to provide Caruso’s guests with seamless access to tailored rewards and offers, enhancing the shopping experience across the company’s premier retail destinations in California.

🇺🇸 American Express announces data access agreement with MX Technologies. AmEx customers will now be able to better manage their personal finances and business expenses via secure connections of their American Express accounts with third-party FIs and FinTech apps via MX.

🇺🇸 Affirm beats on top and bottom lines. The firm reported better-than-expected first-quarter results, with GMV—a key metric of total transaction value—increasing 35% year-over-year. Revenue grew 41% year-over-year, outpacing volume growth and reflecting the company's focus on strong unit economics.

🇨🇳 China’s digital yuan wallet for seniors works without an app. The People’s Bank of China launched a digital yuan hard wallet. Resembling a credit card with a display for QR codes and balances, it’s designed for seniors, students, and foreign visitors and operates with Huawei’s HarmonyOS without needing an app.

🇦🇺 ASX-listed Earlypay announce on-market share buy-back of up to 27 million shares. The buy-back will be managed within the ‘10/12 limit’ permitted by the Corporations Act, and therefore does not require shareholder approval. More here

🇳🇬 Africhange acquires IMTO license, sidestepping costly partnerships. This license allows the subsidiary to process foreign currency transfers for fundraising efforts but only permits inbound transactions, restricting outbound transfers.

PAYMENTS NEWS

🇬🇧 Solidgate Introduces No-Code Payment Links—Now Live in Solidgate HUB. Solidgate Payment Link is a reusable URL that lets businesses instantly create and share payment links with clients. It allows merchants to generate unique links for products or services, sharing them across social media, email, or chat for convenient customer payments.

🇺🇸 ACI Worldwide, Inc. reports financial results for the Quarter ended September 30, 2024. “We are very pleased with our third quarter results and the continued positive momentum in the business. We saw particular strength within our Bank and Merchant segments and are once again raising our full-year outlook,” said Thomas Warsop, president and CEO of ACI Worldwide.

🇸🇬 FOMO Pay teams up with Mastercard to enable contactless card acceptance through FOMO SoftPOS. The solution provides customers with more payment options while giving merchants greater flexibility and mobility as multiple smartphones can be activated for use as needed.

🇺🇸 This year, U.S. consumers are expected to spend about $𝟭𝟴 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 on bargain shopping site Temu. Behind the scenes, though, Temu has encountered trouble with the bank that was handling those payments. Find out more

🇳🇵 NCHL and Ant International launch NEPALPAY QR for cross-border payments. The feature enables travelers from ten regions, including China, Hong Kong, Singapore, and South Korea, to use their native e-wallets and banking apps at over 875,000 NEPALPAY QR-compatible merchants in Nepal.

🇨🇳 XTransfer showcases cross-border payment solutions at SFF 2024. The company aims to expand its presence in Southeast Asia, offering secure and efficient payment solutions to SMEs in the region. Continue reading

🇨🇦 TD integrates with TouchBistro to provide payment solution to Canadian restaurant owners. This will enable Canadian restaurant and food service entrepreneurs to consolidate all management and payment services into one, easy to use POS and restaurant management system.

OPEN BANKING NEWS

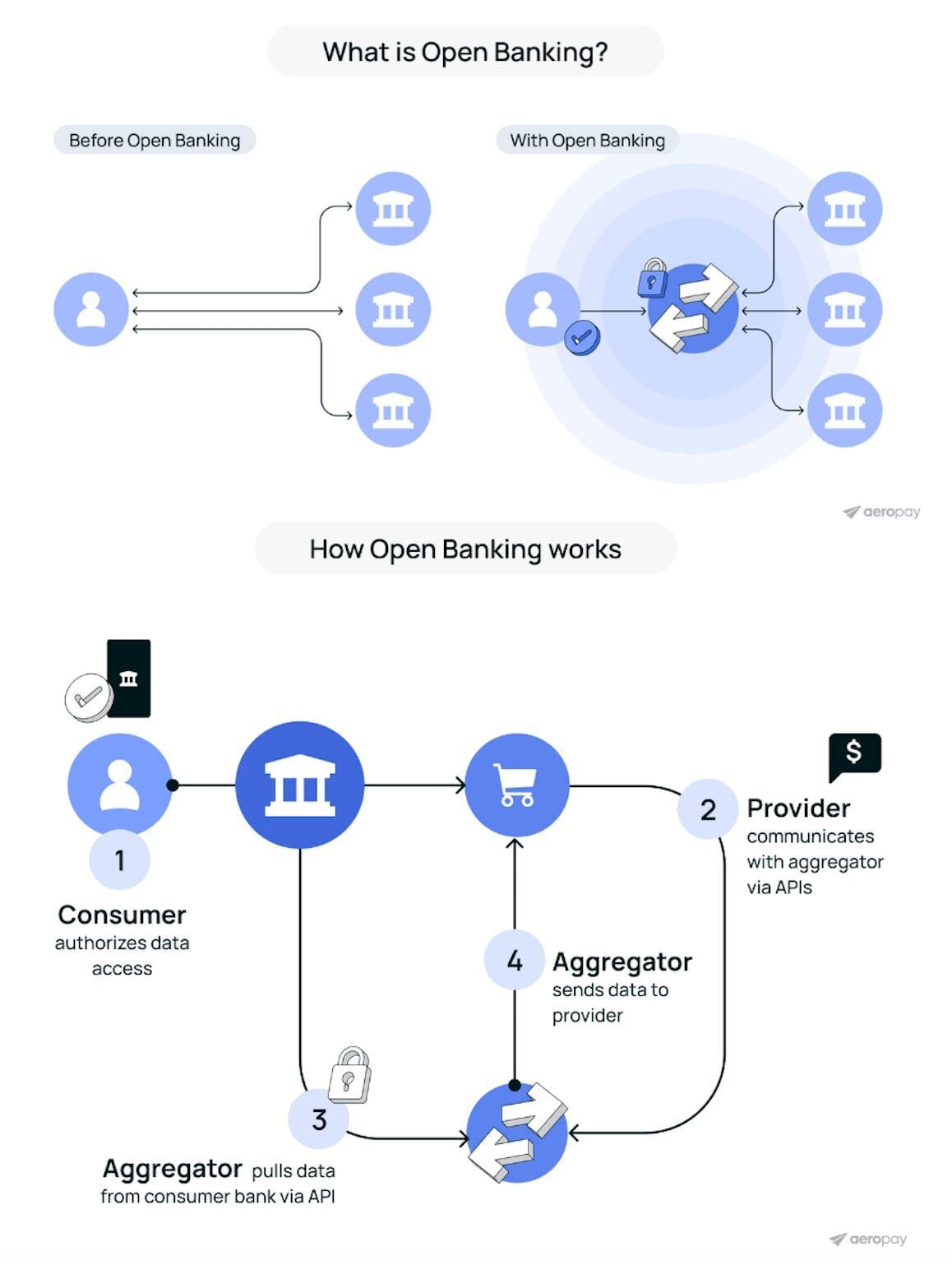

🏦 What is Open Banking? And how does it work?

Here's a quick explainer from Aeropay👇

🇮🇩 Brankas launches integrated APAC Open Banking Compliance Solution with ADVANCE.AI's eKYC solution. Banks that are required to meet open banking regulations such as BI-SNAP in Indonesia can now leverage a single platform for all their compliance needs. Read more

REGTECH NEWS

🇮🇹 Cleafy launches revolutionary GenAI Co-Pilot: Turning data overload into actionable insights for online fraud prevention. The Co-Pilot simplifies fraud detection by providing real-time, natural language-driven insights, empowering teams to tackle even the most advanced threats effectively.

DIGITAL BANKING NEWS

🇺🇸 Kemba Credit Union launches Alkami’s Digital Banking Platform for retail and business members. Alkami’s single platform experience for retail and business banking solutions, will allow Kemba the opportunity to drive growth in new deposit accounts, enhance cross-sell opportunities and strengthen loyalty.

🇺🇸 Alkami surpasses all digital banking providers to become #1 in credit union market share. The company’s success is reflected in the performance of its credit union clients, who experienced stronger deposit, loan, and revenue growth from January 2020 to June 2024 compared to peers.

🇺🇸 US central bank boss says Trump can't fire him. Federal Reserve Chairman Jerome Powell commented during a press conference that he would not step down if asked by Trump, noting that the law prevents the White House from forcing his removal.

🇷🇴 UniCredit completes acquisition of 90.1% stake in Alpha Bank Romania. UniCredit will begin a “gradual integration” of Alpha Bank Romania into its group, aiming to merge Alpha Bank Romania into UniCredit Bank Romania by absorption in the latter half of 2025.

🇭🇰 Hong Kong Monetary Authority fines Fubon Bank HK$4m for violation of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO). This follows Fubon Bank's self-reported transaction monitoring failures and the monetary authority’s investigation into its compliance systems and controls.

🇹🇬 Ecobank partners with Nium to unlock real-time cross-border payments across 35 African markets. This partnership is set to revolutionise the region's payments landscape by enabling faster, more efficient international payments for businesses and consumers alike.

🇺🇸 PNC doubles down on branch expansion plan with additional $500 mln investment. The bank’s total investment on the expansion is now about $1.5 billion and is aiming to open more than 200 new branch locations in 12 cities across the U.S. over the next five years.

🇺🇸 HSBC’s Michael Roberts says the first round of job losses are due in weeks. Roberts told Bloomberg Television that the job losses will be concentrated at the senior level. He said the restructuring, announced last month by new group CEO Georges Elhedery, will be done in a “thoughtful way.”

🇺🇸 CFPB orders Navy Federal Credit Union to pay more than $95 Million for illegal surprise overdraft fees. The CFPB is ordering Navy Federal to refund over $80M to consumers, stop charging illegal overdraft fees, and pay a $15M civil penalty to the CFPB’s victims relief fund—the largest amount it has ever obtained from a credit union for illegal activity.

BLOCKCHAIN/CRYPTO NEWS

🇩🇪 Lunu Pay and Ingenico bring crypto payments to physical retail stores. The collaboration is a key step in making digital currencies more accessible for consumers and enabling merchants to embrace the crypto market confidently, without technical barriers.

🇺🇸 FTX star witness Caroline Ellison begins 2-year prison sentence. Ellison, whose testimony helped convict FTX founder Sam Bankman-Fried for fraud last year, arrived at a Connecticut low-security federal prison on Nov. 7, CNBC reported, citing a Bureau of Prisons spokesperson.

🇺🇸 Trump’s election win wakes up sleepy decentralized-finance cryptocurrencies. Donald Trump won the election. So did crypto. And based on the performance of token prices on Wednesday, some of the biggest winners in digital assets are in a corner of the market that has gone quiet for a while: decentralized finance.

🇺🇸 Coinbase brings Bitcoin to Solana, spurring high hopes for DeFi surge. The exchange has introduced cbBTC, which lets traders swap in and out of the bitcoin-backed token by sending it between the exchange and their Solana wallets. Read on

🪙 Binance launches a new privacy center, featuring easy data download for enhanced user privacy. The privacy program is designed to give users greater control over their personal data, empowering them to manage their information transparently and securely.

DONEDEAL FUNDING NEWS

🇬🇧 LendingMetrics, the credit risk technology group, has secured a significant investment from LDC, which will help the business to accelerate new product development within its core financial services sector and expand its network of partners in its consultancy and data services division.

💰 Visa backs four new African FinTech start-ups as part of $1bn continental commitment. Investment recipients include Nigeria’s AI-powered address verification platform OkHi, Kenya’s HR and payroll platform Workpay, Ghana’s business lending and payments app Oze, and restaurant software vendor Orda.Africa, which operates between Nigeria and Kenya.

🇬🇧 Kaizen receives £42M growth investment from Guidepost Growth Equity. The company plans to use the funds to accelerate product development, invest in go-to-market initiatives, expand in North America, and enhance its compliance technology.

🇩🇪 FinTech Tomorrow raises over €4M. The funding will be directed towards customer acquisition and develpoing its software, including expanding its range of banking products. The startup is known for collaborating with customers to offer cutsomised account fees.

🇮🇹 Satispay raises €60M, reaching Unicorn status after previous €90M and €320M rounds. According to Corriere, the new capital injection comes again from the three funds involved in the last major funding round: Addition, Greyhound Capital, and Lightrock. More info here

MOVERS & SHAKERS

🇳🇱 Netherlands-based Intersolve names Five Degrees co-founder Martijn Hohmann as provisional CEO. Hohmann takes the reins of the payment processor from managing director André Moen. Intersolve said in a Linkedin post that Hohmann will focus on “product innovation and other business development”.

🇳🇱 FINOM appoints Thunes founder Peter De Caluwe and Former Visa Europe Director Frank Stockx to its Supervisory Board. De Caluwe's appointment highlights FINOM's focus on growth and operational excellence, while Stockx's expertise in regulatory and market complexities will bolster FINOM's governance.

🇬🇧 British Business Bank has appointed Leandros Kalisperas as its first Chief Investment Officer. Kalisperas will be tasked with the Bank’s investment business, including overseeing its two subsidiaries, British Business Investments and British Patient Capital.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()