Bitpanda Secures VARA Approval to Enter UAE Market

Hey FinTech Fanatic!

Bitpanda, Europe's leading crypto platform, has received in-principle approval from the Virtual Assets Regulatory Authority (VARA) in Dubai, marking its first expansion beyond Europe. The approval, secured in under 8 months from submission, will enable the company to operate as Bitpanda Broker MENA DMCC in the UAE.

This expansion follows strategic moves in the region, including establishing a Dubai office at the DMCC Crypto Centre and forming partnerships with The National Bank of Ras Al Khaimah ("RAKBANK") and CoinMENA, one of the UAE's leading licensed crypto platforms.

Eric Demuth, Co-Founder and CEO of Bitpanda, outlines their strategy: "In Europe, we have built a reputation as the most trusted and regulated digital asset platform. Now, we are scaling this proven model globally, with Dubai and the UAE serving as our strategic launchpad for international expansion."

I've compiled more updates from the global FinTech industry for your perusal below 👇

Cheers,

#FINTECHREPORT

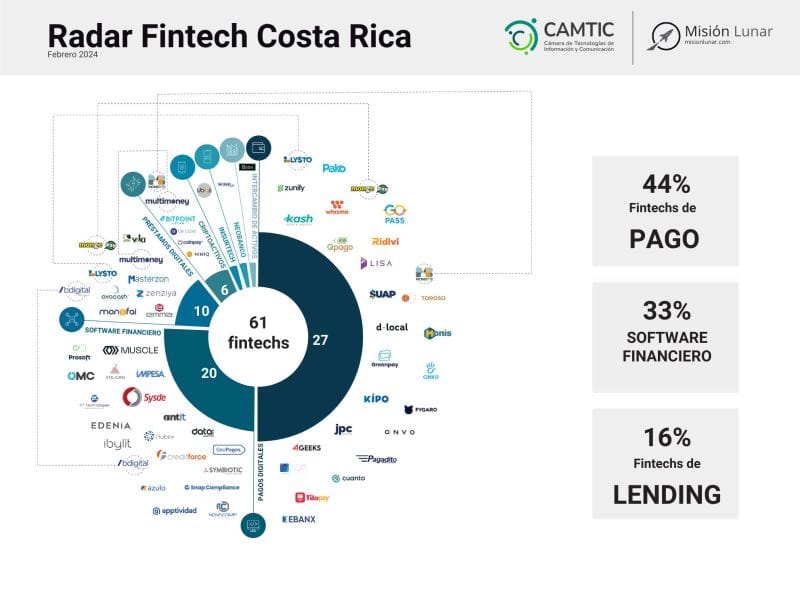

Any company missing in this overview? 👇

INSIGHTS

🇬🇧 Revolut investors sell nearly $1 billion in stock. The secondary share sale, initially for current employees, was extended to include early backers and former staff. Institutional investors, including Abu Dhabi’s Mubadala, participated, marking a first-time stake. CEO Nik Storonsky earned $200-$300 million.

FINTECH NEWS

🇦🇺 Airwallex APAC revenue soars 83%. Lucy Liu, President and co-founder of Australian-founded payments unicorn Airwallex, tells Forbes Australia global revenue grew by 73 per cent year-over-year, and transaction volume increased 60 per cent. Read More

🇸🇪 Klarna CEO Sebastian Siemiatkowski credits AI for reducing the workforce. The firm continues advertising open positions, showing it hasn’t fully transitioned to AI-only operations. Siemiatkowski used an AI deepfake to demonstrate AI's potential to replace executives. Read on

PAYMENTS NEWS

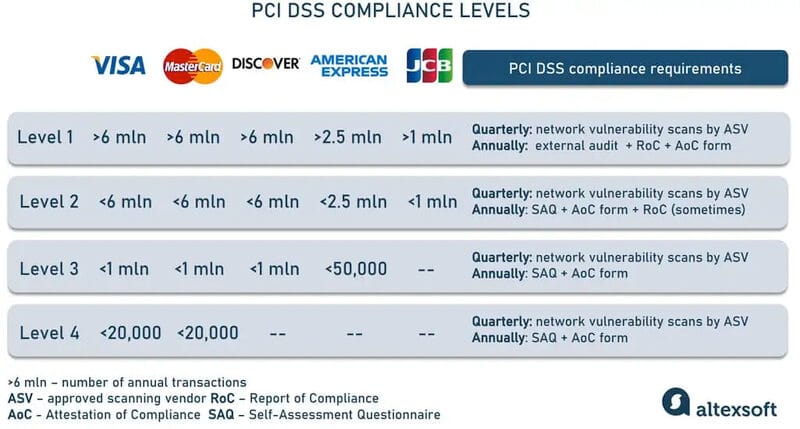

⬆️ How do you comply to 𝗣𝗖𝗜 𝗗𝗦𝗦 𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲 requirements? It largely depends on the number of transactions your business processes during the year.

By this parameter, all merchants are divided into 𝗙𝗼𝘂𝗿 𝗟𝗲𝘃𝗲𝗹𝘀 👇

🇯🇵 JCB now supports transactions on ETA apps for UK travelers. Starting on January 8, 2025, tourists from select countries will need an ETA to enter the UK. The move aligns with new UK border regulations and aims to enhance accessibility for JCB cardholders worldwide.

🇨🇦 Neo Financial launches cashback credit cards. The decision to launch comes during a period of high cost of living, with individuals actively seeking methods to maximise the value of their spending, with Neo Financial’s credit card suite being developed to meet these demands.

OPEN BANKING NEWS

🇬🇧 Modulr secures contract to provide CoP services to HMRC. The agreement will enhance payment validation and security for HMRC's transactions with individuals and businesses. Modulr's CEO emphasized the importance of modern payment technology in improving public sector services.

REGTECH NEWS

🇬🇧 UK crypto regulation: recent government updates offer clarity and reassurance for the market. The new government seems to have adopted the view that leaning into emerging and disruptive technologies is essential to maintaining the UK’s position as a leading financial services hub.

🇦🇺 HSBC sued over scam failures by Australian regulator. ASIC is claiming the bank lacked adequate controls to prevent or detect unauthorised transactions and failed to investigate and respond to reports within required timeframes. Continue reading

🇺🇸 SEC Charges Cantor Fitzgerald for securities law violations. The charges involve antifraud and proxy provisions of securities laws. The firm, led by CEO Howard Lutnick, who was nominated by Trump for the Commerce Department, settled by paying a $6.75 million penalty without admitting or denying the charges.

📈 Experian reports surge in GenAI fraud. The report based on insights from over 1,000 businesses and 4,000 consumers, examines the evolving fraud landscape and digital experience, and on the consumer side, balancing fraud protection with a positive experience is crucial to retaining customers.

DIGITAL BANKING NEWS

🇬🇧 Trust Bank launches a gamified Savings Pots tool, which allows customers to create personalized savings pots for specific goals, such as emergencies or travel. Users can make instant withdrawals without penalties, and digital mascots visually track savings progress. The feature aims to enhance convenience and user engagement.

🇮🇪 Revolut is preparing a new product blitz in 2025. The company announced that it had three million adult users of its app in Ireland, is planning to debut a suite of credit cards and a refreshed range of personal loans. “In the coming year, we’re going to focus very much on product,” said Malcolm Craig.

🇮🇹 Revolut, the neobank with more than 50 million customers worldwide, and almost 3 million in Italy, has announced the launch of Revolut Bank UAB's Italian branch and Italian IBANs. The company is now offering Italian IBANs to all new customers and will offer existing customers to migrate to an Italian IBAN from January 2025 onwards.

🇺🇿 TBC Uzbekistan launches new SME service. The service aims to streamline banking processes for SMEs, enabling them to conduct all banking activities online and eliminating the need for branch visits. The platform also provides round-the-clock payment services, one-click access and instant payments. Find out more

BLOCKCHAIN/CRYPTO NEWS

🇫🇷 SocGen and Banque de France complete blockchain repo transaction. This deal demonstrates Societe Generale's commitment to leveraging its financial structuring expertise and SG-FORGE's technological capabilities to contribute building innovative financial markets.

🇦🇪 Bitpanda expands to UAE, and secures VARA approval. This approval marks a significant step in Bitpanda's global expansion, positioning it as a key player in the digital assets space. The move follows the establishment of its Dubai office and strategic partnerships with other institutions.

🇰🇪 Juicyway has processed over $1B in cross-border payments. These transactions are powered by stablecoin technology at their core. According to its founders, the FinTech racked up these numbers with no publicly available app or marketing efforts. Read More

🇺🇸 Robinhood reports $38B in custody and $119B crypto trading volume. They take a detailed look back at the milestones they’ve achieved. From launching features to expanding into new markets, 2024 was all about helping more people “start their crypto journey and do more with crypto.” Find out more

🇸🇻 Bitget Licensed as BSP in El Salvador. The services include Bitcoin-to-fiat exchanges, facilitating Bitcoin payments, and providing secure custody solutions for crypto traders in compliance with local laws. Continue Reading

PARTNERSHIPS

🇸🇦 Mastercard collaborates with Jeel to drive payment modernization in Saudi Arabia. This collaboration will bring unprecedented benefits to a wide range of stakeholders. It empowers non-banking financial institutions to bring innovative products to the market swiftly and efficiently with greater ease and peace of mind.

🇵🇰 Mastercard partner with Bank of Punjab to transform digital ecosystem. The collaboration seeks to transform the bank’s digital ecosystem and its customers’ digital experience. Also, see the launch of Islamic credit cards to address the high demand for Islamic banking payment solutions in Pakistan.

🇮🇳 Worldline and Forthcode partner for In-Flight Payments in India. The collaboration aims to streamline ancillary revenue management for airlines by integrating in-flight retail, inventory, and payment systems on a single cloud platform. This solution supports cashless purchases, quick transactions, and automated reconciliation.

🇳🇱 Two and ABN AMRO partner on B2B e-Commerce payments. Together, the firms are launching a state-of-the-art “Pay on Invoice” solution, designed to bring seamless, secure, and flexible payment options to B2B e-commerce transactions. Businesses can now offer 30-day net terms, improving cash flow and financial flexibility.

🇦🇪 LuLu Financial Holdings partners with Circle. This collaboration, which was formalised at the Abu Dhabi Finance Week (ADFW), will leverage USDC, Circle’s fully-reserved digital dollar, to facilitate cross-border payments, reinforcing LuLuFin’s position as a leader in adopting digital innovations to transform financial services.

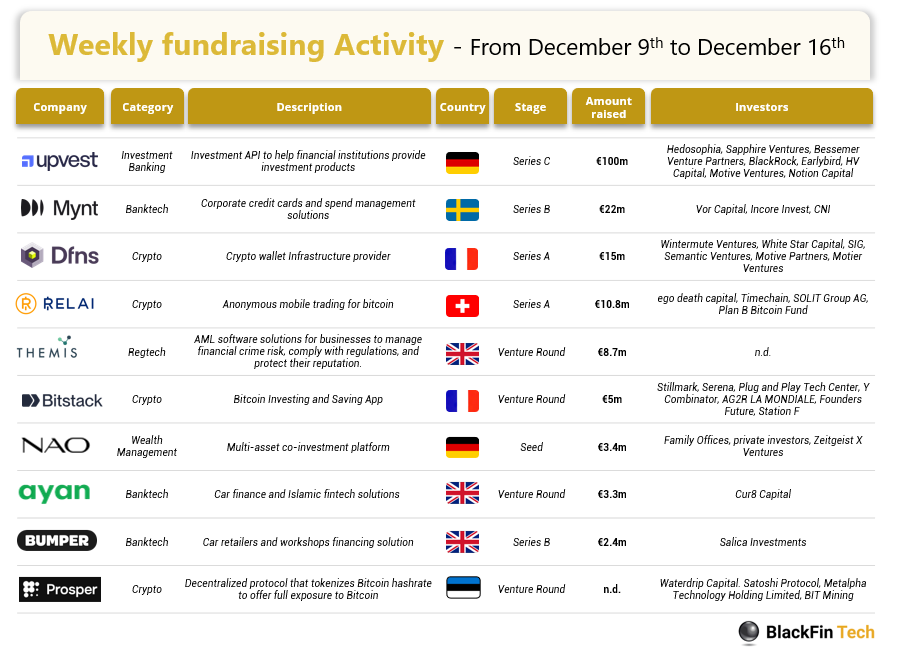

DONEDEAL FUNDING NEWS

💰 Last week, there were 10 official FinTech deals in Europe, raising a total of €170.6 million, with 3 deals in the UK, 2 in Germany, 2 in France, 1 in Switzerland, 1 in Estonia, and 1 in Sweden.

🇦🇪 Emirates NBD invests in Zodia Custody. This move aligns with the UAE's growing crypto-friendly stance and the increasing demand for secure digital asset solutions. By partnering with Zodia, Emirates NBD aims to strengthen its position in the digital asset market and offer innovative solutions to its clients.

🇧🇷 BS2 launches $16M CVC fund to back Brazilian startups. The fund will focus on FinTech, payments, and financial infrastructure to complement BS2’s core services. The initiative aims to enhance BS2’s products and services. Read more

🇧🇷 Numia raises $3.5M seed round. The platform uses AI to personalize and automate customer interactions, boosting efficiency and sales. Numia plans to use the funds to expand in markets like Mexico and Colombia and further develop its AI technology.

🇺🇸 Gigs raises $73M to help tech companies launch mobile services. The funds will support Gigs' global expansion and the development of new products for tech companies. Gigs aims to help tech brands innovate in telecom, provide more value to customers, and generate recurring revenue streams.

M&A

🇬🇧 Demica acquired by FIS for $300M. A decade after its sale to private investors, Demica now manages $40bn in assets and has grown steadily, with 40% annual growth since 2016. Key banking partners include HSBC, Lloyds, and Standard Chartered.

MOVERS & SHAKERS

🇺🇸 Broadridge names Ashima Ghei as CFO. Ghei has led Broadridge’s global Finance team as Interim CFO since July 1, 2024, and has been instrumental in driving the company’s financial strategy and execution forward in the first half of FY25. Read More

🇬🇧 finova strengthens senior leadership team following merger. The company, backed by Bain Capital, has appointed Paraag Davé as CEO and promoted Rowan Clayton to CPO following its merger with Iress' UK mortgage business. Now handling 20% of UK mortgages, finova processes £50B+ in originations annually.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()