Bitpanda Becomes First Major Crypto Firm to Secure MiCAR License in Europe

Hey FinTech Fanatic!

Bitpanda has secured a MiCAR (Markets in Crypto-Assets Regulation) license from Germany's Federal Supervisory Authority (BaFin), making it the first major crypto company to do so. The company grew from 1 million users in 2019 to 6 million by December 2024, and will now operate across all EU member states under a unified regulatory framework.

Eric Demuth, CEO and Co-Founder of Bitpanda, explained: "With the first MiCAR licence for a major crypto player, Bitpanda is setting a new standard for the crypto industry, paving the way for secure and regulated services across Europe. This milestone enables us to bring easy and safe investing to over 450 million people."

Lukas Enzersdorfer-Konrad, Deputy CEO at Bitpanda, stated: "This achievement is the result of a decade of commitment to compliance and regulation. With MiCAR, we are not just meeting the industry's highest standards, we are setting them. Our focus now is on using this license to accelerate adoption and growth across the European market."

Read more global FinTech industry updates below 👇 and I'll be back tomorrow!

Cheers,

Navigate Europe’s evolving FinTech landscape. Get the latest insights delivered weekly—subscribe today.

#FINTECHREPORT

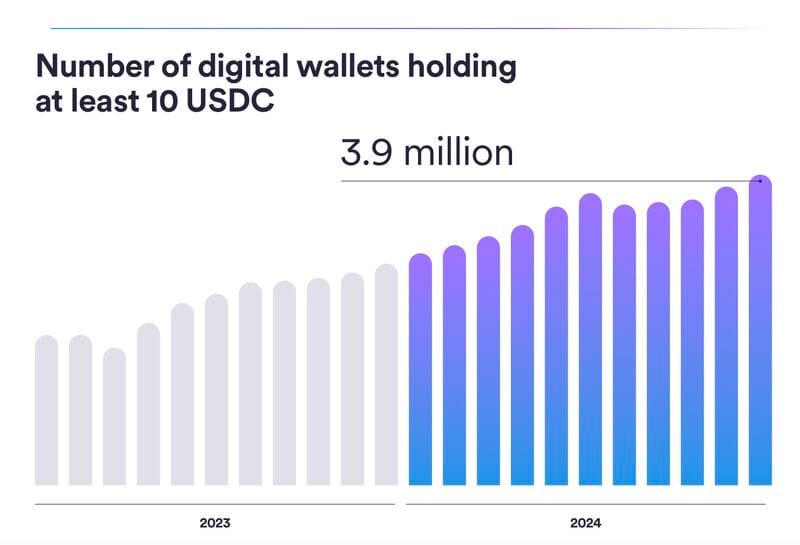

📊USDC stablecoin reaches $𝟭 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 monthly transactions🤯

Circle published its annual USDC stablecoin report providing some impressive figures. Read more

FINTECH NEWS

🇺🇸 'We keep an eye on Brex and Ramp': Amex CEO on FinTech rivals. Steve Squeri said his firm is keeping watch on the progress of rivals, such as small-business-focused FinTechs and potential competition that would result from Discover's acquisition of Capital One.

PAYMENTS NEWS

🇨🇱 MACHBANK and Pomelo: new credit card in Chile. ¨The partnership with Pomelo represents a significant step for MACHBANK, as it allows us to continue expanding the range of digital products that simplify and improve the financial experience for our users. We are confident that together, we will take innovation and financial inclusion to new levels¨, said CTO of MACHBANK.

🇨🇳 Alipay Tap! expands to Macao, now accepted at over 1,000 merchants. Macau Pass, as a partner in the Alipay Tap! rollout, supports the service’s integration into Macao’s digital payment landscape, contributing to greater convenience for merchants and tourists alike.

🇯🇵 Nuvei launches in Japan with the acquisition of Paywiser Japan Limited, including its acquiring license granted by the Japanese Ministry of Economy, Trade and Industry. The license enables Nuvei to progress with launching direct acquiring capabilities across all major card schemes, and to extend its direct connectivity with all relevant alternative payment methods (APMs) in the country.

🇻🇳 Visa and DealMe partner on cross-border installment payments. This move will bring cross-border card installment payment services to Vietnamese and other global users. It will enable Vietnamese travelers to use their Visa credit cards for installment payments at duty-free shops, department stores, and medical institutions in South Korea.

OPEN BANKING NEWS

🇩🇪 Recharge partnered with Tink and Adyen to introduce Pay by Bank payment method. This initiative enables a simple, and convenient way for consumers to transfer money directly from their bank accounts. This eliminates the need for credit cards or third-party services, offering users a faster and more secure checkout experience.

REGTECH NEWS

🇬🇧 Visa and Mastercard face multi-billion pound lawsuit. Harcus Parker is reaching the final stages of preparation for the commencement of a multi-billion pound class action lawsuit. They allege that businesses overpay interchange fees when customers pay them by commercial card - causing an estimated $4 billion in collective losses.

🇪🇺 Bitpanda secures MiCAR license. This milestone reinforces Bitpanda’s reputation as the most secure and compliant crypto platform and unlocks new growth opportunities. It can now expand its services across all EU member states under a unified regulatory framework.

🇺🇸 Lawyer group urges overhaul to ease US process for setting up new banks. U.S. regulators must simplify the authorization process for setting up new banks, a group of lawyers wrote in a letter to the incoming leadership of banking agencies, emphasizing the industry's need to adapt in the FinTech era.

DIGITAL BANKING NEWS

🇪🇺 Barclays delays EU office move to Paris until at least 2027. “Barclays continues to make preparations for a potential move of its EU headquarters from Dublin to Paris. We expect this work to conclude by the end of 2025 and that we will be able to provide a further update in early 2026,” the bank said in an emailed statement.

🇸🇪 UBS axes hundreds of Swiss jobs as integration gathers pace. The current round impacts both higher management levels and lower ranks. Employees can enter a program that allows up to a year to find a new role within the bank. Continue reading

🇩🇪 Santander's Openbank strengthens its presence in Germany. Openbank customers will be able to receive their salaries, set up direct debits for bills, and arrange their capital gains exemption orders, among other actions. With this measure, the bank will offer more products to its customers and can simplify their daily banking experience.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 Bitget Wallet aims to bridge real-world payments and onchain finance. Bitget is bringing PayFi to the forefront of personal finance, transforming crypto from a passive asset into a powerful financial tool for everyday use. PayFi integrates earning, sending, and spending into an ecosystem that maximizes the utility of every dollar, ensuring that every transaction contributes to financial growth.

🇺🇸 Musk reportedly weighs blockchain to track federal spending. The newly created Department of Government Efficiency (DOGE), led by Musk, aims to update federal software and technology to enhance efficiency and productivity within the federal government. The group is expected to present its recommendations for cuts by July 4, 2026.

🇺🇸 Trump boosts Tether, Circle by tying stablecoins to dollar. He signed an executive order to protect the dollar, “including through actions to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide,” and, barred any further work on a central bank digital currency, blocking an instrument seen as a potential competitor to stablecoins.

PARTNERSHIPS

🇰🇪 KCB and Mastercard unveil Kenya’s first platinum multi- currency card. It offers a cost-effective method for managing international transactions by reducing high transaction fees and enhancing convenience for frequent travelers and global spenders. Continue reading

🇨🇳 Shanghai Commercial Bank and Planto partner to drive SME Banking Innovation. Through this partnership, both have developed a comprehensive suite of e-banking solutions, including a streamlined online account opening process and an Internet banking platform designed to deliver seamless, customer-centric banking experiences.

🇺🇸 Prime Trigen Wealth announces partnership with Eton Solutions. This collaboration will redefine wealth management for Ultra-High-Net-Worth (UHNW) and High-Net-Worth (HNW) families across the country. Also, Prime will leverage Eton’s AtlasFive® ERP platform and EtonGPT™ AI engine to introduce an integrated Administrative Family Office (AFO™) solution.

🇪🇸 Tokeny announces partnership with ONYZE. The collaboration aims to assist the adoption of institutional tokenization via ONYZE by leveraging the Tokeny platform. ONYZE provides enterprise-level infrastructure for trading digital assets such as crypto, tokenized assets, NFTs, and digital currencies.

🇪🇬 Mastercard, Banque Misr and Money Fellows collaborate to launch prepaid card. This prepaid card will enable Money Fellows to offer financial planning, savings, and credit access to its users in Egypt. It offers an array of features that include online and in-store purchases, easy deposits and withdrawals at ATMs, spending tracking, and exclusive offers and discounts.

🌎 BVNK partners with First Digital, in a move to bolster the adoption of the USD-backed stablecoin within the crypto ecosystem. Through the new partnership, BVNK and First Digital aim to capitalise on the rising demand for fast, reliable, and cost-effective digital payment solutions and drive FDUSD adoption.

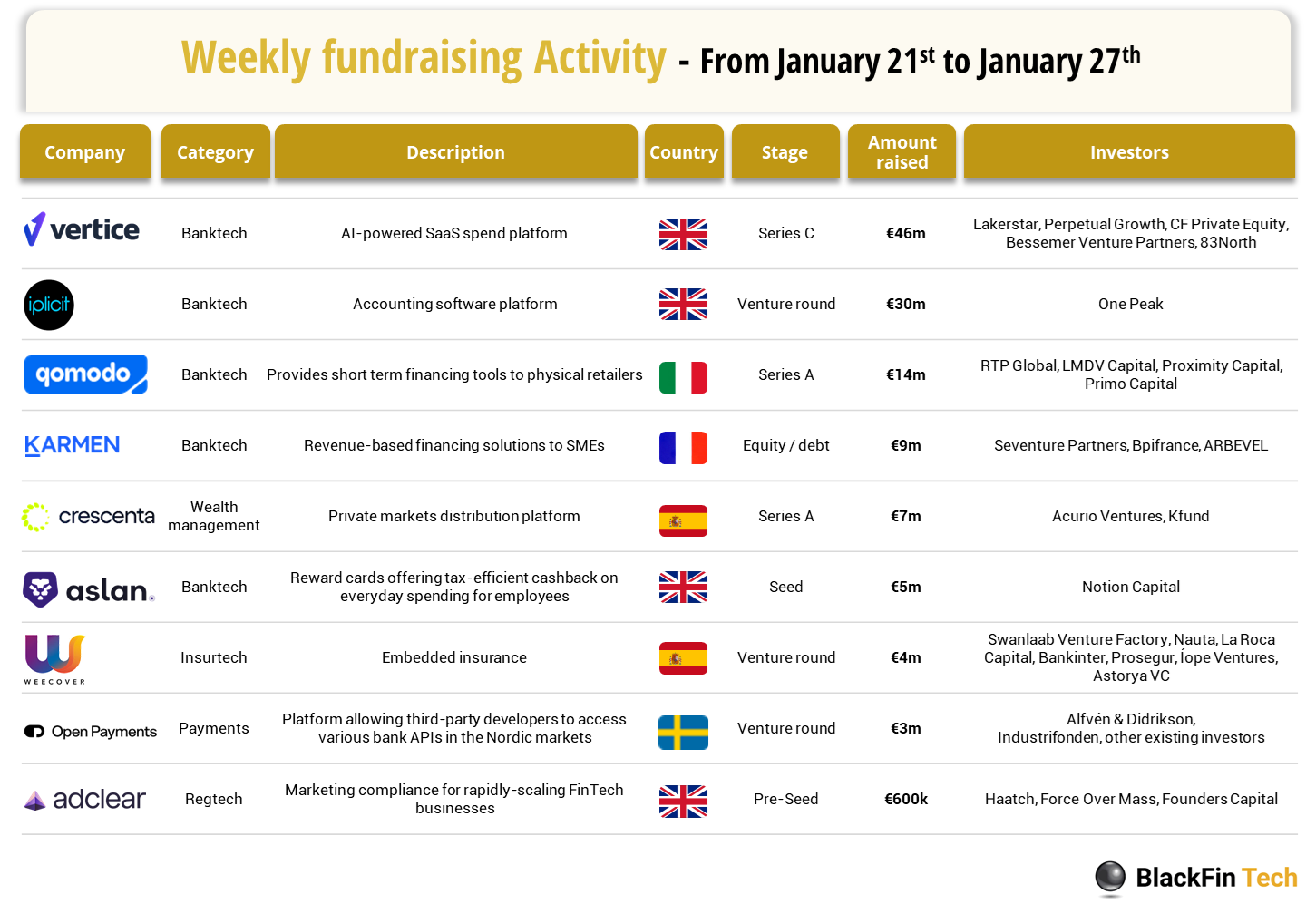

DONEDEAL FUNDING NEWS

💰 Over the last week, there were 9 FinTech deals in Europe, raising a total of €118 million, with 4 deals in the UK, 2 deals in Spain, and 1 deal each in France, Italy and Sweden.

🇮🇱 BitStock raises $400k seed funding. The newly raised funding will be used for marketing, sales, research and development, and operational activities. BitStock specializes in cryptocurrency investment through its proprietary Ten Best Coins (TBC) index.

🇮🇳 JUSPAY is set to become the first unicorn 🦄 of 2025. The company is in the process of raising $𝟭𝟱𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻. It has been instrumental in defining India's digital payment ecosystem. The National Payments Corporation of India (NPCI) called in Juspay's expertise to build its Unified Payments Interface (UPI) app, BHIM.

🇬🇧 129Knots launches with $10M investment led by Sing Fuels, over $500M deal pipeline, and asset origination to distribution (OTD) technology. The OTD technology will reinvent deep-tier industries by delivering and deploying scalable liquidity solutions through secure chain technologies. This will elevate supply chains into high-value assets that meet investment-grade standards.

🇬🇧 FinTech iplicit secures €29.7 million to scale its accounting software platform. This new investment marks iplicit’s first external institutional funding round and will be used to accelerate iplicit’s product development and fuel its growth. Read more

🇪🇬 Egypt’s Fincart secures pres-Seed round led by Plus VC. The funds will help improve Fincart. io’s technology platform, grow its courier network, and support the fast-growing e-commerce market in Africa and the Middle East. Fincart.io is tackling major shipping challenges in a market with huge growth potential.

🇺🇸 Foyer unlocks $6.2M to help people save up to buy homes. Users can create target savings goals and access personalized guidance on the best ways to save for a home, information about mortgage rates, and choosing a real estate firm. The company has a subscription model, offering memberships to users looking for more support.

🇬🇧 Wyzr wins £400,000 from NatWest's Dragons Den. The platform helps SMEs better understand their finances and provides calculations in seconds, saving time and preventing cash flow issues. The fundraising followed a pitch opportunity at NatWest’s FinTech Demo Day to a room of potential angel investors.

M&A

🇺🇸 Abrigo acquires Integrated Financial Solutions. The integration of IFS and IFSLeaseWorks will see Abrigo add equipment and vehicular financing capabilities to its existing loan origination offering, while also expanding its suite of automation and asset management tools.

🇺🇸 Priority Technology buys payroll platform Rollfi. With the backing of Priority, Rollfi partners can now tap into financial infrastructure, including money movement rails that power over $1tn in commerce, connections with over 20 Tier 1 and regional processing banks, and nationwide money transmitter licences.

🇿🇦 Stitch expands to in-person payments with ExiPay. This acquisition enhances Stitch's enterprise payments offering by integrating both online and in-person payments into a single, unified platform. With this Stitch can support multi-lane retail and omnichannel commerce businesses.

MOVERS AND SHAKERS

🇺🇸 Nymbus appoints Ed Gross as CPO to lead product and innovation. Gross has a proven track record of leading product management and innovation strategies for the financial services industry and has been the thought leader and evangelist behind Nymbus’ award-winning user experience.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()