Bitcoin Pulls Back Below $93K

Hey FinTech Fanatic!

Bitcoin is taking a breather from its remarkable post-election rally, sliding below $93,000 as we witness an interesting shift in market dynamics.

The largest cryptocurrency dipped as low as $91,433.54, marking a more than 2% decline, while the broader crypto market, measured by the CoinDesk 20 index, experienced a steeper 6% drop. This pullback is also affecting major crypto-related stocks, with both Coinbase and MicroStrategy down approximately 3%.

A fascinating development is emerging in the spot market, where long-term holders (those holding Bitcoin for 155+ days) are increasingly booking profits from recent gains.

While Bitcoin ETFs have been playing a crucial role in absorbing this selling pressure, they've finally broken their five-day positive streak with significant outflows of $438 million on Monday.

The current market movement comes against the backdrop of growing institutional interest and President-elect Trump's pro-crypto policy platform.

Brett Reeves from crypto infrastructure firm BitGo shares an encouraging perspective: "Historically, when new all-time highs are reached there is typically a period of consolidation before further moves up. We know that new institutional money is coming into the space and retail activity is picking up, both via ETFs and exchanges. With positive macro and regulatory news ahead, we could see a quick pick up in price activity."

What role do you think the upcoming regulatory changes will play in Bitcoin's trajectory? Share your thoughts in the comments!

Now, let's not waste any more of your time and dive straight into today's FinTech news I listed for you below👇

Cheers,

#FINTECHREPORT

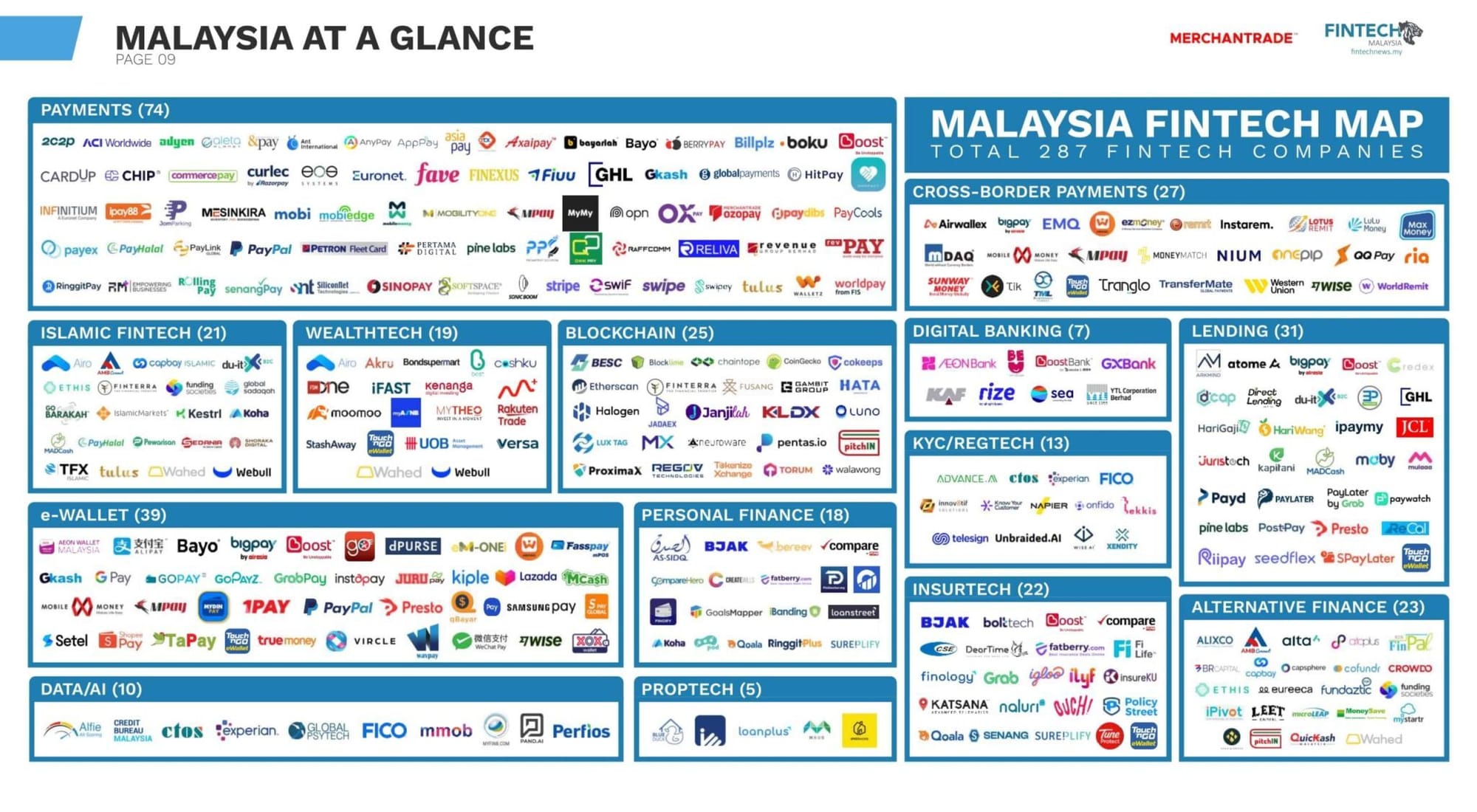

📊 FinTech News Malaysia's 2024 Malaysia FinTech Report is now live 👇

Which company is missing on this map?

FINTECH NEWS

🇬🇧 Cardlytics launches new Insights Portal, giving marketers flexible access to customer spending trends. The portal provides UK brands and marketers with 24/7 access to brand-level, market, and customer insights, including over two years of anonymized customer spending trends and geographic data.

🇨🇦 Manzil launches Halal wealth management solution following acquisition of Canadian Islamic Wealth. Manzil Wealth is being offered to financial advisors in Canada. According to Manzil CEO, the company has acquired all of Canadian Islamic Wealth’s 300 clients, as well as the team, which is moving to Manzil Wealth.

🇺🇸 MoneyLion announces successful completion of senior debt refinancing. This refinancing marks an important milestone in MoneyLion’s evolution, advancing its mission to empower consumers with innovative financial solutions, as stated by Dee Choubey, MoneyLion’s Co-Founder and CEO.

PAYMENTS NEWS

🇯🇵 Checkout.com expands in Japan to strengthen its global presence. To lead this expansion, Checkout.com has appointed Noriko Sasaki as Country Manager for Japan. Following the opening of a new Tokyo office, Checkout. com’s APAC team now exceeds 150 employees, providing localized support to regional brands.

🇪🇸 Checkout.com has officially announced the integration of Bizum as a payment method in Spain. This partnership aims to provide merchants with one of the most popular payment options in the country. Continue reading

🇮🇹 Revolut will expand its payment services in Italy by introducing its POS terminals, starting next week. Italy has been a key market for Revolut, with 2 million customers, personal loans, and advertising campaigns launched this year. The company has increased its investments in the region by 94%.

🇺🇸 Stripe Connect Embedded Components – UI Toolkit. To make it easier to visualize and design embedded experiences in your website, Stripe just shipped a new Figma UI toolkit for embedded components. It’s now publicly available on Figma community.

🇵🇱 Klarna opens new hub in Warsaw to recruit 100 of Poland’s top tech talents. This strategic investment highlights Klarna’s dedication to advancng its global technology capabilities while recognizing Poland as a key player in Europe’s innovation landscape.

🇰🇷 Biosmart granted Mastercard Letter of Approval for IDEX Pay biometric cards. This milestone enables the Korea-based company to begin industrialized production of biometric payment cards. Biosmart is a trusted partner of leading banks in Asia, Middle East, Europe and USA.

🇵🇭 Kyú Reion taps netbank for cross-border payments. Through the partnership, the companies aim to accelerate cross-border fund transfers and make them more accessible for individual users through a smartphone app. Read on

🇪🇹 Tranglo expands remittance services to seven African countries. The cross-border payment hub now facilitates payments in Ethiopia, Kenya, Liberia, Madagascar, Mali, Senegal, and Zambia, aiming to address high remittance fees by offering efficient and cost-effective solutions.

OPEN BANKING NEWS

🇮🇳 FinBox launches Industry’s first Account Aggregation based data platform. This unified platform will enable banks and NBFCs to access extensive customer data and real-time insights, enhancing lenders’ ability to assess customers’ financial health with greater precision and speed.

REGTECH NEWS

🇬🇧 FCA fines Macquarie Bank £13m for fictitious trades amid ‘serious failings.’ The FCA fined Macquarie Bank due to weaknesses in its systems that allowed trader Travis Klein to hide fictitious trades and trading losses for 20+ months. The bank failed to address known issues, enabling bypassing of internal controls.

🇨🇾 Sumsub partners with Elliptic to strengthen crypto fraud prevention and compliance tools. The integration of Elliptic's blockchain analytics into Sumsub’s system creates a unified platform for crypto wallet screening and risk assessment, aiming to combat rising blockchain-related crime and fraud in the crypto sector.

DIGITAL BANKING NEWS

🇧🇷 Consolidated profit of Inter, Nubank, PagBank, Stone and XP grows 46% . In the third quarter of 2024, the five leading publicly traded digital financial institutions in Brazil– Inter, Nubank, PagBank, Stone, and XP – reported an adjusted net profit of R$ 5.863 billion. Keep reading

🇬🇧 Monument Bank expands its savings proposition with market leading Easy Access Cash ISA. Offering a competitive rate of 4.76% this ISA provides a tax-efficient, flexible way to save, giving clients greater access to their funds without the usual constraints of traditional Cash ISAs.

🇮🇹 Banca Investis, in partnership with Bain & Company, has launched NIWA, a Gen AI-driven investment advisory app designed as a "digital junior banker" to transform the customer experience for high-net-worth individuals with hyper-personalised financial services.

🇬🇧 HSBC launches platform for managing domestic and international business payments. The new Smart Transact offers businesses a single platform to manage transactions, access a current account, domestic and cross-border payments, and the HSBCnet global banking platform, according to a press release.

🇬🇧 FE fundinfo launches Nexus platform. The platform will be powered by one ‘golden source of information’ that aims to offer reliable, high-quality investment data and integrated workflows that power the investment lifecycle. Read the full piece

BLOCKCHAIN/CRYPTO NEWS

🇨🇭 In Lugano, Switzerland (Population approx 65,000) there are hundreds of merchants accepting Bitcoin on Lightning Network right now. Including McDonald's. Read more

🇦🇪 Trust Wallet integrates Binance Connect to supercharge fiat-to-crypto transactions, expanding access for millions. This integration provides a seamless experience with direct access to peer-to-peer (P2P) services and robust fiat-to-crypto solutions, all within the efficient environment of Trust Wallet.

🇺🇸 Bitcoin slides toward $90,000 as ETFs end a positive streak. The price of Bitcoin retreated further from the psychologically significant $100,000 milestone, as investors took profits following its post-U.S. election gains. Continue reading

🇲🇦 Morocco preparing law to allow cryptocurrencies, central bank chief says. Cryptocurrencies have been banned in Morocco since 2017, yet the public continues to use them underground. The central bank, Bank Al Maghrib, is currently in the process of adopting a draft law to regulate crypto assets.

PARTNERSHIPS

🇳🇱 Mollie and PayPal join forces on marketplace payments. Mollie’s partnership with PayPal enhances its payment solution for marketplaces, offering seamless flows, better shopping experiences, and business growth. Mollie is one of few financial service providers authorised to offer PayPal to marketplaces.

🇨🇿 Aevi and LEGI.ONE partner to make advanced payments accessible to SMEs. This partnership makes advanced payment tools accessible to SMEs, allowing them to gain access to reliable, professional-grade technology originally developed for major market players.

🇧🇭 Arab Financial Services (AFS) partners with PayTic to optimise card programme management. Through this partnership, the two companies intend to simplify the end-to-end daily operations of users, scaling productivity, decreasing risks, and increasing value.

DONEDEAL FUNDING NEWS

🇬🇧 OpenTrade raises $4M to build future of real world asset-backed lending. The company states it intends to use the funds to scale operations, enhance product capabilities, and develop additional offerings including yield products backed by new asset types.

🇺🇸 Cardless swipes up $30 million to build a new generation of co-branded credit cards. The round, led by Activant Capital and supported by Amex Ventures and others, will drive efforts to optimize loyalty commerce for brands. Find out more

🇮🇳 Insight Partners-backed India FinTech Yubi plans new fundraising. Indian FinTech platform Yubi is looking to raise up to $200 million early next year to finance its global expansion, as the company embarks on a new funding round after narrowing its losses.

MOVERS & SHAKERS

🇬🇧 Monzo appoints two CFOs including one with IPO-experience. The UK challenger bank has appointed Tom Oldham, ex-Nubank executive, as Group CFO and Barclays veteran Mark Newbery as UK CFO. Monzo, now with over 11 million customers, also revealed plans to expand in the US and Europe.

🇬🇧 IFX Payments appoints Adam Dowling as Chief Operating Officer. In his new position, Adam will help drive operational efficiency, manage risk and optimise performance across day-to-day operations and strategic growth initiatives. Learn more

🇬🇧 Premialab announced the appointment of Diane Lansard as Head of Marketing. Based in London, she will be responsible to execute and scale Premialab's marketing initiatives, providing data and analytics solutions to asset managers, pension funds, insurance companies and sovereign wealth funds globally.

🇺🇸 US Bank names payment services CFO Kristy Carstensen to lead Global Treasury Management. In her new role, Carstensen will also oversee the bank’s prepaid card organization, U.S. Bank said in a Monday press release. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()