Binance Founder Sentenced to Four Months In Prison, and Goldman Retreats from Consumer Lending, Barclays to Take Over GM Cards

Hey FinTech Fanatic!

Goldman Sachs is reportedly negotiating the transfer of its General Motors credit-card program to Barclays.

This move signifies a significant development in Goldman's strategy to scale back its consumer lending operations. Barclays appears to be the frontrunner to assume the program, which boasts approximately $2 billion in outstanding balances.

Sources suggest that an agreement with GM might be finalized by the upcoming summer.

Initially, other contenders such as U.S. Bancorp and Bread Financial were considered for this acquisition but have since withdrawn from the running.

Goldman Sachs disclosed to its employees last November its intentions to sever its partnership in issuing GM credit cards, as previously reported by The Wall Street Journal.

The issuance of GM credit cards began in 2022, but Goldman has faced challenges in expanding its customer base. There has been notable frustration among Goldman's executives regarding the lack of promotional efforts for the card by GM dealerships.

This potential deal marks a critical juncture in Goldman's withdrawal from mainstream consumer lending—an initiative that has seen approximately $6 billion in losses since early 2020. This includes various consumer lending products under Goldman’s Platform Solutions unit.

As of the end of March, Goldman had around $19 billion in credit-card balances, with a substantial portion stemming from its partnership with Apple—a collaboration that is also being phased out.

Moreover, Goldman recently offloaded GreenSky, a specialty lending business, at a significant loss, to a consortium of investors.

The firm has also disposed of nearly all its personal loans, further indicating its strategic shift away from direct consumer financial services.

Read more interesting industry news below, and I'll be back in your inbox tomorrow!

Cheers,

BREAKING NEWS

🚨 Binance founder and former CEO Changpeng Zhao was sentenced to 4 months in prison for failing to establish adequately anti-money laundering protections. Judge Richard Jones says that Zhao prioritized “Binance’s growth and profits over compliance with US laws and regulations.”

#FINTECHREPORT

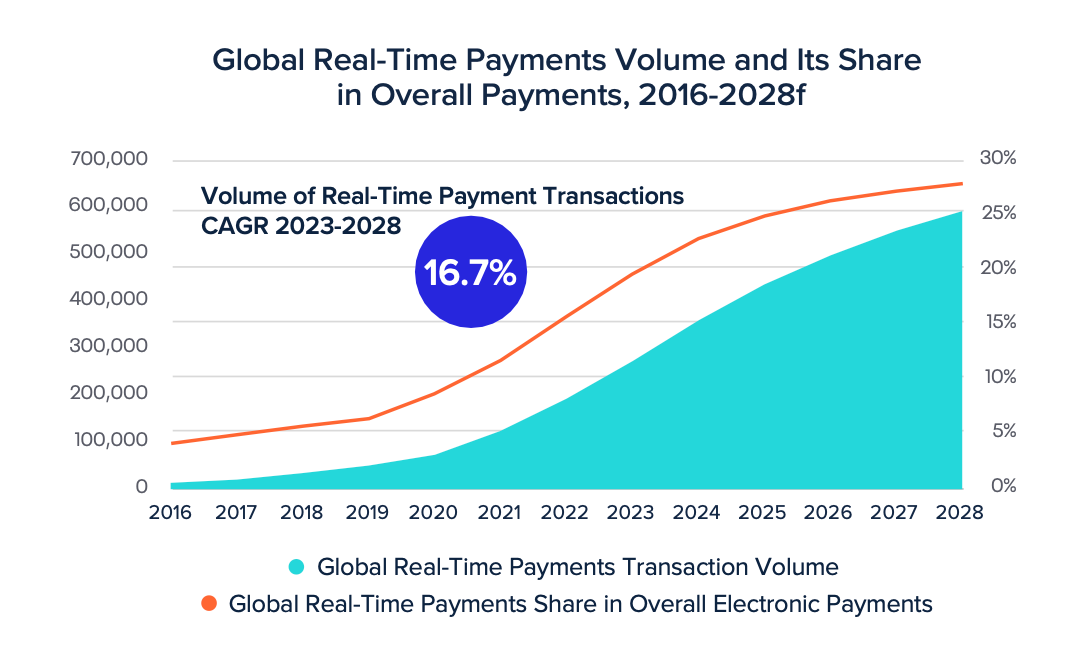

📊 Prime Time for Real-Time Global Payments Report.

📈 A growing number of business and thought leaders in financial services are extolling the transformative opportunities tokenization offers the industry. Read all about it in this interesting Deloitte’s report.

INSIGHTS

🇺🇸 PayPal presents Q1 2024 results. The company reported a 9% increase in revenue to $7.7 billion for Q1 2024, with a corresponding increase in GAAP and non-GAAP earnings per share (EPS). Find all the info here

FINTECH NEWS

🇦🇪 Airwallex signals strategic growth, looking to expand in the Middle East, as it sees the region as critical to building a fully global business. Airwallex recently established an entity in the Mainland and made its first on-the-ground hire based in Abu Dhabi to spearhead initial local engagement.

🇨🇴 Grupo Éxito announced the launch of Kiire, a platform that will help transform businesses, not only with the acceptance of electronic payment methods like cards and digital wallets, but also with tools for business management, access to Puntos Colombia as a customer loyalty program, and credits to boost entrepreneurship.

🇦🇪 Reem Finance partners with Visa to expand its offerings by providing innovative, secure digital payment solutions to its customers including contactless enabled Visa cards and digital wallets. The move is set to solidify Reem Finance’s commitment to exceeding customer satisfaction and offering innovative payment solutions.

🇬🇧 Plend, a UK-based consumer lender, has partnered with Monevo, an innovative credit eligibility and distribution platform, empowering over 150 credit providers and banks to host, manage and distribute pre-qualified credit offers. Read on

🇬🇧 The spend management FinTech, Soldo, and TRIVER, cash flow financing provider have partnered in a bid to tackle the cashflow challenge many UK SMEs are facing. With TRIVER, Soldo’s SMEs customers will be able to access financing equivalent to up to 20% of their annual turnover.

PAYMENTS NEWS

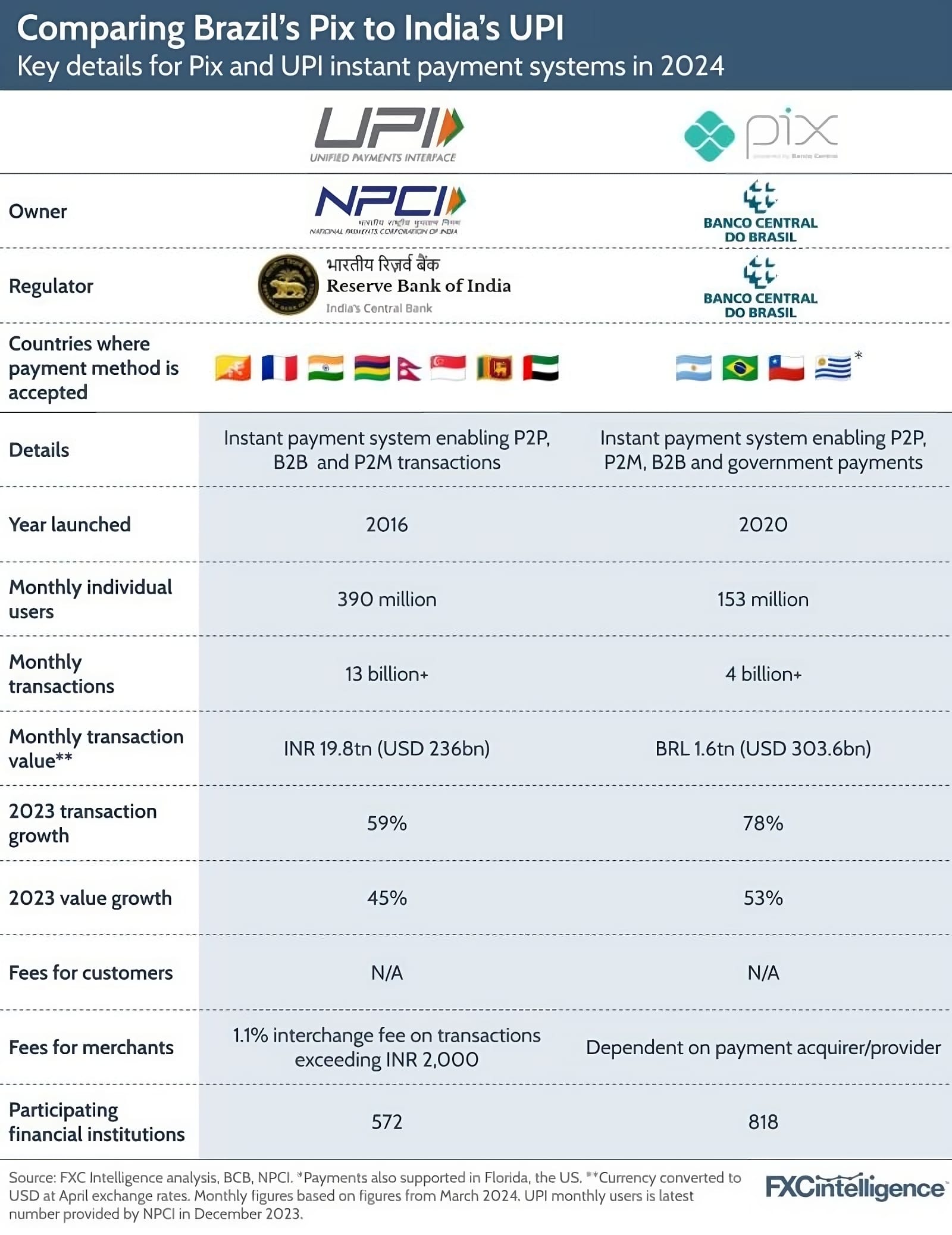

🇧🇷 Brazil’s Pix 🆚 India’s UPI 🇮🇳

🇮🇹 Viva.com partners with Satispay, growing the alternative payment options for European businesses. Viva.com merchants in Italy, France and Luxembourg, can now accept payments via Satispay to provide a secure and seamless payment experience to customers.

🇳🇱 Phos and Silverflow combine on SoftPOS. Silverflow’s advanced processing capabilities seamlessly complement Phos’ front-end components, including the payment app, terminal management system, and merchant portal, empowering businesses to offer a robust and user-friendly experience.

🇨🇴 FinTechs Yuno and Kushki partner to optimize digital payment ecosystem and enhance shopping experience in Latin America. Combining the value propositions will enable the creation of solutions that facilitate the management of digital funds for businesses and an enhanced user experience.

🇦🇪 Abu Dhabi Islamic Bank (ADIB), in partnership with Visa, has announced “Visa Installments Solution” is officially live for ADIB covered cardholders in the UAE. NEOPAY, the payment subsidiary of Mashreq, becomes the first acquirer to enable VIS at local merchants in the UAE.

🇦🇺 Bonza customers who used real-time payments network risk missing out on refunds. Travellers who use the real-time PayTo service will hope the troubled airline Bonza can manage refunds because, unlike with credit or debit cards, they can't fall back on a bank. More here

OPEN BANKING NEWS

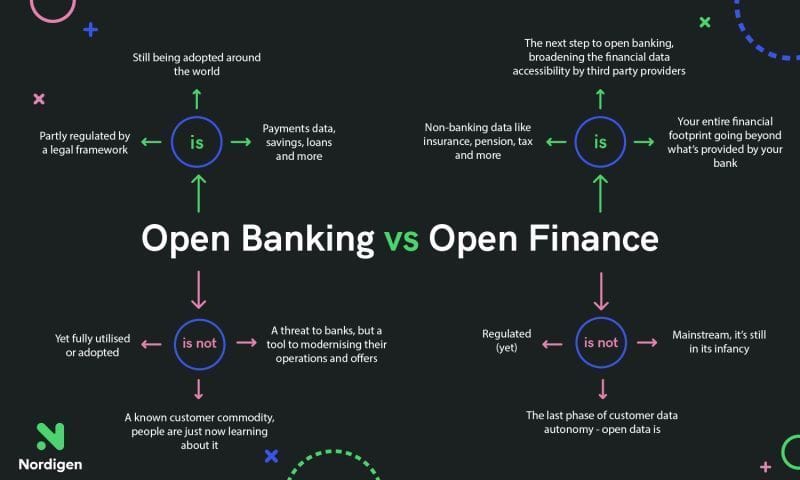

🇫🇮 Neonomics joins with Qvik on open banking roll out to the Nordics and UK. As the demand for diversified payments continues to rise, the partnership is already fielding requests and anticipates launching services with multiple customers in the coming weeks.

DIGITAL BANKING NEWS

🇬🇧 Monese founder to buy consumer arm in break-up. Sky News has learnt that Norris Koppel, the founder and chief executive of Monese, is to take control of its consumer arm as a standalone entity. Continue reading

🇬🇧 Neobanking app Cashaa, which provides banking services for cryptocurrency businesses, said on Monday it is shutting down its business banking division, and will no longer allow users to open new US Dollar or Euro IBAN business banking accounts.

🇮🇳 Paytm Payments Bank's wallet business fading fast as restrictions bite. The Regulatory action on the Bank halted its mobile wallet business, a popular offering. Unable to add new customers as per RBI's directive, transactions plummeted in the last 3 months as users shift away from Paytm's wallet ecosystem.

🇱🇻 AS LPB Bank officially changed its legal name to AS Magnetiq Bank, while also introducing a new brand visual identity. The renaming and rebranding of the bank are based on an acquisition deal concluded at the end of 2023, in which Latvia's leading investment bank, Signet Bank AS, became the sole shareholder and parent company of AS LPB Bank.

🇬🇷 Piraeus Bank and Natech prepare to launch neobank Snappi in Greece. Its launch and subsequent provision is to be centred on Natech’s banking technology, which the vendor’s website describes as a “catalyst for digital transformation”. More on that here

🇬🇧 Allianz Partners and Revolut have settled a lawsuit over an abandoned travel insurance deal that saw the companies trade blows in recent months, Insurance Post can reveal. In an order dated 23 April, the court dismissed both Allianz’s claim and Revolut’s counterclaim, noting that the parties had “agreed confidential settlement terms”.

BLOCKCHAIN/CRYPTO NEWS

🇫🇷 Convicted CZ owns 100% of Binance France. Now all of EU access is under threat. Binance's legal issues in France could hinder its EU access under new crypto laws. It faces legal hurdles in Europe that threaten the exchange giant’s access to the EU market.

🇭🇰 The six ETFs that commenced trading in Hong Kong on Tuesday fell far short of expectations, with a combined trading volume of just $11 million, a fraction of the expected $100 million. Bitcoin ETFs accounted for $8.5 million of the tally, while ether ETFs contributed the rest.

🇺🇸 Stripe, a financial infrastructure platform for businesses with a fiat-to-crypto onramp, now supports the Avalanche C-Chain. Retail users can purchase AVAX directly through Stripe, “removing the need to go through an exchange.” Access the full article here

DONEDEAL FUNDING NEWS

🇩🇰 Danish FinTech Ageras raises €82m for acquisitions. The new funding will be used to make acquisitions as the company bids to widen its product suite and double its annual recurring revenue to €100 million ahead of a potential IPO.

🇬🇧 Gideon Valkin – formerly of Monzo, ClearScore and Entree Capital – has closed on a $12 million FinTech venture fund, Andrena Ventures, and made his first investment in Nustom, an AI startup founded by Monzo’s co-founding CTO Jonas Templestein. “Europe’s time has arrived,” says Valkin. Continue reading

Revolut graduates raise $6.5m for new crypto exchange X10, to fill the void left by FTX. The crypto exchange aims to position itself as a halfway house between centralised and decentralised systems. The funding round is its first as it emerges from stealth this week.

🇺🇸 Wallets-as-a-Service platform Ansa raises $14 million series A funding round. Funds will be used to broaden the depth of Ansa’s payment solutions, with a focus on product development and engineering, to empower merchants to better engage their customers.

🇳🇬 Pascal Ntsama and Oyedeji Oluwoye have raised $2.3M in a seed round for their Web3 Neo FinTech Bank designed to improve Africa's infrastructure. Canza Finance’s co-founders are leaning into Web3 to financially empower the African continent.

MOVERS & SHAKERS

🇬🇧 PPRO appoints Bronwyn Boyle as chief information security officer. In her role, Bronwyn will spearhead PPRO’s security strategy and oversee information, cyber and technology security across all product offerings and processes. Read more

🇸🇬 Xceptor, the intelligent automation platform for financial markets, announced the appointment of Keith Man as General Manager (GM) for Asia Pacific (APAC), based in Singapore. The appointment underscores Xceptor’s continued investment and further penetration into the APAC region.

🇬🇧 Revolut has 500 people applying for every job, despite its "ruthless" reputation. Revolut has some big hiring plans for 2024: it wants to add 3,500 people before December globally and to expand its headcount to 11,500. Click here to learn more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()