Beyond the Hype: What Adyen's Share Slump Tells Us About FinTech's Future

It's evident in the valuation tales of FinTech giants from Adyen to PayPal to Block. These enterprises, once flaunting a market cap that overshadowed many European banks, witnessed a value erosion of over 70% since August 2021.

In their 2021 seminal work, "The Pay Off,How Changing the Way We Pay Changes Everything" two veteran SWIFT executives lauded the art of bridging gaps in the digital payment sector. By being the link that funnels money between points A and B for retailers, payment processors can scrape off a margin of 1% to 3%. This, they commented, might be one of those times where simplicity equates to genius.

Yet, there’s a twist in the tale. The initial simplicity of these financial ventures gradually wore the cloak of sophisticated allure, leading to arguably inflated valuations.

It's evident in the valuation tales of FinTech giants from Adyen to PayPal to Block. These enterprises, once flaunting a market cap that overshadowed many European banks, witnessed a value erosion of over 70% since August 2021.

This shift was largely due to the new normal - waning e-commerce dynamism post-pandemic coupled with inflationary strains burdening traders.

Adyen, notably endorsed in Cathie Wood’s ARK Innovation basket, suffered a staggering blow with its shares plummeting 50% within a mere week. This resulted in a staggering $25 billion erosion from its market cap.

It’s crucial, however, to differentiate between market valuation and intrinsic worth.

These FinTech frontrunners are by no means inept; they've ushered in remarkable technological advancements enhancing options and streamlining digital transactions.

Yet, the market perhaps became too ambitious with its revenue forecasts and evaluations, given that this industry thrives primarily on transaction volume.

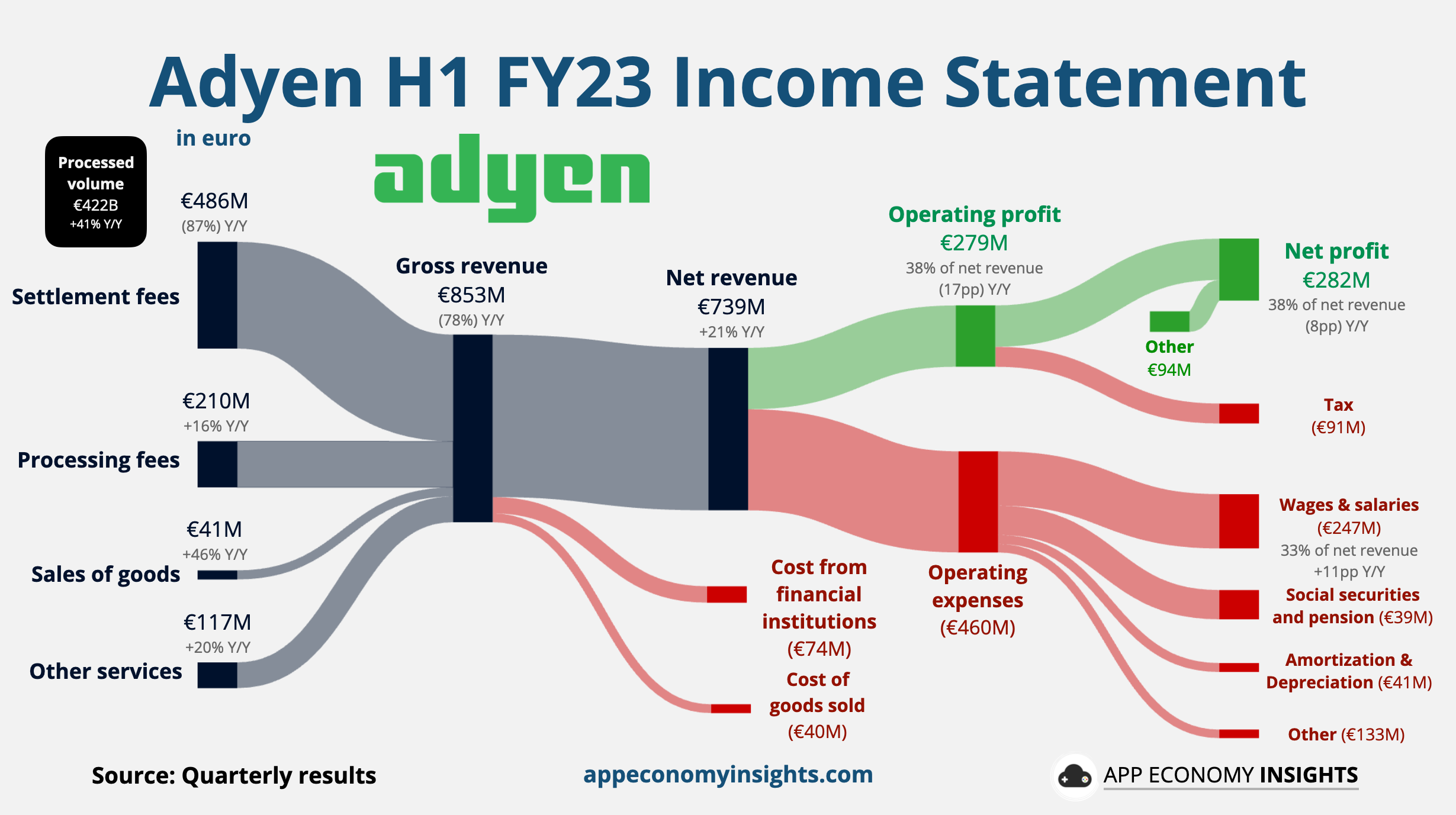

Taking a closer look at Adyen's recent financials provides some clarity. The firm did register growth, but the disparity is hard to ignore.

Adyen’s recent results clearly show growth is still there, but the mismatch between an increase in the value of total payments processed of “only” 23% in the first half of 2023 (down from around 40% a year earlier) and a valuation worthy of Amazon.com Inc. was enough to send investors to the exits.

A significant factor behind Adyen's dwindling share price was unmet earnings projections.

Market saturation and fierce pricing battles were undeniable catalysts. However, Adyen's own handling of communication regarding its operational expenses and EBITDA margins exacerbated the situation.

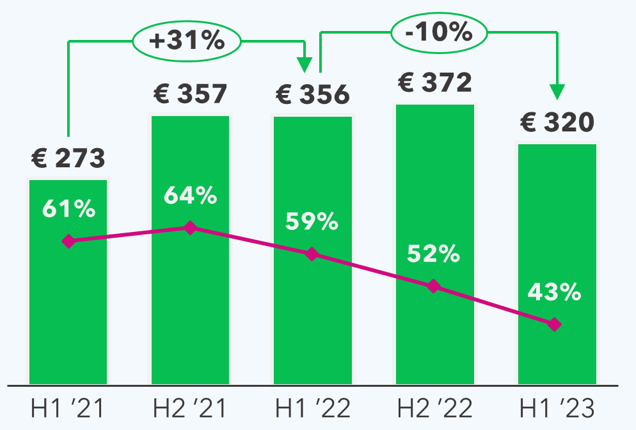

The numbers say it all: a 110% surge in OPEX from H2 2021 to 1H 2023 vs. a net revenue ascent of 33%.

A stark contrast was also observed in EBITDA margins, which tumbled from 64% to 43% in the latest half-year window from the peak on 24 August 2021.

The Adyen episode offers a quintessential lesson for contemporary FinTechs listed on public exchanges: The prowess of effective investor communication is indispensable.

Current equity markets have little tolerance for shocks or deviations. The golden era where FinTechs effortlessly outstripped market anticipations has waned.

Main sources use for the article: Bloomberg and FlagShip Advisory Partners.

Comments ()