Bench Collapses Under $65M Debt, Heads into Bankruptcy

Hey FinTech Fanatic!

Accounting startup Bench has filed for bankruptcy in Canada, revealing over $65 million in debt and just $2.8 million in cash left. Founded in 2012, Bench raised $113 million from backers like Shopify and Bain Capital Ventures but couldn't stay afloat.

Most of the debt—a staggering $50 million—is owed to the National Bank of Canada, largely unsecured. Reports suggest NBC's refusal to offer leniency led to Bench’s sudden shutdown.

Bench also owes millions to VC firms: $1.3M to Bain Capital Ventures, $1.2M to Inovia Capital, $750K to Contour Venture Partners, and $777K to Altos Ventures. On top of that, there's $1.8 million in unpaid severance for laid-off employees and $4 million in unpaid office rent.

The company is now being acquired by San Francisco-based Employer.com, which is reportedly pushing Bench customers to transfer their data or risk losing it. Employer.com assures they have the resources to invest in Bench’s future.

Stay tuned for more on this story. In FinTech, staying ahead is everything!

Cheers,

Join the FinTech Running Club in your city to connect with top FinTech leaders and have fun! Check out the exciting events happening in the coming weeks!

FEATURED NEWS

🇺🇸 eToro files for US IPO and chases $5 bn valuation. The company's Chief Executive and founder said that a US listing would give the company access to a broader range of investors than a presence on the UK market. It could list in New York as soon as the second quarter of this year.

#FINTECHREPORT

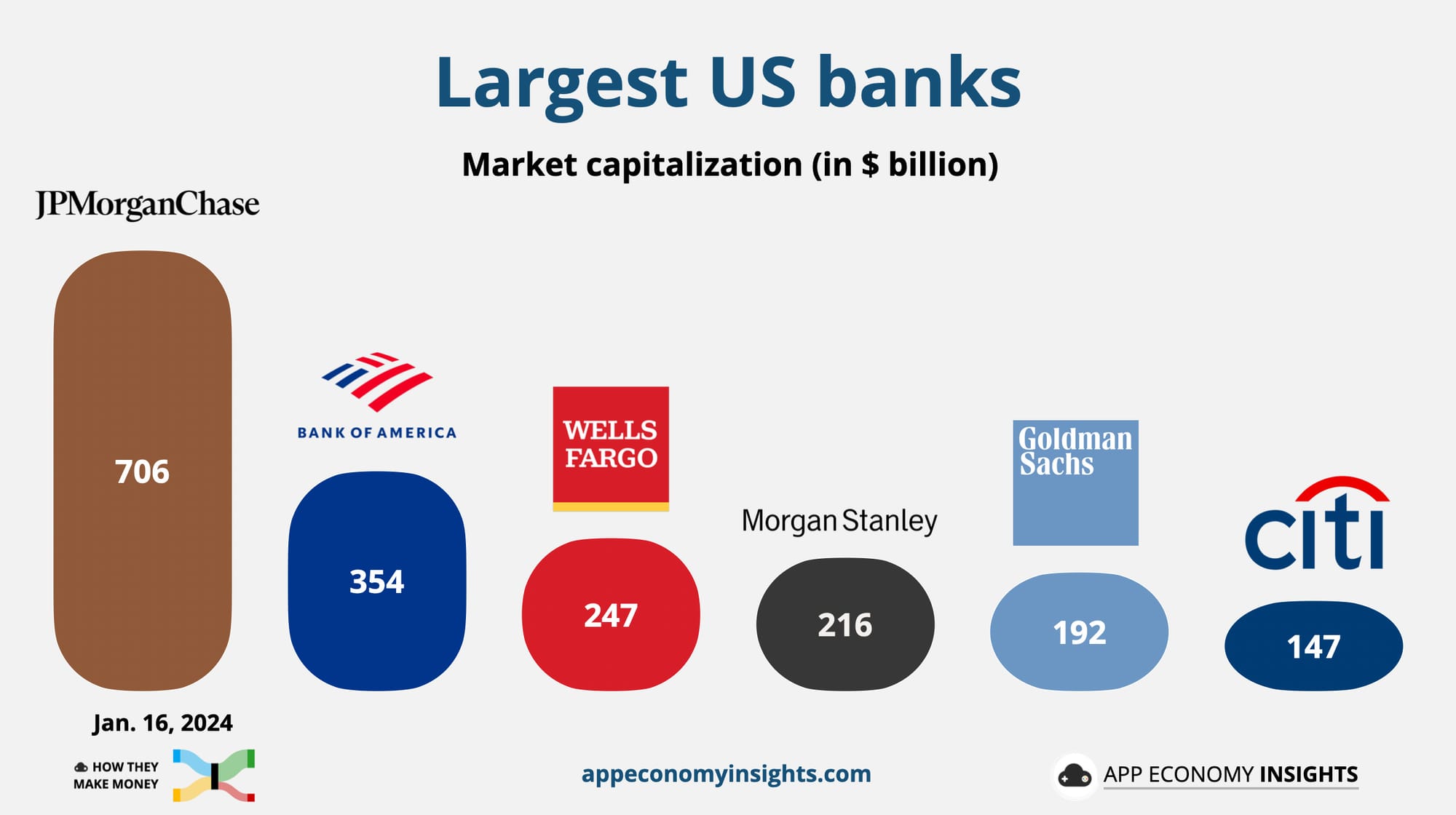

📊 The Largest US 🇺🇸 Banks 👇

Big banks just posted their strongest quarter in years.

FINTECH NEWS

🇨🇦 Bench racked up over $65 million in debt. Most of Bench’s debt ($50 million) is owed to the National Bank of Canada. More than 85% of that debt is unsecured, meaning the bank has little collateral to claim against the loan now that Bench has defaulted.

🇺🇸 Capital One outage drags into second day, leaving some customers without deposit access. The bank said the technical issue was the result of a glitch with a third-party vendor, Fidelity Information Services (FIS). They released a statement saying that a local power outage had affected a data center that was critical to various applications.

PAYMENTS NEWS

🇲🇽 Belvo and J.P. Morgan Payments to boost recurring payments in Mexico. This strategic collaboration aims to provide businesses with an automated and efficient solution for managing recurring payments through direct debit, a core payment method among companies looking to streamline their financial processes.

🇺🇸 American Express to pay $230 million to settle US charges. Amex said it will pay to settle U.S. criminal and civil probes into alleged deceptive practices in selling credit card and wire transfer products to small business customers. It also reached a separate agreement in principle with the Federal Reserve that should become final in the coming weeks.

🇬🇧 PSR sets out updated strategy to deliver competition, innovation, and growth. These commitments set out an impactful programme of delivery as the regulator seeks to achieve world-leading payment systems where competition and innovation deliver secure, accessible, and value-for-money services that meet the needs of people and businesses.

🇺🇸 Columbia Insurance Group modernizes ayments with One Inc. By integrating PremiumPay, CIG will have the tools to power personalized branding, manage multi-channel communication preferences and deliver proactive messaging at the most critical times.

🇨🇳 PhotonPay launches Google Pay Support for Mastercard users in Hong Kong. This enables cardholders to take advantage of simple and secure contactless payments and digital card storage on both Android devices and WearOS. It also includes industry-standard tokenization.

🌍 Synchrony customers have access to Pay Later Feature of Apple Pay. Eligible holders can choose to pay with the standard terms of their credit card or use a promotional offer that includes fixed monthly payments. Read the full piece

🇬🇧 Paysend celebrates 10M consumer customers milestone. This achievement underscores Paysend’s remarkable growth and solidifies its position in the cross-border payments market. It has evolved into the world’s largest digital payment network, embodying its mission of delivering the simplest money transfer solutions globally.

🇸🇦 Google Pay set to launch in Saudi Arabia in 2025. It will offer users a secure and seamless way to make purchases in stores, on apps, and online, and also allow users to conveniently add and manage their cards through Google Wallet, ensuring enhanced convenience and safety.

OPEN BANKING NEWS

🇬🇧 AperiData and PayPoint scale transformative open banking powered debt advice platform. The companies have been able to introduce innovative new features and enhancements tailored to streamline processes further, such as the new pre-populated Standard Financial Statement (SFS).

REGTECH NEWS

🇺🇸 US consumer bureau fines Equifax $15 million. The bureau said Equifax ignored consumer documents and evidence submitted alongside disputes, allowed previously flagged inaccuracies to return to credit reports, and relied on flawed software code, leading to inaccurate credit scores.

DIGITAL BANKING NEWS

🇬🇧 Revolut launches in-app calling feature to tackle impersonation fraud. The new feature targets impersonation scams in which criminals pretend to be a representative of a bank to gain access to sensitive details about their victim’s account, compromising their savings.

🇨🇳 HSBC launches market-first cross-currency netting in China. This solution reduces the hundreds of intra-group multi-currency transactions that Philips entities in mainland China make each month into a single RMB cross-border transaction, streamlining processes, lowering costs, and unlocking working capital.

🇲🇾 Malaysia grants licences to two new digital banks. The first licence has been granted to KAF Digital Berhad, an operating entity developed through an Islamic digital bank consortium. The second licence has been handed to YTL Digital Bank Berhad, formed through a joint venture between YTL Digital Capital Sdn Bhd and Sea Limited.

🇸🇪 Knowit collaborates with Backbase to enhance digital banking services. The partnership means that Knowit can deliver superior banking experiences that maintain highest standards of compliance and security. This enables the rapid implementation of digital banking solutions that meet local market requirements and regulations.

🇺🇸 Gate City Bank selects Lama AI to transform business lending. By implementing Lama AI's full suite of business banking capabilities, Gate City Bank will leverage cutting-edge technology to elevate business lending operations, delivering a seamless borrower experience and unlocking growth potential for business customers.

BLOCKCHAIN/CRYPTO NEWS

🇩🇪 Boerse Stuttgart receives first crypto license. Boerse received a Europe-wide license as part of the firm’s efforts to become a regulated infrastructure provider for banks, brokers and asset managers. The company was granted the license on Jan. 17 by Germany’s Federal Financial Supervisory Authority, known as BaFin.

🇪🇺 Ozuma debuts crypto neobank in Europe with Striga, an EU-licensed financial infrastructure provider that offers a range of services. The platform allows users to deposit, withdraw, and exchange Euros and cryptocurrencies, providing a way to bridge the traditional financial system with the emerging digital economy.

🇺🇸 Coinbase to offer Bitcoin-Backed loans through Morpho. "This is a moment where we're planting a flag that Coinbase is coming on-chain, and we're bringing millions of users with their billions of dollars," said Max Branzburg, head of Consumer Products at Coinbase.

PARTNERSHIPS

🇦🇷 Bamboo and Tiendamia partner to optimize payment solutions. This collaboration is set to address key challenges faced by Tiendamia in Argentina, allowing the company to offer more competitive pricing and a seamless shopping experience to its customers.

🇯🇴 Mastercard Move partners with Cairo Amman Bank. The bank will leverage Mastercard Move’s money movement capabilities to transform international money transfers for its customers in Jordan. The collaboration will advance financial inclusion and contribute to an even more accessible digital economy.

DONEDEAL FUNDING NEWS

🌍 Bitget launchX to support Jambo’s $5m fundraising for first crypto space program. Jambo aims to raise $5m through a token sale on Bitget LaunchX to fund its ambitious satellite launch program, an initiative designed to connect a global network of JamboPhones and expand access to decentralized services.

🇺🇸 SoFi and PGIM Fixed Income announce $52M securitization agreement. The transaction follows a $350 million investment from PGIM in May 2024. It builds on the $3.9 billion in personal loan collateral SoFi sold or securitized to-date through the end of Q3 2024, illustrating the value of the company’s leading personal loan business.

🇺🇸 Phantom Technologies Inc. startup gets $3B valuation in Sequoia and Paradigm Deal. The CEO and co-founder of Phantom, said the wallet’s rise in popularity shows that there’s a “broader trend” in which more people are buying crypto directly with their digital wallets instead of using other centralized platforms.”

M&A

🇺🇸 iCapital to acquire US investor firm Parallel Markets. The acquisition will see Parallel Markets’ KYC technology integrated with iCapital’s onboarding and compliance monitoring systems, culminating in the alternative investment FinTech’s latest offering: the iCapital Investor Passport.

🇺🇸 Digital money transfer firm Paymints.io acquired by CertifID. With the addition of digital payments via its acquisition of Paymints.io, CertifID extends the protection it provides customers in combatting cybercrime and delivering safe closing experiences for clients.

🇵🇭 KKR hires Goldman for selling stake in Philippine FinTech Maya. New York-headquartered KKR owns more than 20% of Maya and the potential sale, if it goes through, could value Maya at more than $2 billion, sources with knowledge of the matter said.

MOVERS AND SHAKERS

🇺🇸 Goldman hands $80M retention awards to Solomon and Waldron. The company handed its top two executives retention awards valued at $80 million each and introduced a new program to give its leaders a slice of carried interest earned on private equity funds as it tries to compete on pay with top alternative asset managers.

🇨🇦 TD speeds up CEO Handoff and cuts pay for more than 40 executives. Toronto-Dominion Bank is moving up the start date for its new Chief Executive Officer, Raymond Chun, by two months and slashed executives’ pay in the wake of its historic and costly money-laundering scandal.

🇺🇸 InterPayments appoints Roger Hochschild to its board of directors. This strategic appointment underscores InterPayments’ mission to empower merchants to manage their cost of acceptance directly and through partnerships with US banks, payment processors, and software platforms.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()