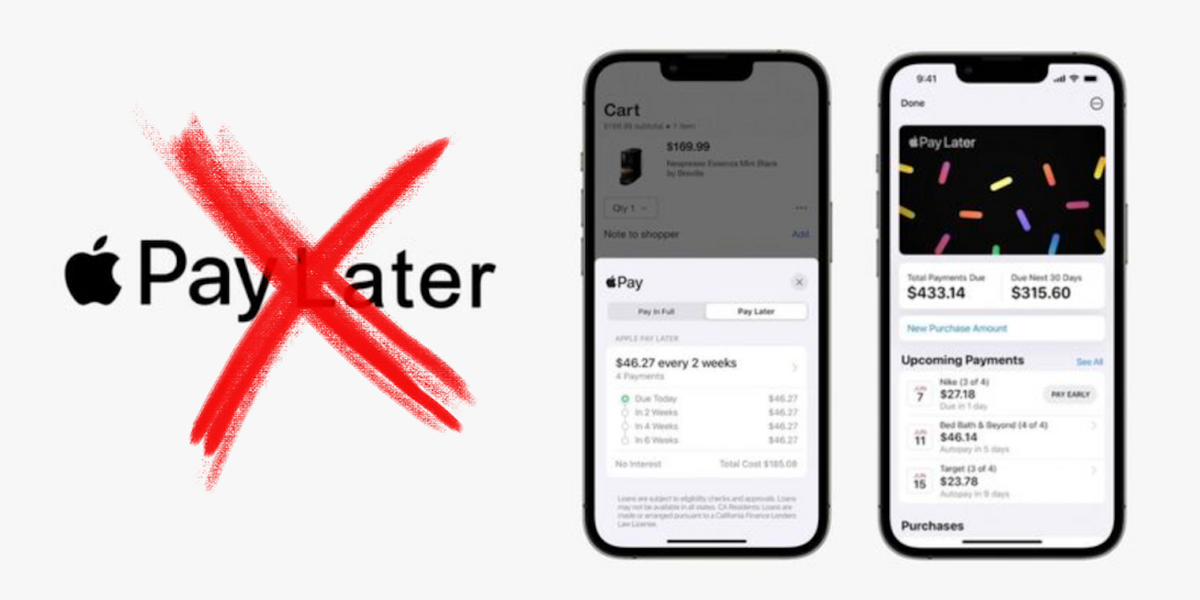

Apple Shuts Down Pay Later Feature

Hey FinTech Fanatic!

Apple has announced the discontinuation of its "buy now, pay later" service, Apple Pay Later, which launched in the United States last year. Effective immediately, the service will no longer be available for new loans. However, current users can still manage their existing Apple Pay Later loans through the Wallet app.

In place of Apple Pay Later, Apple is introducing new global features to Apple Pay. These upcoming features, launching later this year, will allow users to access installment loan options from eligible credit or debit cards, as well as through Affirm.

Apple released a statement to 9to5Mac explaining the changes:

"Starting later this year, users across the globe will be able to access installment loans offered through credit and debit cards, as well as lenders, when checking out with Apple Pay. With the introduction of this new global installment loan offering, we will no longer offer Apple Pay Later in the U.S. Our focus continues to be on providing our users with access to easy, secure and private payment options with Apple Pay, and this solution will enable us to bring flexible payments to more users, in more places across the globe, in collaboration with Apple Pay enabled banks and lenders."

Apple reassures that users with active Apple Pay Later loans can continue to manage and pay their loans through the Wallet app.

Apple Pay Later was first announced at WWDC 2022 and launched in the U.S. in March 2023 in preview, expanding to all users in October. The service allowed users to apply for loans ranging from $50 to $1,000, which could be split into four equal payments over six weeks, with no fees or interest.

Apple emphasizes that the new installment loan features coming to Apple Pay will be available in multiple countries. Apple Pay Later, in contrast, was only available in the U.S.

The ability to access installments from credit and debit cards will begin rolling out in Australia with ANZ, Spain with CaixaBank, the U.K. with HSBC and Monzo, and the U.S. with Citi, Synchrony, and issuers via Fiserv.

Additionally, users in the U.S. will be able to apply for loans directly through Affirm when using Apple Pay.

Pay Later’s life was extraordinarily short, having officially launched in late March 2023.

Ultimately, however, the move isn’t surprising, after last week’s announcement ar WWDC 2024 that users would be able to access loans through third-party app Affirm through Apple Pay.

Have a great day and I'll be back in your inbox with more news tomorrow!

Cheers,

SPONSORED CONTENT

POST OF THE DAY

📱 Real-Time Payments (RTP) accounted for 266.2 billion transactions globally in 2023, a year-over-year growth of 42.2%.

Brazil🇧🇷 (PIX) and India🇮🇳 (UPI) leading the pack:

#FINTECHREPORT

📊 The Ultimate Guide to Building an Open Finance Tech Stack. The report delves into the evolving landscape of Open Finance in Asia, highlighting its critical role in reshaping the financial services sector through digital transformation. Find out more here

INSIGHTS

🇬🇧 How Lanistar boss’s crypto coin blitz left investors out of pocket. While the FinTech firm was recruiting high-profile politicians, its owner was developing and promoting crypto products that crashed after launch. Explore the full article

FINTECH NEWS

🇪🇪 Estonian FinTech Depowise expands to Ireland and the UK. The company has ambitious plans to achieve a volume of assets on the platform worth €8trn. This mission will be helped by its expansion into Ireland, the UK and Luxembourg, where it holds a 5% share of a €16.5 trillion domiciled funds market.

🇺🇸 The Fed hits Evolve bank with order over FinTech troubles. As part of the enforcement action, the bank will have to strengthen its compliance with existing partners. The Board’s enforcement action against Evolve is independent of the bankruptcy proceedings regarding Synapse, according to the statement.

🇬🇧 UK FinTech job vacancies surge as investors flock back to London. FinTech tops UK financial services job openings in 2024, per a Morgan McKinley and Vacancysoft report. It forecasts that if the current pace of recruitment continues, the number of FinTech vacancies will be 37% higher in 2024 than 2023.

🇬🇧 UK’s FCA imposes restrictions on e-money firm AstroPay. The UK’s Financial Conduct Authority (FCA) has imposed a series of constraints against e-money firm Larstal Limited, which trades as AstroPay, with a specific emphasis on the protection of consumer funds.

PAYMENTS NEWS

🇺🇸 𝗔𝗽𝗽𝗹𝗲 𝗸𝗶𝗹𝗹𝘀 𝗣𝗮𝘆 𝗟𝗮𝘁𝗲𝗿 𝗳𝗲𝗮𝘁𝘂𝗿𝗲. Two years after it was announced at WWDC, Apple’s U.S.-only Pay Later feature is no more. Here is a statement in which the company explains why the service is being discontinued in the U.S. and how installment loans will now be offered globally through Apple Pay in collaboration with banks and lenders.

The company has also announced that Apple Pay support at checkout will soon be available across all desktop web browsers on all platforms, including Windows. During the recent WWDC event, Apple introduced a new strategy to extend Apple Pay support beyond the Safari browser and the Mac OS ecosystem.

🇲🇽 MercadoLibre's FinTech arm sees credit-card reader boom in Mexico. Latin American e-commerce giant MercadoLibre's FinTech arm, Mercado Pago, has seen adoption of its slim mobile credit-card readers more than double in the past year, gaining on competing options from banks and Clip, an executive said.

🇺🇸 Elavon to provide BMO Bank with Payment Solutions Platform. The partnership allows for “the acceptance, enablement and optimization of credit, debit, and digital payment transactions.” Additionally, it aims to offer secure, scalable payment solutions for BMO’s U.S. SMBs, corporate enterprises, and capital markets clients.

DIGITAL BANKING NEWS

🇬🇧 Thought Machine has become Mastercard's first strategic end-to-end core banking partner, with the pair offering their combined capabilities to financial institutions looking to modernise their technology stacks. Read more

🇺🇸 Lumin and Pinwheel partner on digital deposit switching. The partnership offers unique benefits to financial institutions. Lumin has a strong reputation as an innovator in digital banking, helping financial institutions build strong digital relationships with their customers and members.

🇦🇺 MongoDB has collaborated with Bendigo and Adelaide Bank to modernise its core banking infrastructure, leveraging MongoDB Atlas as a pivotal component in their comprehensive application modernisation strategy. Read on

🇵🇭 To bring the Bank of the Philippine Island’s (BPI) products and services closer to more Filipinos, it recently partnered with the 24-hour self-service payments company, Pay&Go. According to Dan Ibarra, CEO of BTI Payments, operator of Pay&Go, Filipinos can now conveniently apply for BPI products directly at select Pay&Go kiosks nationwide.

🇮🇹 Nexi, a European PayTech, and Engineering Group will develop a business partnership in digital banking named NOVA, a technology platform designed for different business segments from SMEs to Large Corporate. This new solution will bring together the best of the expertise and proprietary solutions of the two leading companies in the industry.

🇱🇺 Neobanks Revolut and N26 benefit from ING’s Luxembourg retail exit. “Since late May, we’ve observed a roughly 30% increase in Revolut sign-ups in Luxembourg,” said a representative of Revolut. Continue reading

🇩🇪 BBVA plans to start digital bank in Germany to rival JPMorgan. The lender is currently preparing a feasibility study and is putting together a team that would be in charge of the new unit, people familiar with the matter said, asking not to be identified discussing private information.

BLOCKCHAIN/CRYPTO NEWS

🇳🇬 Nigerian authorities have dropped some of the charges against two Binance executives, including a compliance executive of the cryptocurrency exchange who has been detained in the country since February, and whose health is deteriorating, according to his family.

DONEDEAL FUNDING NEWS

🇬🇧 Prosper, the UK WealthTech founded by Tandem and Nutmeg alumni, has hit its £800,000 Crowdcube target before launching to the public. Prosper looks to emulate the likes of Wise in foreign currency exchange by undercutting the fees levied by wealth managers and offering high-interest bearing returns on balances.

🇺🇸 Finaloop secures $35 Million in series A investment led by Lightspeed Venture Partners. The funds will be used to further invest in its AI-driven e-commerce accounting software automation and inventory cost management, as well as to expand its go-to-market and partnership efforts with accounting firms and data-driven marketing agencies.

🇨🇴 Google announced a $200,000 investment in the Colombian FinTech company BioCredit through its Google for Startups Cloud Program. Google launched a comprehensive study and call for applications to identify the most suitable startup, and the selection of BioCredit highlights its potential.

M&A

🇩🇪 Shift4, the leader in integrated payments and commerce technology, has acquired a majority stake in Vectron Systems AG, one of the largest European suppliers of point-of-sale (POS) systems to the restaurant and hospitality verticals. The acquisition will give Shift4 a broad customer base in Europe and a network of around 300 POS resellers.

🇪🇸 Spain's Sabadell has postponed the completion of the sale of its retailers' payments business to Nexi, after becoming the target of a hostile takeover by BBVA. "The plans are expected to continue as soon as the outcome of the takeover bid is clarified," a source said.

MOVERS & SHAKERS

🇺🇸 Brex, a Salt Lake City-based FinTech company, is planning to open an office in downtown Seattle. Despite operating as a remote-first company, Brex sees the Seattle office as an opportunity to further its competitiveness. The new office will operate in a hybrid capacity, adding to the 60 employees in Seattle and over 200 across the Pacific Northwest.

🇺🇸 Momnt announces appointment of Chris Bracken as Chief Executive Officer. Bracken formerly served as Momnt’s Chief Revenue Officer and brings significant consumer lending experience and will help Momnt capitalize on recent disruptions in the moment-of-need lending industry.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()