barq Partners with Mastercard to Elevate Digital Payments in Saudi Arabia

Hey, FinTech Fanatic!

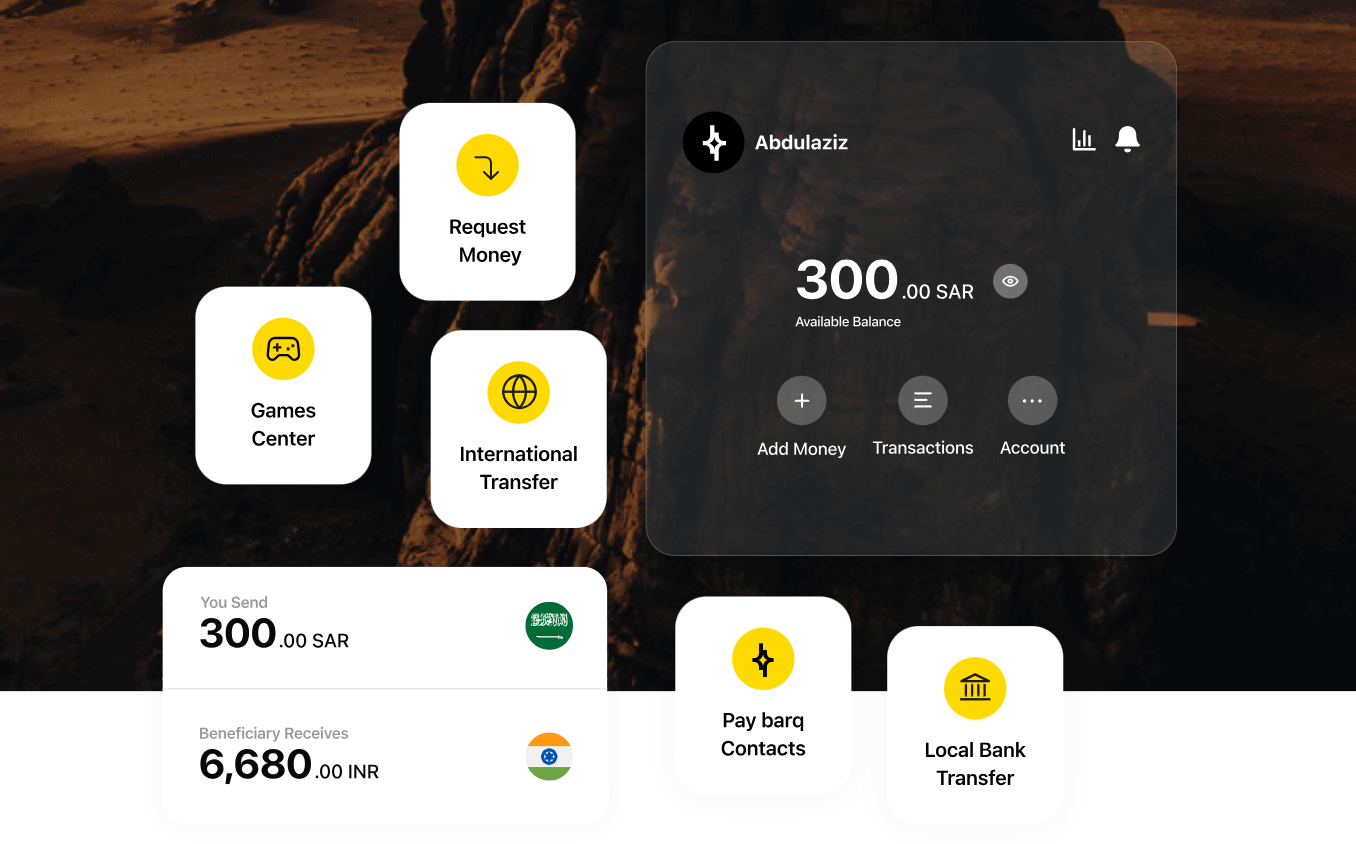

Saudi FinTech startup barq just made a power move by partnering with Mastercard to expand digital payment services across the Kingdom! By integrating Mastercard Gateway technology, barq is set to deliver faster, more secure payment solutions for merchants and consumers alike.

This collaboration aligns with Saudi Arabia’s Vision 2030, pushing the nation’s digital transformation forward. With the rise in demand for secure cross-border transactions, this partnership is geared to meet the needs of businesses and individuals looking for quick, reliable global payments.

“This is an exciting time for the Kingdom and financial services,” said Abdullah Alshalhoub, barq’s Founder. “Our partnership with Mastercard ensures we bring modern, secure payment solutions to the people.”

Leveraging Mastercard’s tech, barq will offer automatic payments, subscriptions, and instalments with advanced fraud prevention built in. Maria Parpou from Mastercard added, “We’re proud to partner with barq in helping to drive Saudi Arabia’s FinTech growth.”

With barq recently securing a Saudi Central Bank license, this partnership with Mastercard strengthens its position in the Kingdom’s booming FinTech scene.

Stay tuned for more FinTech updates!

Cheers,

#FINTECHREPORT

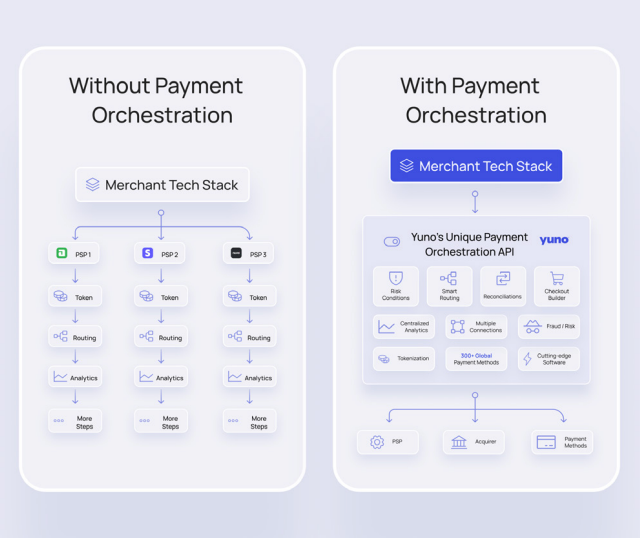

Read this great report by Carol L. Grunberg from Yuno to learn all about it:

FINTECH NEWS

🇧🇷 Ant International collaborates with Brazilian partners to drive financial inclusion with innovative credit tech solutions. In partnership with Dock, Ant aims to enhance credit management and infrastructure efficiency for Dock’s clients, including financial institutions, retailers, and FinTech start-ups.

🇨🇭 Avaloq rolls out digital asset platform at Zürcher Kantonalban. The Avaloq platform enables digital asset trading, settlement and custody while ensuring that banks can efficiently manage risk, optimize transaction costs and comply with regulations.

🇺🇸 FDIC eyeing plan to protect customers from FinTech failures. The Federal Deposit Insurance Corp. is expected to propose a rule requiring banks to maintain ledgers of “for benefit of” accounts opened by third-party FinTechs to track end-user funds, according to sources familiar with the matter.

🇬🇧 iFAST Global rolls out EzRemit for cross-currency transfers. EzRemit enables DPB customers to swiftly and affordably transfer money to over 50 countries in 25+ currencies, with its EzWallet feature supporting transfers to international banks and e-wallets like Malaysia's TNG, the Philippines' GCash, and Pakistan's Easypaisa.

PAYMENTS NEWS

🇺🇸 IRS clears final hurdle in $2B epayment tech award. The IRS now appears able to move forward with a $2 billion electronic payment system contract, now that the final protest has been withdrawn. ACI Payments and Link2Gov Corp. won the Epayment Card Services contract in August 2023, but it was quickly followed by protests from NIC Federal and Value Payment Systems.

🇸🇪 Qliro launches new checkout with SEK 1 million conversion guarantee for new enterprise merchants. As part of the launch, Qliro is offering a time-limited conversion guarantee to new merchants who process more than SEK 10 million per month, reflecting the company's strong belief in the new product.

🇨🇦 Shopify: Back on Track. Shopify’s Gross Payments Volume (GPV = GMV processed through Shopify Payments) was 61% of Gross Merchandise Volume (dollar value of orders facilitated) Vs. 58% in the prior year. Shopify’s Revenue grew +21% to $2.045 billion ($40 million beat), or +25% after adjusting for the sale of the logistic business.

🇺🇸 American Express and Knot team up to simplify adding card-on-file payment information. The feature rolled out as a limited pilot for select American Express customers to enable them to seamlessly add their payment information for some of their favorite merchants.

🇨🇦 Paystand expands its zero-fee B2B payments service to Canada. According to a press release, the expansion comes as Canadian businesses are increasingly choosing cash-based B2B transactions instead of credit, to reduce the risks of payment delays or non-payment.

🇸🇦 Mastercard and barq collab to expand digital payment services in Saudi Arabia. The partnership is expected to deliver increased convenience, speed, and security, as well as advanced fraud prevention features, aligning with Saudi Arabia’s Vision 2030, which seeks to drive the digital transformation of the country’s financial services sector.

🇨🇦 Lithic expands into Canada. This marks Lithic’s first entry into a non-U.S. market and introduces powerful multicurrency processing capabilities that position Lithic to support the most ambitious and innovative card program use cases.

🇺🇸 Trustly selects Newline™ by Fifth Third to drive innovation in U.S. payment capabilities. The first payment products on which the parties will collaborate are deposits and withdrawals via ACH and RTP. Newline’s API platform enables Trustly to transmit payments directly via Fifth Third Bank.

🇺🇸 JAGGAER Pay and Bottomline partner to bolster procure-to-pay offering. The partnership marks a transformative step in simplifying payment processes and leveraging them as a strategic advantage. Continue reading

🇬🇧 UTP’s tapeeno app enables Tap to Pay on iPhone for merchants in the UK to accept contactless payments. With Tap to Pay on iPhone at checkout, the merchant will simply prompt the customer to hold their contactless payment near the merchant’s iPhone, and the payment will be securely completed using NFC technology.

OPEN BANKING NEWS

🇨🇴 Redeban, in collaboration with Capgemini, will implement an innovative project that will transform financial services in Colombia, enhancing access to the benefits of Open Finance. This collaboration marks a milestone in the integration of Open Finance in the country.

🇸🇦 SAMA announces the authorization of “Seen Square FinTech” and “New Technology for Software Solutions” to practice open banking activities, and “Money Moon” to practice peer-to-peer financing activities, to operate under the legislative sandbox.

DIGITAL BANKING NEWS

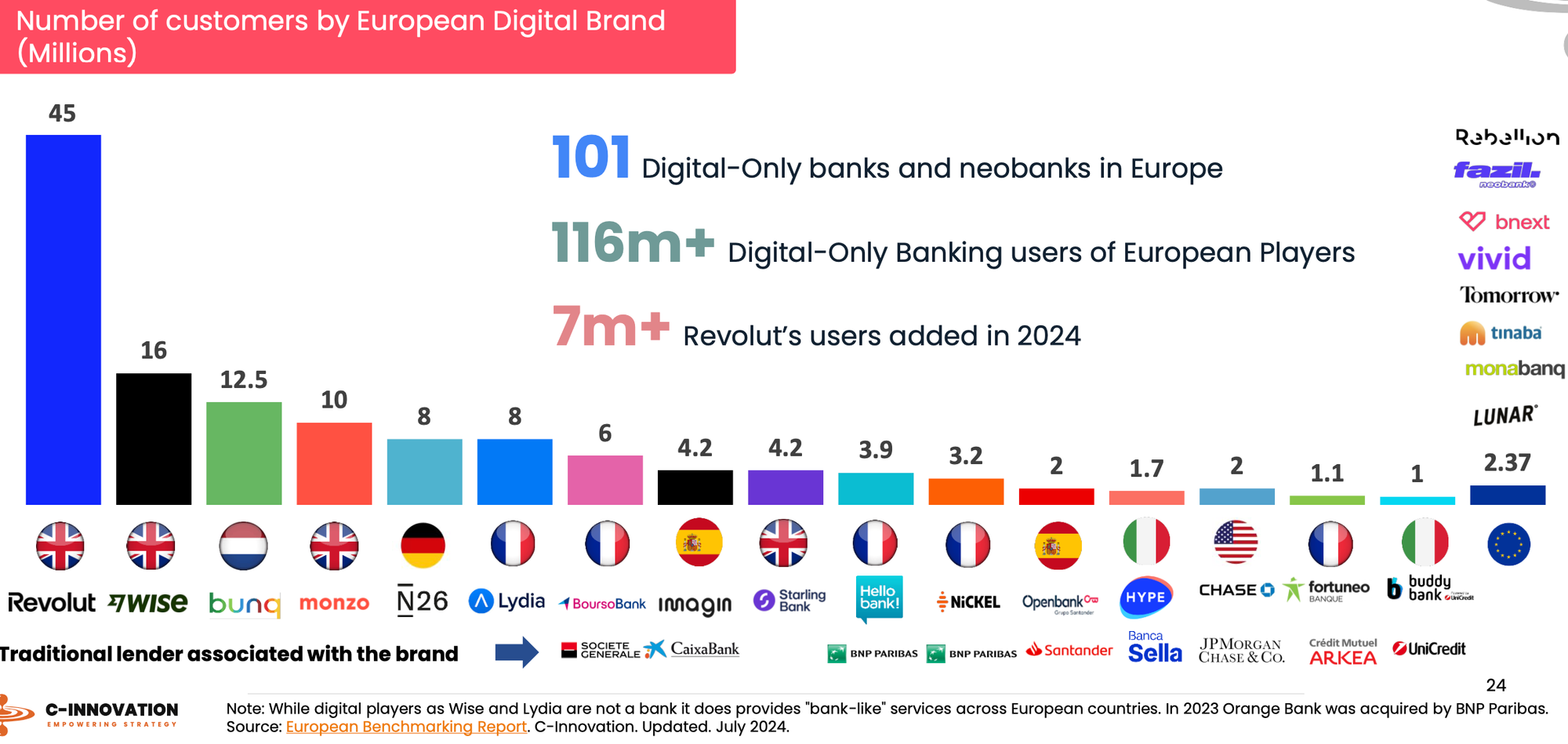

📊 Number of neobank customers by European Digital Brand

A comparison👇

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Mastercard has announced the launch of a new crypto debit card in Europe through a partnership with Mercuryo. This innovative card allows users to spend over 40 different cryptocurrencies directly from their self-custodial wallets at more than 100 million merchants across the continent.

🇭🇰 Aquanow to Power Crypto Payments for Hongkong Jet. This initiative underscores Hongkong Jet's commitment to delivering unparalleled business jet solutions tailored to meet the needs of its clientele. For Aquanow, this initiative represents a key opportunity to grow the crypto payments use case.

🇰🇿 Binance Kazakhstan: First digital-asset platform to obtain AFSA consent for full regulatory license. The organization has already completed the steps required for full license to operate in the country, including a series of internal and external audits and regulatory inspections.

🇦🇪 Dubai Blockchain Center, Cardano Foundation to host Blockchain Masterclasses in 2024. The agreement sets the stage for an innovative series of educational initiatives, including two masterclasses designed to elevate the understanding and practical application of advanced blockchain technologies among industry professionals.

🇺🇸 Coinbase must face shareholder lawsuit over SEC risks. A federal judge rejected Coinbase's bid to dismiss a proposed class action by shareholders who accused the operator of the largest U.S. cryptocurrency exchange of downplaying the likelihood it would be sued by the U.S. Securities and Exchange Commission.

DONEDEAL FUNDING NEWS

🇸🇻 Salvadoran FinTech Ábaco raised $4M in a pre-seed round. With the funds, Ábaco will be able to lend to more SMEs and expand into new markets. Ábaco offers short-term financing to small and medium-sized enterprises (SMEs) by automating money tracking and providing budget control.

🇺🇸 Oyster has successfully raised $59M in Series D funding, with participation from existing investors. The company is still deeply committed to its mission of helping companies everywhere hire people anywhere so they can confidently grow their teams across borders.

🇺🇸 Home equity FinTech Unlock bags $30m Series B funding. The firm plans to use its new funding to expand its current product remit with “tailored products for specific homeowner segments”, such as prospective homebuyers, retirees, and those often excluded by traditional lending.

🇮🇳 Drip secures $113 Million to grow digital trade finance platform. The firm has quadrupled its revenue and doubled its customer base over the past two years, despite rising interest rates that challenged the global trade sector during that time, Drip Capital Co-founder and CEO Pushkar Mukewar said in a press release.

M&A

🇺🇸 BNY to acquire Archer, a leading provider of managed account solutions to the asset and wealth management industry. The acquisition will enhance BNY's capabilities across the entire managed account ecosystem, including manufacturing, distribution and servicing.

MOVERS & SHAKERS

🇺🇸 PayQuicker strengthens client and partner excellence with strategic appointment of Nathan England. He will be responsible for identifying and fostering strategic partnerships and providing industry-proven customer excellence support solutions to PayQuicker’s new and existing global client base.

🇪🇸 Santander appoints Ignacio Juliá as new CEO of Santander Spain. His appointment will help progress in transforming the business model to provide better customer service and, at the same time, generate further growth and efficiency.

🇺🇸 DriveWealth announces hiring of Venu Palaparthi as Chief Operating Officer. In this role, effective September 16th, Palaparthi will oversee DriveWealth’s risk and compliance functions and lend his strategic expertise to the company’s ongoing international expansion.

🇺🇸 Edward Tilly becomes new Clear Street CEO. Effective at the end of 2024, Chris Pento will leave his current role as CEO, having held the role for six years. In July, Tilly became president at Clear Street where he was to work alongside Pento to lead Clear Street through the next phase of its growth.

Flutterwave appoints Mitesh Popat as CFO amid global expansion. Popat’s leadership is expected to guide Flutterwave in navigating the complexities of international growth, enhancing its financial strategy, and delivering on its ambitious goals.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()