Barclays to Shut Down FinTech Accelerator Rise by Mid-2025

Hey FinTech Fanatic!

Barclays has announced it will wind down Rise, its global FinTech accelerator program, by mid-2025. The program, launched in 2015, has produced over 120 graduates including ApTap, WealthOS, and iWarranty through its locations in London, New York, and a virtual community in India.

According to a Barclays spokesperson, London-based Rise members will have the opportunity to transfer their memberships to Barclays Eagle Labs and Barclays Business Banking, which will take over the London facilities. The news was first reported by Axios last week.

The bank states it will "remain committed to the global FinTech ecosystem" and continue its role in scouting, partnering, and investing in FinTech companies. As noted by Barclays, FinTechs have evolved from "predominantly niche start-ups" to becoming "a core part of the financial ecosystem."

Read more global FinTech industry updates below👇 and I'll be back tomorrow! 👇

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily Digital Banking updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

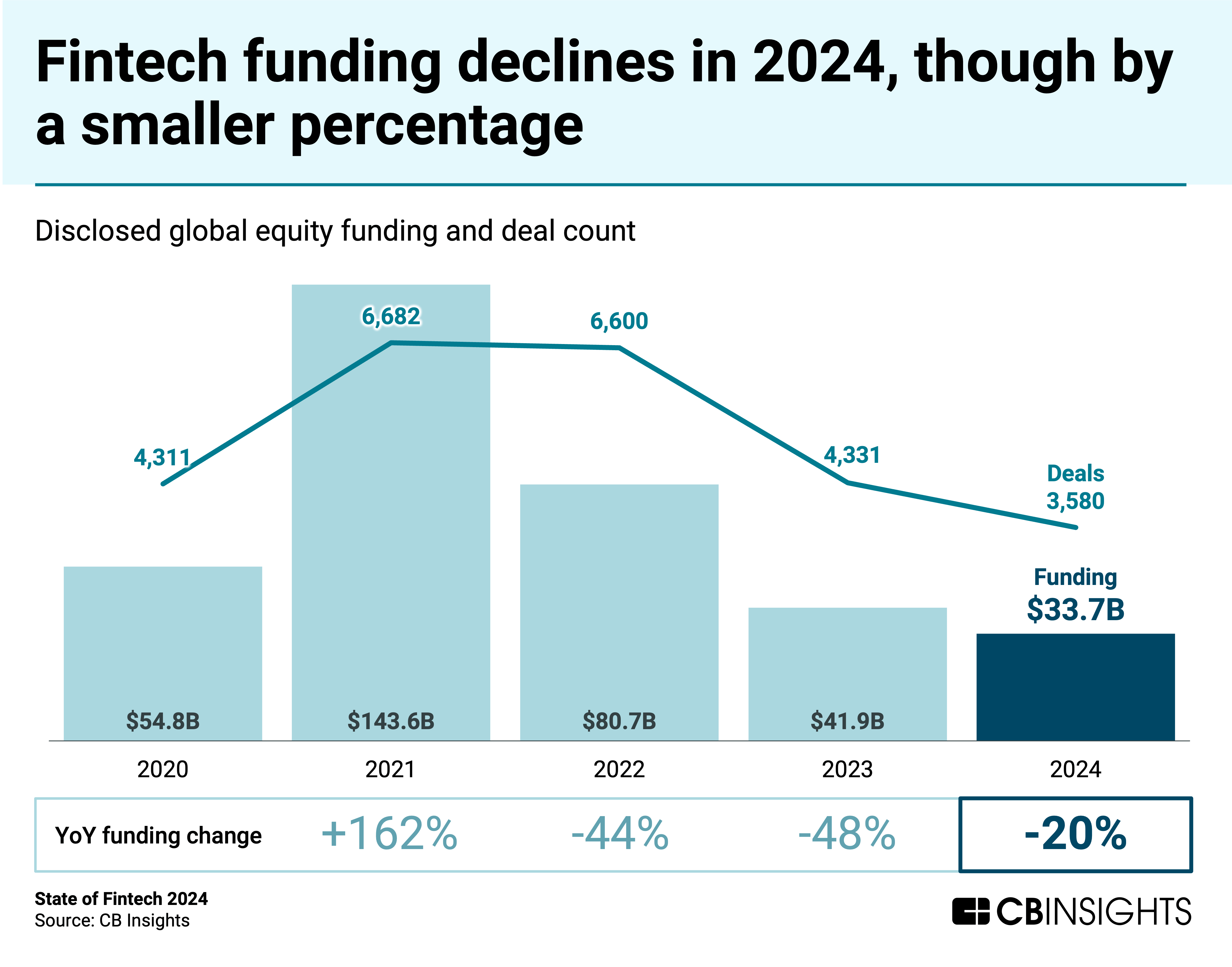

➡️ State of FinTech 2024 Report. FinTech dealmaking continues a downward trend.

In 2024, annual FinTech funding and dealmaking both decreased YoY, hitting 7-year lows 🤯

FINTECH NEWS

🇬🇧 Tred blames regulations as it reveals plans to wind down. The Leeds-based business was set up with the ambition of being “a force for good by making money greener”. But recent changes to financial regulations around Authorised Push Payment Fraud (APPF) have “significantly impacted smaller disruptors like Tred, which we simply aren’t equipped to sustain”.

🇬🇧 Barclays to wind down FinTech accelerator programme Rise by “mid-2025”, to help global FinTech start-ups grow and form partnerships with large financial institutions. The initiative has produced over 120 graduates and provides resources, mentorship, and networking opportunities throughout two locations in London and NY, as well as a virtual community in India.

PAYMENTS NEWS

🇺🇸 DEUNA Introduces the First Commerce Aware AI. At NRF, DEUNA proudly launched Aware AI, the first commerce-aware AI platform designed to turn data chaos into actionable insights for growth. During the event, DEUNA CEO Roberto Kafati showcased the platform’s unique capabilities: real-time insights, end-to-end data automation, and prioritized growth strategies for profitability. Click here for further details

🇪🇸 Air Europa selects Hands In to add split payments to checkout. This enables Air Europa customers to divide ticket costs between multiple travelers or credit cards at checkout. Since launching the feature, Air Europa revealed it has generated over €3.8million in incremental revenue.

🇸🇪 Swedish Central Bank calls for more action by banks on Tips cross-currency project. “The G20 has a global goal of making cross-currency payments more secure, more efficient, and cheaper. The work on it is an important step towards making this a reality but also requires cooperation between central banks and the market," said the Governor of the Riksbank.

🇮🇳 Paytm sales slump after regulator crackdown. India’s banking regulator all but shut down Paytm’s banking affiliate after years of warnings about unregulated data flows. The clampdown forced its Founder to strengthen ties with other Indian lenders to aid its recovery. The company recently announced plans to achieve profitability within one to two quarters, reporting a narrower third-quarter adjusted loss as its payments business rebounded from the closure of its payments bank unit.

🇬🇧 Nuvei expands Omnichannel capabilities to the UK Gaming industry. This platform unifies all payment channels, delivering unmatched convenience and flexibility for operators and players, including unified integration, enhanced player experiences, global reach, and stronger brand loyalty.

🇸🇬 Primer to power dtcpay next-gen payments across fiat and stablecoins. This collaboration particularly aims to expand dtcpay’s reach within the luxury retail and hospitality sectors and also to broaden its service offerings, enabling online checkout experiences for both fiat and stablecoin payments.

🇸🇪 Trustly to roll out enhanced user onboarding technology for gaming operators. The new version of Pay N Play is expected to reduce players’ average login time from 48 seconds to less than 10 seconds, combine logins and deposits into a single flow, and allow customers to start playing in fewer than 20 seconds.

🇲🇾 UnionPay, BSN to launch QR payments in Malaysia. This initiative is set to launch in the first half of 2025 and marks a significant step in expanding digital payment options. Through the collaboration, BSN will join UnionPay’s network as a member, broadening its payment offerings to include UnionPay alongside existing platforms.

DIGITAL BANKING NEWS

🌍 bunq introduces Mastercard benefits to its European SMEs. Through Mastercard's Business Bonus, bunq's users gain access to merchant discounts and offers, including business software, travel, shipping, and freelance contracting. The programme will be available in the Netherlands, Germany, France, Spain, and Italy.

🌍 YC-backed Waza launches Lync, an alternative to Mercury for African startups after $8m raise. Lync enables businesses to receive money and make payments in over 100 countries, supporting multiple currencies and stablecoins making it easier for businesses to reconcile payments, as funds are processed under their accounts.

🇺🇦 Revolut is rolling out a new feature that allows customers to pay off their credit card debt in “instalments.” The FinTech announced plans to enter the mortgage market by summer 2025. Also, it announced that Ukrainians formed the largest waiting list the company had on a "global scale." Revolut did not specify how many Ukrainians have already gained access to the application.

🇬🇧 Santander reviews UK retail banking presence. Santander's review is part of a regular assessment of its major businesses. This could result in different outcomes, including scaling back Santander's business in Britain. "The UK is a core market for Santander and this has not changed," Santander said in a statement.

🇬🇧 Fairer Finance launches new business banking product ratings. This aims to help businesses navigate the complexities of choosing a bank account by highlighting products that offer good value. The ratings consider the benefits and costs of each account, ensuring that business owners understand the value of what they’re signing up for.

🇬🇧 Tuscan rebrands to Allica Bank and expands team. To meet a growth in demand, Allica’s newly-rebranded bridging business development, underwriting and client services teams have also been expanded across the UK. Continue reading

BLOCKCHAIN/CRYPTO NEWS

🇮🇳 Jio Platforms joins crypto space with JioCoin launch. Jio explains in its FAQ section that JioCoins are blockchain-based reward tokens, and can be earned by users engaging with various Jio apps and internet-based activities, provided they use Indian mobile numbers.

🇺🇸 Trump's meme coin attracts billions in trading volume and crashes after Melania’s coin launches. Trump promoted the token on his social media accounts, and it quickly gained momentum, reaching a market value of $15 billion. Crypto fans jumped on the chance to cash in on the hype, but the excitement didn’t last long.

🇺🇸 Binance launches MELANIA perpetual contract. This follows the launch of the TRUMP perpetual contract by the exchange on January 18. MELANIAUSDT on Binance comes with a leverage of up to 25x, which allows users to amplify their trading activities, although it does come with its own risks.

🇺🇸 What crypto hopes to gain from Trump’s second term. Read the interview with Austin Campbell, professor at NYU's Stern School of Business and the CEO of stablecoin company WSPN USA about the possibilities ahead, and what moves the industry is hoping to see from the SEC and bank regulators.

🇺🇸 Circle CEO expects imminent US executive orders to widen crypto, enabling banks to trade crypto, offer it as an investment for wealthy clients, and hold it in portfolios. Circle issues the USDC stablecoin, pegged to the US dollar. Read on

🇺🇸 Ripple and ADAPT to collaborate on Blockchain research at Trinity. The partnership will establish the Ripple Blockchain Collaboratory, a new initiative that will focus on advancing research into blockchain, cryptocurrency, cybersecurity, and FinTech.

🇪🇺 Crypto. com gets preliminary approval for MiCA licence from EU regulators. The licence will allow Crypto. com to offer its services across the EU under a new, unified regulatory framework. The MiCA regulations was designed to increase transparency and consumer protection in the cryptocurrency market.

PARTNERSHIPS

🇬🇧 Offa joins Connect IFA brokerage network. The CCO & Managing Director at Offa, said: “ Accessing their national network will allow us to assist mutual clients, widening distribution of our modern, market-leading Sharia-compliant bridging and buy-to-let finance products through their appointed representative firms.”

DONEDEAL FUNDING NEWS

💰 Over the last week, there was a huge uptake in activity, with 18 FinTech deals in Europe, raising a total of €362.2 million, with 5 deals in the UK, 3 deals in Germany, 2 deals in France, the Netherlands and Switzerland each, as well as 1 deal in Jersey, Spain, Lithuania, and Czechia each. Read the complete BlackFin Tech article

Olé Life reports $13M series B. The company plans to use the funding to accelerate its growth “across Latin America by setting up local operations in key markets,” and is poised to evolve beyond life insurance and plans “to introduce new products that address the unique needs of Latin American consumers.”

🇬🇧 Fundment to hit £150 million valuation with Highland Funding. It plans to use the proceeds for product development, hiring, and future expansion. Fundment offers a technology platform that allows financial advisers to build model portfolios, and monitor investment processes.

🇩🇪 Climate FinTech Bees & Bears locks in €500 million in financing commitments. This funding will enable nearly 25,000 photovoltaic systems, heat pumps, energy storage systems, and home electric vehicle chargers to be fitted. It follows the company’s successful venture capital funding round last year.

MOVERS AND SHAKERS

🌏 Airwallex names new marketing VP for APAC. Andrew Balint will lead marketing efforts in Australia, New Zealand, Singapore, Hong Kong, and Malaysia, effective immediately. In his new role, he will oversee branding, integrated campaigns, growth marketing, content, and partnerships.

🇬🇧 Ecommpay appoints Chris Wilson as new CFO. Driven by data and a passion for problem-solving and relationship-building, Chris’ focus on the commercial, strategic, and operational aspects of finance makes him well-equipped to join the Ecommpay leadership team, supporting the company’s growth ambitions in 2025 and beyond.

🇬🇧 Acquired.com appoints an Ex-Stripe Senior leader as COO. Lee Clifton will be responsible for strengthening Acquired. com’s strategic relationships with its key customers, as well as driving operational excellence across the business, will underpin Acquired.com’s continued growth.

🌍 Richo Strydom joins AAZZUR’s advisory board. His expertise will help guide AAZZUR’s mission to revolutionise how businesses integrate financial services through its cutting-edge API platform and smart front-end solutions.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()