Barclays Finalizes £600M Acquisition of Tesco Bank

Hey FinTech Fanatic!

Barclays has wrapped up its £600M acquisition of Tesco Bank, securing high court approval on October 17th. Under a ten-year partnership, Barclays will now operate Tesco’s banking services, while Tesco retains its insurance, ATM, and travel money operations.

This deal brings 2,800 Tesco Bank employees, billions in deposits, and personal loans under Barclays’ wing. Tesco plans to return £700M to shareholders with an additional buyback once its current £1B buyback is complete.

Ken Murphy, Tesco’s CEO, shared: “Through our partnership, customers will enjoy new, innovative services and the perks of Tesco Clubcard.”

Barclays CEO, CS Venkatakrishnan, added, “We’re thrilled to welcome Tesco Bank’s staff and customers, enhancing our investment in the UK.”

With Barclays' stock reaching a nine-year high, this acquisition promises to strengthen both brands, supporting millions of UK households with expanded financial services.

Cheers,

FINTECH NEWS

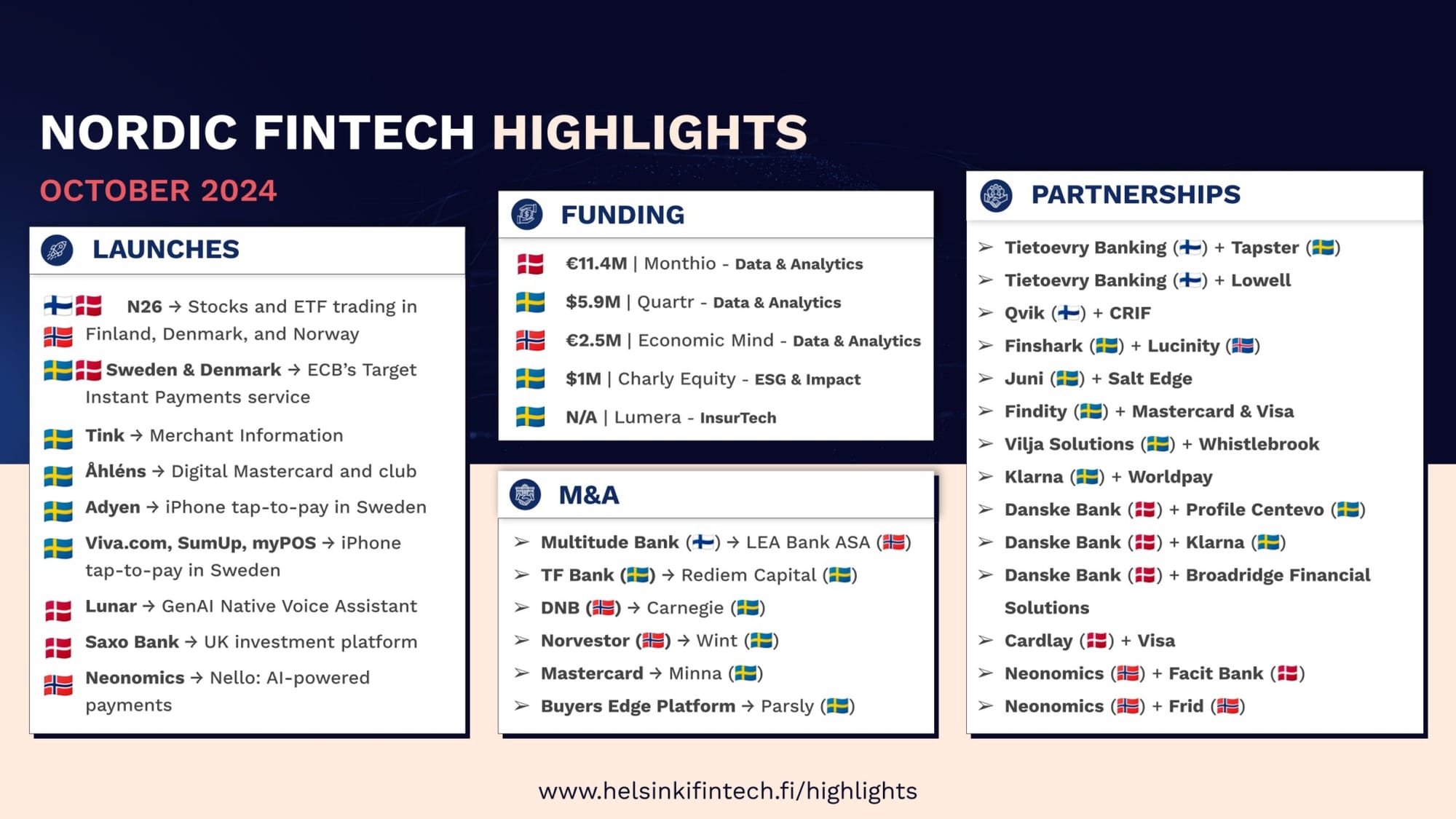

💡 Check out 'Nordic FinTech Highlights – October 2024' from Helsinki FinTech Farm for industry insights, including funding news, partnerships, acquisitions, and new launches.

🇲🇽 Mexican FinTech Klar sets $500 million revenue goal for 2026 IPO. The company is expecting its growth path to allow it to seek an initial public offering by the end of 2026, aiming for an annual run rate of $500 million. Find out more

🇬🇧 Top Estonian FinTech Tuum reassesses London as a possible new global HQ following budget tax rises. CEO, Myles Bertrand, is rethinking London as a headquarters due to recent UK tax policies, which could impact its investment appeal. He mentioned alternative EU cities while highlighting Tallinn’s tech-friendly benefits.

🇺🇸 Lili launches Lili Connect, an embedded finance integration that streamlines small business banking, accounting, and tax processes, allowing partners to offer Lili’s comprehensive financial management tools directly through their platform.

🇺🇸 Former Caribou founder launches Further, a FinTech focused on helping people buy homes. Kevin Bennett launched Further to simplify the financial process for first-time buyers. The FinTech platform guides users through the financial aspects of home buying, making the experience more accessible.

PAYMENTS NEWS

🌐 Klarna and Zoom announce global launch of Flexible Payments in 16 Markets. Customers in 16 countries can now use Klarna to manage Zoom Workplace subscriptions, with Pay Now available in all countries and Pay Later options in the US, Sweden, and Germany.

🇺🇸 Credit and Debit Cards Ate Cash. So what’s eating cards? Card payments in the U.S. are no longer growing twice as fast as personal consumption: what that means for the business of plastic. Learn more in this WSJ article

🇺🇸 Fiserv and Clover serve up new tools for small businesses. The new solutions include new hardware, such as Clover Compact and Flex Pocket, that further build on the Clover hardware suite, providing business owners with greater freedom in how they accept payments.

🇪🇺 Global payments FinTech Remitly expands Seafarers product experience to the EU, UK, Australia, and Singapore. With this launch, Remitly stated their aim is to provide even more seafarers with the reliable, secure, and accessible money transfer service they deserve.

🇸🇬 HitPay launches single switch to 9 APAC real-time payment schemes, enabling flexible, cost-effective cross-border payments for businesses, while allowing them to offer preferred payment methods with seamless interoperability. Discover more

🇺🇸 Zelle reportedly wants users to use its platform via banking apps instead of its own. An executive for the peer-to-peer payments provider told Reuters last week that while more than 2,200 banks and credit unions are part of its network, just 2% of Zelle transactions happen on its mobile app.

🇯🇵 Tokyo-based Credit Engine joins PayPay Group. The transition follows a share transfer agreement completed last week. The Credit Engine Group offers digital lending and debt collection services and will continue its operations within the PayPay Group.

REGTECH NEWS

🔒 How can RegTechs improve the overall security of in-house AI? Flagright’s growth manager, Joseph Ibitola, noted that as AI solutions become more integrated within financial institutions, their security faces increasing scrutiny. Continue reading

DIGITAL BANKING NEWS

🏛️ Comparing the 12 Largest Banks in North America (Q3 2024)👇

🇺🇸 JP Morgan affiliates to pay $151 million to resolve SEC enforcement actions. The SEC charged J.P. Morgan Securities and J.P. Morgan Investment Management Inc., in five enforcement actions for misleading disclosures, breach of fiduciary duty, prohibited joint transactions, principal trades, and failing to act in customers' best interests.

🇺🇸 CFPB fines VyStar Credit Union $1.5m for botched banking system update. The penalty will contribute to the CFPB’s victims relief fund, addressing the disruption that left members without crucial banking services, incurring fees and costs due to the migration issues, according to Finextra.

🇺🇸 Wells Fargo rolls out Paze online checkout option to customers. Wells Fargo is the latest lender to offer Early Warning Service's Paze online checkout for debit and credit card customers. Users can activate Paze in the bank's app or at checkout with participating merchants.

🇺🇸 Agent IQ and Narmi announce a strategic partnership to improve digital banking experiences. The partnership is poised to reshape the landscape of digital banking by empowering financial institutions to deliver seamless, personal, and AI-powered customer experiences.

🇺🇿 TBC Uzbekistan launches Salom Card, its new flagship daily banking product. The product will establish a new standard for daily banking in Uzbekistan, providing previously unavailable benefits and a fully digital interface via the TBC mobile app.

🇩🇪 BIAN advances Coreless Banking Initiative to improve customer retention using AI. This innovation comes as research reveals that 12% of global banking leaders report losing 30-40% of their customers to competitors, highlighting the critical need for strategies to improve customer engagement and satisfaction.

🇲🇽 Cuenta Nu, a savings account with a debit card offered by Nu México, is expanding its locations where customers can make deposits—and soon, cash withdrawals—by incorporating FINABIEN’s extensive branch network. Read on

BLOCKCHAIN/CRYPTO NEWS

🇨🇦 Transak has obtained two licenses from Canada and the US to enhance its regulatory compliance. The firm obtained its second Money Transmitter License from Delaware, following one from Alabama, and is also registered with FINTRAC in Canada as a Money Services Business.

🇸🇬 Paxos Introduces Global Dollar (USDG), a new, secure, and reliable stablecoin designed to accelerate global stablecoin adoption by meeting the needs of regulated institutions that require higher operational standards. Read more

🇳🇬 Bamboo diversifies into remittances, launches Coins by Bamboo to crash remittance cost. The platform announced this in a statement seen by Technext. The move effectively marks Bamboo’s diversification from its primary investments business into remittances.

🇸🇬 Bitget launches Bitget Pay, a 0-Fee peer-to-peer instant crypto payment service. This new service allows users to complete transactions in seconds, supporting a wide range of cryptocurrencies, including BTC, ETH, and USDT. More on that here

🇸🇬 Temasek and Republic-backed blockchain fund Superscrypt plans to raise up to $100 million for its second investment fund, according to sources. Temasek and Republic would serve as general partners in the new fund, with the final amount subject to change as the process continues.

DONEDEAL FUNDING NEWS

🇬🇧 Nick Candy-backed VibePay scoops £5M and pinches Klarna executive. The funds will be used to find its new insights unit and other product development. VibePay, which combines messaging with open banking-powered peer-to-peer payments, has appointed Klarna executive Conor Tiernan to head up its new insights unit.

M&A

🇬🇧 Barclays completes £600m Tesco Bank takeover. As part of a ten-year partnership, Barclays will manage Tesco Bank. Following the takeover, Tesco plans to return £700 million to shareholders via a share buyback, starting after its current £1 billion buyback program concludes.

MOVERS & SHAKERS

🇬🇧 The FCA and PSR Boards have appointed Alison Potter as chair of the FCA’s Regulatory Decisions Committee (RDC) and the PSR’s Enforcement Decisions Committee (EDC). These 2 committees are responsible for taking certain regulatory decisions on behalf of the FCA and the PSR. Read more

🇸🇪 Trustly bolsters European leadership with appointment of Henrik Wallström as Chief Technology Officer. Henrik’s appointment comes at a pivotal time for Trustly, as his expertise will be instrumental in driving continued innovation and growth.

🇺🇸 Kraken has appointed Stephanie Lemmerman as CFO, succeeding Carrie Dolan. With significant FinTech expertise, Lemmerman will help drive Kraken's growth through ongoing restructuring and will retain her role on Dapper Labs' board, supporting collaboration with her previous firm.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()