🏦 BaaS: The New Frontline in Global Banking Innovation

Banking as a Service has taken the financial world by storm. Diverging from traditional white-labeled banking services, BaaS offers an innovative model built upon a plug-and-play API platform. But what does this mean for the financial sector, brands, and consumers alike?

The swift ascent of Banking-as-a-Service (BaaS) is no anomaly. It's firmly rooted in the maturation of open banking APIs worldwide and the burgeoning platform economy, where seamlessly integrated experiences are now the gold standard.

Powering this shift is the rapid assimilation of pioneering technologies in the banking sector, such as Cloud, SaaS, and Microservices — all foundational elements for the BaaS paradigm.

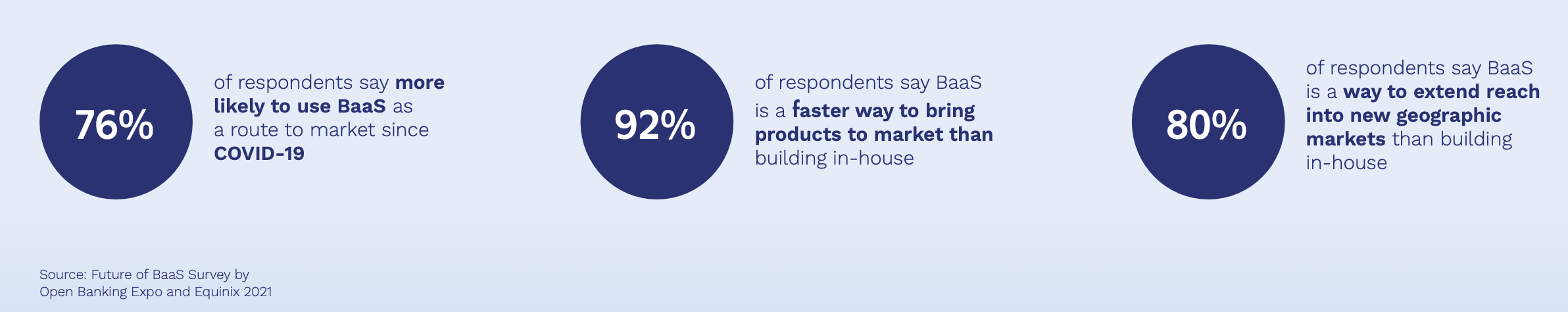

The global economic landscape, already under duress, faced further challenges due to the COVID-19 pandemic.

This resulted in a tightened financial noose for FinTech startups and mounting profitability concerns for established banks.

On one hand, emerging FinTech players find the prospect of developing their banking infrastructure or securing licenses a daunting, often unreachable goal.

On the other, traditional banking giants are on a quest for fresh revenue avenues.

Given these dynamics, the BaaS market's trajectory looks promising. Experts anticipate its value to skyrocket, potentially reaching an astounding $3.6 trillion by 2030.

In this evolving financial ecosystem, BaaS might just be the linchpin that binds innovation and opportunity.

Introduction:

Banking as a Service, commonly abbreviated as BaaS, has taken the financial world by storm. Diverging from traditional white-labeled banking services, BaaS offers an innovative, technical, and operating model built upon a plug-and-play API platform.

But what does this mean for the financial sector, brands, and consumers alike?

Key Differences in BaaS:

- BaaS Vs. Traditional Banking: BaaS isn't just a banking service with a different label. At its core, it's a modernized technical model with a foundation on configurable components. In contrast to older banking models, it offers API-centric platforms that allow swift integration and scalability.

- Revenue Streams: BaaS provides a dynamic revenue model for providers. Initially, they can operate on a "pay-as-you-go" model during the test phase. As the service scales, it transitions to a subscription-based model. Furthermore, data sharing deals present a unique opportunity to acquire customer insights, which can then be used to refine offerings.

- Efficiency: The self-service model emphasizes low sale costs. This model outpaces the traditional ones, which usually involve detailed requests for proposals (RFPs) and custom connectivity solutions.

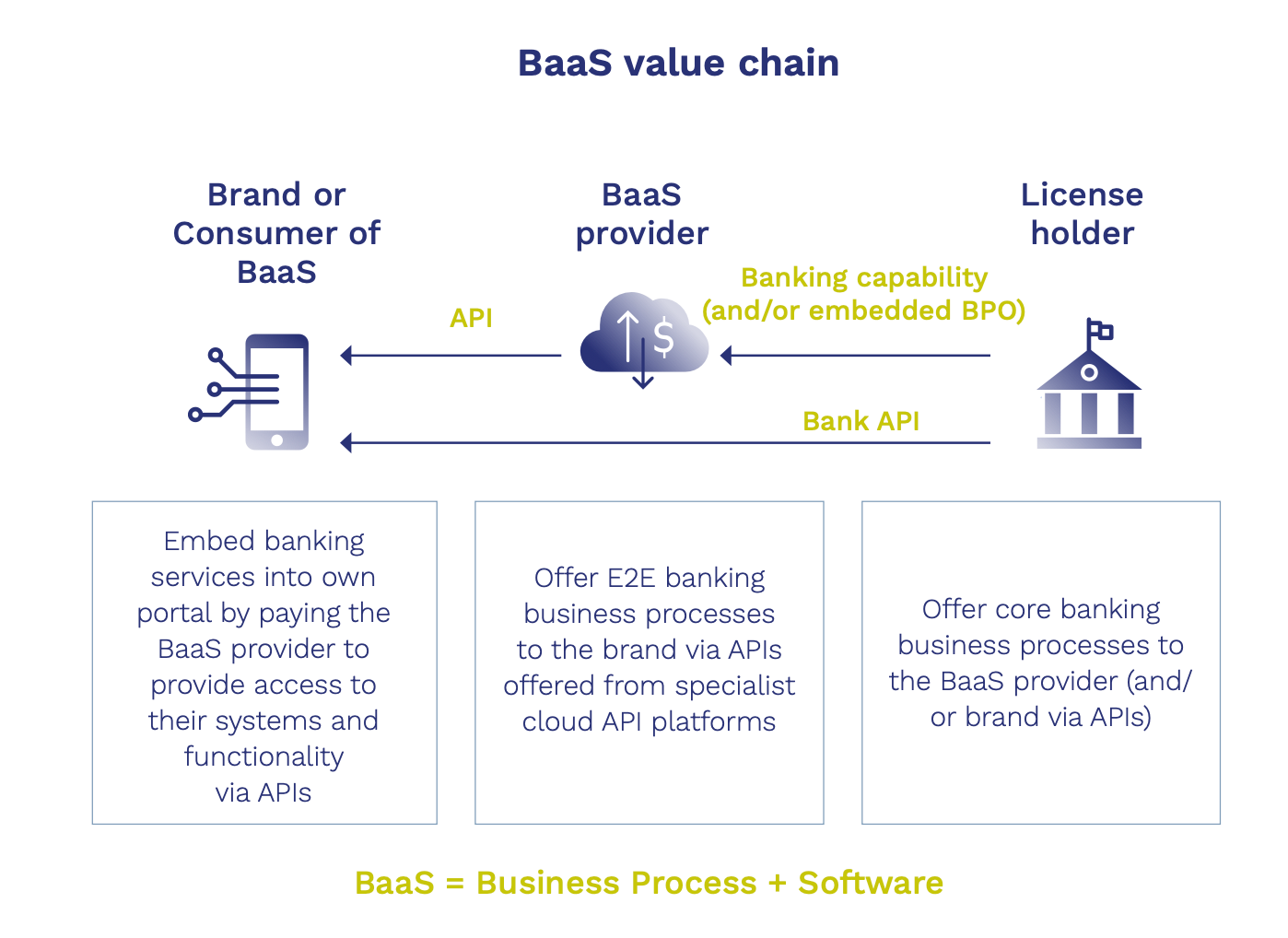

Key Players in the BaaS Ecosystem:

- The Brand or Consumer of BaaS: The ultimate beneficiaries, these entities desire seamless integration of banking services into their customer experience. They prioritize agility and scalability, bypassing the need for their own banking licenses. Examples include companies like Singapore's Grab, which integrated payment services via Adyen, a Dutch payment company.

- The BaaS Provider: These companies offer modular banking services via APIs. While they often partner with regulated banks, some have their own licenses, such as Solarisbank, known for providing frictionless banking services via its extensive API endpoints.

- The License Holder: Acting as the foundation, these players rent out their licenses to BaaS providers, granting them access to foundational banking infrastructures. Some even offer BaaS services directly, illustrating the blurring lines in this ecosystem. A noteworthy mention is the UK's Standard Chartered Bank, which introduced its BaaS solution, 'nexus', aimed at digital platforms.

The Future of BaaS:

As the financial world continues to evolve, BaaS emerges as a symbol of agility, collaboration, and innovation. With its unique model, it presents opportunities not only for new entrants but also for traditional banks to reimagine their roles. Whether you're a fintech enthusiast, an established financial institution, or a brand looking to revolutionize customer experience, BaaS is undoubtedly a domain to watch.

Whether you're banking, e-commerce, or even a ride-hailing service, the future of finance is modular, integrated, and customer-centric. Welcome to the era of Banking-as-a-Service.

Download the complete source report for this article called “Open Banking and the Rise of Banking- as-a-Service” by Temenos for more interesting info on this topic.

Comments ()