Apple's Financial Offerings: Tech Company or Bank in Disguise?

Hey FinTech Fanatic!

Chase customers will soon be banned from using their credit cards to pay for third-part BNPL instalment plans.

The US bank informed credit cardholders on their latest statements:

"Effective October 10, 2024, you will not be able to use Chase credit cards to pay for third-party Buy Now Pay Later (“BNPL”) instalment plans. Payments to these instalment plans (e.g., Klarna, AfterPay, etc.) using your Chase credit card will be declined.

"If your Chase credit card is used for any of these recurring BNPL plans, please update the payment method with your BNPL provider to avoid any missed payments or late fees (if applicable)."

The bank offers its own BNPL feature, Chase Pay Over Time, which lets users break up credit card purchases into instalments.

Now over to you: What do you think about this move?

Cheers,

SPONSORED CONTENT

POST OF THE DAY

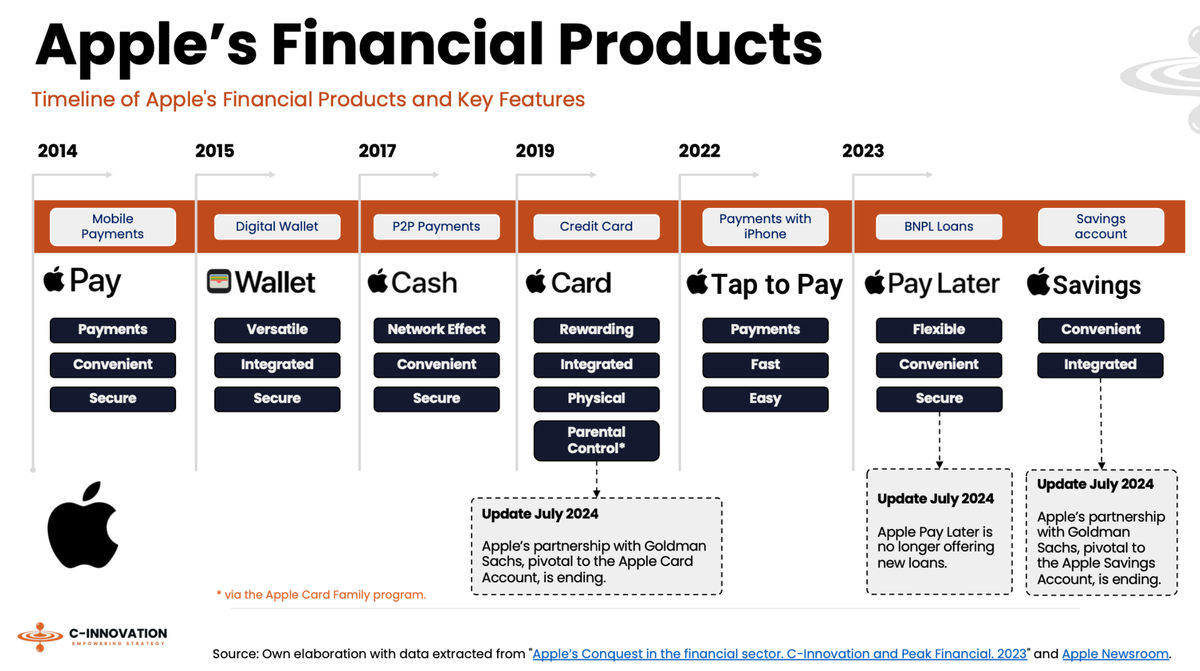

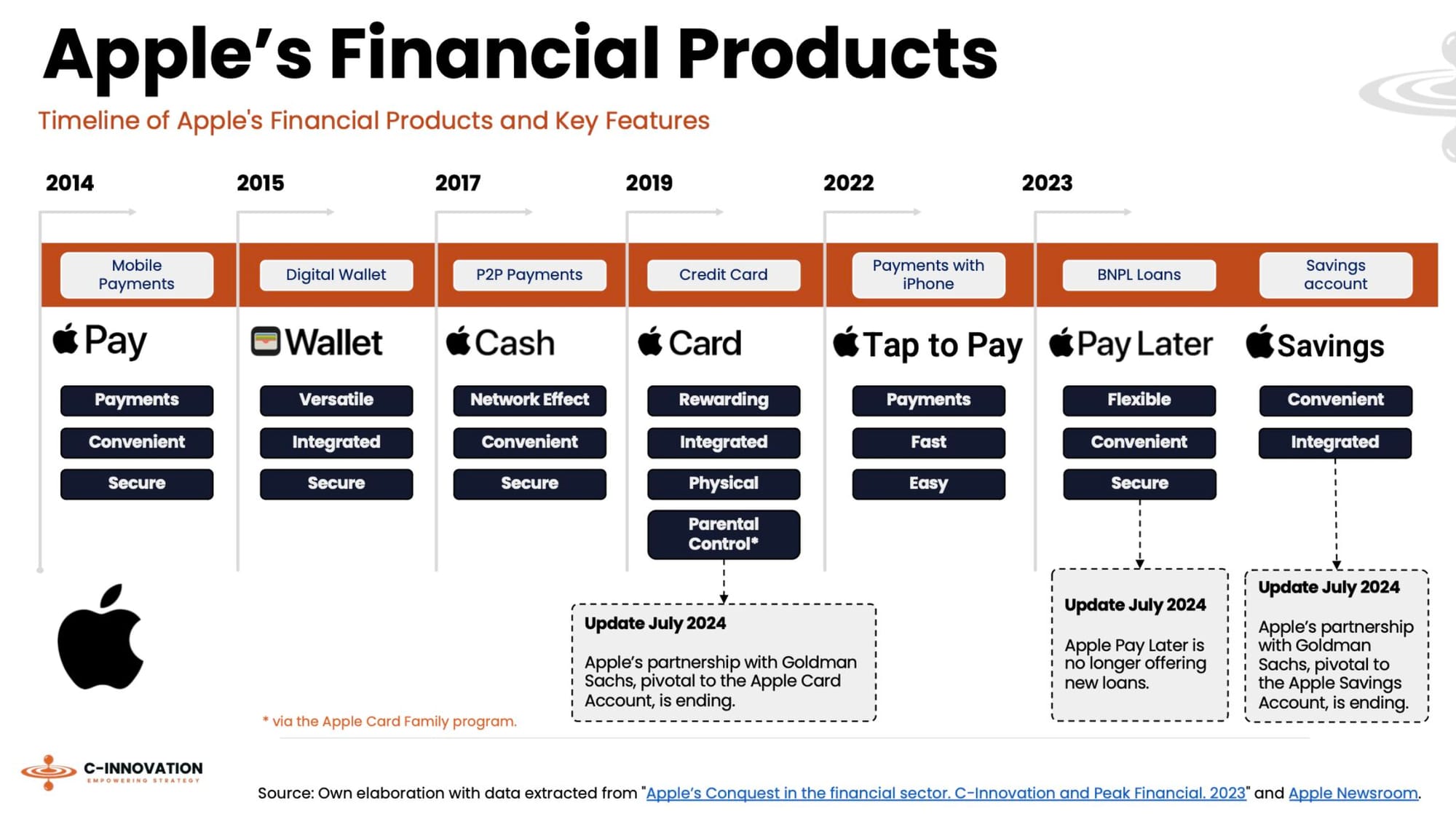

🇺🇸 Apple's Financial Offerings: Tech Company or Bank in Disguise?

Let's dive into Apple's Financial Offerings:

FEATURED NEWS

🇬🇧 British regulators to examine Big Tech's digital wallets. The Financial Conduct Authority and Payments Systems Regulator are seeking views on the benefits and risks of digital wallets like Apple Pay, Google Pay, and PayPal, and will assess their impact on competition and payment options at checkout.

FINTECH NEWS

🇺🇸 Stratyfy, a women-led FinTech confronting bias in AI and optimizing credit risk decisions with transparent machine learning solutions, announced its strategic partnership with Prism Data, a leading cash flow underwriting and data analytics platform.

🇺🇸 Cash App Pay integrates with Google Play, giving next gen consumers more choice at checkout. By joining forces, this partnership will allow avid Cash App and Android users to seamlessly pay and get access to millions of apps, games, music, movies, books, and more.

🇹🇭 The SEC is seeking public comments on a proposed amendment to the rules prohibiting the use of digital assets as a means of payment for products or services (MOP) to include all current types of digital asset business operators.

🇮🇹 Toyota Financial Services Italy and Fabrick collaborate to advance embedded finance. The collaboration, which aims to explore new growth and investment opportunities with FinTech entities, includes working with Fabrick to integrate embedded finance services into vehicles.

🇺🇸 BNPL firms ask for 5 more months to prepare for CFPB rules. The Consumer Financial Protection Bureau’s (CFPB) rule classifying BNPL as credit card providers takes effect July 30, meaning these firms must provide legal protections and rights delivered by conventional credit cards.

🇨🇿 FinTech Mintos targets cautious Czech investors in latest European push. The platform officially launched in the Czech Republic yesterday. The move comes as the company seeks to capitalize on growing investment interest in the Czech market, while addressing the cautious approach of local investors.

🇺🇸 Stripe accelerates growth in Japan with new solutions for ambitious enterprises. The new products and features include the ability to work with multiple payment processors through the Vault and Forward API, installments for consumer payment flexibility, and enhanced verification through Stripe Identity.

PAYMENTS NEWS

🇺🇸 Aeropay, a leading provider of Pay-By-Bank solutions, announced the launch of Aerosync, the company’s proprietary bank aggregator. Aerosync is designed to increase customer conversions while simultaneously lowering risk and addresses many challenges posed to the FinTech industry by existing bank aggregators.

🇱🇹 PAYSTRAX partners with Cardstream to offer global payments solution for merchants. Through this partnership, PAYSTRAX customers can now benefit from an additional way to connect with its acquiring services and accept cross-border payments smoothly and securely.

🇦🇹 Payment provider and carrier billing specialist, DIMOCO Payments, strengthens its partnership with Telekom, a Mobile Network Operator in Germany, by providing carrier billing services to their online shop in collaboration with Brodos.

🇳🇬 Collaboration is key for Unified Payments as it begins recording POS transactions. Unified Payments has been granted a Payment Terminal Service Aggregator licence by Nigeria’s Central Bank, making it the second holder after NIBSS. CEO Agada Apochi emphasizes collaboration, reflecting the company's founding by 14 Nigerian banks.

🇺🇸 Episode Six Payments-as-a-Service proposition arrives in AWS Marketplace. Listing the E6 solution on AWS Marketplace extends its reach to over 330,000 customers, offering a seamless way to find, purchase, and deploy its configurable card issuance and virtual accounts platform.

🇮🇳 India-based FinTech startup TechFini has received approval from NPCI to facilitate UPI-based payment solutions to banks, financial institutions, and FinTechs. This approval acknowledges the firm’s efforts to enhance the payments ecosystem and help their clients and customers to experience seamless UPI payments.

OPEN BANKING NEWS

🇬🇸 QR code payments FinTech Keepz is the first company to obtain an open banking license from the National Bank in Georgia. With this license, the company is permitted to act as both an account information service provider and a payment initiation service provider.

DIGITAL BANKING NEWS

🇬🇧 NatWest launches banking app on Apple Vision Pro. NatWest will be among the pioneering banks globally to feature its app on the Apple operating system, VisionOS, which showcases a three-dimensional user interface and an input system controlled entirely by a user’s eyes, hands, and voice.

🇺🇸 Moelis-backed app has $113 million trapped in FinTech collapse. People with funds on Yotta and other platforms haven’t been able to access their accounts following the bankruptcy of Synapse Financial. Read more

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Failed crypto exchange FTX and CFTC reportedly agree to $12.7B settlement after extensive negotiations. The parties have been actively engaging in discussions during the last few weeks. This, according to court papers submitted on July 12, 2024 to the US Bankruptcy Court for the District of Delaware.

🇭🇰 Hong Kong’s ZA Bank to provide reserve banking services tailored for stablecoin issuers. The move follows the HKMA’s recent initiative to open sandboxes for stablecoin issuers, underscoring Hong Kong's commitment to becoming a global leader in the FinTech and Web3 ecosystems.

DONEDEAL FUNDING NEWS

🇱🇻 Latvian FinTech Jeff App, a data-driven financial marketplaces operator for the emerging world, has secured $2M in late-seed financing round. With the new capital, the startup will expand into India and other Asian markets, accelerate tech talent recruitment, and enhance their suite of financial products.

🇬🇧 wamo, a digital business account provider for SMEs, announced that it has secured a bridge to Series A round of $5 million USD in growth funding, as well as an EU Electronic Money Institution (EMI) license from FIN-FSA (Finland’s Financial Supervisory Authority), positioning the company for accelerated growth across Europe.

🇺🇸 Matera raises $100M from Warburg Pincus to help the US catch up to Brazil in instant payments. Matera offers software to banks or licensed payment institutions so that they are able to send and receive Pix, assign aliases, generate QR codes and perform other functions within the Pix environment.

🇺🇸 FinTech startup Coast lands $40M just 4 months after its last $25M raise. With this raise, the company says it has now secured nearly $100 million in equity since its late 2020 inception. Simon declined to reveal Coast’s latest valuation. Read on

🇺🇸 JP Morgan is making an equity investment in, and providing a debt facility to, AI-led business-to-business payments platform Slope. JP Morgan Payments is being joined by Y Combinator, Jack Altman, and Max Altman’s new fund, Saga, in the $65 million equity and debt round.

🇸🇬 MAS announced that it will commit an additional S$100 million under the Financial Sector Technology and Innovation Grant Scheme to support financial institutions in building capabilities in quantum and AI technologies, as well as enable the advancement of quantum and AI related innovation and adoption in financial services.

🇪🇪 Estonian FinTech Mifundo gets a €2,5M boost from European Innovation Council. With the received funding, they plan to interface the following countries, further develop the pan-European data model and expand the coverage of the data service in the European Union

M&A

🇺🇸 Capstack Technologies, a Miami, FL-based provider of a loan trading platform for financial institutions, acquired Edge Tradeworks, an institutional-grade whole loan-trading and bank analytics platform. The amount of the deal was not disclosed.

🇬🇧 Meridien Holdings acquires 27% stake in London FinTech DKK Partners. The agreement will include DKK gaining shares in Meridien alongside a multimillion-dollar cash injection to enable rapid expansion. Continue reading

🇪🇺 European Commission will not oppose Advent acquisition of Nuvei. The Commission Director-General Olivier Guersent notified the buyers of the decision in a letter, saying the deal is compatible with the internal market and with the European Economic Area (EEA) Agreement.

MOVERS & SHAKERS

🇨🇦 Merrco Payments in Canada is preparing to assume a new identity, with the transition to be led by a fresh management team. The “group of pioneers” who lent their “strategic investment” to the raise are to now be installed amongst a new team managing the rebranding efforts, according to a statement.

🇳🇱 Dagmar van Ravenswaay Claasen selected as Chairperson of Silverflow’s Supervisory Board. This appointment follows the formation of a supervisory board, bringing a diverse mix of skills, experience, and expertise that will have a direct benefit to the company and its customers.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()