BREAKING: Apple Pulls Plug on Goldman Credit-Card Partnership

Hey FinTech Fanatic!

In a surprising twist in the fintech landscape, Apple has decided to terminate its collaborative venture with Goldman Sachs in the realm of consumer credit. This decision effectively ends the Wall Street giant's aspirations in the consumer lending sector.

According to sources familiar with the situation, Apple has put forward a plan to withdraw from the partnership within an estimated 12 to 15 months.

This withdrawal encompasses the full scope of their consumer-focused alliance, which includes the credit card introduced in 2019 and the savings account initiative launched earlier this year.

Details regarding Apple's future plans for a new card issuer remain undisclosed at this point.

This development is a stark reversal from just a year ago when the partnership was renewed until 2029, a move that was seen as a key strategy in Goldman Sachs' efforts to establish a stronger presence in the consumer market.

Earlier this year I published a deep dive article about the Apple - Goldman Sachs Saga.

To be continued...

Cheers,

ARTICLE OF THE DAY

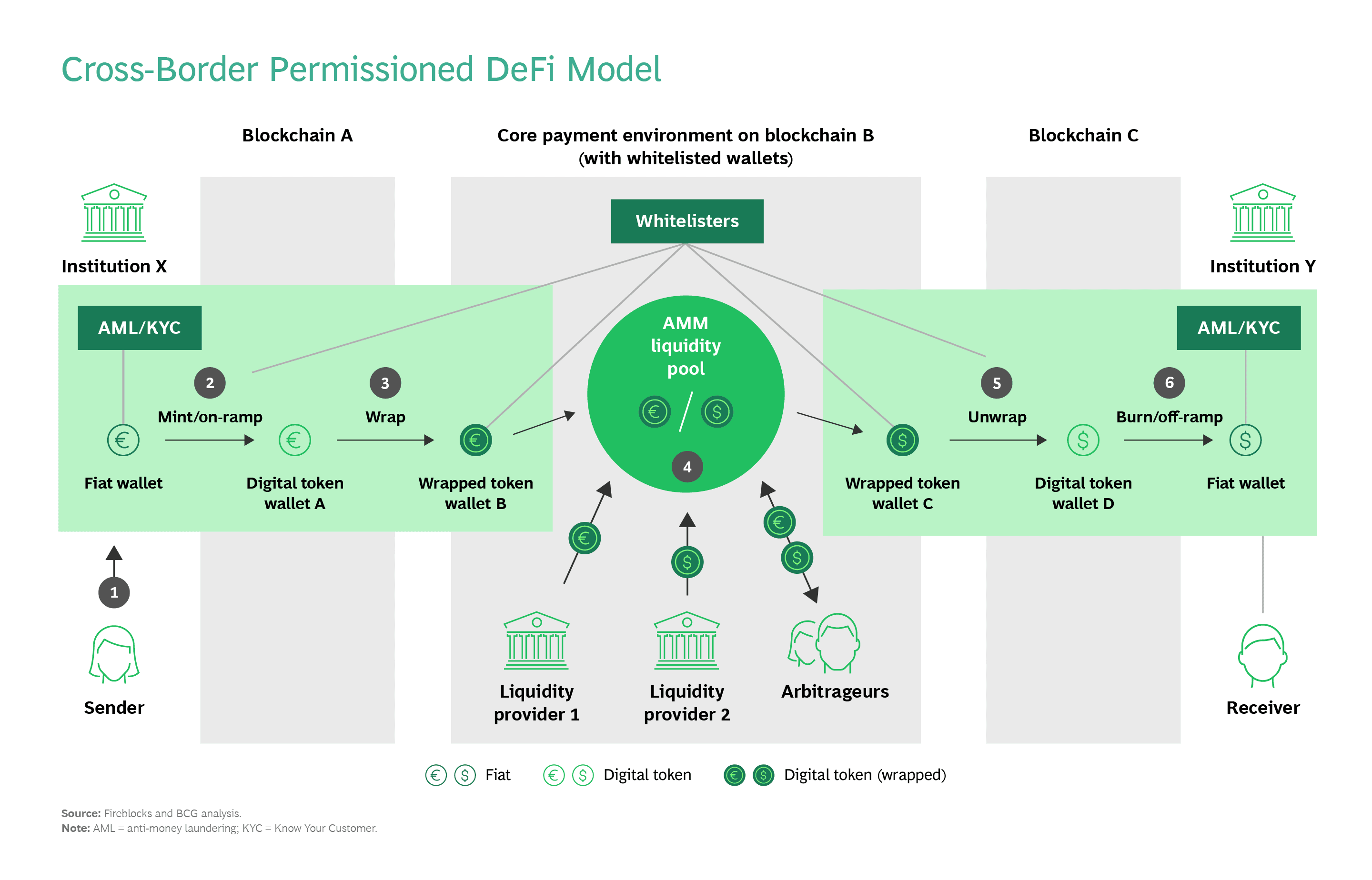

How does Permissioned DeFi Work for Cross-Border Payments? Here are the 6️⃣ steps of the model explained:

POST OF THE DAY

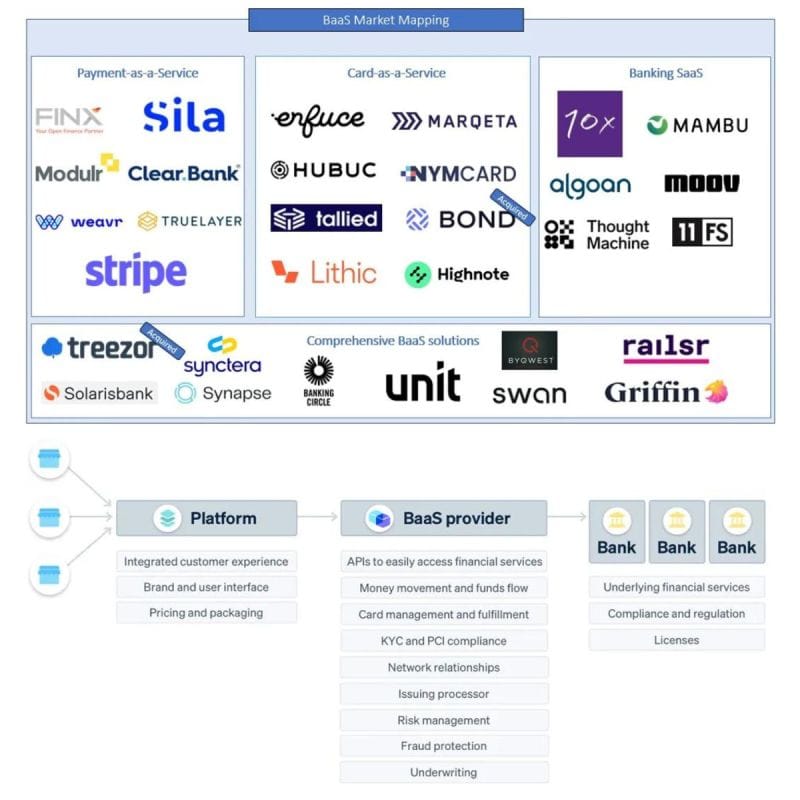

Global BaaS Market Forecast: 15% YoY Growth, $66 Billion by 2030. Banking-as-a-Service software is basically built around 3️⃣ pillars:

FEATURED NEWS

Allianz issues statement about contract dispute with Revolut: In April 2022, Allianz became Revolut's global travel insurance provider for premium or metal account holders. However, Law360 reports that Allianz alleges a contract breach, stating Revolut shifted customers to a new provider before ending the original agreement.

#FINTECHREPORT

🇮🇳 Winning in Uncertain Times. This BCG report on Indian Banking highlights five key imperatives for banks to succeed in complex and unpredictable times. Download full report here

INSIGHTS

🇬🇧 Zopa and Tide given valuation boost by investor Augmentum Fintech, a leading fund in the FinTech sector. The fund, publicly traded in London, focuses on digital finance companies and has observed notable portfolio growth, reaching £198 million by September from £182 million in March.

FINTECH NEWS

🇬🇧 Digiseq receives Mastercard approval for pre-certified concentric ring inlay, opening up the market for small independents and large brands to quickly and effectively launch payment rings within their collections.

🇪🇹 Kacha Wallet integrates with Ezra for digital lending service in Ethiopia. This new partnership has been designed to provide individuals and MSMEs across Ethiopia with a simplified and affordable digital pathway to loan products.

🇷🇴 Aircash has expanded its operations into the Romanian market. Aircash offers a user-friendly mobile application that provides fast and secure money transfer services, as well as deposit and withdrawal operations.

🇧🇷 Clara has announced the launch of its new financial product in Brazil: Clara Conta. This account provides an impressive 110% return on the Certificado de Depósito Interbancário (CDI), which is a significant benchmark in Brazilian finance.

🇬🇧 Moneybox hits one million customers and £5bn AUA. The Fintech has grown by 43 per cent YoY and seen revenue growth of 1047 per cent over the last four years. It has also remained profitable since the second quarter of this year. Read more

PAYMENTS NEWS

🇦🇺 Commonwealth Bank of Australia has teamed up with payment orchestration platform Paydock to roll out 'PowerBoard', providing merchants with a single access to an unlimited number of payment methods and providers. The partnership enables CBA to deliver a dynamic payments experience to its customers through a single API integration.

🇬🇧 Worldline awarded Payment Institution authorisation by the FCA: The licensing confirms Worldline’s ambitions to further reinforce its presence in the UK and enhance its offerings for both local and international merchants operating across the country.

Klarna targets $1 trillion travel sector and anounced a partnership with airline Cathay Pacific to offer fairer, flexible payments to travellers in six countries across Europe: The agreement follows Klarna's global partnership with Airbnb, enabling consumers in seven countries to globally finance their trips.

🇬🇧 Square releases Tap to Pay on iPhone across the UK, making it the third market globally where Square will offer the technology to its sellers, who will be able to begin using Tap to Pay on iPhone, on an iPhone XS or later running iOS 16.4 or higher.

🇧🇷 Inter and Granito Pagamentos have jointly launched a new application, "tap on phone," which transforms a smartphone into a card payment machine. This innovative technology is available to all customers of both companies, including individual users.

OPEN BANKING NEWS

🇬🇧 Lendable implements variable recurring payments with TrueLayer. This strategic alliance reflects a shared commitment to pushing the boundaries of what is possible in the financial technology space. Read on

DIGITAL BANKING NEWS

🇵🇱 Raisin touches down in Poland by announcing the launch of its deposits platform in the country. The platform is designed to bridge the gap between Polish savers and a network of European banks, utilising Raisin's proprietary cross-border savings technology and online marketplace.

Electronic Money Institution Contis fined $840K by The Bank of Lithuania, which accuses Contis of failing to establish adequate AML provisioning to electronic money distributors, delegating the responsibilities for sanctions screening to partner institutions but failing to ensure these duties were properly carried out.

🇪🇬 Codebase joins with eFinance Investment Group to launch BaaS joint venture that will help financial institutions in Egypt transform by providing them with a full range of digital banking, neobanking, lending, and payment solutions. Read more

Revolut mulls auditor switch as banking licence decision looms. BDO's March audit report raised concerns about the completeness and occurrence of £477 million in the debit card provider's revenues. Execs are reportedly considering replacing BDO with a new auditor, but the company is expected to stay with BDO until the end of its 2023 financial year.

BLOCKCHAIN/CRYPTO NEWS

🇦🇪 Wio Bank taps Fuze to provide virtual asset trading services. Wio Invest enables customers to effortlessly buy and sell popular virtual assets, providing easy access to thousands of global stocks, ETFs, fractional shares, and UAE IPOs in a single, integrated app.

DONEDEAL FUNDING NEWS

🇸🇬 Pathao founders’ new firm Wind secures $3.8m round led by GFC, Spartan Group. The company’s goal is simple: open up the payment corridor between Southeast Asia and the US. The fresh funds will go toward product development, strengthening compliance and licensing measures, and other initiatives.

🇸🇻 DiMO recently celebrated a major milestone with the successful closure of its Pre-Series A funding round, raising $1.2 million. This funding, consisting of equity and a credit line, aims to expand DiMO's influence in Central America. More here

🇦🇪 Flow48 secures $25 million in pre-Series A funding. Flow48 provides upfront financing to SMEs to facilitate their growth by transforming future revenues into up-front capital under flexible terms. The new financing will accelerate the company’s expansion plans into South Africa

🇰🇼 Kuwait’s Raha raises $7 million pre-Series A. Raha is a multi-sector technology and automation provider, offering an e-grocery platform along with ShopRaha, which features an automated robotic fulfilment centre. The funds will enable Raha to fuel its expansion to Saudi Arabia and the UAE.

M&A

🇸🇬 Temasek Trust to acquire MoneyOwl, giving it a second lease of life barely three months since it announced that it would wind down the business. The move aims to develop targeted products and solutions catering to community groups.

🇺🇸 OneMain buys auto lender Foursight from Jefferies for $115M. Upon close — expected in the first quarter of 2024 — OneMain will acquire Foursight’s $900 million loan portfolio, mostly composed of automobile retail installment contracts made to near-prime borrowers.

MOVERS & SHAKERS

🇬🇧 HSBC hires CEO to lead embedded finance venture. HSBC wants to develop and commercialise embedded finance solutions, with Vinay Mendonca hired from HSBC’s global trade and receivables finance division to get it up and running.

🇬🇧 Monkey, a marketplace for advance payments of invoices and credit card receivables, has recently strengthened its commercial team by hiring three new executives: Danilo Castro from Standard Bank, Nataly Pavan from Santander, and Roberto Matos from Mercado Bitcoin.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()