Apple Pay Turns 10: A Decade of Innovation

Hey FinTech Fanatic!

Jennifer Bailey, Apple’s VP of Apple Pay, reflects on a decade of changing how the world pays. From the early vision of using your iPhone for everything—from groceries to train tickets—Apple Pay has transformed into a global payment leader, now active in 78 markets and supported by over 11,000 banks.

One standout moment? The launch of Apple Pay for Tokyo’s transit system, where commuters tapped iPhones and Apple Watches to breeze through turnstiles. No cards, no cash—just seamless payments.

With 90% of users praising its ease, 88% its privacy, and 87% its security, it’s no wonder Apple Pay boasts a 98% recommendation rate. And Apple isn’t stopping here—next up, rewards, installment payments, and more ways to connect with your favorite banks and issuers.

Cheers to 10 years of making payments effortless, secure, and trusted.

Catch you next time!

Cheers,

BREAKING NEWS

🇺🇸 Stripe has acquired stablecoin platform Bridge in a $𝟭.𝟭 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 transaction, marking the largest acquisition in the crypto industry to date. Techcrunch founder Michael Arrington confirmed the news through a post on X, emphasizing the significance of this milestone deal. The acquisition of Bridge reflects Stripe’s growing commitment to cryptocurrency.

#FINTECHREPORT

📊 The Edgar, Dunn & Company and Ingenico FinTech report on "𝗧𝗵𝗲 𝗙𝘂𝘁𝘂𝗿𝗲 𝗼𝗳 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗔𝗰𝗰𝗲𝗽𝘁𝗮𝗻𝗰𝗲," provides valuable insights into the evolving landscape of the retail and payments industries. Read the complete report

FINTECH NEWS

🇵🇱 PayPo has officially revealed plans to release virtual cards that allow purchases under the “buy now, pay later” model. Currently, the product is being tested by several thousand customers, and in November, it will be made available to all interested users.

🇺🇸 US FinTech start-up CapWay shuts down.The FinTech focused on financial inclusion has shut down, with founder Sheena Allen announcing on LinkedIn that the start-up is 'no longer an active business.' Link here

🇺🇸 LoanPro launches Smart Verify tool for KYB/KYC and ongoing monitoring. This new suite of data solutions integrates third-party data sources into their platform for rapid identity verification and ongoing monitoring for business and consumer accounts.

🇺🇸 Ultimate Care partners with DailyPay to support employee financial wellbeing. Within this partnership, Ultimate Care is modernizing its benefits offerings by providing the financial wellness benefit to empower all its employees access to their earned pay at their convenience.

🇺🇸 CFPB sues Climb Credit and 1/0, alleging ‘False Promises’ to borrowers. The regulator’s complaint alleges that the companies offered loans for programs that had failed their return-on-investment analysis or that they had not analyzed, and in some cases failed to properly disclose annual percentage rates and loan origination fees.

🇮🇳 8i Ventures nears final close of second fund on the back of 12x returns from M2P. The firm has secured commitments from major institutional investors like GMO FinTech and TVS Credit, along with significant banks and global corporations. The fund's final close is expected in the coming months, aiming for a range of $40 to $60 M.

🇯🇵 Mitsubishi acquires half of Ayala's stake in FinTech unicorn Mynt. Ayala Corp. is selling half of its stake in Mynt to Japan's Mitsubishi Corp. for a minimum of 18.4 billion pesos ($318.89 million). Read the full piece

🇺🇸 Nasdaq turns to AI to improve bank and insurance risk assessment. The new functionality will be woven into Nasdaq’s Calypso platform, used by banks, insurers and other financial institutions to do things like access capital markets, manage risk and adhere to regulatory reporting obligations.

🇬🇧 Card fraud scourge prompts fresh call for social media action. UK Finance has said: “We need the social media, technology, and telecommunications sectors to do far more in partnership with us to protect the public and society from fraud.”

➡️ FinTechs are literally passing the buck to private credit. Once-prominent companies like Klarna, SoFi, and Upstart have been selling loans worth billions of dollars. This latter group has been hammered by higher interest rates, heavy expenses and limited profits. Keep reading

PAYMENTS NEWS

🇰🇪 Kenya’s central bank plans instant payment system across all banks and FinTechs. This would mark a big advance in the country’s money transfer network. The Fast Payment System (FPS), will allow instant transactions across all financial institutions, including banks and payment service providers (PSPs).

🇰🇪 Bank of Kenya migrates national payment system to ISO20022. This move marks the modernisation of Kenya’s national payment systems, and will bring with it numerous benefits for the speed, security, efficiency, and convenience of payments for financial institutions in the country.

🇺🇸 Apple celebrates 10 years of Apple Pay. The digital wallet is used by hundreds of millions across 78 markets, supporting over 11,000 banks and networks worldwide. During its anniversary celebration last week, Apple announced plans to expand features like redeeming rewards with more partners and offering additional installment loan options.

🇦🇺 RBA reviews card payment regulations to ease merchant costs. The regulator is undertaking a significant Review into Retail Payments Regulation, aimed at evaluating the costs that merchants endure when accepting card payments and the existing surcharging framework.

🇺🇸 Cash App Pay integrates with Lyft for seamless payments. The partnership puts the convenience and accessibility of paying with Cash App Pay front and center, focusing on the preferences of the next generation of customers.

🇮🇩 Mastercard and ASEAN Foundation sign MoU to launch Cyber Resilience Program to bolster cybersecurity capacity across the region. As part of this collaboration, the parties will focus their efforts on three main pillars: raising awareness, providing skills and training, and improving capacity through technology and intelligence.

🇨🇴 FinMont partners with Payválida to strengthen global travel e-Commerce payments. This collaboration offers a unique chance to provide alternative payment methods (APMs) within the FinMont ecosystem, allowing Payválida to expand beyond LatAm and enabling FinMont to integrate into the global market.

🇿🇦 Visa and littlefish team to help Africa’s MSMEs go digital. Through this partnership, the companies will deliver an innovative solution for merchants, offering payment options across traditional POS systems, mobile POS, Tap2Phone, and eCommerce channels, along with additional tools.

🇬🇧 WorldFirst has celebrated surpassing $300bn in total accumulative transaction volume. With a significant focus on providing digital payments and financial services to small and medium-sized enterprises (SMEs), WorldFirst has adopted various solutions to help drive international trade for smaller businesses.

DIGITAL BANKING NEWS

🇬🇧 More than 100 Revolut customers contacting BBC over scams saying Revolut failed them, following a Panorama investigation. Revolut was also named in more reports of fraud than any other major UK bank, according to figures collected last year by Action Fraud - the UK’s national reporting centre for fraud and cyber-crime.

🇭🇰 Hong Kong to rename ‘virtual banks’ to ‘digital banks.’ The Hong Kong Monetary Authority (HKMA) announced that it will amend the Guideline on Authorization of Virtual Banks to adopt the new name from ‘virtual’ to ‘digital banks.’ Continue reading

🇧🇷 Nubank expands working capital offerings for SMEs, sees 150% growth in loan volume. The Working Capital line has been created to address cash flow needs and other business demands, following Nubank’s policy of transparency, with no hidden fees.

🇬🇧 Monzo Business customer base exceeds 500K. With that milestone, the company recently announced a new plan for “bigger small businesses” called Team, designed to give business owners more control over their financial management with less expense administration.

🇬🇧 HSBC UK simplifies loan application for International customers. HSBC UK has launched an initiative allowing international applicants to use their overseas credit history for UK mortgage applications, addressing delays and barriers often faced by newcomers and international customers.

🇺🇸 Capital One has a new tool to help keep track of all your subscriptions. The bank launched a free subscription management tool, enabling customers to track, block, and cancel recurring payments from over 10,000 merchants through its mobile app.

🇺🇸 The OCC has filed an enforcement action against Axiom Bank in Florida. The action was filed due to suspicious activity, insufficient compliance with Bank Security Act and anti-money laundering practices, and poor risk management from the bank.

🇻🇳 Techcombank partners with Databricks for optimised banking solutions. This new collaboration represents a part of Techcombank’s significant investments in digital, data, and digital talent under its 2021-2025 transformation plan. The strategy is expected to also drive faster and more profitable growth for the bank.

🇸🇬 DBS CEO says only half of banks are making enough tech progress. The head of Singapore’s biggest lender said only about half of the banking industry has made sufficient progress in transforming their businesses to embrace digitalization and artificial intelligence.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 PayPal's Venmo can now be used to buy Bitcoin and Ethereum via MoonPay. PayPal is diving deeper into the crypto world. In a recent announcement, the payments giant said that U.S. customers could now buy digital coins and tokens like Bitcoin and Ethereum on MoonPay using their Venmo accounts.

🇬🇧 Cryptocurrency Maneki signs English football marketing deal with Sheffield United. Terms of the deal will see the Maneki logo feature on Sheffield United’s kits. “Together with Maneki, the club aims to create unique digital and in-stadia experiences,” a Sheffield United statement read.

🇺🇸 Paxos to expand to blockchain payments and remittances focused Stellar Network. The collaboration between Paxos and Stellar will further facilitate institutional adoption of stablecoins issued by prudentially regulated institutions.

🇷🇺 Russia expects Raiffeisen, UniCredit subsidiaries to help launch digital rouble. Austria's RBI and Italy's UniCredit are under pressure from the European Central Bank to reduce their exposure to Russia, which has been piloting a digital rouble and plans to begin mass implementation by July 1, 2025.

🇨🇲 Binance turns on mobile money payments for crypto in six African countries. The introduction of this service aims to enhance access to cryptocurrency for users in these regions. Currently, the functionality only supports buy transactions. Read on

PARTNERSHIPS

🇦🇪 Multi Level Group partners with Sipay in order to launch embedded finance and payments platform for customers in the GCC Region. The partnership is expected to offer businesses and companies the possibility to optimise financial accessibility for customers in the GCC area.

DONEDEAL FUNDING NEWS

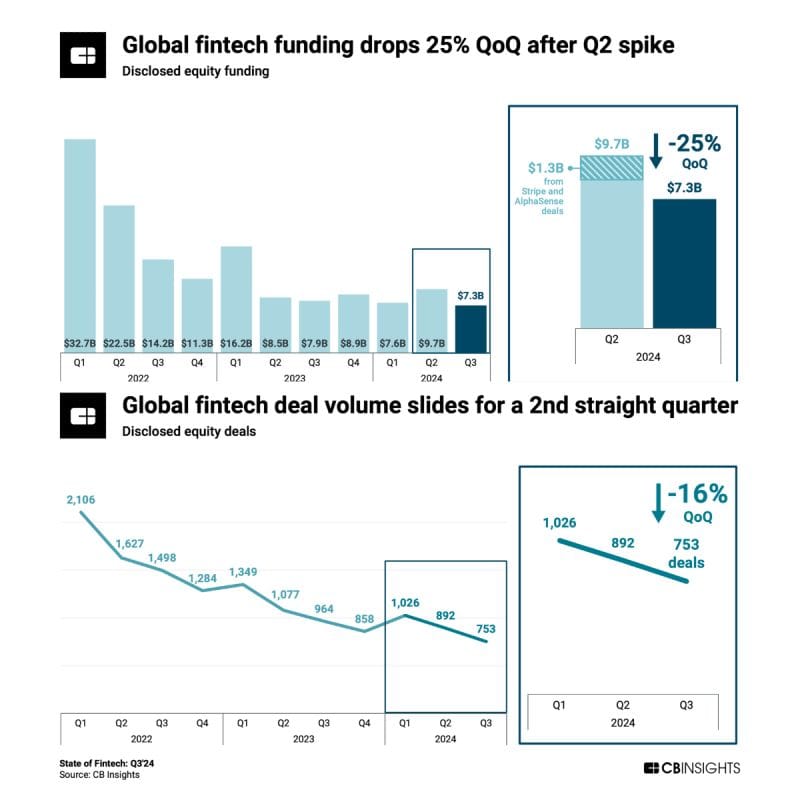

Global FinTech funding sinks to $𝟳.𝟯𝗕, a 25% QoQ decline 🤯

🇳🇿 Emerge (Mainland Portfolio company) raises $12m to redefine banking. Emerge, though not yet a registered bank, aims to become a full challenger bank, helping customers maximize their money. As a digital-first banking alternative, it enables businesses to operate faster, more cost-effectively, and efficiently.

🇲🇽 Mexican FinTech Albo has secured a $60 million line of credit from SixPoint Capital Management, positioning the company to reach profitability in the coming months. Funds will be used to finance personal and business loans in a growing financing market in Mexico.

🇵🇭 PH FinTech lending startup for used car dealers raises $4m. The influx of capital aims to expand OneLot’s services to a broader range of used car dealers and expedite the development of its AI-powered products.

MOVERS & SHAKERS

🇮🇩 Indonesian FinTech lending company Batumbu has appointed a new Board of Directors. Reza Perazi Armadi has been appointed as the new President Director, with Paulus Adinata Widia as Deputy President Director, and Mochamad Tommy Hersyaputera as Director, pending approval from the Financial Services Authority (OJK).

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()