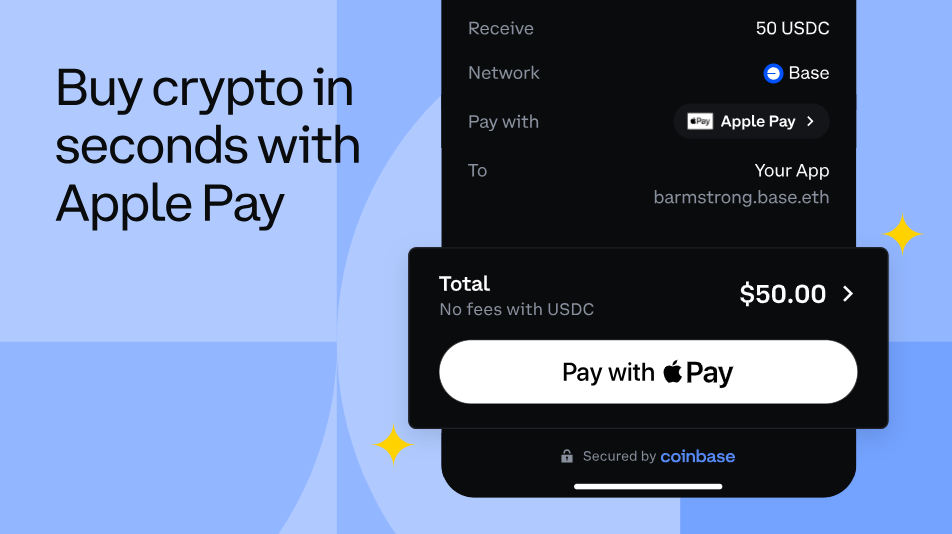

Apple Pay Supports Fiat-to-Crypto on Coinbase

Hey FinTech Fanatic!

Coinbase has launched Apple Pay integration for all fiat-to-crypto purchases via Coinbase Onramp. The service enables users to convert traditional currency to cryptocurrency, with the entire process taking seconds to complete. The system includes a lightweight Know Your Customer (KYC) process for eligible purchases and provides free USDC on and off-ramping.

The integration gives applications access to Apple Pay's network of over 60 million U.S. users. For existing apps using Coinbase Onramp, users will automatically see Apple Pay as a payment option when making eligible purchases. New developers can implement the feature through Coinbase's quickstart guide or one-click-buy option.

Coinbase Developer Platform (CDP) has made the integration available immediately, requiring no additional setup for existing Coinbase Onramp applications. The service includes access to multiple payment methods, with Apple Pay appearing automatically for users making eligible purchases.

Read more global FinTech industry updates below 👇 and I'll be back tomorrow!

Cheers,

#FINTECHREPORT

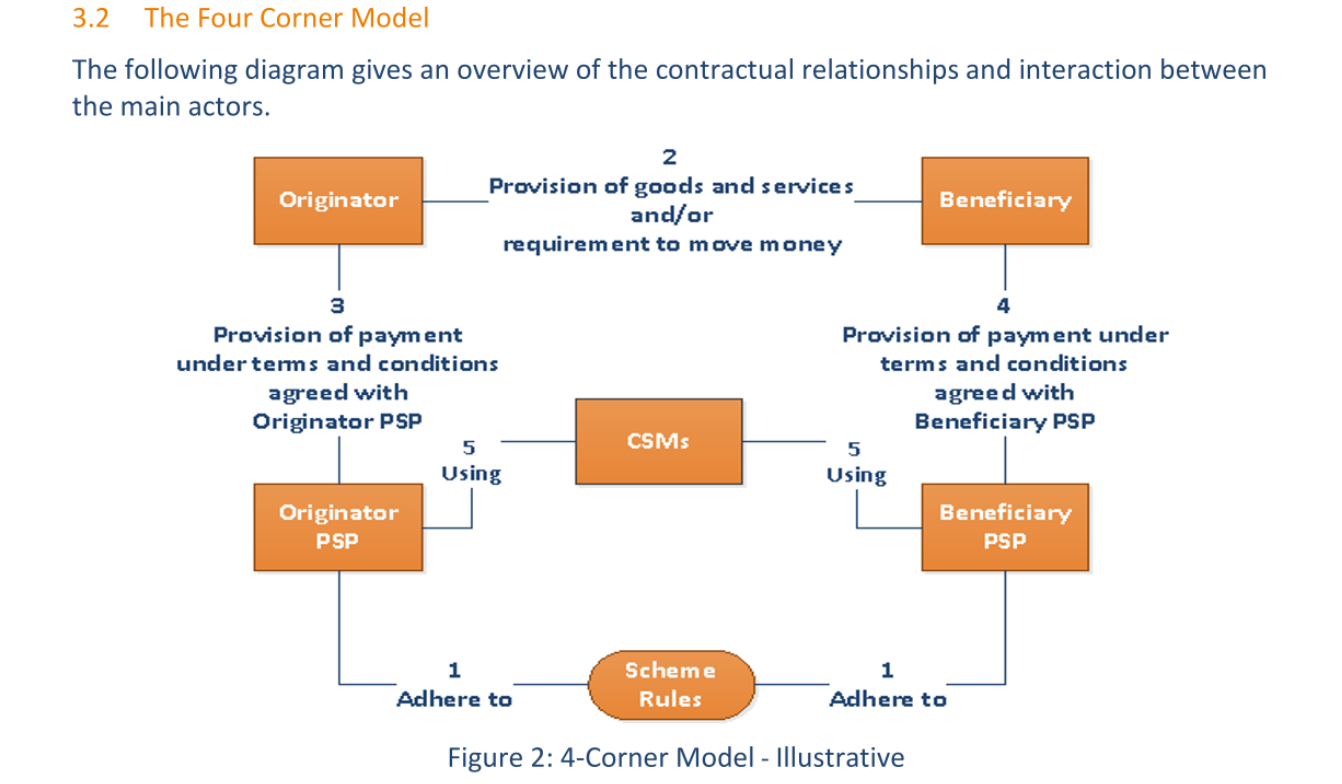

📊 The 2025 SEPA Instant Credit Transfer (SCT Inst) Rulebook by the European Payments Council (EPC) 👇

FINTECH NEWS

🇰🇷 TNG eWallet Now Accepted in Korea. This partnership makes TNG eWallet the first Malaysian e-wallet endorsed by KTO, granting users access to 1.9 million ZeroPay merchants across major cities and tourist hotspots and over 3 million Visa merchants across the country.

🇪🇺 ECB publishes second progress report on digital euro. Since the first progress report, the ECB has updated its digital euro rulebook to harmonize payments across the euro area and concluded a call for applications to select providers of digital euro components and services.

🇺🇸 Masttro launches next-gen platform for wealth management. The platform upgrade comes at a time of rising global asset valuations and an increase in the complexity of estates as more wealth owners acquire illiquid alternative investments. Read on

🇮🇪 Ebury to open new Dublin office as Irish businesses grows. The firm say the move is a response to growing demand for their services in Ireland. The Irish team will focus on serving SMEs, filling a significant gap in the market. Continue reading

🇬🇧 Private markets platform bunch launches in the UK. The move builds on a stellar year of growth for the company, which has tripled both its revenue and Assets under Administration over the past 12 months. bunch provides an end-to-end platform for investors to operate, administrate and transact within private markets.

🇲🇾 Sam Altman’s World launches its digital identity tool in Malaysia. World ID Credential, a digital identity tool by World (formerly Worldcoin), has launched in Malaysia as part of its mission to build an inclusive financial and identity system globally, spearheaded by OpenAI co-founder Sam Altman.

🇦🇺 Zetaris releases AI-powered financial services suite. Last week, Zetaris, a provider of AI data hub solutions, launched a suite of agentic AI capabilities for financial services, including AI Digital Brokers, AI Bankers, and other specialized AI solutions.

PAYMENTS NEWS

🇧🇷 PayRetailers launches enhanced solution to help betting operators comply with Brazil's new sports betting regulations.

Juan Pablo Jutgla, CEO at PayRetailers, said: “The sports betting industry in Brazil is poised for significant growth, but operators will face increasing pressure to comply with the new regulations. Our enhanced Pix solution helps operators strike the right balance between ensuring compliance while maintaining an optimal user experience.”

Daniel Niezgoda, CTO at PayRetailers, added: “As Pix becomes central to Brazil’s financial system, the need for seamless payment processing paired with compliance automation has never been greater. Our enhanced Pix solution offers real-time account validation and intelligent routing, streamlining operations while reducing risks and ensuring efficiency.”

🇮🇹 Construction accident triggers $106 Million Italian payments outage. Italy has restored a payment services outage that disrupted Black Friday sales on Nov. 28-29, reportedly caused by gas roadwork damaging Worldline’s network connection. Nexi was also affected and is investigating, according to Bloomberg and Reuters.

🇧🇷 Brazil's instant payment transactions more than doubled on Black Friday. On Nov. 29, the central bank said, 130 billion reais ($21.60 billion) were transacted using Pix, up from 58.9 billion reais on Black Friday last year. The number of transactions also saw a sharp increase, reaching 239.9 million compared to 136.3 million a year earlier.

➡️ You've probably seen the Stripe BF/CM monitor. But did you know it's a real machine? 🤯 Click here for mind-blowing Stripe stats from the weekend and an insightful video!

OPEN BANKING NEWS

🇬🇧 Ordo joins Charity Finance Group to expand open banking donations for charities. As a Corporate Partner, Ordo will use Open Banking to improve donation access, ensuring more funds reach vital causes. This offers charities faster, secure, and transparent transactions while reducing traditional fees that cut into donations.

REGTECH NEWS

🇬🇧 UK marks progress on creating digital ID for businesses. A coalition led by the UK's Centre for Finance and Innovation Technology has developed a digital company ID to streamline financing and daily business while reducing fraud risk. Read more

🇬🇧 Revolut and Monzo see spike in fraud complaints. Two of the UK’s challenger banks have faced a surge in fraud complaints, with the Financial Ombudsman Service reporting 2,888 complaints about Revolut and 1,864 about Monzo in the six months to June end this year.

DIGITAL BANKING NEWS

🇩🇪 Troubled FinTech Solaris in search of fresh funding. German banking-as-a-Service platform Solaris is reportedly seeking an emergency cash injection of £100 million and will put the business up for sale if it fails to raise fresh funds.

🇬🇧 Revolut faces UK fraud lawsuit after scammer stole €700,000. The firm faces a UK lawsuit over a €700,000 ($735,880) fraud claim by Serbian company Terna Energy Trading d.o.o, raising concerns about scammers on the FinTech platform. Terna alleges that the account belonged to a 22-year-old Czech fraudster.

🇸🇬 Singapore central bank fines JPMorgan $1.8 million over misconduct by relationship managers. The Monetary Authority of Singapore (MAS) said that JPMorgan's relationship managers provided inaccurate or incomplete information to clients in 24 instances of over-the-counter bond transactions, charging them spreads above the agreed rates.

🇬🇧 UK specialist mortgage lender Vida Homeloans secures full banking licence, rebrands as Vida Bank. With its new banking licence, the company will operate as a specialist mortgage bank offering residential and buy-to-let mortgages. The new bank plans to launch a range of savings products “before the end of the year”.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase now lets you buy crypto with Apple Pay in third-party apps. Coinbase announced an integration with Apple Pay on Monday, allowing app makers to build the ability to buy crypto with Apple Pay directly into their apps. The integration is part of Coinbase Onramp, which gives app makers a way for customers to turn their traditional currencies, such as USD, into cryptocurrencies.

🇹🇷 Coinbase withdraws application to enter Turkish market. The list of companies requesting liquidation was updated by the Capital Markets Board of Türkiye (SPK) on November 29th. According to the update, Coinbase withdrew its pre-application, filed in August, and requested liquidation.

🇸🇬 Tenity to invest in XRP Ledger startups as it doubles down on DeFi. The company is expanding its focus on decentralized finance (DeFi) through Incubation Fund II, supporting startups building on the XRP Ledger (XRPL) across Asia and Europe.

🇯🇵 Japanese crypto exchange DMM Bitcoin to shut down. The Japanese crypto exchange will close following a May security breach that resulted in the theft of 4,503 bitcoin (worth $306 million at the time). Customer accounts and custodial assets will be transferred to SBI VC Trade, SBI Group's cryptocurrency division, by March 2025.

Aeon debuts authorization payments on the TON blockchain. Users start by choosing a service or product and initiating a transaction. From there, Aeon’s system prompts them to authorize a payment, locking in the required amount, according to a press release.

PARTNERSHIPS

🇺🇸 Shastic announces partnership with MeridianLink to provide AI workflow automation for banks and credit unions. This partnership reflects the similar missions of MeridianLink® and Shastic to democratize lending for community banks and credit unions, making advanced solutions accessible to thousands of financial institutions.

🇬🇧 Nationwide partners with Experian to digitise payslip income. Nationwide will use Experian’s work report income and employment verification service, which will digitally confirm homebuyers’ declared income “removing the need for applicants to provide manual income proofs, such as copies of their payslips”.

DONEDEAL FUNDING NEWS

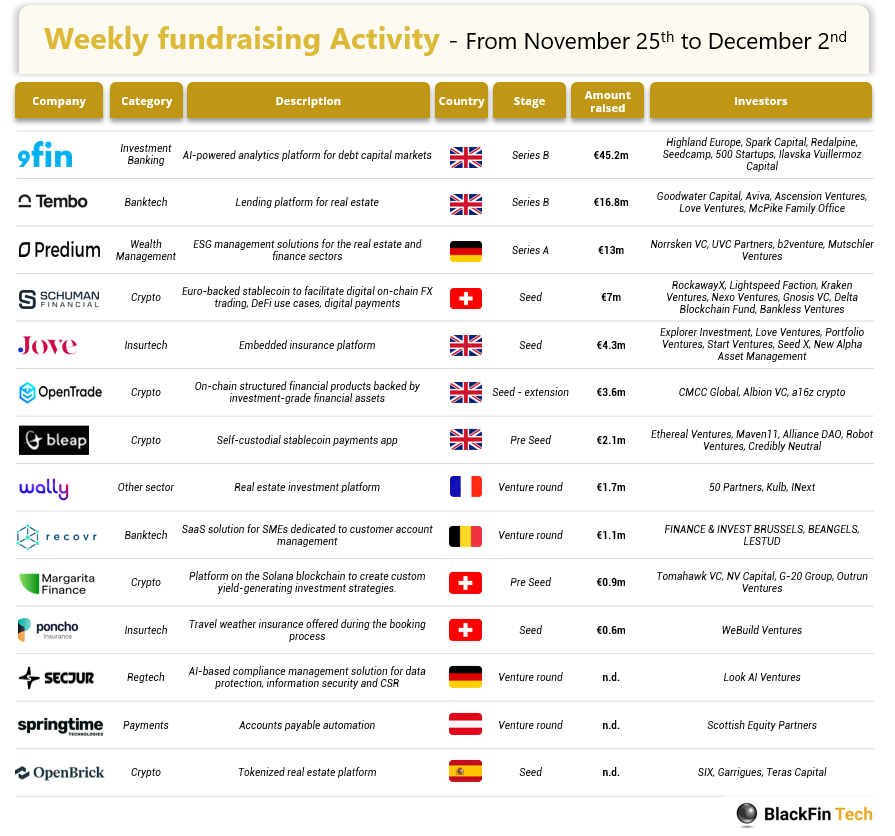

💰 Last week, there were 14 official FinTech deals in Europe, raising a total of €96.3 million, with 5 deals in the UK, 3 deals in Switzerland, 2 deals in Germany, 1 deal in France, 1 deal in Austria, 1 deal in Belgium and 1 deal in Spain. Read the complete BlackFin Tech overview article

🇬🇧 Revolut crowdfunders to cash in on extended secondary share sale. Revolut is offering early-stage investors, including those through Republic Europe, the chance to cash in on its latest secondaryTerna Energy Trading d.o.o share sale in a move that has staved off potential legal action, City AM revealed.

🇬🇧 Tembo raises EUR 16.8 million to support first-time property buyers. The funds will help Tembo expand its solutions, scale its savings app, and introduce new mortgage schemes to tackle affordability challenges in the UK housing market. The investment brings the company’s total funding to EUR 24 million.

🇬🇧 London-based 9fin raises €47.5 million to advance AI-powered debt capital markets platform. The funding will support 9fin’s ongoing development of its AI technology, expansion into the US market, and growth of its analytics team. Find out more

🇨🇮 HUB2 banks $8.5M to become the ‘Stripe for Francophone Africa.’ HUB2 already works with some 55 neobanks, payment companies, remittance companies and cryptocurrency providers, and it has now picked up $8.5 million to expand that list, and to up its game in its tech stack.

M&A

BlackRock is near deal to buy private credit manager HPS. The purchase would vault the firm into the top ranks of private credit as it seeks to become a major force in alternative assets. The deal would leave BlackRock, which manages $11.5 trillion, with more than $500 billion of alternative assets.

🇬🇧 UK FinTech Offa acquires Bank of Ireland’s Alburaq Sharia-compliant home finance portfolio. Offa’s CFO says that customers transferred through this purchase will now have “access to a wider range of Sharia-compliant property re-financing options”.

MOVERS & SHAKERS

🇬🇧 Sabadell names COO to run UK unit TSB amid BBVA takeover bid. Banco Sabadell has named its chief operating officer, Marc Armengol, to run its UK unit TSB, whose future with the lender is unclear if Sabadell gets taken over. The decision to appoint Armengol was formally taken by TSB’s board.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()