Amazon to Phase Out Just Walk Out Checkout Technology in Grocery Stores

Hey FinTech Fanatic!

Amazon's innovative Just Walk Out checkout system has been a key part of its strategy to revolutionize traditional grocery stores. This system, aimed at streamlining the shopping experience by eliminating traditional checkouts, is currently featured in 47 of its 64 Fresh stores in the U.S. and U.K.

However, Amazon plans to introduce a new series of grocery stores following an 18-month hiatus, moving away from this technology.

According to Tony Hoggett, Amazon's Senior Vice President of Grocery Stores, the upcoming Amazon Fresh stores will shift focus towards implementing Dash Carts, enabling shoppers to scan their purchases as they go.

Furthermore, Amazon intends to upgrade the majority of its current Fresh locations to "version two" stores this year. This upgrade will involve the removal of the Just Walk Out technology from locations where it is present, alongside general enhancements to the store's design and offerings.

A spokesperson mentioned to The Information that Amazon plans to keep Just Walk Out in smaller-format Fresh stores in the U.K. The technology also still features in Amazon’s 22 Go convenience stores, though the company closed nine of those stores last year.

More FinTech industry news is listed for you below, and I'll be back in your inbox tomorrow!

Cheers,

P.s. If you like this newsletter and/or my other content, you can also show your support by becoming a member. I'll be forever grateful.

Now let's dive into the news of today:

FEATURED NEWS

💥 Quietly-Explosive News last week for anyone who cares about consumer privacy in digital banking and access to credit.

Your help is needed! Read on

#FINTECHREPORT

📊 Embedded Finance market to be worth $22bn by 2028. The market for embedded finance is forecast to grow by 148% over the next five years, according to a recently published study. Learn more

INSIGHTS

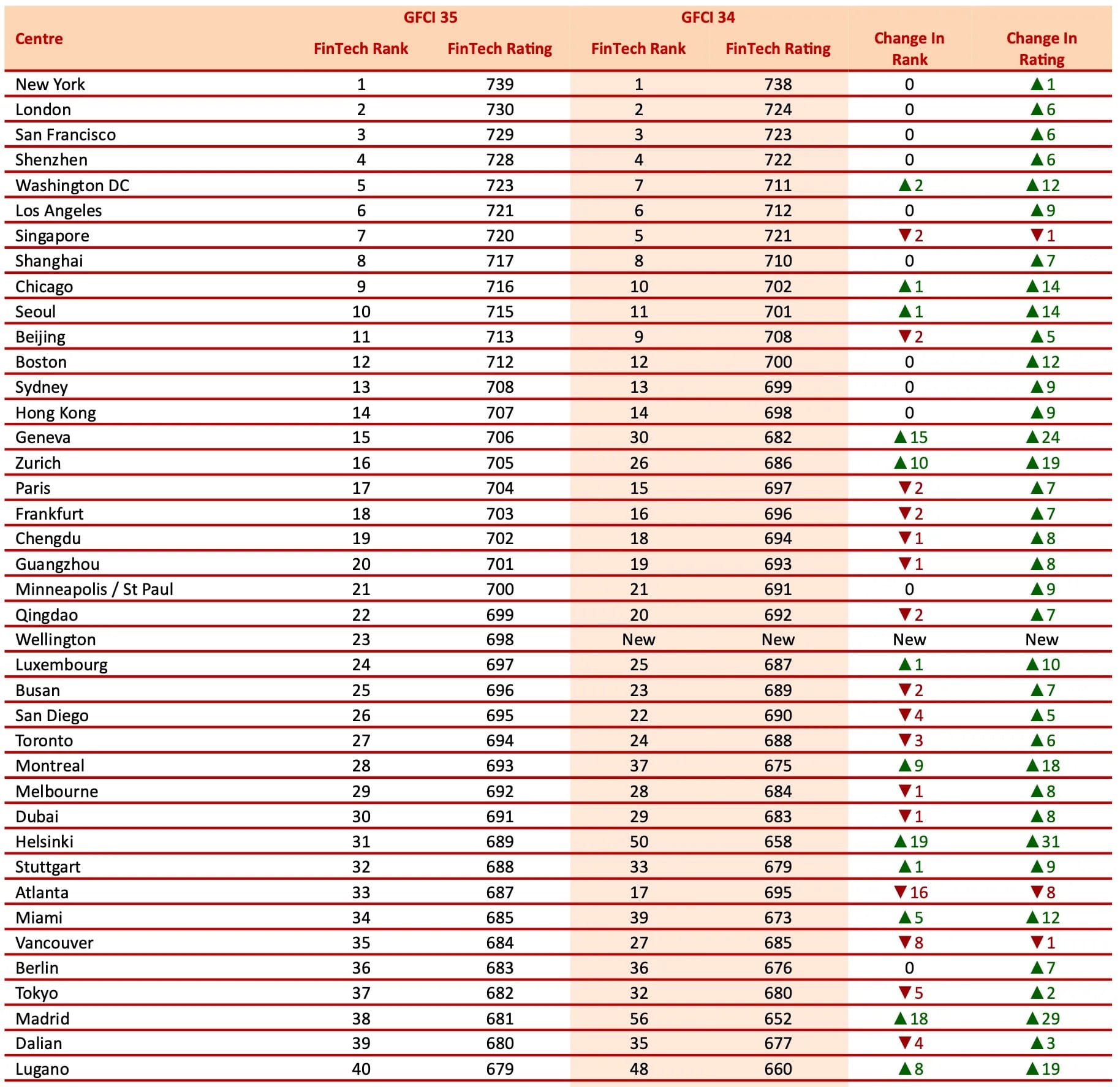

📉 Alongside the main GFCI index, Z/Yen analyzed Financial Centres in terms of their FinTech offering👇

My first thought: Where is Amsterdam??

FINTECH NEWS

🇸🇬 Superapp Grab has declared that its GrabPay Card service will be phased out, effective 1 June 2024. The decision affects both digital and physical versions of the card. The ride-hailing company noted "much higher adoption and use of other Grab offerings (such as PayLater by Grab, GrabPay Wallet) that better cater to the needs of our users".

🇺🇸 Two US FinTechs to pay a total of $59m to settle FTC charges related to PPP. The Federal Trade Commission (FTC) says that two US FinTechs, Biz2Credit and Womply, have agreed to pay a total of $59 million to settle charges made by the commission relating to PPP (Paycheck Protection Program) loan applications.

🇦🇺 Investment app Raiz Invest has announced that it has finalised the exit of its Indonesian Joint Venture operations. In February 2024, Raiz announced that its subsidiary Raiz Invest Australia Limited (RIAL) entered into a binding Conditional Share Purchase Agreement (CSPA) with senior management of the Indonesian business, to transfer RIAL’s entire holding in the Joint Venture.

PAYMENTS NEWS

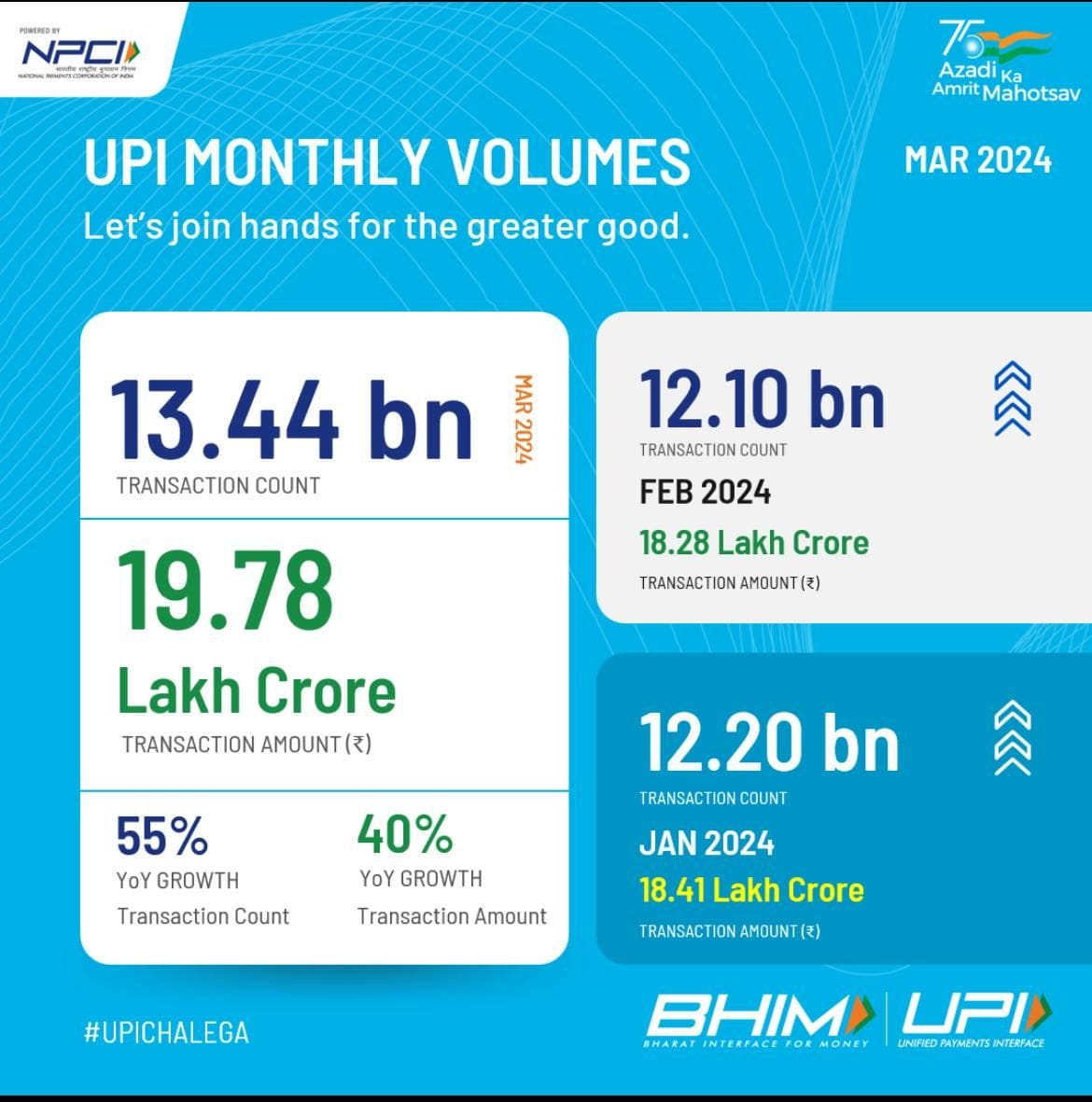

🇮🇳 UPI Payments Volume March, 2024👇

🇧🇭 ACI Worldwide has announced a 10-year strategic partnership with Arab Financial Services (AFS). With this partnership, AFS will utilize ACI's Enterprise Payments Platform, leveraging its multi-language, multi-currency, and multi-institution capabilities to drive the modernization of retail banking for its banking and FinTech customers

🇺🇸 X lands money licenses in Illinois, New Mexico. The social media platform is now nearly halfway to securing the state licenses needed to fulfill owner Elon Musk’s vision of a nationwide payments app. X received money transmitter licenses from Illinois and New Mexico on March 20, bringing the company’s total up to 23.

🇭🇰 Adyen partners with PayMe by HSBC to broaden global businesses' customer reach in Hong Kong. PayMe has over three million users and is accepted at over 65,000 physical and online stores in Hong Kong. Through this partnership, Adyen’s merchants can now accept PayMe as a payment method when their Hong Kong customers check out their purchases online.

🇬🇧 Payment provider Yaspa is awarded Innovate UK grant for Safer Gambling platform. Yaspa’s innovative web-based B2B platform will combine payments and AI to help gambling operators identify vulnerable players in a frictionless manner. The platform, the first of its kind, will help gambling businesses to identify and address some of the UK’s 300,000 estimated ‘problem gamblers’.

🇺🇸 Amazon’s grocery stores to drop Just Walk Out checkout Tech. Amazon’s grab-and-go checkout system, Just Walk Out, has been a centerpiece of its ambitions to transform bricks-and-mortar supermarkets. Now Amazon is gearing up to open a new batch of grocery stores after an 18-month pause—and it’s ditching the technology.

REGTECH NEWS

🇺🇸 Prove Identity, the digital identity FinTech, announced a strategic partnership with BetMGM, a sports betting and iGaming leader, to enhance the security and user experience for BetMGM customers through the cutting-edge Prove Pre-Fill identity solution. Read more

DIGITAL BANKING NEWS

🇲🇽 The Governing Board of the CNBV has officially granted the license for Revolut. Revolut Mexico joins the roster of authorized and regulated neobanks in the country. More on that here

🇷🇺 Tinkoff Bank wins ‘Digital Assets’ operating permit in Russia. Tinkoff Bank, one of Russia’s biggest banking players, has won a license to issue and sell “digital financial assets” (DFAs) in the country. Interfax reported that the Central Bank added Tinkoff to its official list of approved DFA operators on March 28.

🇩🇪 Wise platform and N26 expand partnership for enhanced customer journey. Wise is seamlessly integrated into the N26 app, so customers can make international transfers right from their smartphone on one platform. As part of this transition, they’re rolling out nine additional currencies - BDT, CLP, JPY, KRW, LKR, PKR, THB, TZS, UYU - and opening up more possibilities for international transactions.

🇬🇧 Interesting data point from Revolut: “Since January 2023, 9+ million people globally have trusted us with their international transfers”. In Q4 2023, Wise and Remitly reported 7.2 million and 5.9 million quarterly active customers respectively.

🇬🇧 Bank of England examining claim Metro Bank put customers’ money at risk with ‘pirated software’. The central bank’s regulatory arm received an email, seen by City A.M., in February from a whistleblower raising concerns that software used for the high street lender’s coin-counting machines had been built out by the bank without the developer’s authorisation.

BLOCKCHAIN/CRYPTO NEWS

🇹🇭 Thailand’s biggest crypto exchange, Bitkub Capital Group Holdings, hiring advisers for 2025 IPO. CEO Jirayut Srupsrisopa said in an interview on Monday that Bitkub plans to go public on the Stock Exchange of Thailand in an effort to boost the company’s profile and raise money. The firm is in the process of hiring financial advisers for the listing, he added.

🇺🇸 TradeStation Securities collaborates with OptionsPlay to enhance user experience with Cross-Platform integration. This integration allows TradeStation Securities brokerage clients the ability to trade directly from the OptionsPlay platform with customized pricing and provides them with access to OptionsPlay’s additional service offerings.

DONEDEAL FUNDING NEWS

🇲🇽 Pulpos, a FinTech company dedicated to helping Mexican SMEs transition to the cloud, has raised $4 million to enhance its platform with artificial intelligence. The startup plans to use the capital to expand its software development team and enhance its platform's capabilities by incorporating AI.

🇬🇧 Lloyds Bank invests £3m in proptech startup. Lloyds Banking Group has invested £3 million in Coadjute, an innovative FinTech designed to connect all parties involved in the homeownership journey. Coadjute has also received funding from NatWest, Nationwide, and Rightmove.

🇩🇪 B2B FinTech startup Bavest secures $1.2m in pre-seed funding. The investment round draws support from a notable group of backers that are not only providing capital but are also offering strategic guidance and product development expertise to Bavest’s founding team, according to the announcement.

MOVERS & SHAKERS

🇺🇸 Santander hires former Marcus head Swati Bhatia to lead US digital charge. Bhatia joins Santander Bank as head of retail banking and transformation. She joins Santander as the Spanish giant prepares to launch a fully digital platform in the US for its consumer and commercial businesses.

🇮🇳 Revolut doubles India headcount as country becomes tech hub. Roughly a third of Revolut’s 9,000 employees are now based in India. Staff numbers doubled between December 2022 and December 2023 to reach more than 3,000, Revolut India chief executive Paroma Chatterjee told Financial News.

🇺🇸 PayPal plans to appoint Carmine Di Sibio to board of Directors. Alex Chriss, President and CEO, PayPal said: “If appointed, Carmine will be helpful in sharing his expertise in driving transformation and profitable growth in markets around the world to help us revolutionize commerce globally.”

🇺🇸 Bolt appoints interim CEO as Maju Kuruvilla departs. Justin Grooms has been appointed as interim CEO, with current CEO Maju Kuruvilla departing the firm after more than two years in the role. More on that here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail

Comments ()