Amazon Expands Credit Card Options in Germany and the UK

Hey FinTech Fanatic!

Greetings from Bogotá, Colombia! After an invigorating week in Curaçao, I’m thrilled to be here, diving into what promises to be an exciting week ahead. The agenda is packed with meetings with some of the most innovative minds in the local FinTech industry, and I’m looking forward to the opportunities and insights that this vibrant city has to offer. More updates from Colombia to follow soon.

Now over to my FinTech news highlights of today:

Amazon has launched two new credit cards in partnership with Santander in Germany and Barclays in the UK, enhancing its financial offerings in Europe.

In Germany, the Amazon Visa credit card, offered with Santander, has no annual fee and allows customers to earn 1% back on Amazon.de purchases and 0.5% on other spending.

Prime members can earn 2% back on Amazon purchases during special events like Prime Day. Points can be tracked and redeemed through the Amazon Visa app, and payments are managed via Zinia, Santander's financing platform.

In the UK, Amazon has introduced the Amazon Barclaycard, which offers 1% back on Amazon purchases and 0.5% on other spending for the first year, decreasing to 0.25% thereafter.

Prime members earn 2% back on Amazon during events like Black Friday. The card also comes with no annual fee, a £20 Amazon gift card upon approval, and 0% APR on purchases for the first six months. Additional perks include access to exclusive UK event pre-sales and discounts at select venues.

These new cards, powered by Visa, reflect Amazon's commitment to providing valuable rewards and enhancing the Prime membership experience across Europe.

Enjoy more FinTech industry updates below, and I'll be back in your inbox tomorrow!

Cheers,

Stay on top with daily updates and breaking news on my new Telegram channel. Join now to get essential insights and engage with fellow enthusiasts!

POST OF THE DAY

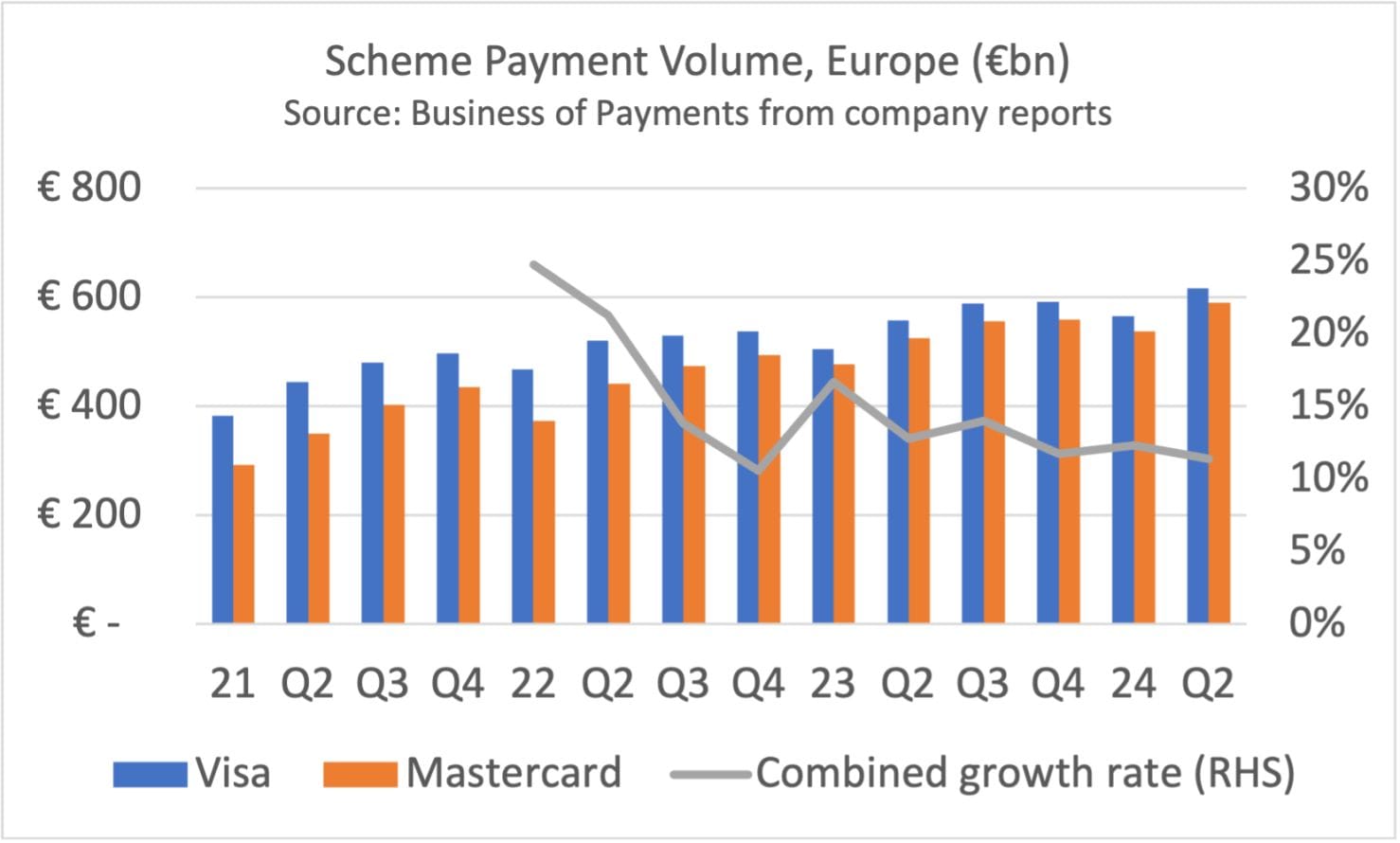

📊 Visa and Mastercard are thriving in Europe, with their total transaction volumes surging by 11% in the second quarter, reaching €1.206 trillion 🤯

PODCAST

🎙️ What Vault’s co-founder learned at Revolut. Saud Aziz explains what it takes to build a locally-grown business banking platform in Canada. Let’s dig in

INSIGHTS

🇺🇸 People who have used Cash App accounts may be entitled to receive up to $2,500 each as part of a $15 million settlement related to a data breach involving the popular payments and investment platform, according to court documents and the company.

FINTECH NEWS

🇸🇬 Thunes has announced that it has hit major growth milestones, exceeding $100m run-rate Revenue whilst remaining firmly on course to reach EBITDA break-even by year-end. Thunes' growth is driven by rising demand for its Direct Global Network, enabling real-time payments in over 130 countries and 80+ currencies.

🇩🇪 Ticombo selects Mangopay to transform the ticket-selling experience. Mangopay will manage Ticombo’s end-to-end payment flow from pay-in to payout as Ticombo works to provide a fair, trusted, and transparent experience for its users worldwide.

🇧🇪 iBanFirst & SeedBlink team to improve payment terms for investors. The collaboration introduces a bespoke solution for fundraising start-ups and their private investors, ensuring faster onboarding and access to preferential FX rates. Read on

🇺🇸 The Timberwolves and WNBA’s Minnesota Lynx have agreed to a multiyear corporate sponsorship deal with the Minneapolis-based buy-now-pay- later company Sezzle Inc., which includes the new jersey patch sponsorship. Terms of the sponsorship deal were not disclosed.

🇮🇳 Stenn partners Payyd on invoice financing for India’s exporters. The collaboration delivers seamless access to Stenn's innovative invoice financing, providing Payyd’s customers with on-demand capital through converting outstanding invoices into cashflow.

🇨🇭 Coop set to discontinue Finance+ project, says “demand did not meet expectations.” A Coop spokesperson explained that the platform fell short of such expectations due to “various new offers from other providers [having] come onto the market and increased competition”.

PAYMENTS NEWS

🇨🇴 Yuno, a global leader in payment orchestration, has formed a strategic partnership with Nequi, a digital financial platform with over 20 million users in Colombia. This collaboration will enable Nequi users to easily purchase products and services from a wide range of merchants, with the added assurance that their transactions are secured by Yuno’s advanced encryption technology.

🇦🇿 AzeriCard integrates Apple Pay and Google Pay with Akurateco’s expertise. This enhancement, facilitated by Akurateco’s payment solutions, marks a significant milestone in AzeriCard’s commitment to providing cutting-edge financial services.

🇧🇷 Nium expands operations in LatAm. This month Nium applied for a Payment Institution License in Brazil, which will enable the company to provide payment services to clients including managing funds locally in BRL and real-time payments through Pix.

🇴🇲 Arab Financial Services introduces Samsung Pay to Oman. This partnership combines AFS's regional expertise in digital payment solutions with Samsung's innovative technology to provide Omani consumers with a secure and convenient contactless payment option.

🇺🇸 Scanco taps Nuvei to boost B2B payments for warehouse management systems. The partnership will enhance Scanco’s new Invoice2Payment (i2PAY) solution. By utilizing Nuvei’s global reach, Scanco will achieve its future international expansion plans.

OPEN BANKING NEWS

🇦🇺 The Australian Government has instigated a “reset” of the country’s Consumer Data Right (CDR), citing the cost of implementation as an impediment to adoption. The Albanese Government has opened a consultation on simplifying consent rules, allowing consumers to give multiple consents in a single action.

DIGITAL BANKING NEWS

🇨🇴 Interest rates offered by financial institutions in Colombia

A snapshot of the landscape👇

🇮🇳 Wise Payments Ltd. plans to start signing up new customers in India for overseas remittances after a pause, seeking a bigger slice of a market that’s swelled to $32 billion. The London-based FinTech firm stopped accepting new clients in recent months in order to revamp its infrastructure after getting a license from the Reserve Bank of India that permits the app’s customers to send more money overseas. Wise plans to restart signing up new customers in the next few months, said Shrawan Saraogi, Asia Pacific head of expansion at Wise.

🇵🇭 Global FinTech Innovations Inc (Mynt), the Alibaba-backed parent company of the Philippines’ finance app GCash, is reportedly looking at the possibility of applying for a digital banking licence in the country now that the central bank lifts a moratorium, planning to accept four more digital lenders in the Philippines.

🇬🇧 HSBC has pledged not to close any more branches until at least 2026 amid politcal and regulatory pressure to maintain access to cash on UK high streets. The lender, which has closed 743 branches since 2015, has also allocated a £50 million spend on refurbishing its remaining 327-strong branch network.

🇺🇸 Pennsylvania-based Customers Bancorp, the parent company of Customers Bank, has been hit with an enforcement action by the US Federal Reserve, with the regulator alleging it “identified significant deficiencies” concerning the bank’s “risk management practices and compliance with the applicable laws, rules, and regulations relating to anti-money laundering (AML).

🇮🇳 Niyo, a travel banking platform, has expanded its services to include flight bookings and visa applications, adding up to its travel-banking solutions for users. This expansion targets India's growing segment of new international travelers.

🇸🇦 Saudi Central Bank (SAMA) has announced the launch of a government banking services digital platform named ‘NQD’. The platform provides ‘easy access’ for government entities to their accounts at SAMA to conduct financial transactions through a ‘secure and unified’ digital platform,’ according to the announcement. The central bank describes NQD as part of its strategy to ‘deliver banking services to government entities, as well as supporting digital development’.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 US-based crypto company BitGo has received a Major Payment Institution License from Singapore's MAS, allowing it to offer regulated payment token services. According to data from the MAS, BitGo is now one of 27 MPI-licensed firms alongside major industry companies.

🇱🇹 Switchere expands payment methods with Apple Pay and Google Pay. In response to the continuous growth of mobile payments adoption, Switchere, a prominent EU-based online cryptocurrency exchange service provider, has announced the integration of Apple Pay and Google Pay as new payment options.

🇳🇬 Binance executive Tigran Gambaryan’s health continues to deteriorate amid prolonged incarceration in Nigeria. Gambaryan’s prison condition had exacerbated a preexisting back problem, a herniated disc, which requires highly specialised surgery, according to Nigerian sources who spoke with DL News under conditions of anonymity.

DONEDEAL FUNDING NEWS

🇬🇧 Revolut backer Balderton Capital has raised $1.3bn in Europe’s largest venture funding focused on start-ups in the region, as capital returns to private technology companies. The fundraise follows new capital for several of the region’s top VC firms this year.

🇰🇪 Conduit’s cross-border payments expand from LatAm into Africa with $6M round. Conduit serves over 50 direct clients; most are import and export businesses, payroll services, and other cross-border platforms. Access full article

M&A

🇺🇸 Janus Henderson Group Plc has agreed to buy Victory Park Capital Advisors in a bid to expand in the fast-growing private credit market, particularly asset-based finance. Discover more in the full article

MOVERS & SHAKERS

🇺🇸 Robinhood welcomes Jeff Pinner as Chief Technology Officer. Jeff is a deeply respected innovator who will help accelerate Robinhood’s product roadmap, scale their infrastructure, enhance customer experiences, and drive operational efficiencies.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()