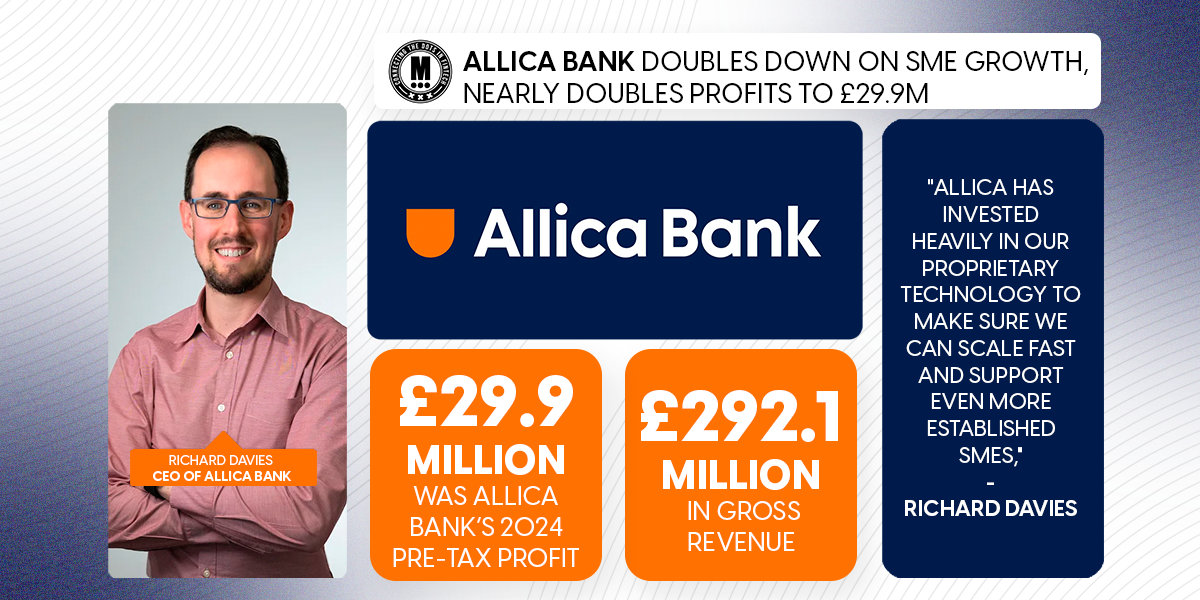

Allica Bank Doubles Down on SME Growth, Nearly Doubles Profits to £29.9M

Hey FinTech Fanatic!

Allica Bank, a UK-based SME-focused digital challenger, has reported a pre-tax profit of £29.9 million for 2024, marking an 86% increase from the previous year. The bank's gross revenue surged by 68% to £292.1 million, bolstered by significant investments in proprietary technology and digital infrastructure.

The bank's loan book now tops £3 billion, with customer deposits surpassing £4 billion. Allica also welcomed 6,000 SMEs to its Business Rewards Account and acquired bridging finance firm Tuscan Capital to expand its lending muscle.

"Allica has invested heavily in our proprietary technology to make sure we can scale fast and support even more established SMEs," said CEO Richard Davies.

With over 3,500 tech updates rolled out last year—including integrations with Wise, Sage, and Xero—Allica is proving it's not just another neobank. Named the UK's fastest-growing private company by The Times and top tech firm by Deloitte, Allica is positioning itself as the go-to bank for the UK's growth SMEs.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

Open banking payments by Ecommpay. Discover how a full-suite open banking solution can streamline your payments, boost conversions, and eliminate the need for external providers. Access here

FINTECH NEWS

🇦🇺 ANNA Money and Shaype partner to launch Australia’s first AI-powered finance “super app” for businesses. The super app will act as a 24/7 financial co-pilot, replacing fragmented financial workflows by consolidating everything from business banking, tax, expenses, company formation, and cards into one seamless platform.

🇬🇧 TS Anil, CEO of Monzo, is joining TechCrunch’s StrictlyVC London lineup. Known for his global leadership background and steady hand at the helm of one of Europe’s most prominent FinTechs, Anil brings a unique perspective on the future of money, trust, and digital innovation.

PAYMENTS NEWS

🇬🇧 eBay announces global payment acquiring partnership with Checkout.com. The partnership expands eBay’s global payment platform capabilities to enhance customer experience and drive operational efficiencies. Guillaume Pousaz, CEO at Checkout.com, said: “eBay is an iconic global commerce leader which continues to push the boundaries of digital commerce.”

🇬🇧 Ecommpay urges merchants to adopt modern mindsets as ticket fraud soars. The company is working closely with merchants to help them understand and tackle fraud to help protect customers. Ticket fraud involves scammers selling fake or non-existent tickets for concerts, sports events, or festivals, often through unofficial platforms, social media, or phishing emails.

🌎 Real-time payments are accelerating through key partnerships and tech upgrades. Orum (with Visa Direct), ACI Worldwide + Ingo, Jack Henry + Mastercard, and Nium (with Interac) are driving faster, broader access to instant transfers in the U.S., Canada, and beyond.

🌍 Stripe to make Tencent's Weixen Pay (WeChat Pay) available on terminals in 20 countries. Stripe is working to expand Weixin Pay’s reach to more countries and plans to introduce recurring payments for eligible merchants as an add-on feature soon. Continue reading

🇸🇬 Revolut rolls out five new currencies, including Chinese Yuan. With this, Singaporean users can now hold and exchange 39 different currencies directly in-app, according to a press release. Apart from exchanging currencies, users can also set stop and limit orders for automatic exchanges.

🇬🇧 Ant International’s WorldFirst launches World Card to simplify payment for global commerce. Having empowered over one million SMEs to scale their businesses internationally, WorldFirst has partnered with Mastercard to develop customised features to enhance global operational efficiency for customers.

🇬🇧 Wise launches ‘Spend With Others’: a new feature for spending with family and friends. The feature allows customers to set up a group of family and friends to spend together straight from Wise, splitting everything from everyday costs to once-in-a-lifetime trips abroad.

🌍 PayPal, TerraPay partner to boost real-time digital transfers across Middle East and Africa. The partnership aims to drive economic growth by making cross-border transactions faster, easier to use, and more accessible by connecting banks, mobile wallets, and financial institutions.

OPEN BANKING NEWS

🇬🇧 Thinslices and Salt Edge partner to simplify financial data aggregation and open banking payments. The partnership will be especially impactful in industries like automotive finance and lending, where seamless access to financial data and real-time payments are essential for smarter, faster decision-making.

REGTECH NEWS

🇬🇧 NorthRow explores potential sale as part of strategic review. In an announcement this week, the company says the review aims to ensure the business continues to develop and grow, both here in the UK and internationally. Keep reading

DIGITAL BANKING NEWS

🇲🇽 Nu México has reportedly been granted authorization to obtain a banking license in the country. The green light was given during the most recent Board of Governors meeting of the National Banking and Securities Commission (CNBV). With this license, Nu México will join a group of just over 50 banks currently operating in the country.

🇬🇧 Allica Bank nearly doubles profits. The growth was driven by significant investment in digital infrastructure, leading to a surge in revenue as the digitally-native bank grew its loan book to over £3 billion and customer deposits surpassed £4 billion.

🇬🇧 Africa’s fastest-growing FinTech Moniepoint enters UK market with launch of remittance product. The MonieWorld application, available via the App Store and Google Play, allows UK customers to send money to Nigeria seamlessly, making financial transactions easier.

🇺🇿 Uzum Bank issues 1.5 million cards and launches nationwide access to plastic cards. Anyone in Uzbekistan can easily order both plastic and virtual cards, making secure and convenient banking more accessible and contributing to financial inclusion by bringing modern financial tools to every corner of the country.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Blockchain bank account platform Bleap partners with Mastercard in latest push to take stablecoins mainstream. The collaboration aims to accelerate this growth by leveraging Bleap's proprietary technology to enable other wallet providers to integrate directly with Mastercard's payments network to facilitate more seamless, stablecoin payments.

🌏 Tether backs Fizen to improve stablecoin payments and self-custody. The partnership with Fizen is to boost the real-world use of stablecoins and help out those who don’t have access to banking. Tether’s investment will help Fizen scale its blockchain tech to boost stablecoin use across different platforms and tackle some of these issues.

🌍 Solayer launches crypto rewards Visa debit card. The card, called the Emerald Card, will use the Solayer Infini Solana Virtual Machine (SVM) L1 chain. It will be available in over 100 countries, including the US, and it has Apple Pay and Android Pay integration.

🇸🇬 Singapore Gulf Bank: Embracing cryptocurrencies and new banking services under a compliant framework. It combines crypto-friendly services with strict compliance supervision to provide a new banking solution for crypto users and digital nomads who are ignored by the traditional financial system.

🇧🇷 Brazil’s Meliuz floats to boost Bitcoin buying strategy. The company said its core business will remain unchanged, but the generation of cash from operations is fundamental to the strategy of acquiring more Bitcoin over time. Read more

🇺🇸 OKX accelerates US expansion with crypto exchange, Web3 Wallet, and new US CEO. Customers in the US can now access OKX's high-performance trading platform, with existing customers migrating seamlessly and new customers gradually gaining access ahead of a full nationwide launch. The firm has also appointed Roshan Robert as US CEO and established its new regional headquarters in San Jose, California.

PARTNERSHIPS

🇬🇧 Thales offers Prime Factors' bank card security system. This collaboration aims to enhance the security and efficiency of payment systems, providing a scalable solution for financial institutions. The partnership underscores a commitment to advancing payment security infrastructure.

🇲🇦 Visa and Chari announce strategic partnership. By leveraging Chari’s deep market insights and innovative solutions, both companies will work together to broaden their customer base and unlock new revenue streams, positioning themselves at the forefront of the country’s digital financial evolution.

DONEDEAL FUNDING NEWS

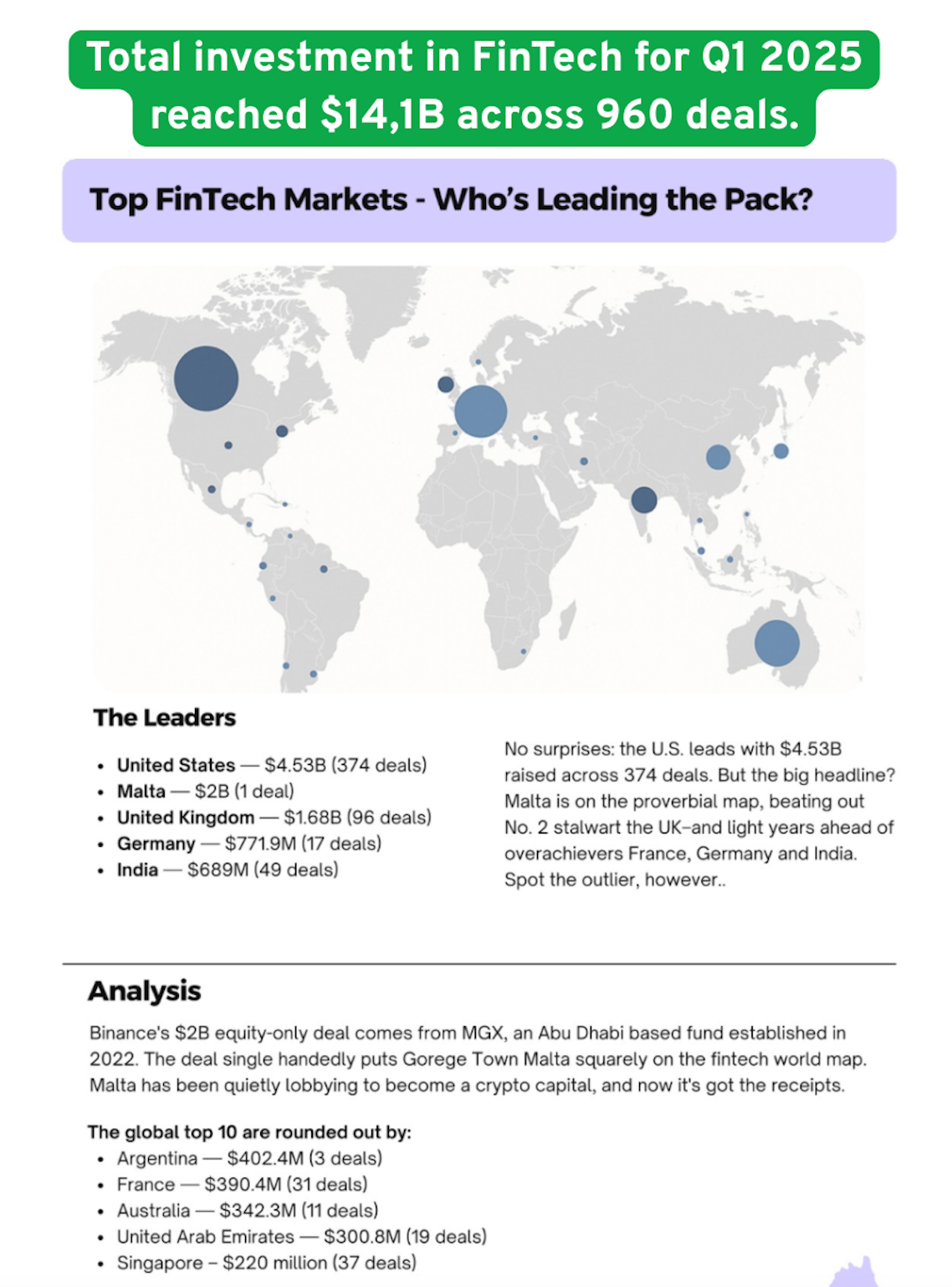

📈 Total capital invested in FinTech for Q1 2025 reached $14.1B across 960 deals.

🌎 Belvo secures $15 million in new round of funding to expand Open Finance access and innovation across Latin America. The new funds will accelerate the expansion of Belvo’s Open Finance product suite across data and payments and advance its AI capabilities to foster the development of more inclusive and personalized financial tools for millions of individuals and businesses.

🇬🇧 Tracxn breaks down where UK FinTech investment is going as it reaches $ 446 million in Q1’25. Despite the UK ranking second for FinTech funding, this was following a 65% decline from the $ 1.3 billion raised in Q1 2024 and a 59% drop from the $ 1.1 billion funds recorded in Q4 2024.

🇮🇹 Italian FinTech startup Tundr raises €7.2M to transform employee benefits: Here’s how. Led by 360 Capital and joined by other investors and notable business angels, the round supports Tundr’s expansion in Italy. Read more

🇬🇧 Coventry FinTech secures £2.6m in round backed by prominent investors. The investment will support the company's expansion in several key areas, including launching what is believed to be the UK's first and only FCA-regulated specialist consumer affordability passporting service, where consumers can share their results.

🇺🇸 Working capital platform C2FO lands $30m with IFC to tap emerging markets. The cash injection has been earmarked to accelerate the platform's development and support deeper expansion into emerging markets. Continue reading

M&A

🇬🇧 Barclays close to selling stake in payments unit to Brookfield. Brookfield could initially buy a minority holding with an option to raise its stake depending on business performance within a window of three to seven years after the deal goes through.

MOVERS AND SHAKERS

🇬🇧 GoCardless appoints Shaun Puckrin as new CPO. Puckrin will lead the product teams for the product development and innovation agenda, including new payment flows, Open Banking capabilities, and continuous product improvements to help merchants collect and send payments from GoCardless’ bank payment platform.

🇵🇱 Zen welcomed Andrzej Bassara as their new COO and Lukasz Neska as their new CGO. Bassara will focus on scaling a secure, resilient backbone to support the company’s growing user base and transaction volume. And Neska's focus will include expanding the base of active ZEN Card users, growing the Rewards Zone program, and strengthening the ZEN Deals offering.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()