Airwallex Expands Rapidly Across EMEA with 152% Revenue Increase YOY

Hey FinTech Fanatic!

Airwallex, a prominent global payments and financial platform, is rapidly expanding in the Europe, Middle East, and Africa (EMEA) region, boasting a 152% year-on-year (YoY) revenue increase and a 125% rise in transaction volume. This growth is notable given the challenging economic environment for the FinTech sector.

The company's success reflects its dedication to helping businesses grow internationally. Airwallex now serves over 100,000 businesses worldwide, highlighting the rising demand for global payment solutions tailored for small to medium-sized enterprises and larger corporations.

More than half of its EMEA customers utilize multiple products, including business accounts, expense management, treasury management, and both virtual and physical cards. This comprehensive suite allows businesses to operate globally with greater efficiency and local adaptability.

In the UK, Airwallex reported impressive revenue and transaction volume growth of 157% and 136%, respectively, driven by new partnerships with companies like Moss and Plum Guide.

Airwallex was founded in Melbourne in 2015, and today is headquartered in Singapore. The company has since grown to 23 locations globally and currently employs over 1,500 people, with plans to hire 300 people by the end of 2024.

The company's EMEA team has expanded to over 150 employees across offices in London, Amsterdam, Vilnius, and Tel Aviv. Additionally, Airwallex is enhancing its presence in the UAE, France, and the Netherlands, viewing these markets as vital for its European expansion.

Recent successes, such as partnering with Bird in Amsterdam, underscore its growing influence in mainland Europe.

Very impressive.

Enjoy more FinTech industry news I listed for you below and I'll be back with more updates in your inbox tomorrow!

Cheers,

Join my Telegram channel for instant access to daily updates and exclusive breaking news from the FinTech industry. Connect with fellow FinTech Fanatics and stay ahead with the latest trends and insights.

POST OF THE DAY

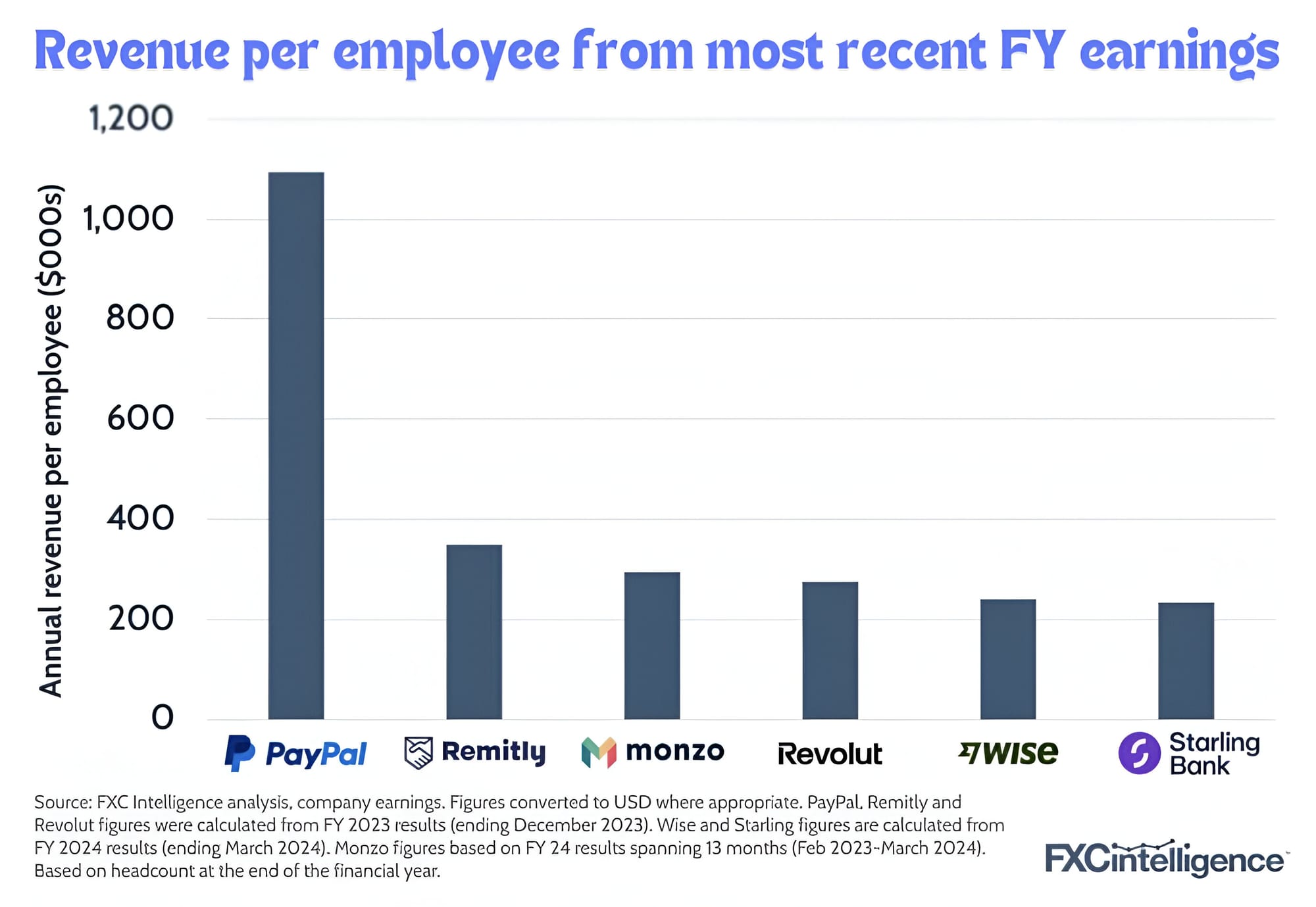

📊 Revolut 🆚 Monzo Bank 🆚 PayPal 🆚 Remitly 🆚 Starling Bank 🆚 Wise

A Revenue per Employee comparison:

#FINTECHREPORT

📜 A new study from Visa, the SME Megatrends report, delves into the ever-evolving landscape of Small and Medium Enterprises (SMEs) in the United Arab Emirates (UAE). Find out more

INSIGHTS

📝 Yuno rides Latin America's FinTech wave to global expansion. An interview with CEO, Juan Pablo Ortega, conducted by bne IntelliNews at London Tech Week: Read the complete interview here

FINTECH NEWS

🇦🇪 Mashreq has onboarded India’s Profinch as a strategic technology partner for its global expansion, with the FinTech company anchoring its key technology transformations. This partnership will see the confluence of Mashreq’s commitment to its customers and Profinch’s drive to excellence, aiming to enhance end customer value and satisfaction.

🇮🇩 GoTo launches a new AI strategy with the introduction of Dira, the first AI-based FinTech Voice Assistant in Bahasa Indonesia. Dira is currently accessible on the GoPay app for a limited number of users and will be rolled out further before being made available on the Gojek app in the future.

🇭🇰 RC365 Holding plc announced that it has gained a Money Lenders Licence (“MLL”) in Hong Kong, which allows the Company to provide money lending services to its clients for the first time and represents progress on its strategy to expand its offering into virtual banking.

🇮🇳 OneCard, a FinTech company, has partnered with Razorpay to create a new path in the Indian credit card market and tap into the fast-growing segment of tech-savvy individuals who value both design and financial control. Read on

PAYMENTS NEWS

🇩🇪 Klarna combines Sofortüberweisung with Klarna Payments to bring customers and merchants the best of both worlds. The aim is to increase the security of the checkout process for both consumers and merchants and to optimize user-friendliness. Consumers in Germany will continue to see the name "Sofortüberweisung" in their payment process.

🇭🇰 BBMSL, a payment solutions provider in Hong Kong, announced a strategic collaboration with PayMe by HSBC, becoming a payment acquirer for one of the territory's most popular digital wallets.This partnership enables BBMSL's merchants to offer PayMe as a secure and convenient payment option.

🇭🇰 KPay merchants can now accept payments from HSBC’s PayMe app. With this, the 33,000 merchants in KPay’s Hong Kong network will now be able to accept payments from approximately 3.2 million PayMe users. Continue reading

OPEN BANKING NEWS

🇱🇹 Bud chooses Vilnius as European hub. After receiving the Account Information Service (AIS) Provider license, the financial data intelligence platform Bud Financial is expanding its team in Lithuania. Bud’s Lithuanian office will become one of the company’s hubs for technical and risk roles, driving growth in the region and across Europe.

🇷🇴 Online accounting FinTech Keez is now connected to all banks in Romania through the new "Online Statements" service. The new "Online Statements" service launched by Keez is carried out under the PSD2 (Payment Service Directive 2), the European directive for electronic payment services aimed at stimulating innovation and helping banking services adapt to new market technologies.

DIGITAL BANKING NEWS

🇸🇬 MariBank just lost US$38.6 million. Digital banks – unlike most incumbents – tend to lose money, and MariBank is no exception. In 2023, its second year of operation, Sea’s Singapore digibank lost a cool US$38.6 million, which it unsurprisingly attributes mostly to expenditure on staff.

🇬🇧 Customer complaints over fraud reimbursement by Revolut surge. The UK's Financial Ombudsman has fielded a 35% surge in customer complaints about requests for reimbursement over scam thefts being denied by Revolut. More on that here

🇬🇧 FCA to lift customer onboarding restrictions for Modulr. In lifting the ban, the FCA states: “The firm has agreed with the Authority that it will not without providing prior written notification to the Authority of at least 10 business days, on-board any new agent and/or distributor.”

🇦🇺 Australian FinTech start-up Chipkie was recently unveiled to the public as it set its sights on providing services to the ‘Bank of Mum and Dad’ sector in Australia. Chipkie aims to enhance security and transparency in informal familial loans, transforming them into legally binding arrangements through a user-friendly interface and tracking dashboard

🇲🇽 BBVA opens global cybersecurity centre in Mexico. The new site will mirror the bank's existing Spanish cybersecurity hub and will incorporate technologies in artificial intelligence and process automation for the detection and prevention of cyber crime.

BLOCKCHAIN/CRYPTO NEWS

🇦🇺 Australian stablecoin payments startup Stables has announced its expansion to Europe in partnership with Mastercard, which co-founder Bernado Billota says indicates a wider trend of the dollar-pegged assets breaking into the mainstream.

🇮🇳 WazirX, one of India’s largest cryptocurrency exchanges, has “temporarily” suspended all trading activities on its platform days after losing about $230 million, nearly half of its reserves, in a security breach. Continue reading

DONEDEAL FUNDING NEWS

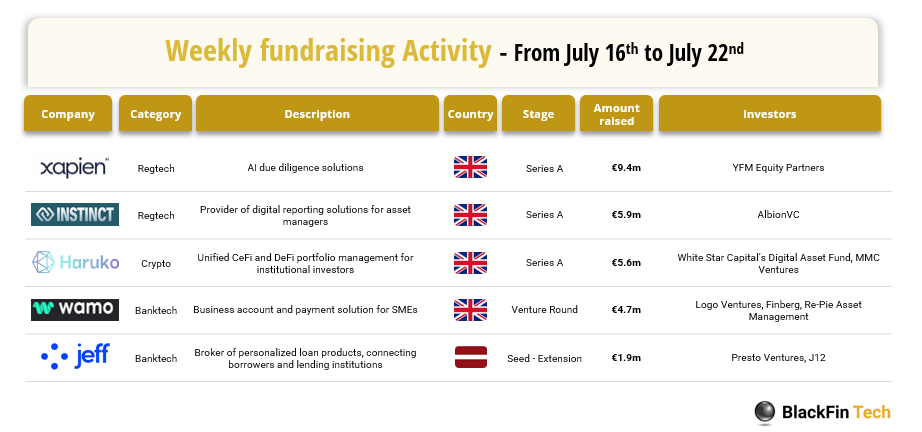

💰 Last week we saw 5 official FinTech deals in Europe for a total amount of €27.4m raised with 4 deals in the UK and 1 deal in Latvia. Read the complete BlackFin Tech article here

🇬🇧 Ebury has appointed investment bankers at Goldman Sachs to lead work on its planned £𝟮𝗯𝗻 initial public offering (IPO) in London, as the FinTech presses ahead with one of the rare listings set for the UK. Ebury, owned by Spanish bank Santander, could be valued at roughly £2bn, they added.

🇱🇹 Alternative lender Finbee Verslui raises €35 million investment. This investment will enable more than 1,500 businesses to be financed faster and on more favorable terms than before. More on that here

🇪🇬 Egyptian FinTech company MNT-Halan has raised US$157.5 million in funding to support its imminent geographical expansion. The current funding round positions the Egyptian FinTech company favorably for further regional growth.

🇮🇳 Stable Money, a wealthtech startup, has raised nearly $15 million in a new round from Matrix Partner, Lightspeed India, and RTP Capital. Especially during the so-called funding winter, the Bengaluru-based company has become one of the few startups to close two rounds within a year.

🇬🇧 Wintermute Trading, the crypto trading firm that has become a dominant market marker since the collapse of FTX, has been in talks to raise fresh money in a funding round, according to investors with knowledge of the process. The firm has been discussing a share sale of $100 million, with some of that money going to existing shareholders.

MOVERS & SHAKERS

🇸🇬 Ingenico appoints Anushka Weeratunga as Regional Managing Director in APAC region. Anushka, who served as Country Business Leader for the Pacific, has been a driving force of Ingenico's business growth in the Pacific region over the past three years

🇺🇸 Brex names Sibongile Ngako as chief compliance officer. In her role, Sibongile will be responsible for leading the company’s compliance program and expanding upon the firm’s current frameworks designed to mitigate regulatory risk.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()