Airwallex Expands into LatAm with Record Profits & Key Acquisition

Hey FinTech Fanatic!

Airwallex is making a major move into Latin America with a dual-market expansion into Mexico and Brazil, marking a significant step in its global growth strategy. The company has acquired Mexpago in Mexico and secured a payment institution license from the Banco Central do Brasil, enabling it to offer cross-border and local payment solutions in both countries.

This expansion comes alongside record-breaking financial performance, with Airwallex processing $130 billion in transactions, reflecting a 30% year-over-year increase. The company has also reported a 78% growth in gross profit and expanded its customer base to 150,000 businesses worldwide.

Or Liban, CEO of Airwallex Israel and the Middle East, commented on the expansion: "Airwallex is committed to providing Israeli companies with the ability to expand their businesses into Latin American countries, especially Brazil and Mexico. Through our global financial infrastructure and the licenses we have received in these two major economies, we offer a reliable, efficient, and cost-effective platform for executing cross-border and local payments."

More details on this and other FinTech industry updates are below 👇

Cheers,

SPONSORED CONTENT

Schedule a meeting at FinTech Meetup

POST OF THE DAY

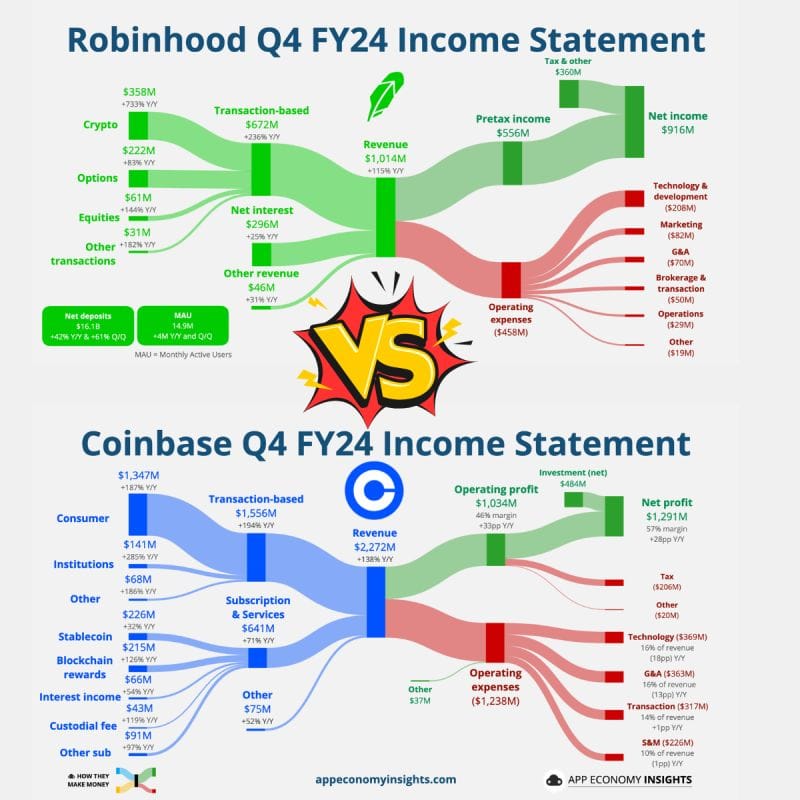

🇺🇸 Robinhood has quietly built one of the largest crypto marketplaces in the U.S.

Can Robinhood catch up with Coinbase?👇

FINTECH NEWS

🇦🇺 Airwallex announces record profits (as transactions hit $𝟭𝟯𝟬𝗕) in tandem with LatAm expansion with a dual market strategy targeting Mexico and Brazil. Much of this growth can be attributed to Airwallex’s expansion into new regions and its ability to offer businesses a compelling alternative to traditional financial institutions.

🎤 We are seeing a rebound in FinTech valuations, says N26 CEO. Valentin Stalf, the founder and CEO of N26, discusses the European FinTech space. Watch the complete video

📊 Global FinTech investment falls to seven-year low of $95.6 billion in 2024, but uptick in Q4’24 is a sign of cautious optimism says KPMG’s pulse of FinTech H2’24. The report, based on PitchBook Data Inc., cites macroeconomic challenges, geopolitical tensions, major elections, and valuation concerns as key factors dampening investor appetite.

🇬🇧 NatWest announces the five FinTechs joining new FinTech Growth Programme. TunicPay, Ask Silver, mmob, Aperidata and Sprive were selected to take part in the programme. The programme is an exciting opportunity to use the resources, expertise and networks of an established high-street bank to help them scale-up sustainably.

🇸🇦 SAMA Permits 4 FinTech Startups to Operate Under Regulatory Sandbox. These are: SpireTech for open banking, The Lending Hub and Soar for peer-to-peer (P2P) lending, and Ldun for micro, small and medium enterprises factoring. This underscores SAMA's continued efforts in the development of the Saudi FinTech sector.

PAYMENTS NEWS

🌏 Checkout. com supports HEYTEA’s global expansion with enhanced digital payments experience. HEYTEA customers can now place orders through its app and enjoy a smooth checkout process powered by Checkout.com’s technology. This integration reduces queuing times and enhances convenience, a trend increasingly embraced by consumers worldwide.

🇸🇪 Surfboard Payments offers Tap to Pay on iPhone for customers in Sweden to accept contactless payments. The payment will be securely completed using NFC technology. It also supports PIN entry. Apple’s Tap to Pay on iPhone technology uses the built-in features of iPhone to keep the business and customer data private and secure.

🇺🇸 The checkout button wars have come for PayPal. Checkout has been referred to as the “last few feet” of ecommerce. PayPal was one of the first to address the problem with the introduction of a “button” that could be installed on merchant websites for quick one-click payment.

🇨🇳 Aspire launches Visa Corporate Card for Hong Kong SMBs. By providing access to powerful, user-friendly financial tools, this aims to lay the foundation for a new era of growth and efficiency in Hong Kong’s business landscape. Read More

🇧🇷 Redpin launches international payments service to empower Brazil-to-Portugal real estate investment. The new payment corridor Currencies Direct will facilitate investments in Portuguese property by providing smooth and secure international property payments to Brazilian nationals.

🇬🇧 Emburse brings Apple Pay to customers in the UK. It's a safer, more secure and private way to pay that helps customers avoid handing their payment card to someone else, touching physical buttons or exchanging cash, and uses the power of iPhone to protect every transaction.

🇳🇬 Flutterwave expands its foreign exchange solution “Swap” to its Send App. By integrating Swap into Send App, Flutterwave provides a secure and instant way for users to exchange Naira (NGN) for US Dollars (USD), British Pounds (GBP), and Euros (EUR), with more currencies to come.

REGTECH NEWS

🇲🇩 Paynet partners with Salt Edge to meet Moldova’s PSD2 requirements. This allows Paynet to align with Moldova’s regulatory framework while automating several key processes, including customer consent management, report generation, and fully managed support for Third Party Providers (TPPs).

🇨🇳 PhotonPay enhances global payment solutions with robust compliance and risk solutions. The company integrates AI-powered AML and Risk engine that enhances the speed and efficiency of its "Know your Customer" (KYC) and onboarding processes. The new tool reduces 'false positives' by an average of 50%.

🇺🇸 JPMorgan set to relive ‘huge mistake’ at Javice fraud trial. JPMorgan executives are expected to take the stand in coming days to testify about how the lender was allegedly defrauded out of $175 million by a 29-year-old entrepreneur, drawing fresh attention to how the biggest US bank vets its acquisitions.

DIGITAL BANKING NEWS

🇺🇸 Earnix unveils Earnix Copilot "Alix" to enhance productivity and business performance. This generative AI-driven agent is designed to supercharge decision-making within the Earnix platform, driving exceptional business outcomes and unmatched productivity for insurance and banking organizations.

🇪🇸 Leading Spanish bank Ibercaja partners with Mambu. With Mambu's composable API-first platform and extensive partner ecosystem, the bank aims to reach 200,000 new customers within five years and later deliver future-ready, sustainable financial solutions to its existing customers.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 StanChart to support StraitsX stablecoin reserves. The collaboration aims to enhance the security, transparency, and scalability of StraitsX’s digital payment solutions, facilitating seamless access to XUSD and XSGD for businesses and individuals.

🇸🇬 Robinhood expects to launch crypto products in Singapore in 2025, through the entity of European digital-assets exchange Bitstamp Ltd., which it recently acquired. The company intends to roll out the services with guidance from local regulators, although it hasn’t yet set a launch date, said Johann Kerbrat, VP and GM of Robinhood.

PARTNERSHIPS

🇵🇹 Mastercard and Feedzai join forces to protect more consumers and businesses from scams. By integrating device intelligence, network data, and behavioral biometrics, Feedzai AI identifies suspicious activity as it’s happening so fraud can be stopped in real-time before any money is lost.

🇰🇪 TransUnion and FICO partner to introduce groundbreaking risk solutions in Kenya to expand credit access. This collaboration aims to improve credit-granting processes by equipping lenders with these advanced tools to manage portfolio risk and monitor credit activity.

🇺🇸 Payfinia partners with TAPP Engine to provide instant wealth management capabilities. The partnership enables participating clients to access Payfinia's full suite of instant payment services, enabling an embedded suite of services to support account-to-account transactions, ACH messaging, and instant payment requests.

🇦🇪 Mamo and Paymentology join forces to drive financial inclusion. The partnership will enhance the features and services available through Mamo's existing card program, offering greater rewards and benefits for SMEs across the UAE. Read more

🇨🇳 HashKey Exchange announces partnership with Deutsche Bank. With this cooperation, the bank will provide fiat currency deposit and withdrawal services for the exchange. The service is based on Deutsche Bank's API virtual account solution. Users can deposit Hong Kong or US dollars directly into the virtual account managed by Deutsche Bank.

🇬🇧 Fabrick teams up with Token.io to advance Pay by Bank. As part of their collaboration, Fabrick is set to utilize Token.io’s A2A payment connectivity and infrastructure to support B2B and B2C customers in accepting Pay by Bank in the UK. Continue reading

🇫🇮 Worldline and OP Financial Group strengthen partnership with a new 12-year agreement. This collaboration aims to provide faster transaction processing, improved security features, and innovative digital payment solutions, ensuring seamless operations across all of OP Financial Group's card products.

DONEDEAL FUNDING NEWS

🇺🇸 Digital Bank Varo Bank aims to raise $55 Million. The funding round is part of a Series G offering of preferred shares, not voting common stock and warrants to acquire more common shares. Varo offers savings and credit services. It also includes cards, ATM access, early pay, and other features while touting its “no hidden fees” promise.

🇬🇧 Ziglu raises £5 million and plans to introduce Ziglu Coin. FCA-approved Ziglu lets Brits buy and sell eleven cryptocurrencies, earn yield via its ‘Boost’ products, pay using a debit card, and move and spend money. Users will be able to earn Ziglu Coin unlocking rewards and benefits via an upcoming enhanced subscription programme.

🇸🇦 Saudi FinTech lite secures $3.2m in pre-seed funding. The round was led by Scene Holding, with participation from prominent angel investors, marking a significant milestone in lite’s journey to redefine the payments ecosystem for businesses in Saudi Arabia.

M&A

🇩🇪 Viva.com acquires majority stake in Fiskaltrust. Through this partnership, Viva.com builds on its banking offering to introduce Europe’s first business solution to combine uninterrupted payments, fiscalisation services for sales invoices and receipts, card issuing, deposits, and loans.

🇨🇭 Shift4 Payments has struck a $𝟮.𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 deal for Global Blue. The acquisition enhances Shift4’s unified commerce capabilities and extends its reach to the 400,000+ retail and hospitality locations utilizing Global Blue’s specialized technology solutions supporting cross-border luxury shopping.

MOVERS AND SHAKERS

🇨🇦 Nuvei strengthens executive team with key Product and Compliance hires. Moshe Selfin joins as CPO while Chad Gerhardstein assumes the newly created role of CRCO. These strategic appointments represent Nuvei's continued investment in its product innovation, risk management, and compliance capabilities.

🇮🇪 TrueLayer hires Basil Bailey as CEO of Ireland, head of EU operations. Bailey will oversee the commercial and regulatory functions of TrueLayer Ireland, which holds a European Payment Institution license and is regulated by the Central Bank of Ireland, as well as managing TrueLayer’s European operations.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()