AI Hits Wall Street: Morgan Stanley Expands OpenAI Tools

Hey FinTech Fanatic!

Morgan Stanley is pushing the boundaries of what generative AI can do in the investment banking space. The firm has expanded the use of OpenAI-powered tools into its prestigious institutional securities group, rolling out AskResearchGPT—a next-gen assistant designed to help analysts and traders access Morgan Stanley’s vast research library more efficiently.

As Katy Huberty, Morgan Stanley’s global director of research, says, “We see it as a game changer from a productivity standpoint, both for our research analysts and our colleagues across institutional securities.”

Imagine extracting key insights from over 70,000 reports annually with just a few prompts. This isn’t just about speeding things up—it’s about empowering decision-makers with the highest quality information available.

With nearly half of its 80,000 employees already using OpenAI's tools, Morgan Stanley is setting a high bar. Meanwhile, JPMorgan Chase isn't far behind, with 60% of its massive workforce tapping into similar platforms. The adoption rate is staggering, but we’re only scratching the surface.

As Pierre Buhler of SSA & Co. insightfully notes, “They are ahead of everyone else in terms of market penetration... but it is an emerging market, and we are still at the very beginning.”

AI is rapidly taking over the FinTech space. Who will be next? Tell me more in the comments.

P.S. for the FinTech Runners! Don’t miss out on “Pick up the Pace,” the upcoming FinTech Running event organized by Checkout.com on November 7th in Berlin. Lace up your shoes and join them for a great run, networking, and some exciting FinTech conversations. Register here!

Cheers,

POST OF THE DAY

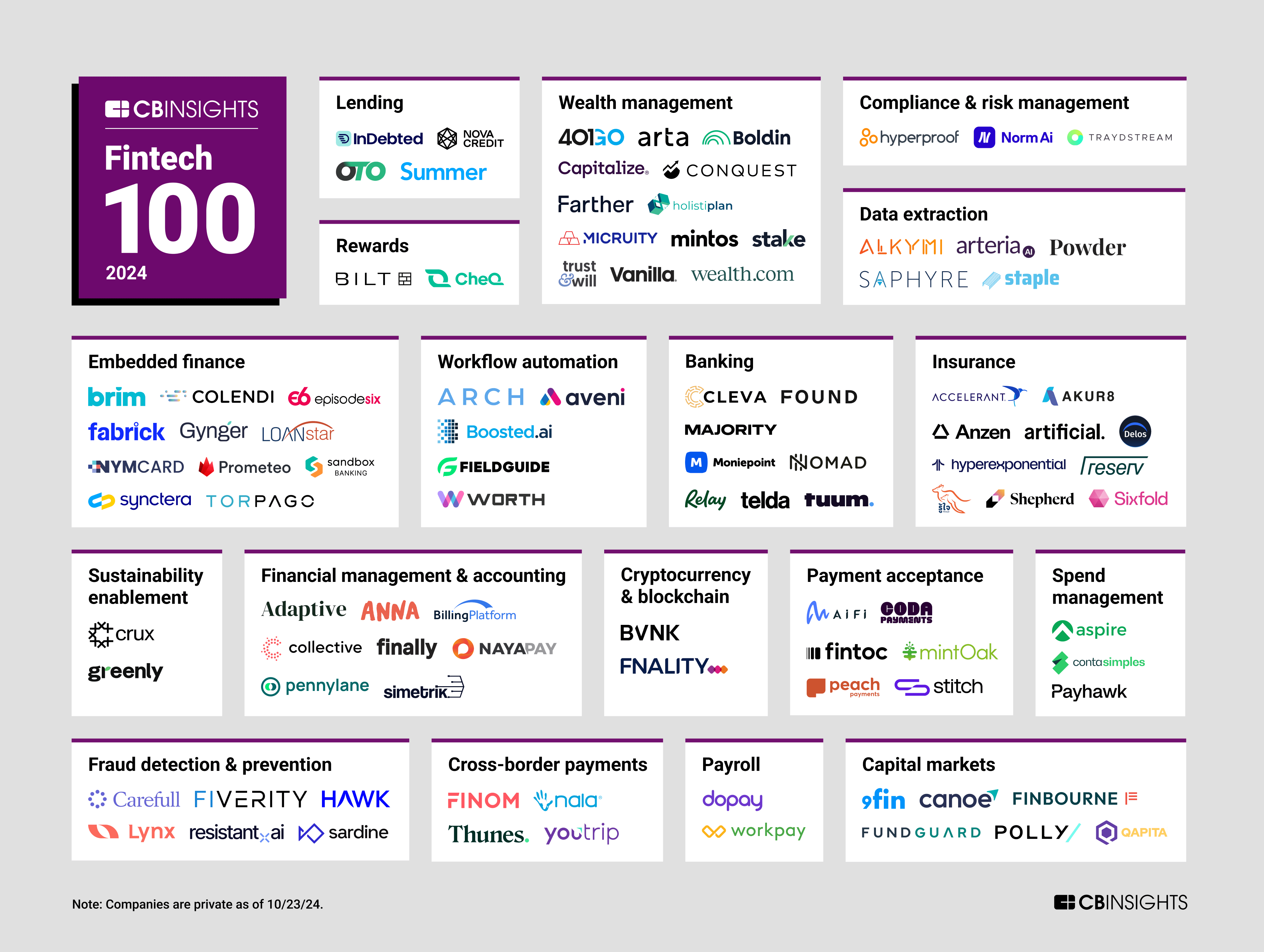

Here is a summary of the 2024 FinTech 100 cohort highlights:

#FINTECHREPORT

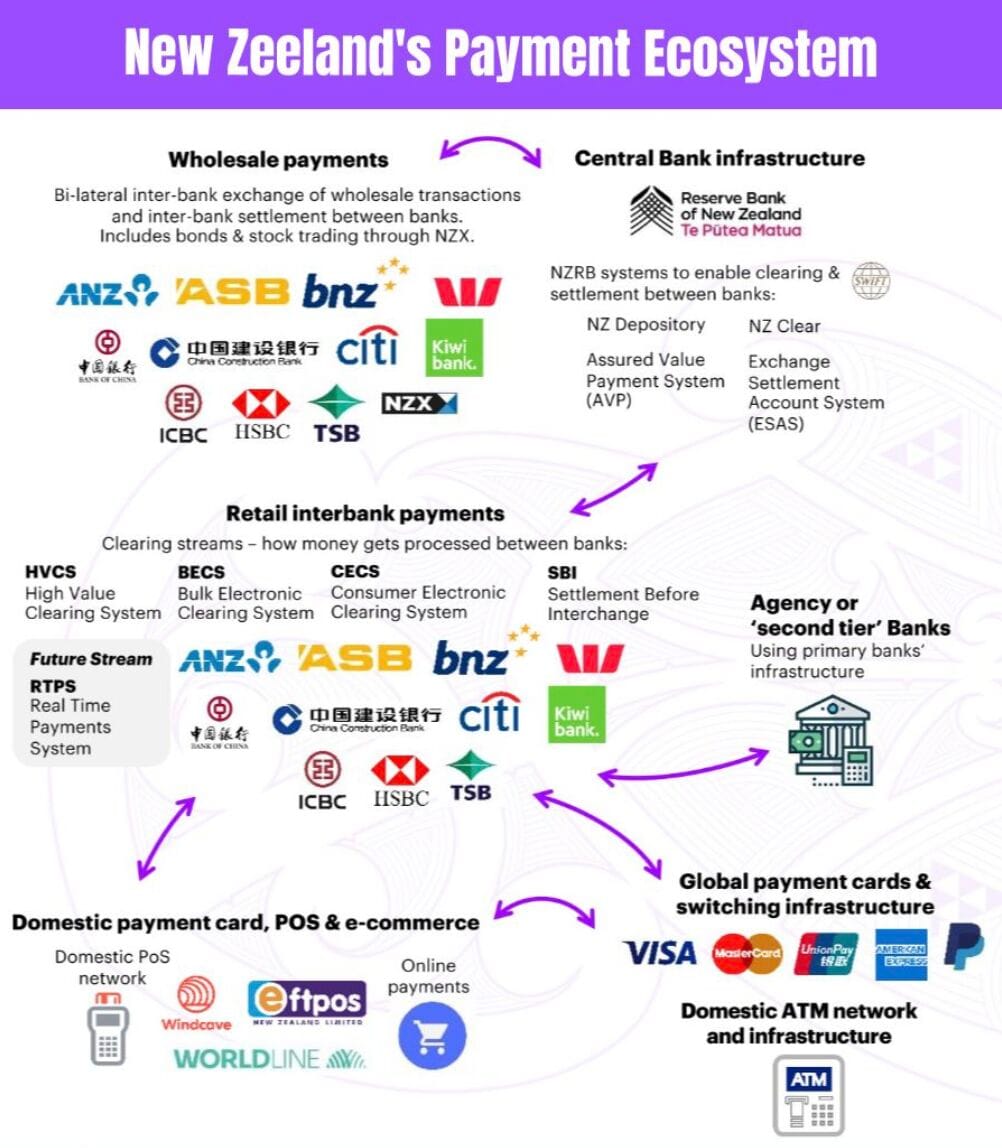

📊 The New Zealand Payments Ecosystem is relatively simple compared to many advanced nations.

INSIGHTS

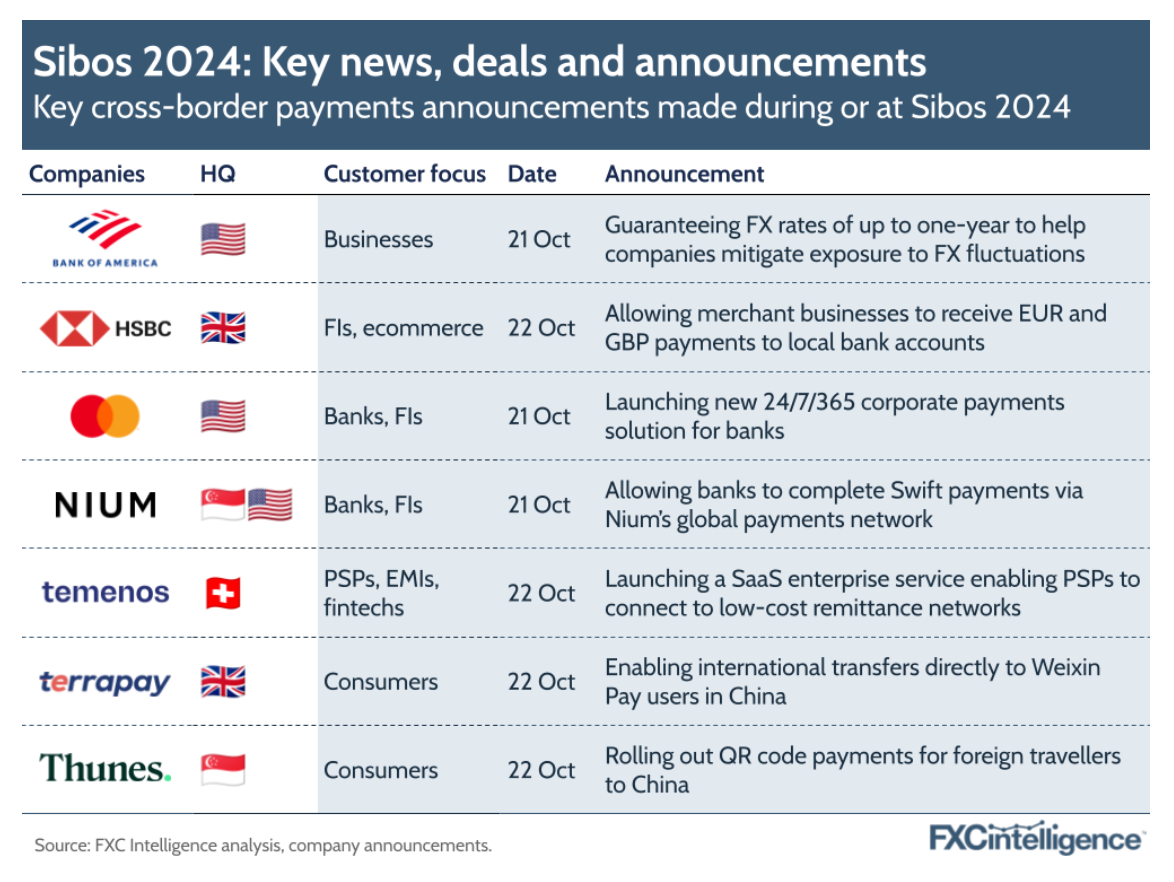

🇨🇳 Swift’s annual Sibos conference took place in China for the first time this week, and with it came the usual flurry of deals and announcements. We were also proud to see our market size data featured in reports launched by EY and Citi to coincide with the event.

Here are some of the main announcements that took place both at and during the conference, share by FXC Intelligence:

FINTECH NEWS

🇺🇸 Western Union’s Digital Business sees 15% growth in transactions. This marked the sixth consecutive quarter of double-digit transaction growth for the Branded Digital Business, the company said in a presentation released on Oct. 23 in conjunction with its quarterly earnings call.

🇸🇬 Singtel to divest its Dash mobile wallet to Western Union. The deal, recently announced, is pending regulatory approval. In the meantime, existing Dash services remain accessible to customers throughout the process. Read on

🇺🇸 Nasdaq's third-quarter profit rises on FinTech strength. Nasdaq reported a rise in 3Q profit, driven by strong demand in its solutions and financial technology businesses. Revenue from the FinTech segment increased nearly 56%, while solutions business revenue rose 31% to $906 million on an adjusted basis.

🇺🇸 Europe losing the SaaS embedded finance race as U.S. strides ahead. A recent research reveals that 33% of SMBs in the U.S. already use embedded finance solutions via Software-as-a-Service (SaaS) platforms, compared to just 11% in the U.K., and 6% in Germany and France.

🇺🇸 ebankIT selects MX as open banking partner to provide secure data access to financial institutions in North America. ebankIT's omnichannel tech and MX's Data Access help banks offer personalized digital banking by enhancing consumer insights to improve service and meet needs.

🇲🇽 Mexican watchdog proposes FinTech reforms to boost financial inclusion. The Federal Economic Competition Commission (Cofece) has proposed a series of changes seeking to ensure that more Mexicans gain access to better and more affordable financial services.

💳 Mastercard has announced the expansion of its Product Express platform in Africa and Middle East, Europe, North America, and more markets in Latin America to help FinTechs launch card programs quickly and through a process that’s simple and transparent.

PAYMENTS NEWS

🥇 Mangopay wins Fraud & ID Verification at the Global FinTech Awards 2024. Alex Taylor, Head of Sales at Mangopay, explained how "a couple of years ago, we [Mangopay] acquired a fraud prevention business and brought that into the wider Mangopay product stack. So it's fantastic that the progress of our teams and the value that we're delivering to customers has been recognised." Click here to learn more

🇫🇷 Cash collection startup Upflow also wants to handle B2B payments. The French startup has announced a shift in its strategy to become a B2B payment platform with its own payment gateway to complement its accounts receivable automation solution.

🇬🇧 Klarna enters £7 Billion UK Gift Card market with launch of Gift Card Store in partnership with Blackhawk Network (BHN). This gives customers the ability to buy gift cards from an extensive selection of brands and pay for them using Klarna's range of Buy Now, Pay Later (BNPL) products and instant debit option, Pay Now.

🇸🇪 Klarna shareholders vote to oust Director Mikael Walther amid tension on board. Walther was removed from the board during a meeting of the company’s investors on Thursday, according to a statement on Klarna’s website. The move was approved by 87% of shareholders, the company said.

🇪🇺 Sweden and Denmark to initiate real-time cross currency settlement service. The ECB is launching the cross-currency service on its Target Instant Payment Settlement (Tips) platform, enabling instant payments in one Tips currency to be settled in another using central bank money. Initially, this will include the euro, Swedish kronor, and Danish krone.

🇫🇷 Worldline partners with Visa Acceptance Solutions to deliver data-driven fraud management solution. The collaboration combines both companies' transactional data and expertise, enhancing Worldline's payment services with Cybersource Decision Manager for robust fraud detection across industries.

DIGITAL BANKING NEWS

🇨🇦 Wealthsimple, the Canadian money management platform, today announced the launch of a Travel eSIM, powered by Gigs. With the introduction of a Travel eSIM, Wealthsimple follows in the footsteps of leading FinTechs like Nubank and Revolut, who launched their own travel eSIMs earlier this year.

🇦🇷 Nubank is taking new look at Argentina under Milei, CEO says. David Velez said that Nubank “will watch” Argentina over the next 12 months. The company is “taking a new look” toward Argentina under president Javier Milei, Velez said in an interview at the Bloomberg New Economy at B20 in Sao Paulo.

🇬🇧 FinTechs’ IPO valuations can look beyond Nubank. The $70 billion Brazilian financial group has become the go-to valuation benchmark for a host of digital “neobank” players keen to become publicly listed companies. For the likes of Revolut, Chime and Monzo there's just one catch: as listed comparisons go, Nubank leaves something to be desired. Find out more

🇺🇸 Morgan Stanley expands OpenAI-powered chatbot tools to Wall Street division. The firm began rolling out a version of an AI assistant based on OpenAI’s ChatGPT, called AskResearchGPT, this summer in its institutional securities group, according to Katy Huberty, Morgan Stanley’s global director of research.

🇩🇰 Danish challenger bank Lunar says GenAI chatbot will handle 75 per cent of customer calls. Its voice assistant moves beyond traditional voice support systems by using a voice native AI model instead of the conventional voice-to-text-to-voice approach.

🇦🇷 "Before the end of the year, we’re going to announce something big in that space because we think there’s a huge opportunity for machine learning and for AI specifically," according to Ualá's Pierpaolo Barbieri. Watch more

🇺🇸 Santander will have a full-service digital bank in US by end-2025, chair Ana Botin said during the Institute of International Finance conference in Washington. Santander is the fifth-biggest auto lender in the United States and is expecting a pick-up in consumer demand, she added.

🇧🇷 PagBank, C6 Bank, and Inter lead the Central Bank of Brazil’s ranking for customer complaints in the third quarter of 2024. Following these three digital banks, Itaú ranks fourth on the list of the 15 largest banks and payment institutions. Link here

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Crypto firm Circle expects the UK to introduce stablecoin laws in ‘months, not years’. Dante Disparte, Circle’s global head of policy, said that he sees the U.K. will soon bring in legislation for stablecoins, a type of cryptocurrency that aims to maintain a constant peg to government currencies such as the U.S. dollar or British pound.

🇹🇷 Garanti BBVA Crypto strengthens security with Ripple and IBM collaboration. This collaboration aims to boost customer trust in Turkey's cryptocurrency market by offering secure storage solutions that combine IBM’s advanced technologies with Ripple’s security features.

🇺🇸 Coinshares opens office in New York amid ambitious expansion plans in the US. The company seeks to strengthen its presence in the US financial market. The office will improve Coinshares' ability to serve a growing base of institutional and retail clients in the United States.

DONEDEAL FUNDING NEWS

🇺🇸 Finix raises $75 Million series C. The firm is evolving into a full-stack acquirer/processor, offering no-code/low-code solutions to provide flexible payment options. Its momentum and Series C milestone reflect the effectiveness of this approach and increasing demand for its services.

M&A

🇺🇸 Socure to acquire Effectiv for $136M. With this acquisition, Socure expands its role in the identity verification and fraud prevention market, entering the $200B enterprise fraud industry, which additionally encompasses payments fraud, credit underwriting, and AML transaction monitoring.

MOVERS & SHAKERS

🇬🇧 TransUnion appoints Madhusudan Kejriwal as CEO for UK and Europe. He will officially join TransUnion on January 2, 2025. The appointment is subject to the required regulatory approvals. Discover more

🇺🇸 Kraken set to add investor Arjun Sethi as Co-CEO. Arjun Sethi, a co-founder of venture capital firm Tribe Capital, is expected to be named co-CEO of cryptocurrency exchange Kraken, working alongside its existing CEO, Dave Ripley, according to two people familiar with the matter.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()