Adyen’s Intelligent Payment Routing Cuts Costs by 26% and Boosts US Debit Payment Performance

Hey FinTech Fanatic,

Adyen has just launched its AI-powered solution, Intelligent Payment Routing, for U.S. debit transactions, designed to enhance revenue while cutting costs. In a recent pilot with major merchants like eBay, Microsoft, and 24 Hour Fitness, Adyen achieved an average of 26% in cost savings and a 0.22% increase in authorization rates.

The solution offers several key benefits:

- Easy Adoption: No extra coding required—simply toggle it on and start saving.

- Improved Performance: Boosts acceptance rates while lowering costs.

- Omnichannel Capable: Works seamlessly across online, in-store, or in-app purchases.

- Speed & Efficiency: Optimizes without compromising transaction speed.

- Network Agnostic: Routes payments across the most cost-effective networks.

As debit card usage continues to rise, this innovation offers a timely way to streamline costs and improve efficiency for merchants.

Cheers,

PODCAST

🎙️ David Weisburd interviewed Steve McLaughlin Founder and CEO at Financial Technology Partners / FT Partners on how FT Partners consistently competes with and beats bulge bracket banks.

They discuss FT Partner’s secret sauce why their companies outperform the competition and how every company can apply these principles to improve their fundraising and M&A activities.

If there is anything you listed today, let it be this podcast:

FEATURED NEWS

🇺🇸 Stripe has a tough time keeping tabs on customers—and that’s a worry for some of its banks. Last year, Stripe learned its partnership with Wells Fargo was in jeopardy. Wells Fargo wanted to end its collaboration with Stripe, citing growing risks and regulatory scrutiny. Read the full piece

#FINTECHREPORT

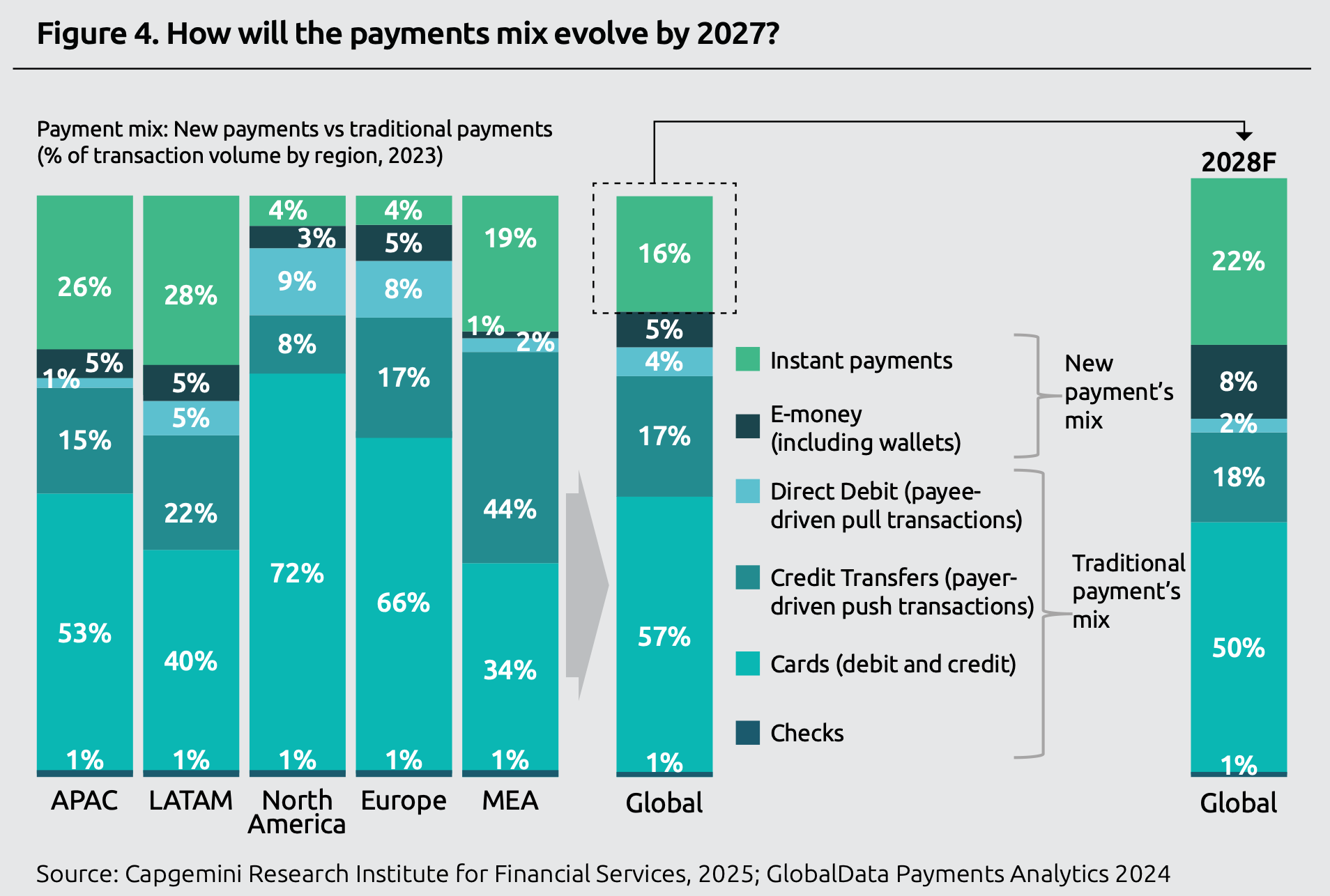

📊 Capgemini latest report predicts instant payments will account for 22% of all non-cash transaction volumes by 2028 globally 🤯

Non-cash transaction volumes rose to 1,411 billion in 2023 and are on track to reach 1,650 billion in 2024. Check out the complete report for more info

FINTECH NEWS

🇩🇪 Pliant partnered with the Vereinigte Volksbank Raiffeisenbank eG (VVRB), allowing it to strengthen its financial position and increase total capacity for providing credit lines to 200 million Euro. Find out more

🇬🇧 Griffin announces move to general availability, opens up BaaS platform to UK FinTechs. Griffin enables companies to seamlessly embed banking products like payments, savings, safeguarding and client money accounts, and unlock more revenue opportunities across their value chain.

🇬🇧 Liberis to extend Small Business financing to 10 European countries through myPOS partnership. This will enable myPOS to offer revenue-based financing in 10 European countries starting with the UK, providing small businesses with the money they need to fund new projects, address business challenges, and expand at their own pace.

🇺🇸 Klarna partners with UATP to tap the $1 trillion air travel industry. The partnership allows airlines to offer Klarna's flexible payment services, including interest-free Buy Now Pay Later, providing customers with more flexible payment options for travel products and services.

🇸🇦 Saudi FinTech acquisition by Tabby sparks new hopes for VCs. Tabby’s acquisition of Tweeq, was viewed as fresh evidence that Saudi Arabia’s startup market is maturing and may start to give VCs more strategies for exiting their investments, investors said at the 24 FinTech conference in Riyadh last week.

🇺🇸 Markel launches FinTechRisk+ policy to offer enhanced cyber coverage and support services for FinTechs. This new policy provides financial services and technology liability, directors and officers (D&O) liability, theft and cyber protection for UK and international FinTech businesses with limits up to USD $20 million.

PAYMENTS NEWS

🇬🇧 Ecommpay launches Ecommpay for Good. The global payments platform has unveiled a new brand identity and inclusivity program, emphasizing accessibility, inclusivity, and sustainability. Its “Ecommpay for Good” initiative supports merchants in enhancing website accessibility, which can boost traffic by 23-24%.

🇫🇷 Factoryz selects Mangopay to power payments on its circular economy platform. The alliance between Factoryz and Mangopay enhances the Factoryz platform by integrating secure, seamless payments directly within the system. It also streamlines operations, improving overall efficiency.

🇺🇸 Adyen announced Intelligent Payment Routing for US debit payments. This new feature ensures that enterprise businesses processing US debit transactions do not need to choose between cost, acceptance, or speed. Read on

🇬🇧 DNA Payments launches Apple Pay Express Checkout for Ecommerce. This will enable merchants to offer Apple Pay at checkout or via the Express option through the Safari browser, ensuring consumers a swift and seamless buying experience. Link here

🇬🇧 Wise joins AbbeyCross ABX Platform to bring greater connectivity to global FX payments. By joining the ABX Platform, Wise Platform will give AbbeyCross users access to faster, transparent and low-cost FX payments rates, including emerging markets rates, as well as a more convenient settlement experience.

🇺🇸 Zelis launches solution for Out-of-Network Health Bill Payments. Health Bill Assist is designed to improve plan members’ healthcare financial literacy, spot and resolve billing discrepancies, and use Zelis’ team of expert negotiators to settle bills with providers when appropriate, according to a press release.

DIGITAL BANKING NEWS

🇦🇷 Ualá announced the launch of its new secured credit card, designed for individuals without a credit history or those looking to repair their credit. The new card will be backed by a security deposit provided by the customer when applying for the card. This deposit will generate returns of up to 5% in the customer's Ualá account.

🇧🇷 Webull launched what they call a Global Account for their customers in Brazil. With Global Account, Webull unlocks a complete rewards program for customers based in Brazil by enabling them to open a US bank account and then spend in US dollars and/or in BRL in Brazil.

🇺🇸 MoneyLion partners with Nova Credit to activate cash flow underwriting within its consumer finance ecosystem. This collaboration will allow credit issuers on MoneyLion’s platform to integrate Nova Credit’s cash flow data analytics, providing a more comprehensive view of a consumer’s financial health and expanding access to credit.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 FCA files first criminal charges against operator of crypto ATM network. Olumide Osunkoya, 45, is accused of running crypto ATMs, which processed £2.6m in crypto transactions across multiple locations between 29 December 2021 and 8 September 2023 without the required registration.

🇯🇵 Largest Japanese banks to use SWIFT-linked stablecoin system for cross-border payments. MUFG, SMBC and Mizuho plan to use a stablecoin-based system to facilitate cross-border payments in the future. The initiative, Project Pax, replaces correspondent banks with blockchain technology, linking it to SWIFT to allow users to initiate payments conventionally using regular banking rails.

PARTNERSHIPS

🇦🇺 ConnectID partners with Lendela for secure loan matching. The partnership enhances security and efficiency in loan application processes for Australian users. The addition of Lendela to ConnectID’s ecosystem reinforces its role in providing secure digital identity verification across various sectors.

DONEDEAL FUNDING NEWS

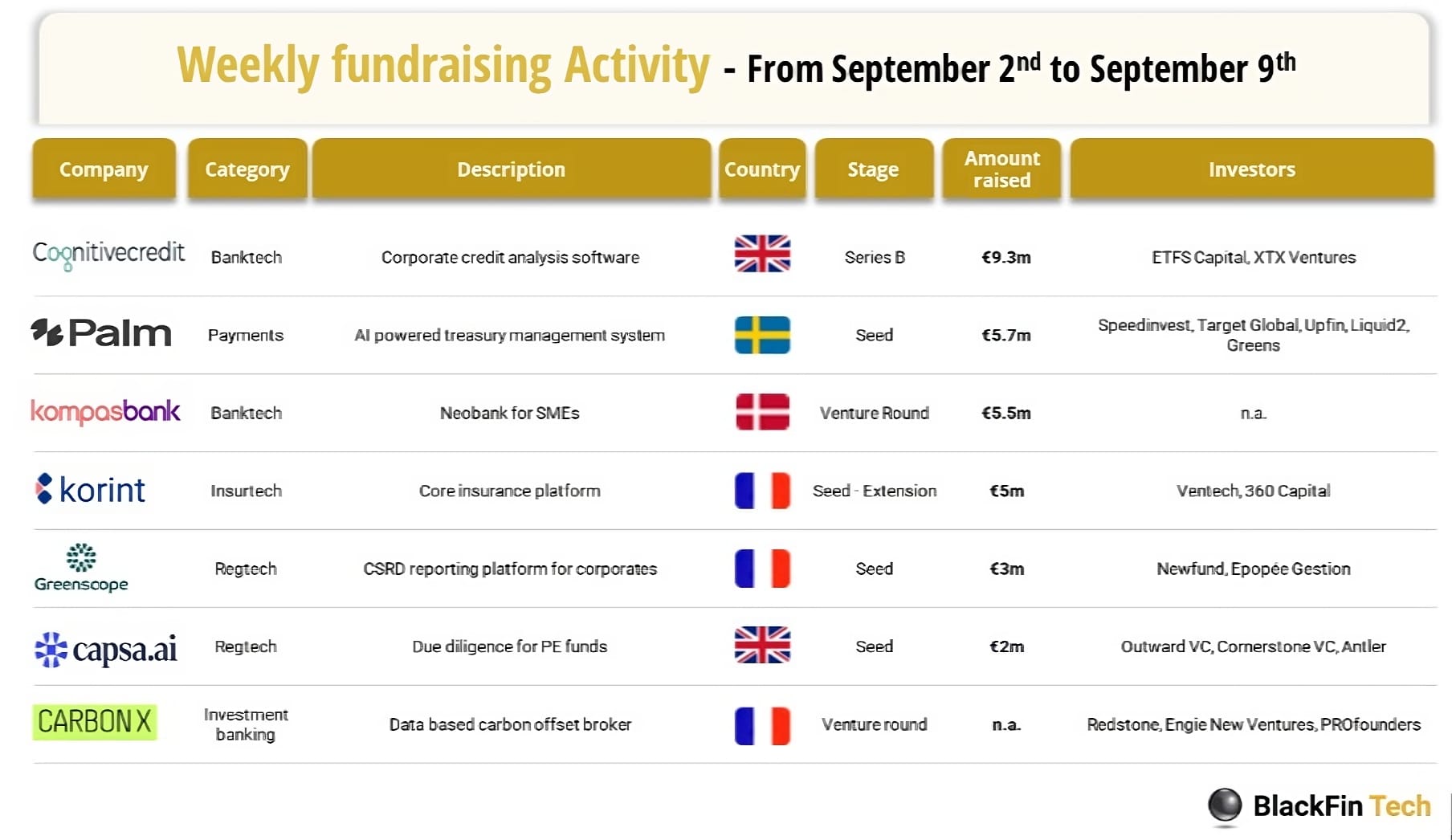

💰 Last week, we saw 7 official fintech deals in Europe, raising a total of €30.5 million, with 2 deals in the UK, 3 in France, 1 in Denmark and 1 in Sweden. Check out the complete BlackFin Tech overview article

🇬🇧 Form3 successfully completes a $60m series C extension, with new investment from British Patient Capital and existing shareholders. This funding will enable Form3 to develop new products and services to help support exponential growth in key markets such as the UK, Europe and the US.

🇬🇧 FinTech fund Outward raises £51m to defy the sector’s funding slump. The firm has largely concentrated on investing in FinTechs based in the UK, such as London-based payments wallet Curve, open banking startup Bud and alternative investment platform Vauban, which exited to US competitor Carta in 2022.

🇺🇸 Versana announced the closing of a $26 million capital raise with the addition of Barclays as an investor in its centralized, real-time digital data platform. Barclays' inclusion is clear evidence of Versana's growing success in transforming the $7 trillion broadly syndicated loan and private corporate credit markets globally.

🇬🇧 Twenty7tec bags £16.5M from BGF to transform UK’s mortgage landscape. With this investment, the company aims to drive significant growth and expansion in the UK, enhance its team of industry experts, and deliver exceptional service and innovation to its expanding customer base.

🇦🇪 IN1 secures $6M in seed funding to revolutionize financial management. The new capital will complete product development and support the launch of the full MVP for Europeans. IN1 will then expand rapidly into the MENA region and Asia.

🇬🇧 Lendinvest lands £500m investment from JPMorgan. The new funding would go towards the growth of its mortgages proposition, which includes buy-to-let and residential products. Continue reading

🇦🇪 FlapKap secures $34 million pre-Series A in a mix of debt and equity. The company will use the new investment to expand its SME financing services across the Middle East and North Africa and the Gulf Cooperation Council (GCC) region.

MOVERS & SHAKERS

🇺🇸 Nium has announced two new executive appointments to strengthen its leadership team. Andre Mancl joins as Chief Financial Officer, overseeing all financial strategies for the company, while Philip Doyle joins as Chief Compliance Officer, leading Nium's global risk and compliance programs. More here

🇦🇪 XTB MENA appoints Salma Tabbech as new Sales Director to spearhead strategic expansion. With years of experience in the UAE’s and global financial services industry, Salma brings a wealth of expertise and a proven track record of success to her new role.

🇬🇧 Quant appoints Lenna Russ as Chief Commercial Officer. She will apply her extensive leadership skills, commercial acumen and knowledge of the financial technology landscape to spearhead the company’s commercial operations and support its continued growth.

🇫🇮 Neonomics strengthens team with the addition of Panu Poutanen as new Head of Growth. Panu will focus on expanding large corporate commercial activities and growing Neonomics customer base across the Nordics, with specific focus on the Finnish market in the short term.

🇩🇪 Primer appoints ex-Amazon, Microsoft leader Alex Mallet as its Chief Technology Officer. This strategic appointment demonstrates the company’s commitment to developing robust and cutting-edge infrastructure for its global customer base.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()