ACI Worldwide and RS2's New One-Stop Payments Solution in Brazil

Hey FinTech Fanatic!

ACI Worldwide and RS2 have partnered to deliver a comprehensive solution for acquirers and issuers in Brazil.

This collaboration merges ACI's and RS2's strengths in acquiring and issuing, aiding financial institutions, integrated software vendors, payment facilitators, independent sales organizations, and payment processors in their digital transformation.

The new cloud-enabled platform allows merchants, banks, and payment service providers to efficiently launch new products and services via configuration portals that seamlessly integrate with third-party platforms. This integration ensures platform security, reduces operational costs, and boosts revenues. Supported by ACI's Fraud Management and Payments Intelligence, it provides real-time fraud management through advanced machine learning, predictive analytics, and expertly defined rules.

The platform is certified for Brazil and complies with local regulatory requirements and card scheme standards.

Key benefits of the platform include:

Acquiring: For the first time in Latin America, the joint solution is offered as a software as a service, enabling financial players to quickly and cost-effectively start a new acquiring business. It enhances the merchant experience, manages interchange fee risk, and simplifies global compliance.

Issuing: Issuers and processors benefit from a single consolidated platform for all card types, including credit, debit, pre-paid, and domestic cards, as well as new payment methods like wearables. This allows them to provide better service, more options, and increased fraud protection to customers.

Enjoy more FinTech news I listed for you below, and let me know if there is any news I might have missed!

Cheers,

#FINTECHREPORT

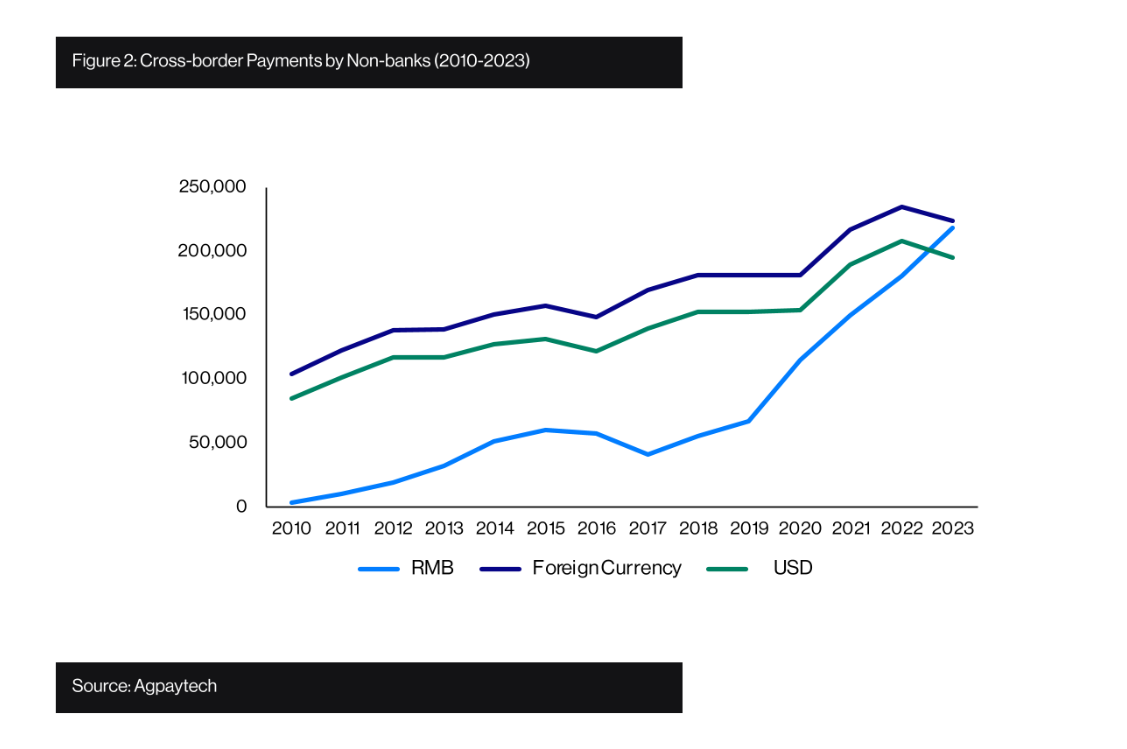

📊 How China's FinTechs make gains in RMB 🆚 USD. Check out the complete report here

FINTECH NEWS

🥇 Most Influential Women in FinTech 2024. For the second year running, American Banker is recognizing women in the financial technology community who have wielded influence and helped move the industry forward. Please click here to take a look at the list of the honorees

🇳🇬 O3 Capital's launch of American Express cards in Nigeria meets with huge demand. Since launch, the O3 American Express® Green Card and the O3 American Express Platinum® Card, have been the most standout performers proving their broad appeal and widespread benefits.

🇸🇦 Mastercard Move collaborates with urpay to enable convenient and secure cross-border payment services. The collaboration aims to digitally transform the Saudi financial sector in line with Vision 2030. Leveraging Mastercard's capabilities, urpay will enable its broad customer base to access the company's cross-border and remittance services.

🇦🇪 Pyypl (pronounced “People”) announces Visa Principal Licence Membership and strategic framework agreement. The Visa partnership underscores Pyypl's mission to democratize financial services, its innovative business model, and the significant market potential. It also demonstrates Visa's confidence in Pyypl to drive financial inclusion forward.

PAYMENTS NEWS

🇧🇷 ACI Worldwide, a global leader in mission-critical, real-time payments software, and RS2, a payments processor and technology provider, have joined forces to offer a one-stop solution for acquirers and issuers in Brazil. The new offering combines the best of ACI’s and RS2’s acquiring and issuing capabilities.

🇩🇪 Apple has launched Tap to Pay on iPhone in Germany, enabling millions of merchants to use their iPhones for seamless and secure contactless payment processing in-store. Read more

🇺🇸 xnPOS and Adyen announce partnership and launch of new integrated mobile POS and payment device at HITEC Charlotte. The device features a full version of the leading xnPOS point of sale system combined with the Adyen payment platform to give a fully mobile POS and PCI compliant payment solution.

🇺🇸 The Federal Reserve has developed a tool, called the ScamClassifier model, to help the payments industry improve scam reporting, detection and mitigation. The ScamClassifier model uses a series of questions to differentiate and classify scams by category and type.

OPEN BANKING NEWS

🇧🇷 The Open Finance platform Sicredi has introduced two new features to meet the needs of its 8 million members with practicality and security. With these new options, members can now transfer money from another financial institution using the app and authorize the sharing of their financial history via WhatsApp, allowing Sicredi to access information for personalized offers.

🇬🇧 Nuapay joins UK public sector Open Banking framework. Nuapay announced its inclusion as an approved supplier on the Crown Commercial Service’s (CCS) Open Banking Dynamic Purchasing System (DPS) framework, making it a trusted partner for government bodies seeking to leverage Open Banking in their payment infrastructure.

🇮🇹 Banco Desio is leveraging open finance for the digitalization of invoice advance services for SMEs through a new collaboration with Fabrick. The implemented solution allows SMEs to have visibility of the active credit lines and commitments made with the bank.

DIGITAL BANKING NEWS

🇩🇪 German digital bank C24 extends relationship with Mambu. The partnership with Mambu has allowed C24 Bank to build a product that has gained substantial attention and traction in the German market. More on that here

🇺🇸 Charlie, a FinTech company focused on providing banking services for the 62+ age group, is introducing SpeedBump, an advanced anti-fraud feature that activates when a new payee or an unfamiliar device is added to an account, or when the account owner transfers over $100.

🇬🇧 Atom bank passes £1bn commercial mortgage completions. Atom bank head of business lending, Tom Renwick, said: “We know what it’s like to start a business, we’ve been there and done it, so we are fiercely passionate about helping SMEs wherever they are on their journey,” he said.

🇲🇾 More than half a million Malaysians have signed up for GXBank. GXBank offers a range of offerings including online savings account that accumulates daily interest of 3% p.a. without minimum balance requirements or lock-in periods.

🇬🇧 Starling Bank boosts debt recovery amid surging regulatory demands in UK. As geopolitical tensions and economic turmoil escalate, UK businesses are facing increased regulatory pressure, prompting Starling Bank to intensify its efforts in debt recovery and compliance. Read on

🇺🇸 FinTech Atmos Financial partners directly with Five Star Bank in a sustainable BaaS model. The new partnership provides Atmos account holders with access to a greater range of services and products. And, importantly, they are able to play an active role in supporting a clean economy and combating climate change.

DONEDEAL FUNDING NEWS

🇪🇬 Connect Money scores $8M to enable non-bank businesses to offer embedded finance services. The startup is enabling trade companies to issue white-label debit and credit cards to their customers for access to various financial services, including payments and credit.

🇱🇺 FinTech firm MiddleGame Ventures raises €55m of targeted €150m fund. The Luxembourg-based firm is raising a FinTech-specific fund amid declining investor appetite for the sector. The new fund will focus on startups at Series A and Series B stages.

🇮🇳 Women-focused neobanking startup LXME has raised $1.2 Mn (INR 10 Cr) in a seed funding exercise led by Kalaari Capital via its CXXO initiative. The startup plans to use the funds for brand-building and user acquisition across India, as well as enhancing its technology and product stack to improve user experience and engagement.

🇬🇧 Augmentum FinTech has made a £2.6 million investment in London-based peer-to-peer FX trading platform LoopFX. This platform enables traders to match, in real-time, with other asset managers and banks without information leakage and at a mid-market rate, reducing trading costs and improving best execution processes.

🇮🇹 Italian FinTech Banca AideXa, a digital lender specialising in providing credit to micro and small businesses, has secured €16 million in fresh capital. The funding sees the company add Italy’s largest business association, ConfCommercio, to its roster of investors.

🇭🇰 Hong Kong FinTech company FundPark has obtained a three-year $250 million private loan with HSBC Holdings Plc as a senior facility provider, the second such investment the firm has secured this year. Loan brings FundPark’s total pool of funds to $750 million.

🇸🇬 Singapore-based financial technology firm Atome Financial said on Tuesday it had secured an up to $100 million debt facility including from EvolutionX, a debt financing platform jointly set up by DBS opens new tab and Temasek, to expand in Southeast Asia.

🇨🇱 Chilean FinTech Retorna secures $1.2M to develop customer acquisition and retention operations. This recent capital injection represents an important milestone in the development of Retorna, since it becomes its first investment round.

M&A

🇺🇸 Small business lender Funding Circle has reached an agreement with iBusiness Funding for the sale of its US operations in a £33 million all-cash deal. The transaction is expected to close by the end of June. Click here to learn more

🇲🇽 Mexican FinTech Finsus announced that it purchased Distrito Pyme‘s platform and technology to launch Digital Credit Pyme. With the acquisition, Finsus seeks to enter the digital lending market for SMEs in Mexico. Finsus projects to place $540M in digital credit products over the next 5 years.

🇺🇸 Global Payments acquires UK’s Takepayments for undisclosed sum. The acquisition is forecast to enable Global Payments, which is headquartered in Atlanta, to tap a wider merchant base in the UK and further establish its remit in card payment solutions.

MOVERS & SHAKERS

🇬🇧 Thredd appoints Matt Swann as Non-Executive DIirector. This appointment follows the recent expansion of Thredd’s global product and technology team under the leadership of Edwin Poot. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()