ABN AMRO Aquires BUX, Pleo And Apex Eye IPO

TGIF! 😉

Straight from Amsterdam, ABN AMRO Bank has announced its acquisition of neobroker BUX. This significant deal, expected to close in 2024, excludes BUX's cryptocurrency operations (now we probably know why they let go of their complete crypto team in April this year) and awaits regulatory approval.

BUX, established in 2013 and boasting over 500,000 clients, endured a tumultuous 2023, including a withdrawn acquisition by N26 and an exit from the UK market. This acquisition marks a new chapter for both entities, with BUX's CEO Yorick Naeff eyeing leadership in Europe's retail investment sector.

Meanwhile, the $4.7 billion European FinTech giant Pleo has brought on Søren Westh Lonning as its new CFO, signaling a possible IPO on the horizon.

Lonning, with a rich background in financial services, aims to steer Pleo towards profitability amidst challenging economic conditions. While Pleo isn't rushing to go public, this strategic move suggests preparations for a future stock market listing.

Apex Fintech Solutions, known for its digital clearing and custody services, has confidentially filed for a U.S. IPO. After an unsuccessful public listing attempt in 2021, the company is poised for its second foray into the IPO arena.

With these developments, one can't help but wonder if we'll see a surge in fintech IPOs in 2024.

What do you think? Let me know!

Cheers,

POST OF THE DAY

A snapshot of 🇲🇽 Mexico’s most popular Banking Apps by Latinometrics👇

BREAKING NEWS

🇩🇪 German public prosecutor brings charges against ex-Wirecard CFO. Prosecutors in Munich said they have brought charges against long-time chief financial officer Burkhard Ley, accusing him of market manipulation, commercial and organised fraud, and breach of trust, among other things.

INSIGHTS

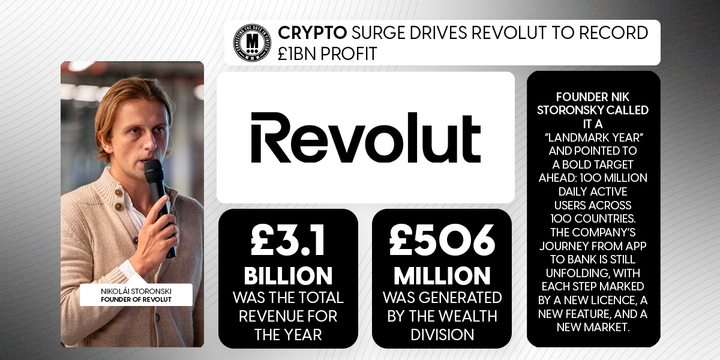

🇬🇧 Revolut's Storonsky claims second place in UK ranking of top ten young billionaires. Although only reaching number 928 in Forbes global wealth ranking index, Storonsky comes in second behind GymShark fitness clothing entrepreneur Ben Francis in the City Index UK league table, with a net worth of £2.6 billion.

FINTECH NEWS

🇺🇸 Upgrade says its secured card has trifecta of differentiators. Upgrade, which offers checking and savings accounts, credit and loans through its bank partners, announced the launch of Secured OneCard, a secured version of its Upgrade OneCard

PAYMENTS NEWS

🇺🇸 Melio taps JPMorgan to for real-time payments. This new capability to deliver funds faster allows businesses to hold on to their funds for as long as possible, avoiding early payments days before an invoice's due date to ensure the payment arrives on time.

🇨🇴 The Central Bank of Colombia selects ACI to develop new real-time payments system. The Central Bank will utilize ACI’s Digital Central Infrastructure to build the Central Infrastructure of an interoperable, countrywide scheme that includes centralized settlement and addressing services for the existing real-time payments schemes.

DIGITAL BANKING NEWS

🇺🇸 Hyperplane wants to bring AI to banks.The startup, focused on building foundation models for banks to predict customer behavior, is emerging from stealth. The goal is to assist banks in leveraging their first-party data for personalized experiences by predicting user behavior.

🇬🇧 UK's Metro Bank faced widespread outrage on Thursday, leaving customers without access to their accounts and rendering online services and mobile apps inaccessible. On a different note, the bank has announced Board changes after recent resignations. These changes are subject to regulatory approval.

🇰🇷 Toss Bank just reached profitability. In the July to September period, it recorded its first profitable quarter, which means that all three of the country’s digital lenders, which also include Kakao Bank and K Bank, are now moneymakers.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Giddy turns to Stripe for crypto purchases. Giddy’s integration with Stripe aims to make cryptocurrencies more accessible to the general public by expanding fiat-to-crypto purchase options with an easy and reliable payment gateway.

🇧🇷 Nubank has announced plans to enable Bitcoin and other cryptocurrency withdrawals in 2024. This move comes after Nubank introduced the option to buy cryptocurrencies in 2022, which had sparked concerns within the Bitcoin community in Brazil due to the lack of withdrawal and deposit capabilities for digital assets.

DONEDEAL FUNDING NEWS

APP fraud fighter Salv raises €3.9 million for launch into UK. "Our suite, particularly the inbound monitoring feature, is critical for detecting fraudulent activities and money mule accounts, thereby reducing the financial institution’s liability,” says Taavi Tamkivi, Salv CEO.

🇦🇺 Blockbuilder embarks on $4m capital raise to expand cashless deposits internationally. Blockbuilder is on a mission to remove cash deposits from life’s biggest purchases and it has already seen tremendous success with its initial product offering Downsizer.com.

Apex Group invests in Tokeny, the leading enterprise-grade tokenization solutions provider. This significant move solidifies Apex’s dedication to leading the digitization of finance, with tokenization at its core.

🇮🇸 Meniga raises EUR 15 million in Series D funding. According to the official press release, part of the investment will be used to clear Meniga's existing debt, making the company almost debt-free. More here

🇬🇧 Wealthtech Prosper hits £1 million crowdfund mark. Prosper is looking to emulate the likes of Wise in foreign currency exchange by undercutting the fees levied by wealth managers and offering high-interest bearing returns on balances.

Former BigPay, Monzo, and VP Bank execs launch Pave Bank with $5.2M seed funding round. The bank emerges as the world’s first programmable bank, and aims to revolutionize the financial sector by offering efficient banking products and access to digital assets.

M&A

🇳🇱 Dutch banking giant ABN AMRO acquires neobroker BUX after cost-cutting drive. The combined BUX and ABN AMRO will immediately become the leading investment platform for investors in the Netherlands and the deal is said to include “additional growth investment” to accelerate the growth of BUX.

🇲🇽 The Mexican paytech company Tu Dinero Digital (TUDI) has been acquired by the pharmacy chain Farmacias del Ahorro, a move endorsed by the CNBV (National Banking and Securities Commission). Read more

MOVERS & SHAKERS

🇬🇧 Starling alum Megan Cooper joins ClearBank as CPO from Barclays. In her new role, Cooper will lead ClearBank’s product management team and develop its product strategy. She will work closely with the bank’s client management, innovation, engineering, and risk and compliance teams.

Flutterwave names new executives a month after CFO’s departure. The fintech giant has named five new executives across its risk, compliance, and expansion departments one month after the abrupt exit of its CFO. Read on

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()