8 Key Trends & Drivers in Core Banking & BaaS

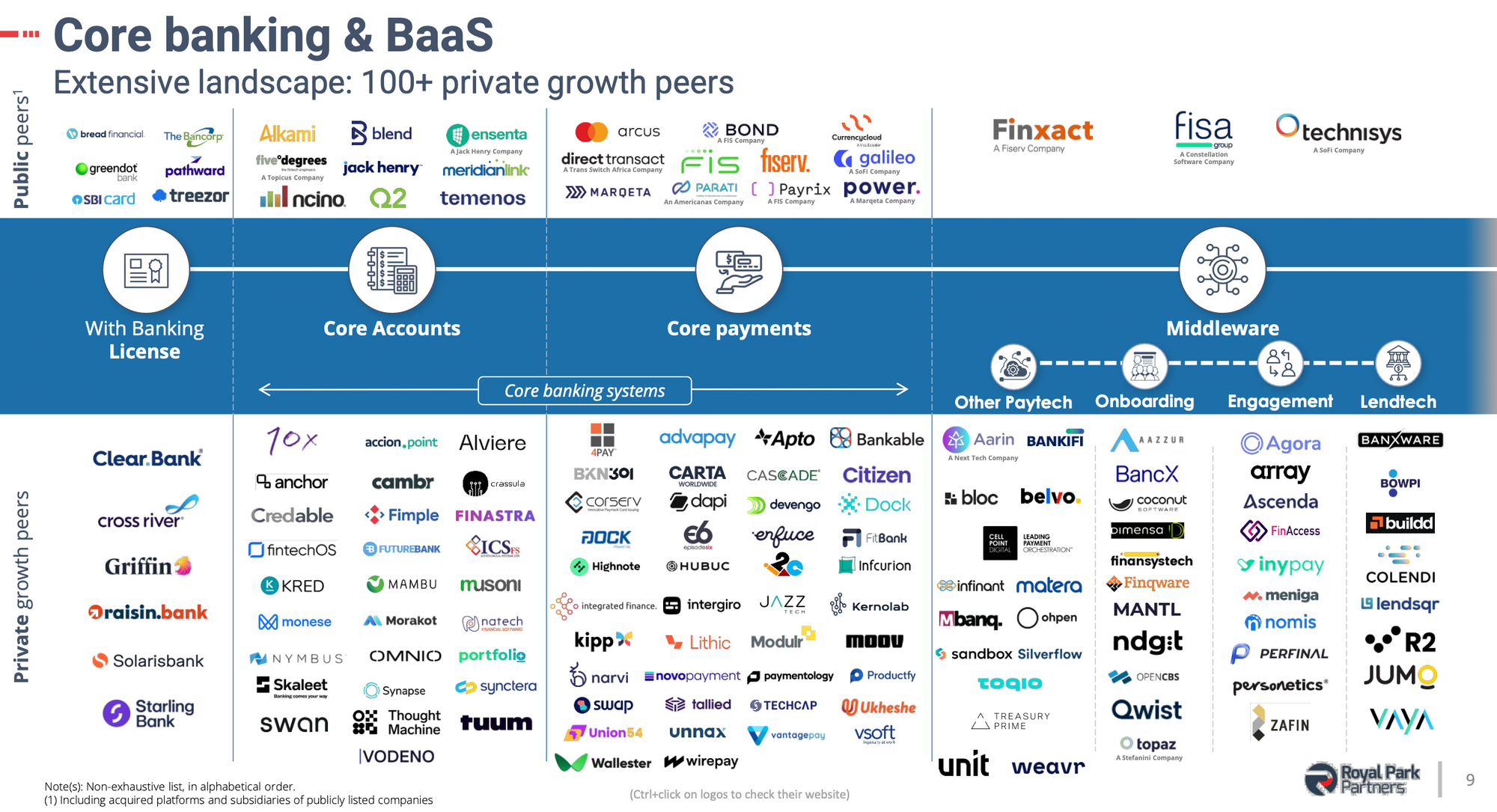

The FinTech Report provides a comprehensive overview of the tech-overlay platforms for banking solutions, whether to licensed banks or to non-banking clients that want to launch such banking products to their end clients.

Royal Park Partners released their latest Core Banking and BAAS Market Update report with some interesting findings.

The report provides a comprehensive overview of the tech-overlay platforms for banking solutions, whether to licensed banks or to non-banking clients that want to launch such banking products to their end clients.

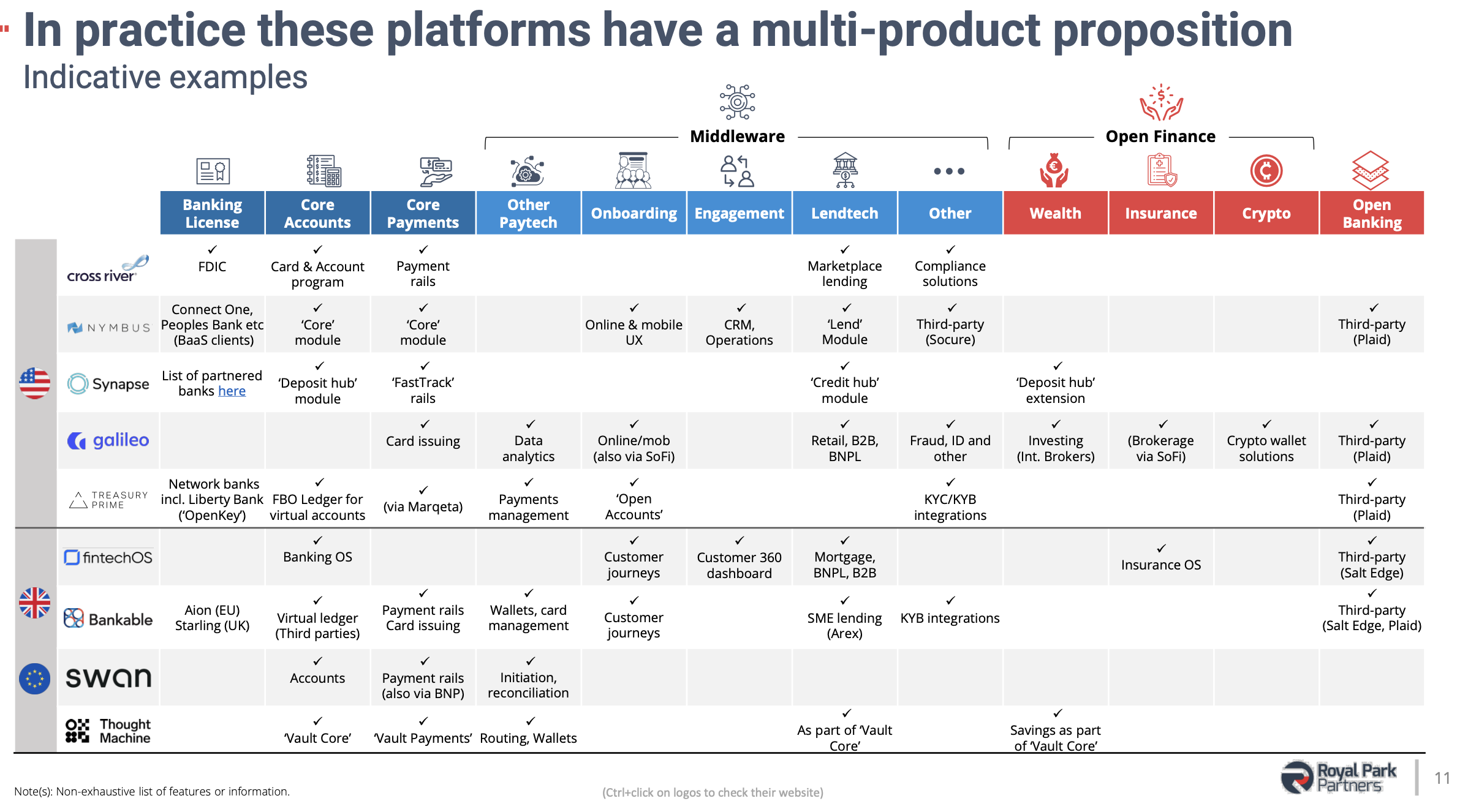

An overview of the multi-product propesitions these platforms have:

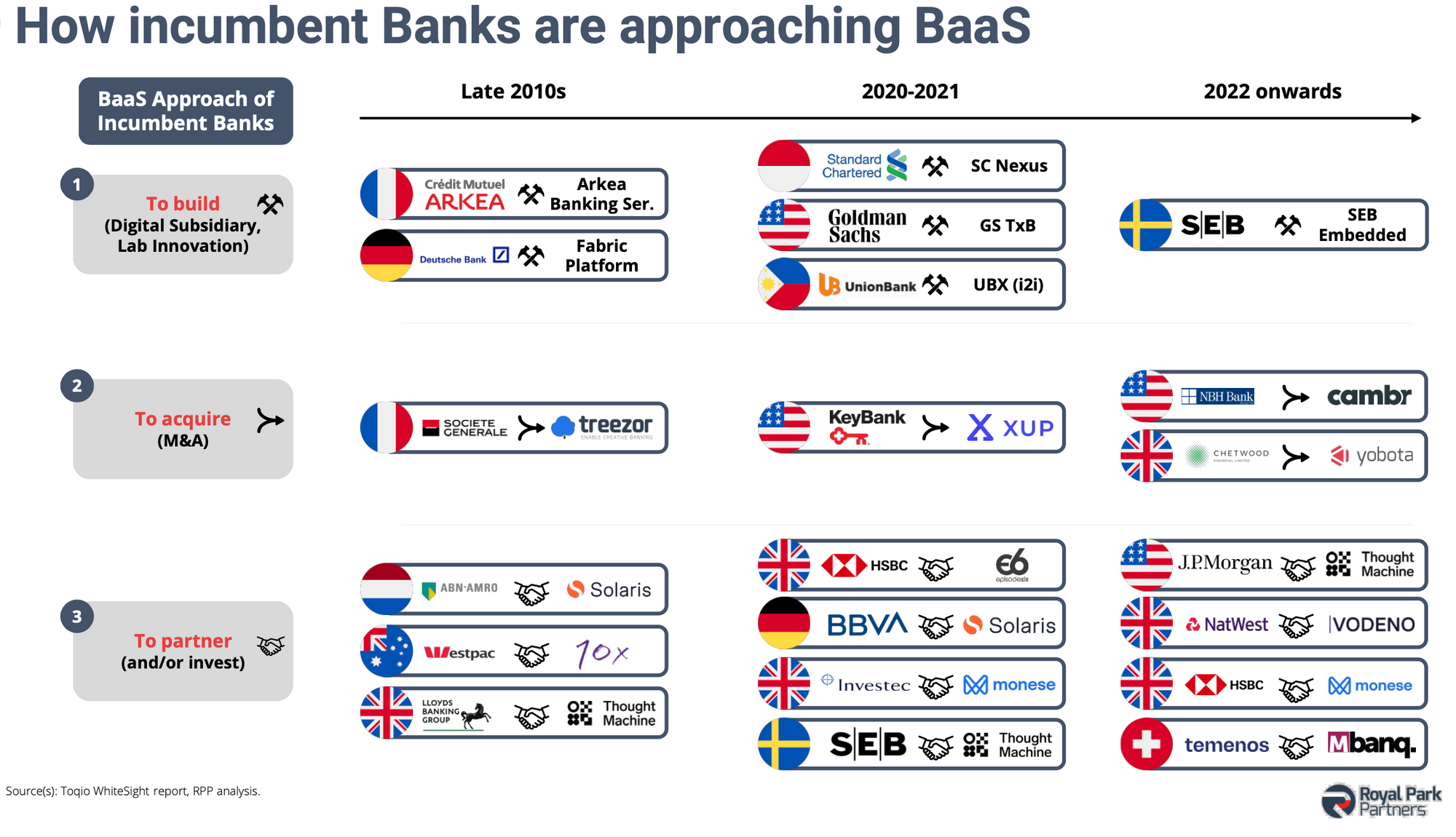

An overview of how incumbent banks are aproaching BaaS:

And last but not least; a list of 8 industry trends!

8 Key Trends & Drivers in Core Banking & BaaS

- Regulation and Open Banking: Regulatory dynamics, particularly Open Banking, have encouraged embedded finance applications. This has not only led fintechs and merchants to develop new banking solutions, but also highlighted the need for BaaS providers to adhere to evolving regulations like AML/KYC and ensure compliance.

- Convergence and Expansion: With the shift from on-premise to cloud, traditional core banking systems aim for broader audiences, targeting both non-bank clients and banks. Examples include Temenos's partnership with Mbanq and BaaS enablers like Synctera serving established banks.

- Economic Shifts and Lending Appeal: Recent macroeconomic changes, including rising interest rates, have spurred merchants and fintechs to explore BaaS for client monetization. The attractiveness of lending, especially via BaaS/LaaS, has grown in these conditions.

- Market Potential and Consolidation: Despite a crowded Core Banking & BaaS market, the potential remains vast, exemplified by Europe's EUR100bn market. This promises continued growth, even with expected industry consolidations.

- Investor Dynamics: Following the 2021 investment boom, there's increased scrutiny on both established and new platforms. Established players are expected to showcase advancements, while new entrants must justify their market position.

- SME Focus in BaaS: While BaaS has historically targeted individual consumers, there's an evident uptick in interest for solutions catering to SMEs, highlighting the sector's adaptability and responsiveness to market needs.

- AI Integration: The significant data processed by BaaS platforms offers fertile ground for AI integrations. This has the potential to revolutionize operations, including client onboarding, credit risk assessment, and customer interactions.

- M&A and Market Evolution: The industry anticipates more mergers and acquisitions, driven by motives ranging from market consolidation to product and regional expansion. The lines between BaaS and other services like LaaS may blur as providers diversify their offerings.

I highly recommend downloading and reading the complete source report to learn more about this interesting topic!

Comments ()