2024 FinTech Trends: Investment Decline and Shifts in Deal Stages

Hey FinTech Fanatic!

New data from Innovate Finance reveals a significant downturn in global FinTech investment in the first half of 2024.

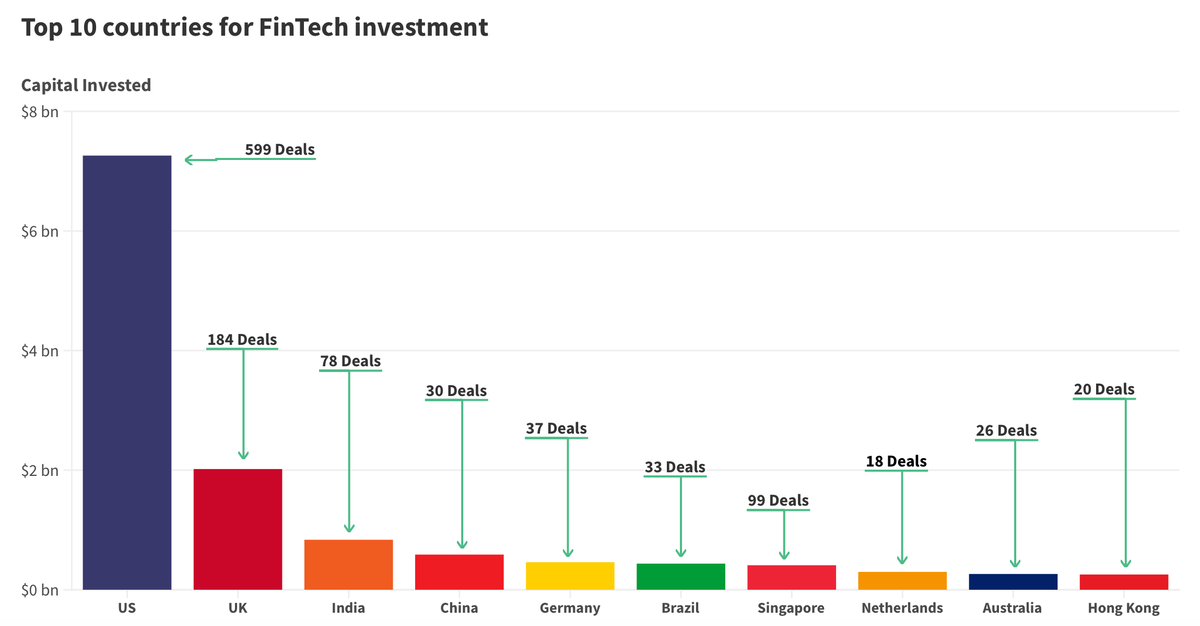

The total capital invested worldwide reached $15.9 billion, a 19% decrease from the $19.5 billion recorded in the second half of 2023. This decline mirrors the broader economic slowdown impacting venture capital markets globally.

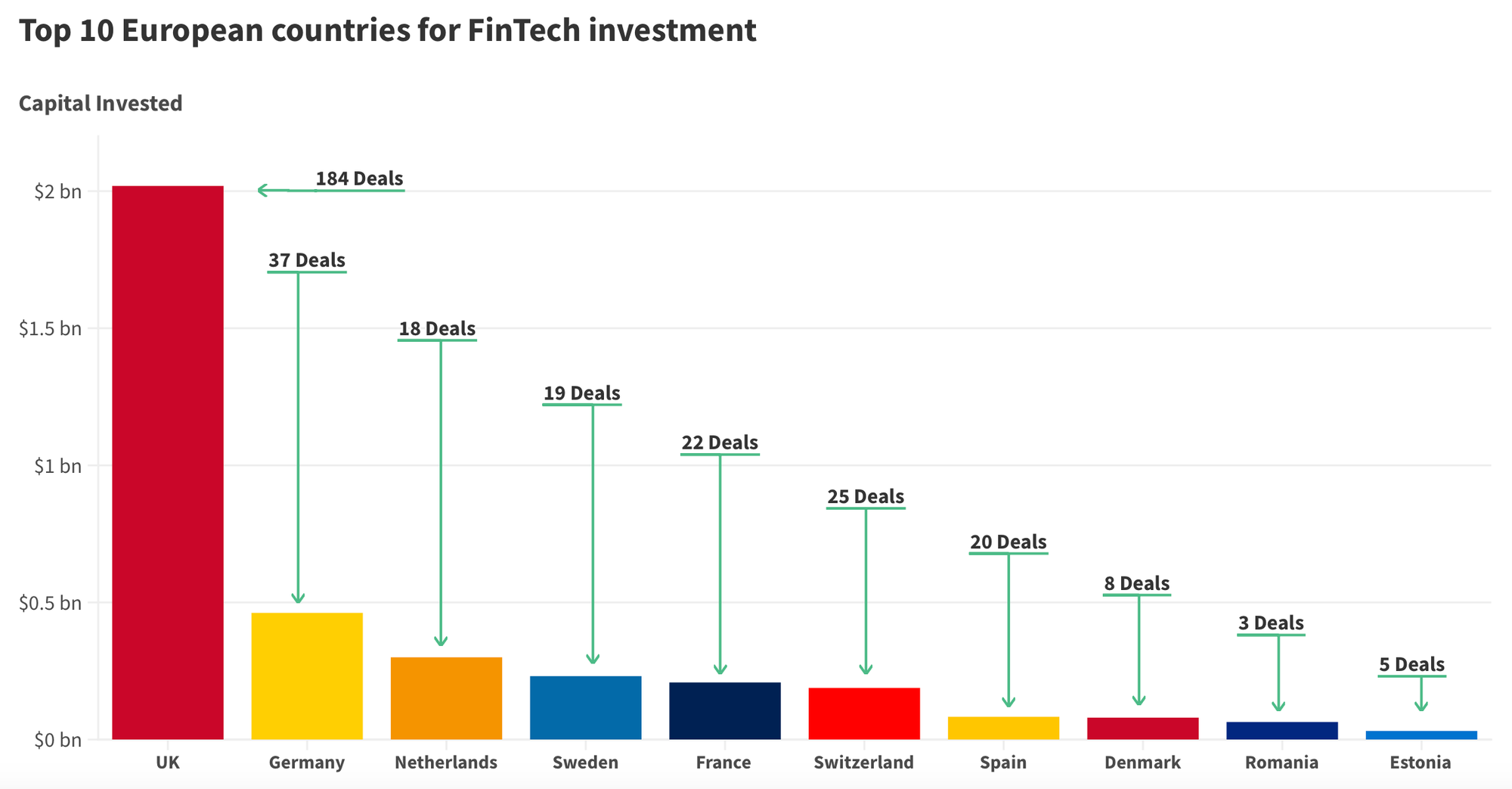

Despite the downturn, the UK maintains its leadership position in FinTech investment, ranking second globally behind the US. In H1 2024, the UK FinTech sector attracted $2 billion in investment, marking a 37% drop from the previous six months. However, this amount still surpasses the combined FinTech investment of all other European countries, securing 12.7% of the global market.

The latest figures indicate a shift towards earlier-stage deals, with the average deal size at $10.2 million. The total number of deals decreased from 1,661 in H2 2023 to 1,566 in H1 2024, highlighting a cautious approach by investors amid economic uncertainties.

The United States led the global FinTech investment, receiving $7.3 billion across 599 deals. Following the UK, India, China, and Germany rounded out the top five with $837 million, $589 million, and $462 million respectively.

UK FinTech investment, despite the decline, remains robust, even exceeding pre-Covid levels of 2018 and 2019 over the past 12 months.

Female-led FinTechs in the UK secured $136 million across 42 deals, representing approximately 7% of the UK’s total FinTech investment in H1 2024, down from 10% in 2023.

Enjoy more FinTech news updates I listed for you below, and I'll be back in your inbox tomorrow!

Cheers,

INSIGHTS

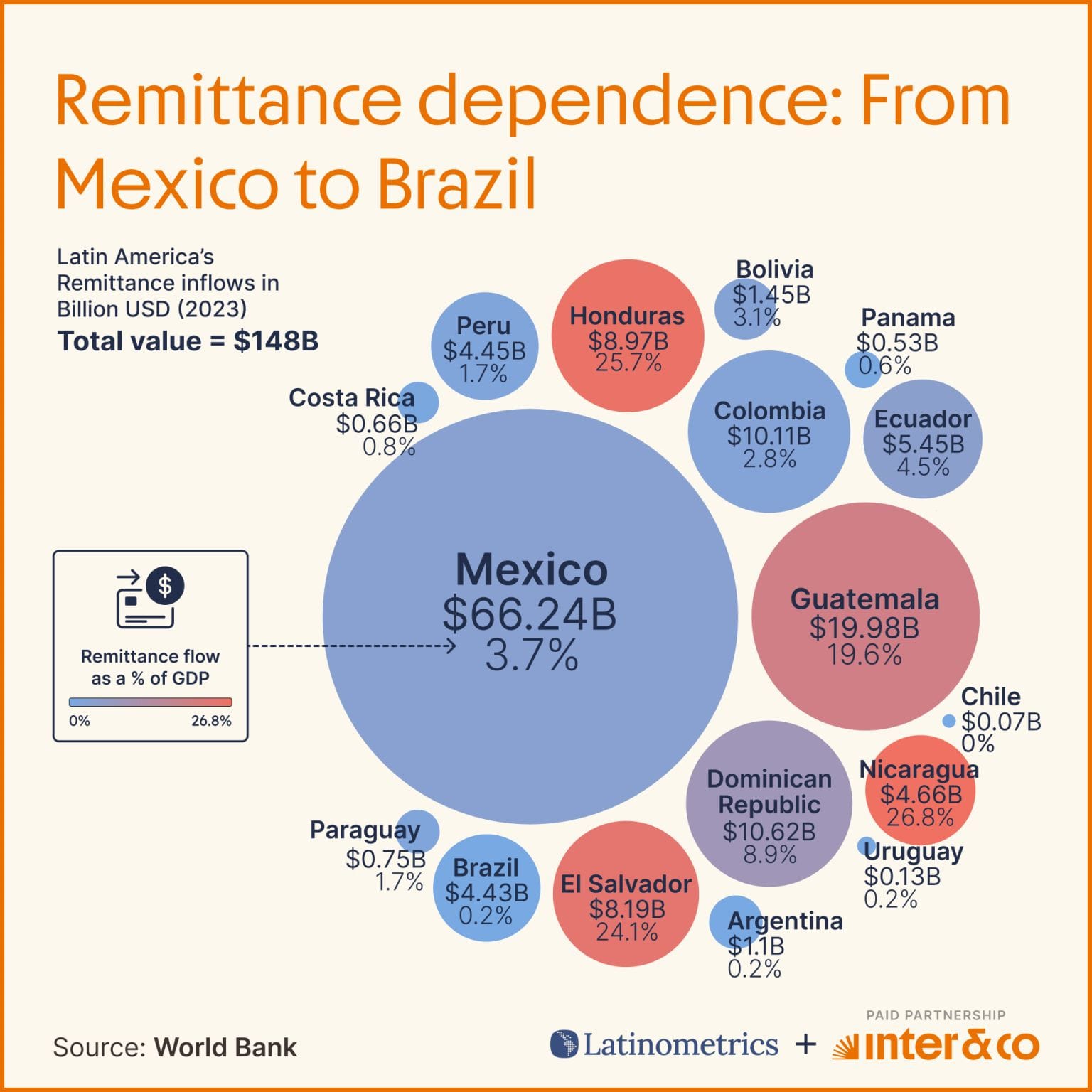

📈 Latin America's remittance inflows surged to $𝟭𝟰𝟴 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 in 2023 🤯

Let's dive into the stats:

FINTECH NEWS

🇬🇧 Webull UK, a digital investment platform, announced the launch of Webull Savings, an offering that provides users with access to a marketplace of savings accounts and the ability to move funds quickly between trading accounts and banks. Read on

🇭🇰 Octo3 and Evantagesoft, a banking technology solutions provider, have established FTS.Money. The new company, headquartered in Hong Kong, aims to revolutionise the global FinTech landscape by leveraging the combined strengths of Octo3 and EVS.

🇸🇬 XTransfer receives In-Principle-Approval for MPI license from MAS facilitating Cross-Border remittances for local SMEs. This license will allow XTransfer to provide services including account issuance, domestic money transfer, cross-border money transfer, and e-money issuance.

🇨🇭 Swiss FinTech Klarpay shares H1 2024 updates, achieving key milestones. Klarpay has been active on the global stage, “participating in many renowned events to strengthen our international relationships and explore new opportunities,” according to the firm.

🇬🇧 Inside FinTech Founders, the exclusive network of FinTech execs with a line to the UK government. How a grassroots network holding “invitation-only” events became a lifeline for the UK’s FinTech founders. Click here to learn more

🇺🇸 American FinTech Council (AFC) responds to Consumer Financial Protection Bureau (CFPB) interpretive rule on BNPL. AFC welcomed the recommendations by the CFPB but requested additional time and clarity to ensure that all Buy Now Pay Later providers, if necessary, can adjust their programs to come into compliance to ensure consistent consumer product experiences.

🇮🇹 eToro Ventures into Italian FinTech through collaboration with SDA Bocconi. This partnership aims to strengthen eToro's position in the Italian and European FinTech ecosystem. Read more

PAYMENTS NEWS

🇬🇧 J D Wetherspoon partners with Payit by Natwest to provide customers a new way to pay for food and drinks via the Wetherspoon app, available immediately. Powered by Open Banking technology, the integration of Payit provides patrons with a fast, secure and reliable means to complete in-app pay orders.

🇧🇷 In the first half of 2024 Pix moved an impressive 𝗥$𝟭𝟭.𝟴 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 🤯 Here are more key Pix Payments stats of the first half of 2024: Discover here

🇸🇬 Alchemy Pay, a fiat-crypto payment gateway, has partnered with Mastercard to verify authentic users and prevent fraud in the application process. By leveraging Mastercard’s account opening solution, Alchemy Pay ensures a seamless registration experience while efficiently detecting fraud, thereby strengthening risk control measures and enhancing platform security.

🇺🇸 Law firm Milberg skirts sanctions over fake claims in credit card fees case. A law firm that said it unknowingly submitted fake claims as part of a $5.6 billion antitrust settlement with Visa and Mastercard will escape sanctions for now, a federal magistrate judge has ruled.

🇧🇷 FinTech Entrepay receives authorization from the Central Bank to operate as an Acquirer Payment Institution in Brazil. According to the publication in the Official Gazette of the Union on Friday 12/7, the IP has a share capital of R$ 351.7 million. Continue reading

🇦🇺 SWiM PAY, a digital payment platform, announced the launch of instant payments, providing a solution for buyers and sellers. With this new feature, transactions between buyers and sellers can now be completed instantly, eliminating the need for lengthy waiting periods and traditional payment methods.

OPEN BANKING NEWS

🇦🇺 Real-time payment growth in Australia draws FinTech interest. Global FinTechs like Volt and GoCardless are attracted to Australia's consistent growth in real-time payments, driven by customer behaviour and business demand.

REGTECH NEWS

🇵🇱 Nethone is now rebranded as Mangopay Fraud Pevention. Following the acquisition of Nethone by Mangopay in 2022, they have unified both brands under the Mangopay name. Find out more

DIGITAL BANKING NEWS

🇨🇭Temenos integrates Visa Direct with Payments Hub. Through the integration of Visa Direct with Temenos Payments Hub, Temenos customers will have the ability to seamlessly incorporate Visa Direct’s payment capabilities and consolidate them with other payment services on the single Temenos platform.

🇯🇴 Jordan Kuwait Bank unveils multi-currency eliWallet with support from FOO and Mastercard. eliWallet, developed by JKB, is a prepaid wallet offering virtual and physical cards for multicurrency transactions, enabling customers to make payments easily in-store, through the app, or online.

🇧🇷 Nu Shopping offers up to 10% cashback during Amazon Prime Day, an exclusive event for Prime members, which will take place from July 16 to 21, and will allow members to receive a series of benefits. More on that here

🇮🇳 India's Paytm gets warning from markets regulator for old transactions with banking unit. The administrative warning was related to two transactions with an unapproved amount of 3.24 billion rupees ($38.8 million) and 360 million rupees each.

🇸🇦 The Saudi Central Bank (SAMA) has announced the launch of Naqd, a government banking services platform that focuses on digitising the financial services of government agencies. The move focuses on optimising the financial operations services of organisations on their accounts at the Saudi Central Bank via a unified and safe platform.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Trump Campaign reaps $3 million in crypto, from Bitcoin to Dogecoin. Trump, who received the Republican Party’s official nomination recently, has increasingly supported bitcoin and other cryptocurrencies in recent months. Crypto donations made up a sliver of the $331 million that Trump raised in the second quarter.

DONEDEAL FUNDING NEWS

🇧🇷 CloudWalk, a Latin America–focused FinTech startup that sells payments products to small and medium-size businesses, plans to raise up to $400 million at a valuation of at least $4 billion, according to two people who discussed fundraising plans with the company. Financial Technology Partners, a FinTech-focused investment bank, is working on the deal, according to the people, and has advised CloudWalk in previous transactions.

🇺🇸 Goldman Sachs Group Inc.’s alternatives unit is leading a consortium investing in a $540 million continuation vehicle created by venture capital firm NEA, according to people familiar with the matter. The VC firm contributed stakes in 11 of its companies — including startups Databricks, Plaid and Tempus AI Inc. — to the vehicle.

🇬🇧 Tiger Global in talks to lead $500m Revolut share deal at a valuation of at least $𝟰𝟬𝗯𝗻 and ultimately be as high as $𝟰𝟱𝗯𝗻. The global technology investor is among a number of parties which are exploring leading the secondary share sale at a valuation of at least $40bn. Read more

M&A

🇦🇺 ASX-listed Spenda Limited have announced that it has signed a binding term sheet to acquire 100% of the issued shares in Limepay Pty Ltd. The acquisition is an all-scrip transaction for a total purchase price of up to $8 million, payable in four tranches, three of which are performance based.

🇬🇧 BUX offloads UK subsidiary to APM Capital. The sale of BUX Financial Services Limited (BFS) is a subsequent step in the divestment strategy of BUX Holding after the sale of its Netherlands based business to ABN Amro.

MOVERS & SHAKERS

🇬🇧 Starling Bank founder Anne Boden has quit the board of the challenger bank to pursue a new AI venture. First reported by the Sunday Times, Boden has declined to comment on her future plans. More here

🇬🇧 SMEB announced it has appointed Dickson Chu as Head of Payments. Based in London, Dickson will leverage his 10 years of experience in the payments industry to develop and deliver new payment products, such as a Multi-Service App and to drive new business growth.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()